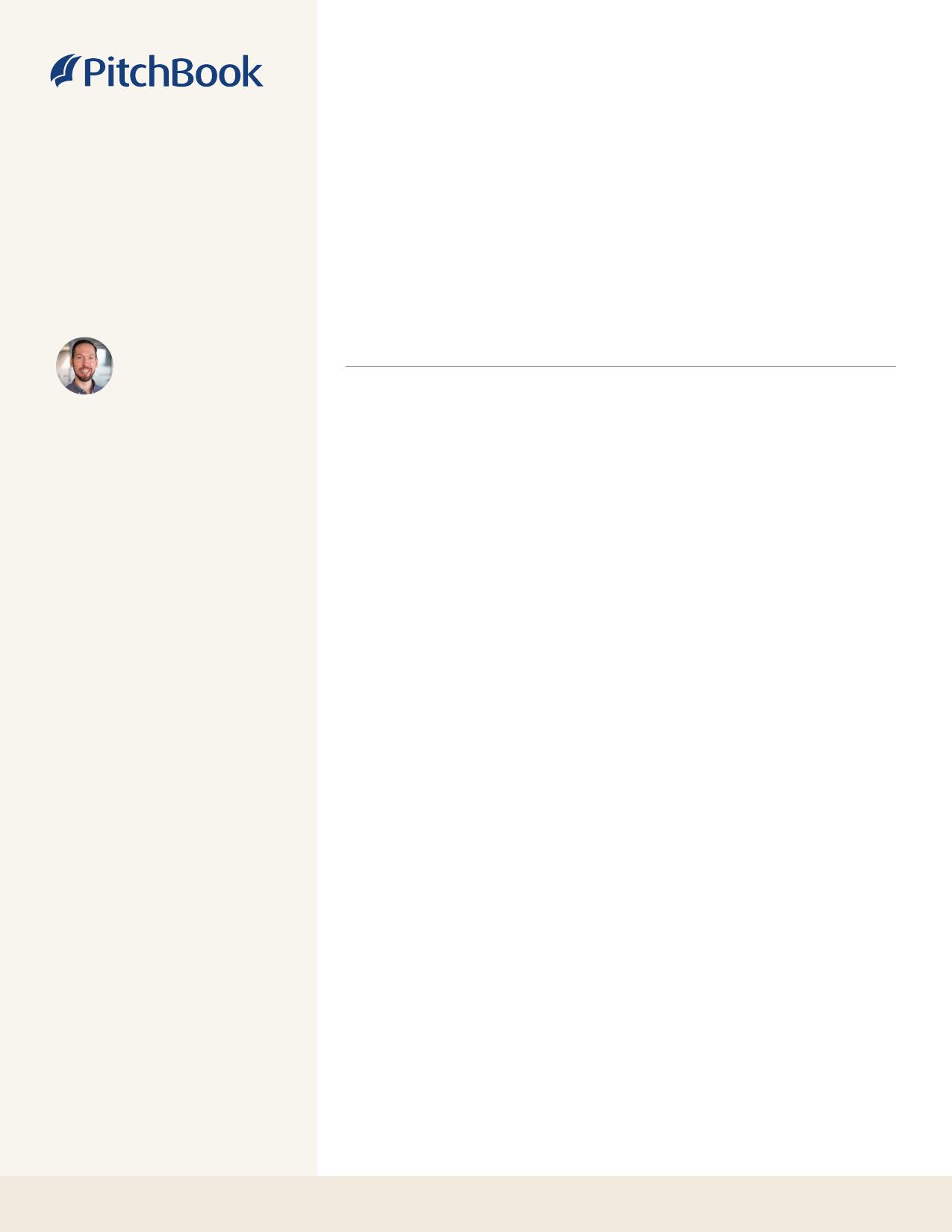

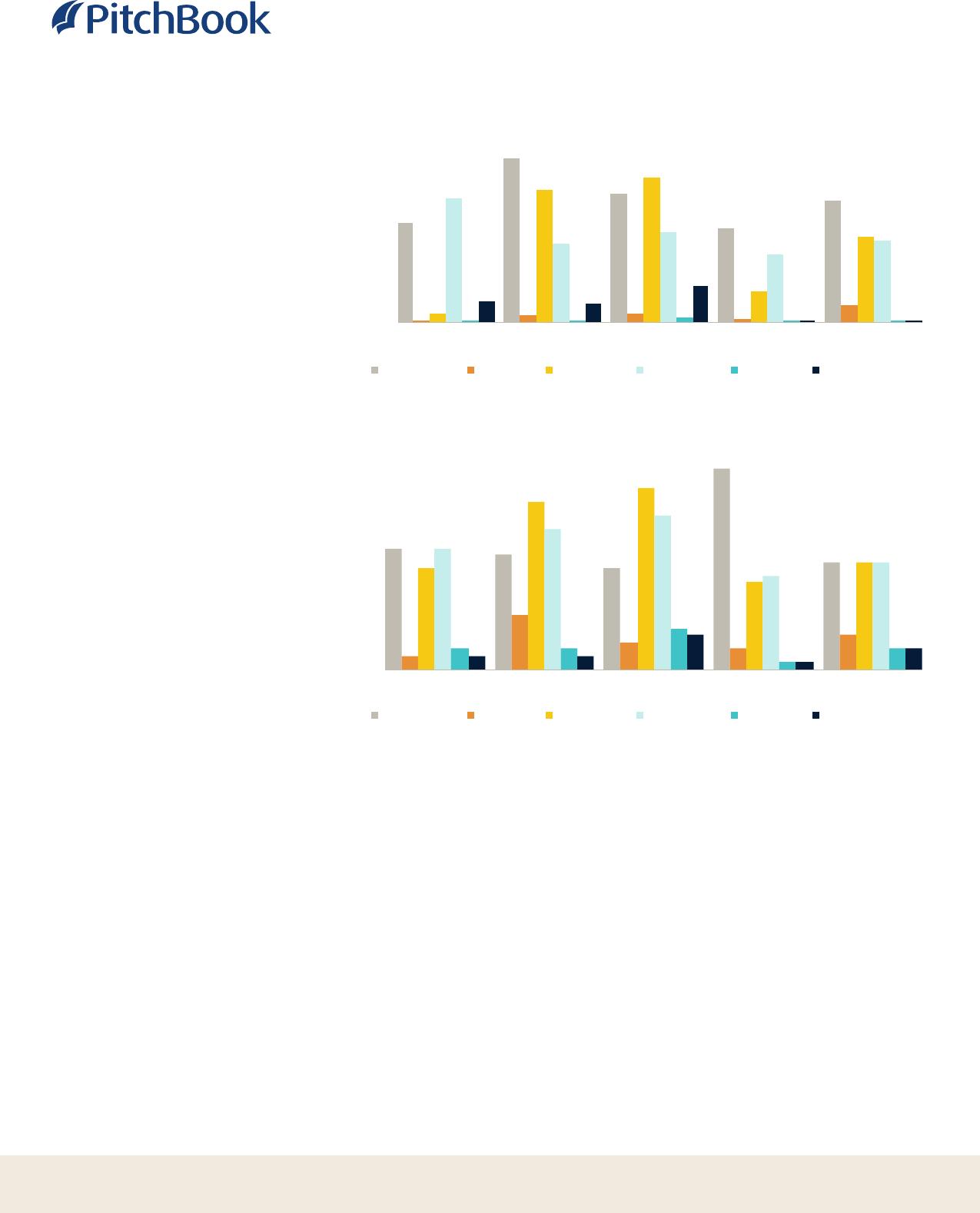

PitchBookData,Inc.EMERGINGTECHRESEARCHJohnGabbertFounder,CEOBiologicalsBringNatureBacktoAgricultureNizarTarhuniVicePresident,InstitutionalResearchandEditorialSustainablealternativestosyntheticagriculturalinputsPaulCondraHeadofEmergingPitchBookisaMorningstarcompanyprovidingthemostcomprehensive,mostTechnologyResearchaccurate,andhard-to-finddataforprofessionalsdoingbusinessintheprivatemarkets.InstitutionalResearchGroupOverviewAnalysisTheagriculturalindustryisundergoingatransformativeshifttowardsustainableandenvironmentallyfriendlyfarmingpractices.OneofthekeyfacilitatorsofAlexFrederickthischangeistheadoptionofagriculturalbiologicals—acategoryofproductsSeniorAnalyst,Emergingderivedfromnaturalsourcesthatenhancecropproductivity,optimizesoilhealth,Technologyandreducetherelianceontraditionalchemicalinputs.Despiteanoveralltepidalex.frederick@pitchbook.commacroeconomicenvironmentandapullbackinVCactivity,demandforbiologicalshasremainedrobust.Weestimatethisindustrywillgeneratecloseto$15billioninDatarevenuein2023,withatotalVCinvestmentofnearly$1billion.TJMeiDataAnalystAgriculturalbiologicalsencompassadiverserangeofproducts,includingbiopesticides,biofertilizers,andbiostimulants,amongothers.Unlikeconventionalpbinstitutionalresearch@pitchbook.comchemicalagriculturalinputs,biologicalsleveragethepoweroflivingorganismssuchasbacteria,fungi,andplantextractstopromoteplantgrowthandprotectPublishingcropsfrompestsanddiseases.Thiscategoryhasexperiencedrapidgrowthinnewcompanyformationandventurefunding.DespitemarketvolatilityaffectingfundingDesignedbyJoeySchafferinotherindustries,strongindustrydrivershavekeptVCfundingforbiologicalsrobust.Thisreportprovidesacomprehensiveoverviewofagriculturalbiologicals,PublishedonJanuary19,2024examiningtheirbenefits,challenges,ventureactivity,androleinshapingthefutureofsustainableagriculture.ContentsKeycategoriesofagriculturalbiologicalsOverview1Biofertilizers:Theseproductscontainbeneficialmicroorganisms(suchasbacteria,Keycategoriesofagriculturalbiologicals1fungi,oralgae)ortheirbyproductsthatenhancenutrientavailabilitytoplants,promotinghealthierrootsystemsandincreasednutrientuptake.TheyworkbyBenefitsandchallenges3establishingsymbioticorassociativerelationshipswithplants.Forexample,nitrogen-fixingbacteriainbiofertilizersconvertatmosphericnitrogenintoformsMarket4thatplantscanuse,promotingsoilfertility.Biofertilizerscontributetoimprovedsoilfertilityandlong-termsustainability.KeyVC-backedprovidersincludePivotBio,Macrodrivers5Loam,KulaBio,andNutritionTechnologies.VCactivity7Exits81PitchBookAnalystNote:BiologicalsBringNatureBacktoAgricultureBiostimulants:Comprisingsubstancessuchasseaweedextractsandhumicacids,1biostimulantsstimulatenaturalprocessestoenhanceplantgrowth,development,andresiliencetostressfactors.Theyactascatalystsforphysiologicalprocesses,resultinginincreasedcropyieldsandquality.Unlikebiofertilizers,biostimulantsmaynotcontainlivemicroorganisms.Instead,theyoftenconsistofcompoundssuchasaminoacids,seaweedextracts,humicsubstances,andotherorganicmaterialsthatactivatephysiologicalprocessesinplants.KeyVC-backedprovidersincludeIndigo,Sound,Aphea.Bio,andNewLeafSymbiotics.Inoculants:Inoculants,specificallymicrobialinoculants,areproductsthatcontainbeneficialmicroorganisms,suchasbacteria,fungi,orothermicrobes,andareappliedtosoilorplantsurfacestoestablishsymbioticorbeneficialrelationshipsthatenhanceplantgrowth,nutrientavailability,andoverallcropproductivity.Themicroorganismsininoculantsinteractwithplantsinwaysthatenhancenutrientavailability,protectagainstpathogens,orpromoteoverallplanthealth.Examplesincludenitrogen-fixingbacteria,mycorrhizalfungi,andplant-growth-promotingbacteria.KeyVC-backedprovidersincludeGroundworkBioAg,AlgaEnergy,andFicosterra.Biopesticides:Thesearenaturallyoccurringsubstances,suchasmicrobesorplantextracts,thatcontrolpestsanddiseases.Biopesticidescanincludemicrobialpesticides(forexample,bacteriaandfungi),plant-basedpesticides,andbiochemicalpesticides(pheromones,forexample).Unlikechemicalpesticides,biopesticidesoffertargetedsolutionswithminimalimpactonnontargetorganismsandtheenvironment.KeyVC-backedprovidersincludeAgBiome,Vestaron,Enko,andInvaio.Macrobials:Macrobialsgenerallyrefertolargeorganismsusedinagricultureforpestcontrol.Thiscategoryincludesmacroscopicorganismssuchasinsects,mites,nematodes,andpredatoryorparasiticorganisms.Macrobialsareemployedasbiologicalcontrolagentstomanagepests.Forexample,predatoryinsectssuchasladybugsorparasiticnematodesmaybeintroducedtocontrolpestpopulationsinatargetedandenvironmentallyfriendlymanner.Otherexamplesincludeladybugsforaphidcontrol,predatorymitesforspidermitecontrol,andentomopathogenicnematodesforcontrollingsoil-dwellingpests.KeyVC-backedprovidersincludeUbees,Beeflow,andBigSis.Semiochemicals:Semiochemicalsarechemicalsubstancesthatconveyinformationbetweenorganisms.Inagriculture,theyareoftensignalingchemicalsusedforcommunicationbetweenplants,insects,andotherorganisms.Semiochemicalscanactasattractants,repellents,ordisruptantsinthebehaviorofpestsorbeneficialorganisms.Theyplayaroleinchemicalcommunicationwithinecosystems.Examplesincludepheromonesreleasedbyinsectstoattractmates,plantvolatilesthatattractpollinators,andrepellentsusedtodeterpests.KeyVC-backedprovidersincludeProvivi,PherobioTechnologies,andAgroSustain.1:Humicacidisanorganicmoleculethatimprovessoilstructure,waterretention,andnutrientuptakebyplants.Itisderivedfromcoal,lignite,soils,andotherorganicmaterials.2PitchBookAnalystNote:BiologicalsBringNatureBacktoAgricultureAgriculturalbiologicalsVCdealvalue($M)bysegment$800$600$400$200$020202021202220232019InoculantsBiofertilizersBiopesticidesMacrobialsSemiochemicalsBiostimulantsSource:PitchBook•Geography:Global•AsofDecember22,2023AgriculturalbiologicalsVCdealcountbysegment30252015105020202021202220232019InoculantsBiofertilizersBiopesticidesMacrobialsSemiochemicalsBiostimulantsSource:PitchBook•Geography:Global•AsofDecember22,2023BenefitsandchallengesAgriculturalbiologicalscontributetoenvironmentalsustainabilitybyreducingchemicalresidues,promotingsoilandwaterconservation,andfosteringoverallecosystemhealth.Biofertilizersenhancesoilhealthbyencouragingbeneficialmicroorganisms,improvingnutrientcycling,andincreasingorganicmattercontent.Adoptingbiopesticidesandbiofertilizersreducesrelianceonsyntheticchemicals,supportsintegratedpestmanagement,andalignswithsustainableagricultureprinciples.Biostimulantsplayacrucialroleinplantgrowthpromotion,optimizingphysiologicalprocessesaswellasenhancingcropyieldsandquality.Biopesticidesalsocontributetoresistancemanagementbyofferingadifferentmodeofactioncomparedtoconventionalchemicalpesticides.Theintroductionofagriculturalbiologicalssupportsmicrobialdiversityinthesoil,contributingtoahealthyandbalancedsoilmicrobiome.Moreover,thecompatibilityofmanybiologicalswithorganicfarmingpracticesmakesthemvaluabletoolsfororganicfarmers.3PitchBookAnalystNote:BiologicalsBringNatureBacktoAgricultureHowever,thesebenefitsareaccompaniedbyseveralchallenges.Theefficacyofagriculturalbiologicalscanvary,influencedbyfactorssuchasenvironmentalconditions,applicationmethods,andcompatibilitywithotherinputs.Somebiologicalsmayhavelimitedpersistenceintheenvironment,necessitatingmorefrequentapplicationscomparedtotheirsyntheticcounterparts.Thedevelopmentandcommercializationofagriculturalbiologicalsinvolveresearch&developmentcosts,posingfinancialchallengesforstartupsandcompanies.A2021pulsepolloffarmersindicatedthat21%ofrespondentsknewnothingaboutbiologicals,andanother41%neededtolearnmoreaboutthembeforeusingthemontheirfarms.2Awarenessandeducationamongfarmersaboutthebenefitsandproperuseofthesebiologicalsarecrucialfortheirsuccessfuladoption.Storageandshelf-lifeconsiderationscanpresentlogisticalchallenges,especiallyformicrobialinoculantswithspecificrequirements.Regulatoryapprovalprocessesforagriculturalbiologicalsarecomplexandtime-consuming,posinghurdlesformarketentry.Challengesrelatedtoresistanceandadaptationofpestsanddiseasestobiopesticidesrequireongoingresearchefforts.Achievingmarketacceptanceandwidespreadadoptionofagriculturalbiologicalsmaynecessitateovercomingskepticismandtraditionalfarmingpractices.Addressingthesechallengesinvolvescollaborativeeffortsamongresearchers,industrystakeholders,andregulatorybodies,withadvancementsintechnologyandbetterunderstandingofmicrobialinteractionsexpectedtoenhancethebenefitsofagriculturalbiologicalsovertime.MarketTheglobalagriculturalbiologicalsmarketisexpectedtogenerate$14.6billionin2023,growingto$27.9billionby2028,representinga13.8%CAGR,3excludinganystructuralmarketdisruptions.Environmentalconcerns,mountinginterestinimprovingsoilandoverallfarmhealth,technologicalinnovations,andapursuitofsustainableyieldimprovementenablethisgrowth.Geopoliticalconflicts,suchastheongoingwarinUkraine,cancausesupplychaindisruptionsandresultinresourcescarcity.Thisscarcitycanaffecttheaccessibilityandaffordabilityofconventionalagriculturalinputssuchassyntheticfertilizer.Asaresult,theadoptionofnovelalternativessuchasbiofertilizersmaybeaccelerated.However,thegrowingdemandforagriculturalbiologicalsisnotexpectedtocannibalizedemandforconventionalinputs.Infact,demandforconventionalinputsisexpectedtooutpacebiologicalsfortheforeseeablefuture.Duetothechallengesofadoptingbiologicals,expertsnowlargelyviewthemlessasareplacementforchemicalsinputsandmoreasanewtoolinatoolboxofsolutions.Theconsensusamongexpertsatthe2023SalinasBiologicalSummit—thelargestconferenceonagriculturalbiologicals—pointedtotheneedforan“integratedapproach”usingvariouschemicalandbiologicalproductsintandemtoboostormaintainyieldswhileimprovingfarmhealth.4Thecropprotectionmarketisdominatedbythe“bigfour”agrochemicalcompanies:Bayer,BASF,Corteva,andChem-China.Thesecompanieshavegainedexposureto2:“FarmersWantProofofConceptBeforeTryingBiologicals,”Agweb,SonjaBegemann,January11,2021.3:“AgriculturalBiologicalsMarket,”MarketsandMarkets,July2023.4:“BiologicalsWon’tReplaceChemicalCropInputsAnytimeSoon:Here’sWhy,”AgfunderNews,JenniferMarston,June27,2023.4PitchBookAnalystNote:BiologicalsBringNatureBacktoAgriculturebiologicalsthroughacquisitionsandin-housedevelopment.SomeofthelargestacquisitionsincludeChemChina’sacquisitionofSyngenta,Corteva’sacquisitionofStollerGroupandSymborgCorporate,andBASF’sacquisitionofMicroFloCompany.Thesecompaniesalsogainexposurethroughcorporateventureactivity.Someofthemostwell-fundedbiologicalstartupswithcorporateventurecapital(CVC)fundingincludePivotBio,AgBiome,andProvivi.Whilethebigfourcontinuetodominate,VC-backedstartupshaveraisedsignificantcapitalandintroducednewproductstomarket.Indigohaslaunchedaportfolioofbiostimulantsforcorn,soy,wheat,andcottonproducts.PivotBiohasitsownportfolioofcorn,wheat,andsorghumbiofertilizers,andAgbiomerecentlylaunchedtwobiofungicideproducts.Themajorityofbiologicalcompanies—64outofourlistof764—arebasedintheUS,followedbyCanada(37),Spain(36)andIndia(35).Asaregion,Europehasproduced169startups,whileAsiahasproduced60.MacrodriversTheadoptionofagriculturalbiologicalsisinfluencedbymacroeconomicdriversthatreflectbroadereconomictrendsandprioritieswithintheagriculturesector.Somekeymacroeconomicdriversinfluencingtheadoptionofagriculturalbiologicalsinclude:•Sustainabilityandenvironmentalconcerns:-Increasingawarenessofenvironmentalsustainabilityandadesiretoreducetheecologicalfootprintofagriculturearedrivingincreasedinterestinbiologicals.Agriculturalproducersrespondtomarketsignals,recognizingtheimportanceofaligningtheirpracticeswithconsumerpreferencesforenvironmentallyfriendlyandresponsiblysourcedgoods.-Sustainablepractices,includingtheuseofbiologicals,alignwithconsumerpreferencesandregulatoryinitiativesfocusedonenvironmentalconservation.-Soilcarbonprojectsandcarboncreditsincentivizeagriculturalproducerstoadoptbiologicalsandothersustainablepractices.•Globalpopulationgrowth:-Thegrowingglobalpopulation,expectedtoreach9.7billionby2050,5necessitatesincreasedfoodproduction,promptingtheadoptionoftechnologiesthatenhancecropyieldandquality.-Agriculturalbiologicalscontributetosustainableintensification—anagriculturalapproachthatincreasesfoodproductionwhileminimizingenvironmentalimpact.Forexample,usingbiologicalmethodstoimprovesoilhealthandfertilitycanimprovecrophealthandyields.5:“Population,”UnitedNations,n.d.,accessedDecember21,2023.5PitchBookAnalystNote:BiologicalsBringNatureBacktoAgriculture•Governmentsupportandregulations:-Supportiveregulatoryframeworksthatencouragesustainableagriculturalpractices,includingtheuseofbiologicals,playacrucialroleinadoption.-Governmentspromotingreducedrelianceonsyntheticchemicalsandendorsingeco-friendlyalternativescreateanenvironmentconducivetotheadoptionofagriculturalbiologicals.TheUSDepartmentofAgriculture’sNaturalResourcesConservationServiceoffersconservationprogramsthateducateandencouragetheadoptionofbiologicals.-Governmentpolicies,subsidies,andincentivesthatpromotesustainableagricultureandtheadoptionofbiologicalsencouragefarmerstoincorporatethesepractices.•Technologicaladvancements:-Advancesinbiotechnology,microbiology,andprecisionagriculturecontributetothedevelopmentofmoreeffectiveandtargetedagriculturalbiologicalproducts.•Climatechangeresilience:-Concernsabouttheimpactofclimatechangeonagriculturedrivetheadoptionofpracticesthatenhanceresilience.-Agriculturalbiologicals,whichcancontributetoimprovedsoilhealthandplantstresstolerance,areseenastoolsforbuildingclimate-resilientfarmingsystems.•Economicviability:-Theeconomicfeasibilityofadoptingagriculturalbiologicals,consideringfactorssuchasinputcosts,yieldimprovements,andoverallfarmprofitability,influencesadoptiondecisions.-Farmersevaluatethereturnoninvestmentandcost-effectivenessofincorporatingbiologicalsintotheirfarmingpractices.•Geopoliticaleventsanddisruptionsinsupplychains-Geopoliticaleventsandconflictscandisrupttraditionalsupplychainsforagriculturalinputs,includingsyntheticfertilizers.Thisdisruptionmaypromptfarmerstoexplorealternativeandlocallyavailableinputs,suchasbiofertilizers.Thesemacroeconomicdriverscollectivelyinfluencethedecision-makingprocessforfarmersandagriculturalstakeholders,shapingtheadoptionlandscapeforagriculturalbiologicalswithinthebroadercontextofglobalagriculture.6PitchBookAnalystNote:BiologicalsBringNatureBacktoAgricultureVCactivityTheagriculturalbiologicalssectorhasgainedinvestorattentionduetotheincreasingdemandforsustainableandenvironmentallyfriendlyagriculturalpractices.2023YTDdealvaluesexceededthetotaldealvaluesfor2022,buckingthecurrenttrendofVCslowdown.Welogged$983.5millioninvestedacross49dealsin2023,withdealvaluesup30.6%versusthe2022annualtotal.AgriculturalbiologicalsVCdealactivity7164475549334037292717$72.7$141.3$183.4$398.0$605.4$676.9$740.5$1,514.4$1,633.0$753.3$983.520132014201520162017201820192020202120222023Dealvalue($M)DealcountSource:PitchBook•Geography:Global•AsofDecember22,2023Thebiostimulantcategoryattractedthemostventurecapital,with$497.7millioninvestedacross16dealsin2023.Thelargestbiostimulantdealof2023wasa$250.0millionlate-stageinvestmentinscale-upIndigo.AlthoughIndigo’sfirstproductwasabiostimulant,ithassinceexpandedtonewproductsandservices,includinganintegratedcarboncreditandcarbonfarmingprogramandadigitalsustainabilityprogram.Thesecond-largestdealwasa$77.8millionlate-stageroundattributedtoElementalEnzymes,acropnutrientdeveloperthatproducesvariousplantnutrientproductsusingnaturallyoccurringenzymesandbiochemistries.Laggingcategoriesincludeinoculantsandsemiochemicals.Whileproductsinthesecategoriesbenefitsoilandplanthealth,lackofawarenessandeducationamongfarmersandthelearningcurvestohandleandstoretheseproductshavechallengedadoption.Scale-upLoamBioisakeyproviderofinoculantsandhasraised$109.7million.Itprovidesamicrobialsoilinoculantproducttoimprovesoilhealthaswellassoilcarbonprojectsthatcompensatefarmersforthecarbonsequestrationbenefitsofitsproducts.Valuationsincreasedforthreestraightyearsthrough2022asenthusiasmforthespacegrew.However,marketvolatilityandachallengingexitenvironmentreversedthetrendacrossallventurestagesin2023,withoverallmedianpre-moneyvaluationsdown44.5%to$16.0millionYoY.Themostsignificantdeclineinvaluationsisattheventure-growthstage,wherealackoffundingopportunitiesandexitoptionshavecompressedvaluationsby85.1%to$44.6millionYoY.7PitchBookAnalystNote:BiologicalsBringNatureBacktoAgricultureMediandealsizespaintaverydifferentpicture,withoveralldealsizesup71.8%to$10.0millionYoY.Dealsizesincreasedateverystage,barringpre-seed&seed,whichdeclined70.6%to$1.0millionYoY.WeattributethegrowthindealsizestoVCstakingamoreconservativeapproachbywritingfewerbutlargerchecks,withafocusonportfoliocompaniesornewcompanieswiththegreatestchanceofsuccess.KeyVC-backedagriculturalbiologicalscompaniesCompanyHQlocationCategoryMostrecentfinancingVC($M)raisedMostrecentpost-Mostrecentdealtypetodatemoneyvaluation($M)Late-stageVCSeriesDPivotBioBerkeley,USBiofertilizersOctober13,2023$622.0$1,700.0SeriesDBiofertilizersDecember11,2023SeriesCYnsectÉvry,FranceBiopesticidesNovember14,2023$583.4$747.5SeriesC2BiopesticidesMarch30,2023Late-stageVCAgBiomeDurham,USSemiochemicalsJune12,2023$236.2N/ASeriesDSemiochemicalsSeptember4,2023SeriesCVestaronDurham,USBiostimulantsDecember14,2023$199.3$362.0SeriesCBiopesticidesAugust24,2023ProviviSantaMonica,USBiopesticidesJune20,2023$192.2$420.0Biostimulants,SemiosBioTechnologiesVancouver,CanadabiopesticidesJuly11,2023$180.5$789.6SoundAgricultureEmeryville,US$170.4$375.0EnkoMystic,US$151.0$330.0InvaioCambridge,US$150.9$144.0Aphea.BioGhent,Belgium$123.9$34.8SeriesCSource:PitchBook•Geography:Global•AsofDecember22,2023ExitsWhiletheagriculturalbiologicalssectorhasexperiencedrapidgrowth,itisstillnascent.VC-backedexitactivityremainslimited,andupwardgrowthwasstuntedin2023duetobroadermarketchallenges.WeloggedfiveVC-backedexitsin2022andfourexitsin2023asofDecember21.Analyzingall-timeexitactivity,companiesproducingbiostimulantsandbiopesticideswerethemostlikelytoexit,with19exitslogged,or70.4%ofexits.M&Aisthemostcommonformofexit,accountingfor37.0%ofallexits.WeloggedsevenIPOsandthreereversemergers,makingpubliclistinganequallylikelyexitpath.TwoofthemostnotablebiologicalcompaniesincludeGinkgoBioworksandGreenLightBiosciences.Bothcompaniesexitedviareversemerger.8PitchBookAnalystNote:BiologicalsBringNatureBacktoAgricultureAgriculturalbiologicalsVCexitactivity5431221$162.20100$0.0$262.2$0.0$0.0$0.0$18.2$0.0$17,112.5$1,275.4$0.020132014201520162017201820192020202120222023Exitvalue($M)ExitcountSource:PitchBook•Geography:Global•AsofDecember22,2023COPYRIGHT©2024byPitchBookData,Inc.Allrightsreserved.Nopartofthispublicationmaybereproducedinanyformorbyanymeans—graphic,electronic,ormechanical,includingphotocopying,recording,taping,andinformationstorageandretrievalsystems—withouttheexpresswrittenpermissionofPitchBookData,Inc.Contentsarebasedoninformationfromsourcesbelievedtobereliable,butaccuracyandcompletenesscannotbeguaranteed.Nothinghereinshouldbeconstruedasinvestmentadvice,apast,currentorfuturerecommendationtobuyorsellanysecurityoranoffertosell,orasolicitationofanoffertobuyanysecurity.Thismaterialdoesnotpurporttocontainalloftheinformationthataprospectiveinvestormaywishtoconsiderandisnottoberelieduponassuchorusedinsubstitutionfortheexerciseofindependentjudgment.9

VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP