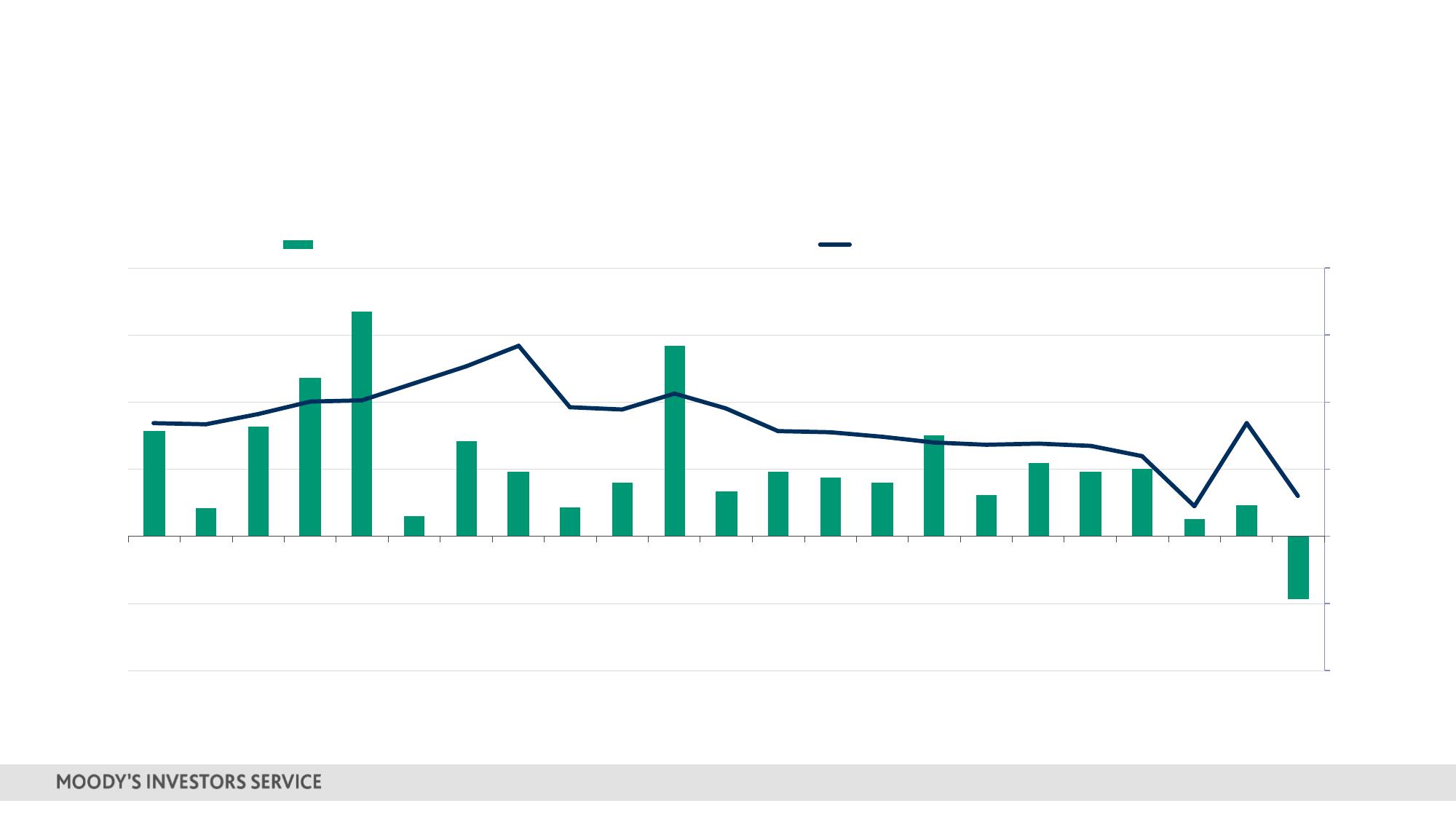

InsideChinawithMoody’s:CreditimpactonoilandgassectorsfromChina’sslowinggrowthandcarbontransitionOctober2023Agenda»WhatareMoody’sexpectationsforoilandgasdemandandsupplygrowthamidChina’sslowingeconomicgrowthandcarbontransition?»Whatistheassociatedcreditimpactonratedoilserviceproducers?»HowwillrisingnewenergyvehiclepenetrationandincreasedrefiningcapacityimpactChineserefinersandpetrochemicalcompanies?InsideChinawithMoody’s,October20232StrongcorrelationbetweenoilconsumptionandGDPChinaoilconsumptiongrowth(%,leftaxis)China'sGDPgrowth(%,rightaxis)20%20%15%15%10%10%5%5%0%0%-5%-5%-10%-10%20002001200220032004200520062007200820092010201120122013201420152016201720182019202020212022Sources:EnergyInstituteStatisticalReviewofWorldEnergy2023andIMFInsideChinawithMoody’s,October20233ChinaishighlydependentonimportedoilandgasOildependencyratioGasdependencyratio100%90%80%70%60%50%40%30%20%10%0%2001200220032004200520062007200820092010201120122013201420152016201720182019202020212022Source:WindInsideChinawithMoody’s,October20234DomesticgasproductionwillcontinuetooutpacecrudeoilproductionChangeincrudeoilproductionChangeinnaturalgasproduction25%20%15%10%5%0%-5%-10%2001200220032004200520062007200820092010201120122013201420152016201720182019202020212022Source:EnergyInstituteStatisticalReviewofWorldEnergy2023InsideChinawithMoody’s,October20235Naturalgasimportdeclinedin2022duetoCOVID19,buthasreboundedin2023Importofcrudeoil(leftaxis)Importofnaturalgas(leftaxis)Changeinimportsofnaturalgas(rightaxis)Changeinimportsofcrudeoil(rightaxis)60072%60%54248%36%50651350824%12%5004620%-12%419902018400381Milliontonnes3353002001005469971021211094420162017201920202021202202015Source:GeneralAdministrationofCustomsofthePeople'sRepublicofChinaInsideChinawithMoody’s,October20236NEVownershipasa%ofChina'stotalautomobilefleetwillrisetoaround20%by2030ICEownershipvolume(leftaxis)NEVownershipvolume(leftaxis)NEVownershipas%oftotalautofleet(rightaxis)45025%40035020%Inmillionunits30015%25020010%1501005%500201820192020202120222023E2026E0%20172030ENote:ICEstandsforinternalcombustionengine,andNEVstandsfornewenergyvehicles.China'sdefinitionofNEVincludesbatteryelectricvehicles,plug-inhybridelectricvehiclesandfuelcellelectricvehicles.Sources:China'sMinistryofPublicSecurityandMoody'sInvestorsServiceestimatesInsideChinawithMoody’s,October20237KeydriversandrisksforChineseoilfieldserviceprovidersSource:Moody’sInvestorsServiceInsideChinawithMoody’s,October20238COSLgeneratesmostofitsrevenuefromChina100%ChinaOilfieldServicesLimited(COSL)90%80%Domesticrevenue%70%60%50%40%30%20%10%0%20192020202120222018Source:Company’sannualreportInsideChinawithMoody’s,October20239Anton’srevenueexposuretoChinaishigherthanHilong’sAntonHilongDomesticrevenue%100%90%80%70%60%50%40%30%20%10%0%20182019202020212022Source:Companies’annualreportsInsideChinawithMoody’s,October202310ProductionofSinopec’spetrochemicalproductshasoutpaceditsrefinedoilproductsProductionvolumeincreaseofgasoline,dieselandkeroseneusing2012asthebaseyearProductionvolumeincreaseofsyntheticresinusing2012asthebaseyear1.6x1.5x1.4x1.3x1.2x1.1x1.0x20132014201520162017201820192020202120222012Note:'Productionvolume'inabovechartreferstoaggregateproductionvolumes.Thebaseyearforcomparisonis2012.Forexample,theaggregateproductionvolumeofsyntheticresinfromPetroChinaandSinopecCorpin2022was1.55timesthatin2012.WetakesyntheticresinasproxyofSinopec’sandPetroChina’spetrochemicalproducts.Sources:PetroChina’sandSinopecCorp’sannualreports;Moody'sInvestorsServiceInsideChinawithMoody’s,October202311Exportsofrefinedoilproductswilllikelyrecovermoderatelyin2023Exportofgasoline,dieselandkerosene(leftaxis)Portionofexporttototaldomesticouputvolume(rightaxis)10020%8016%Inmilliontonnes6012%408%204%020162017201820192020202120220%2015Jan-Jul2023Sources:GeneralAdministrationofCustomsofthePeople'sRepublicofChina,WindInsideChinawithMoody’s,October202312China’sproductioncapacityinseveralkeybasicchemicalsandpolymerswillrisefurtherthisyear202120222023(F)80Productioncapacity(inmilliontonsperyear)706050403020PropyleneParaxylenePolyethylenePolypropylenePTAEthylenePTA:PurifiedterephthalicacidSource:ChinaPetroleumandChemicalIndustryFederation(CPCIF)InsideChinawithMoody’s,October202313NaphthacrackersareatcostdisadvantagecomparedtogascrackersUSEthaneMontBelvieuSingaporeNaphthaspotFOB1,2001,000800$perton600400200-May-21Sep-21Jan-22May-22Sep-22Jan-23May-23Jan-21Source:BloombergInsideChinawithMoody’s,October202314ChineseNOCshavesettheircarbontransitiontargetsSources:CompanyreportsInsideChinawithMoody’s,October202315Q&APleasesubmityourquestionsviatheQ&AboxonyourscreenThispublicationdoesnotannounceacreditratingaction.Foranycreditratingsreferencedinthispublication,pleaseseetheratingstabontheissuer/entitypageonwww.moodys.comforthemostupdatedcreditratingactioninformationandratinghistory.©2023Moody’sCorporation,Moody’sInvestorsService,Inc.,Moody’sAnalytics,Inc.and/ortheirlicensorsandaffiliates(collectively,“MOODY’S”).AllTotheextentpermittedbylaw,MOODY’Sanditsdirectors,officers,employees,agents,representatives,licensorsandsuppliersdisclaimliabilityforanyrightsreserved.directorcompensatorylossesordamagescausedtoanypersonorentity,includingbutnotlimitedtobyanynegligence(butexcludingfraud,willfulmisconductoranyothertypeofliabilitythat,fortheavoidanceofdoubt,bylawcannotbeexcluded)onthepartof,oranycontingencywithinorbeyondtheCREDITRATINGSISSUEDBYMOODY'SCREDITRATINGSAFFILIATESARETHEIRCURRENTOPINIONSOFTHERELATIVEFUTURECREDITcontrolof,MOODY’Soranyofitsdirectors,officers,employees,agents,representatives,licensorsorsuppliers,arisingfromorinconnectionwiththeRISKOFENTITIES,CREDITCOMMITMENTS,ORDEBTORDEBT-LIKESECURITIES,ANDMATERIALS,PRODUCTS,SERVICESANDinformationcontainedhereinortheuseoforinabilitytouseanysuchinformation.INFORMATIONPUBLISHEDBYMOODY’S(COLLECTIVELY,“PUBLICATIONS”)MAYINCLUDESUCHCURRENTOPINIONS.MOODY’SDEFINESCREDITRISKASTHERISKTHATANENTITYMAYNOTMEETITSCONTRACTUALFINANCIALOBLIGATIONSASTHEYCOMEDUEANDANYNOWARRANTY,EXPRESSORIMPLIED,ASTOTHEACCURACY,TIMELINESS,COMPLETENESS,MERCHANTABILITYORFITNESSFORANYESTIMATEDFINANCIALLOSSINTHEEVENTOFDEFAULTORIMPAIRMENT.SEEAPPLICABLEMOODY’SRATINGSYMBOLSANDPARTICULARPURPOSEOFANYCREDITRATING,ASSESSMENT,OTHEROPINIONORINFORMATIONISGIVENORMADEBYMOODY’SINANYDEFINITIONSPUBLICATIONFORINFORMATIONONTHETYPESOFCONTRACTUALFINANCIALOBLIGATIONSADDRESSEDBYMOODY’SFORMORMANNERWHATSOEVER.CREDITRATINGS.CREDITRATINGSDONOTADDRESSANYOTHERRISK,INCLUDINGBUTNOTLIMITEDTO:LIQUIDITYRISK,MARKETVALUERISK,ORPRICEVOLATILITY.CREDITRATINGS,NON-CREDITASSESSMENTS(“ASSESSMENTS”),ANDOTHEROPINIONSINCLUDEDINMoody’sInvestorsService,Inc.,awholly-ownedcreditratingagencysubsidiaryofMoody’sCorporation(“MCO”),herebydisclosesthatmostissuersofdebtMOODY’SPUBLICATIONSARENOTSTATEMENTSOFCURRENTORHISTORICALFACT.MOODY’SPUBLICATIONSMAYALSOINCLUDEsecurities(includingcorporateandmunicipalbonds,debentures,notesandcommercialpaper)andpreferredstockratedbyMoody’sInvestorsService,Inc.QUANTITATIVEMODEL-BASEDESTIMATESOFCREDITRISKANDRELATEDOPINIONSORCOMMENTARYPUBLISHEDBYMOODY’Shave,priortoassignmentofanycreditrating,agreedtopaytoMoody’sInvestorsService,Inc.forcreditratingsopinionsandservicesrenderedbyitfeesANALYTICS,INC.AND/ORITSAFFILIATES.MOODY’SCREDITRATINGS,ASSESSMENTS,OTHEROPINIONSANDPUBLICATIONSDONOTrangingfrom$1,000toapproximately$5,000,000.MCOandMoody’sInvestorsServicealsomaintainpoliciesandprocedurestoaddresstheindependenceCONSTITUTEORPROVIDEINVESTMENTORFINANCIALADVICE,ANDMOODY’SCREDITRATINGS,ASSESSMENTS,OTHEROPINIONSANDofMoody’sInvestorsServicecreditratingsandcreditratingprocesses.InformationregardingcertainaffiliationsthatmayexistbetweendirectorsofMCOPUBLICATIONSARENOTANDDONOTPROVIDERECOMMENDATIONSTOPURCHASE,SELL,ORHOLDPARTICULARSECURITIES.MOODY’Sandratedentities,andbetweenentitieswhoholdcreditratingsfromMoody’sInvestorsServiceandhavealsopubliclyreportedtotheSECanownershipCREDITRATINGS,ASSESSMENTS,OTHEROPINIONSANDPUBLICATIONSDONOTCOMMENTONTHESUITABILITYOFANINVESTMENTFORinterestinMCOofmorethan5%,ispostedannuallyatwww.moodys.comundertheheading“InvestorRelations—CorporateGovernance—DirectorandANYPARTICULARINVESTOR.MOODY’SISSUESITSCREDITRATINGS,ASSESSMENTSANDOTHEROPINIONSANDPUBLISHESITSShareholderAffiliationPolicy.”PUBLICATIONSWITHTHEEXPECTATIONANDUNDERSTANDINGTHATEACHINVESTORWILL,WITHDUECARE,MAKEITSOWNSTUDYANDEVALUATIONOFEACHSECURITYTHATISUNDERCONSIDERATIONFORPURCHASE,HOLDING,ORSALE.AdditionaltermsforAustraliaonly:AnypublicationintoAustraliaofthisdocumentispursuanttotheAustralianFinancialServicesLicenseofMOODY’Saffiliate,Moody’sInvestorsServicePtyLimitedABN61003399657AFSL336969and/orMoody’sAnalyticsAustraliaPtyLtdABN94105136972AFSLMOODY’SCREDITRATINGS,ASSESSMENTS,OTHEROPINIONS,ANDPUBLICATIONSARENOTINTENDEDFORUSEBYRETAILINVESTORS383569(asapplicable).Thisdocumentisintendedtobeprovidedonlyto“wholesaleclients”withinthemeaningofsection761GoftheCorporationsActANDITWOULDBERECKLESSANDINAPPROPRIATEFORRETAILINVESTORSTOUSEMOODY’SCREDITRATINGS,ASSESSMENTS,OTHER2001.BycontinuingtoaccessthisdocumentfromwithinAustralia,yourepresenttoMOODY’Sthatyouare,orareaccessingthedocumentasaOPINIONSORPUBLICATIONSWHENMAKINGANINVESTMENTDECISION.IFINDOUBTYOUSHOULDCONTACTYOURFINANCIALOROTHERrepresentativeof,a“wholesaleclient”andthatneitheryounortheentityyourepresentwilldirectlyorindirectlydisseminatethisdocumentoritscontentstoPROFESSIONALADVISER.“retailclients”withinthemeaningofsection761GoftheCorporationsAct2001.MOODY’Screditratingisanopinionastothecreditworthinessofadebtobligationoftheissuer,notontheequitysecuritiesoftheissueroranyformofsecuritythatisavailabletoretailinvestors.ALLINFORMATIONCONTAINEDHEREINISPROTECTEDBYLAW,INCLUDINGBUTNOTLIMITEDTO,COPYRIGHTLAW,ANDNONEOFSUCHINFORMATIONMAYBECOPIEDOROTHERWISEREPRODUCED,REPACKAGED,FURTHERTRANSMITTED,TRANSFERRED,DISSEMINATED,AdditionaltermsforJapanonly:Moody'sJapanK.K.(“MJKK”)isawholly-ownedcreditratingagencysubsidiaryofMoody'sGroupJapanG.K.,whichisREDISTRIBUTEDORRESOLD,ORSTOREDFORSUBSEQUENTUSEFORANYSUCHPURPOSE,INWHOLEORINPART,INANYFORMORwholly-ownedbyMoody’sOverseasHoldingsInc.,awholly-ownedsubsidiaryofMCO.Moody’sSFJapanK.K.(“MSFJ”)isawholly-ownedcreditratingMANNERORBYANYMEANSWHATSOEVER,BYANYPERSONWITHOUTMOODY’SPRIORWRITTENCONSENT.agencysubsidiaryofMJKK.MSFJisnotaNationallyRecognizedStatisticalRatingOrganization(“NRSRO”).Therefore,creditratingsassignedbyMSFJareNon-NRSROCreditRatings.Non-NRSROCreditRatingsareassignedbyanentitythatisnotaNRSROand,consequently,theratedobligationwillnotMOODY’SCREDITRATINGS,ASSESSMENTS,OTHEROPINIONSANDPUBLICATIONSARENOTINTENDEDFORUSEBYANYPERSONASAqualifyforcertaintypesoftreatmentunderU.S.laws.MJKKandMSFJarecreditratingagenciesregisteredwiththeJapanFinancialServicesAgencyandBENCHMARKASTHATTERMISDEFINEDFORREGULATORYPURPOSESANDMUSTNOTBEUSEDINANYWAYTHATCOULDRESULTINTHEMtheirregistrationnumbersareFSACommissioner(Ratings)No.2and3respectively.BEINGCONSIDEREDABENCHMARK.MJKKorMSFJ(asapplicable)herebydisclosethatmostissuersofdebtsecurities(includingcorporateandmunicipalbonds,debentures,notesandAllinformationcontainedhereinisobtainedbyMOODY’Sfromsourcesbelievedbyittobeaccurateandreliable.Becauseofthepossibilityofhumanorcommercialpaper)andpreferredstockratedbyMJKKorMSFJ(asapplicable)have,priortoassignmentofanycreditrating,agreedtopaytoMJKKormechanicalerroraswellasotherfactors,however,allinformationcontainedhereinisprovided“ASIS”withoutwarrantyofanykind.MOODY'SadoptsallMSFJ(asapplicable)forcreditratingsopinionsandservicesrenderedbyitfeesrangingfromJPY100,000toapproximatelyJPY550,000,000.necessarymeasuressothattheinformationitusesinassigningacreditratingisofsufficientqualityandfromsourcesMOODY'Sconsiderstobereliableincluding,whenappropriate,independentthird-partysources.However,MOODY’SisnotanauditorandcannotineveryinstanceindependentlyverifyorMJKKandMSFJalsomaintainpoliciesandprocedurestoaddressJapaneseregulatoryrequirements.validateinformationreceivedintheratingprocessorinpreparingitsPublications.Totheextentpermittedbylaw,MOODY’Sanditsdirectors,officers,employees,agents,representatives,licensorsandsuppliersdisclaimliabilitytoanypersonorentityforanyindirect,special,consequential,orincidentallossesordamageswhatsoeverarisingfromorinconnectionwiththeinformationcontainedhereinortheuseoforinabilitytouseanysuchinformation,evenifMOODY’Soranyofitsdirectors,officers,employees,agents,representatives,licensorsorsuppliersisadvisedinadvanceofthepossibilityofsuchlossesordamages,includingbutnotlimitedto:(a)anylossofpresentorprospectiveprofitsor(b)anylossordamagearisingwheretherelevantfinancialinstrumentisnotthesubjectofaparticularcreditratingassignedbyMOODY’S.InsideChinawithMoody’s,October202317

VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP