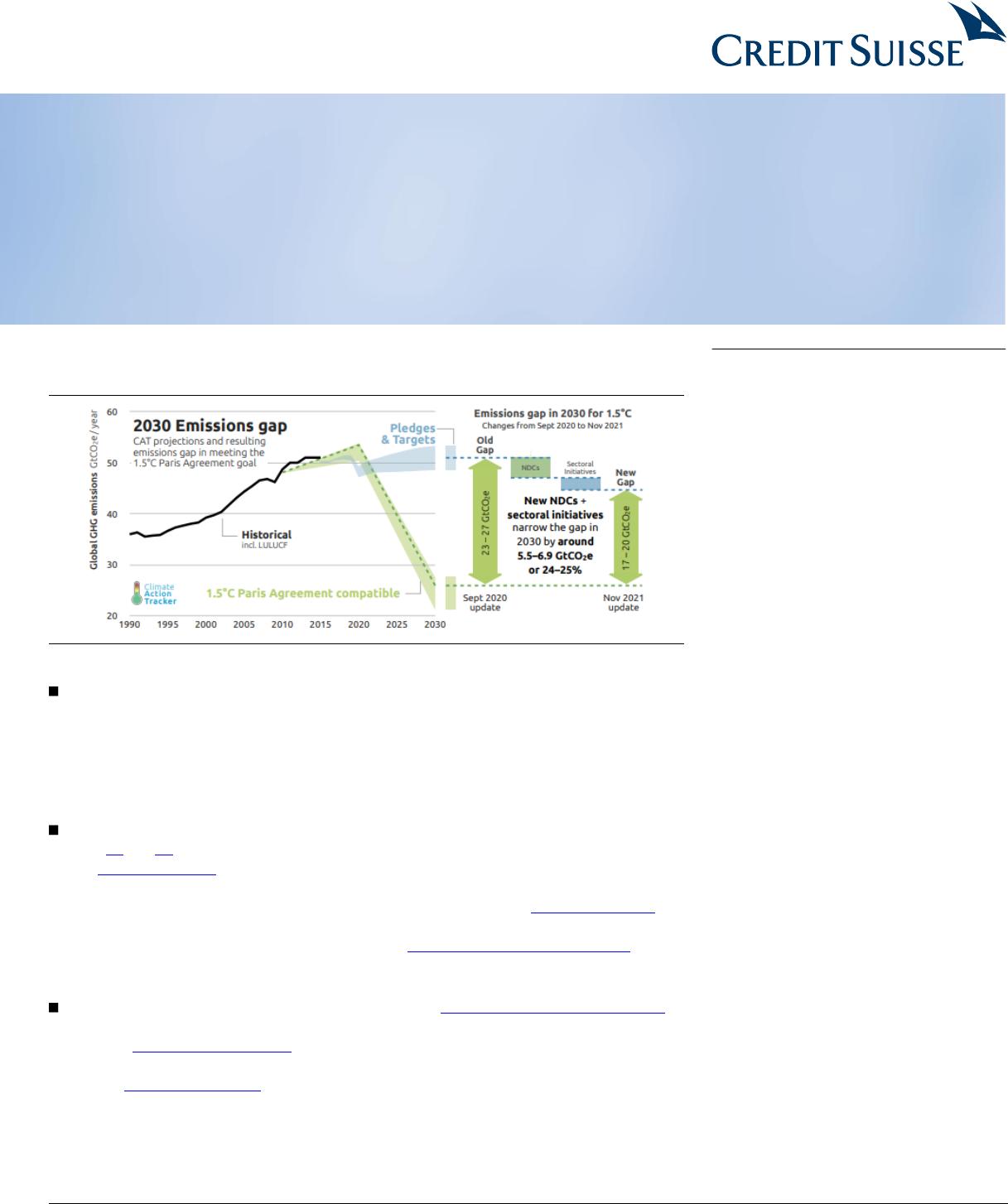

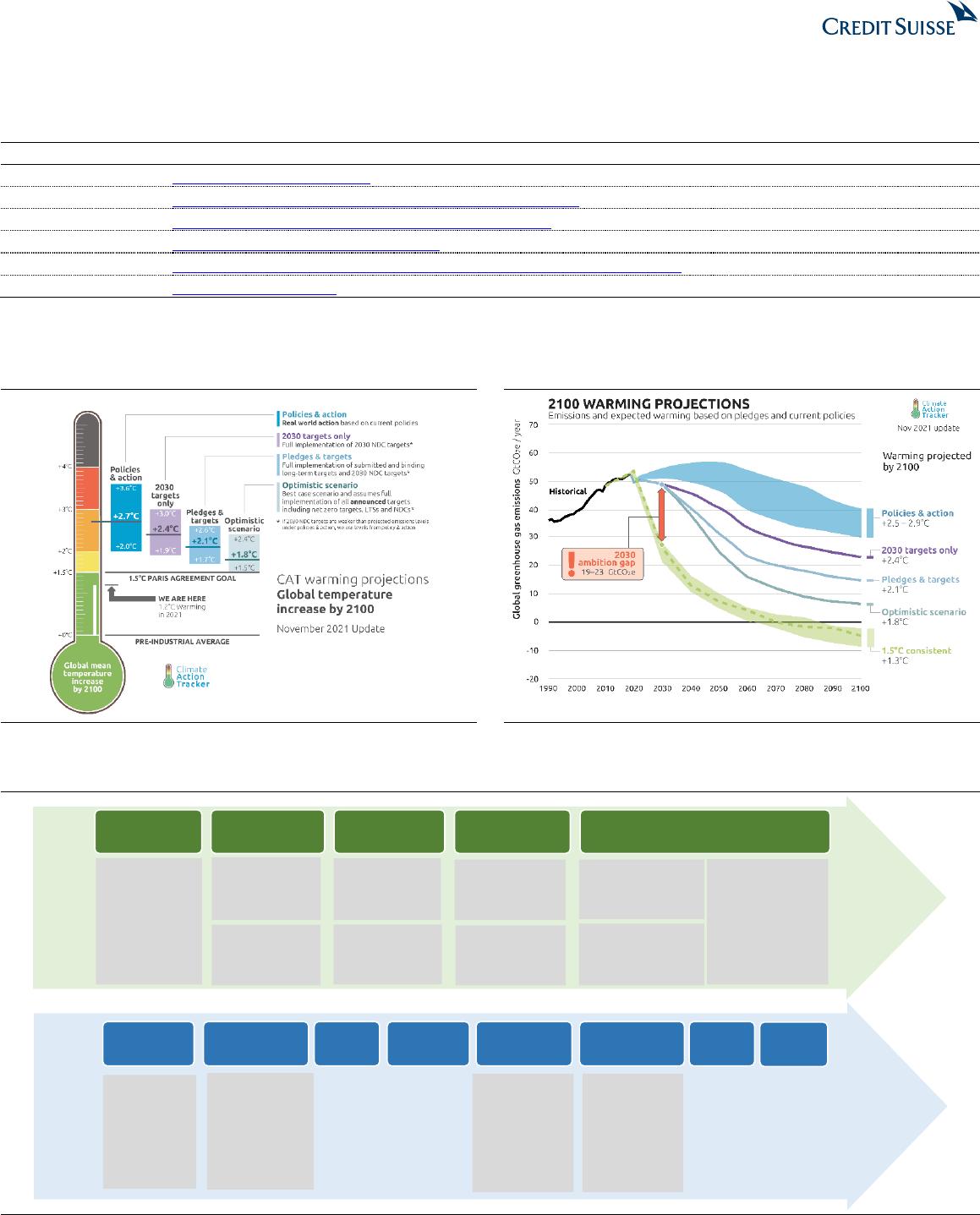

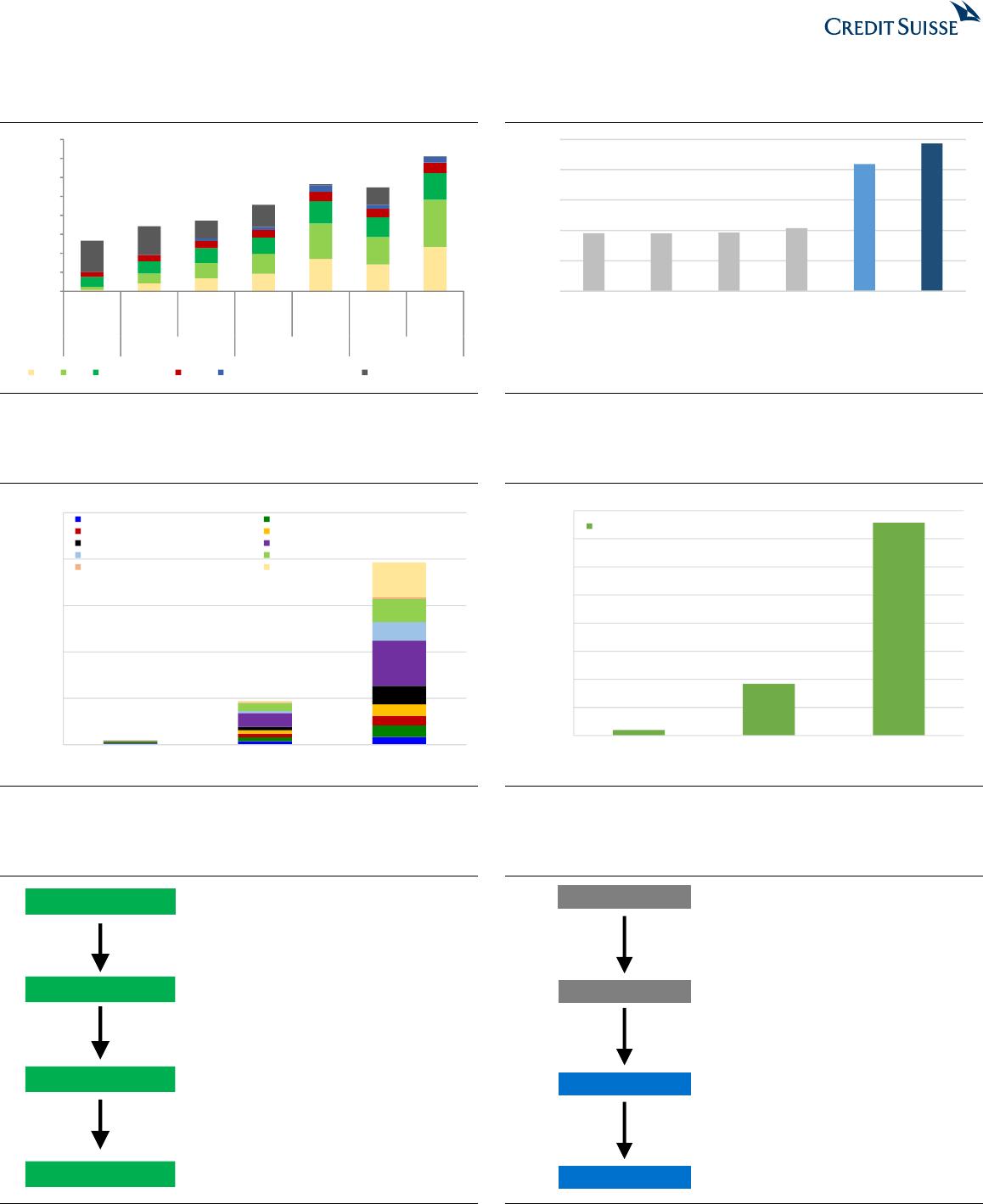

GlobalThemesMonitorAlternativeEnergy(Vol.3):Hydrogen,DecarbonisationandRenewablesThematicResearchThemeFigure1:ImpactofrecentNDCsubmissions+sectoralpledgessinceSept-2020onthe2030emissionsgapSource:ClimateActionTracker.NDC–NationallyDeterminedContribution2021turnedouttobeanimportantyearformankind’seffortstomanageitscarbonfootprint.Afterleadershipchange,USAre-committedtoclimatechangemitigationefforts.Equallyimportant,China,whichisamanufacturingbaseforanumberofglobalproductsandhenceasizeablecontributortoGHGemissions,shareditsnetzerotargets.COP26broughttogetherleadershipfromacrosstheworld,andcountrieshaverenewedtheircommitmenttowardsmakingearthgreenerandtheenvironmenthealthier.However,asshowninFig.1,currentNDCsarenotsufficienttoreachthetargetedlevelofemissions.InthisthirdeditionoftheGlobalThemesMonitoronAlternativeEnergy(refertoearliereditionshere#1and#2),wehighlightkeyCSresearchreports.OurglobalESGresearchteamlooksatthekeyindustrytrends,andpresentsitsviewregardingkeymonitorablesin2022.TheteambelievesthatregulationanddecarbonisationwilldominatetheESGinvestments,whichhavenowreachedUS$35tninAUMin2021.CSGlobalESGteamevaluatestheprogressofCOP26,andsharesthatprivatesectorcommitmentscameoutasthebiggestupsidesurprise.Keepinginmindthenetzeroemissiontargets,CSEuropeteammapsoutthecapacitybuild-upplaningreenhydrogenproduction,renewablespowerandelectrolysiscapacityinthenextfewdecades.TheteamalsoinitiatedonEuropeanhydrogenandrenewablespure-plays.OurAPACESGStrategistdelvedintovariousfacetsofChina’sNetZeropolicyframeworkreleasedinlate2021.ThisreportbuildsonearlierworkdonebytheChinaEquityresearchteamonChina’scarbonneutralityefforts,whichhighlightstheprogressinrenewables,autos(NEV),materialsandindustrialssectors.OurGlobalRenewablesteamdidadeep-diveintovariousdisruptiveinnovationsacrossthesolar/windsupplychain,whichwillfurtherreducecostofrenewableenergy,andprovideastrongboosttonetzeroemissioninitiatives.Basedonthedeep-diveofourglobalteams,wepresentaconsolidatedlistofcompaniesexposedtothehydrogenthemeinAmericas,APAC,andEuropeinFigures35-37.‘GlobalThemesMonitor’providesupdatesonkeyglobalthemesandpresentsacomprehensiveround-upofCreditSuisseresearchonthesector.8February2022EquityResearchAsiaPacificDISCLOSUREAPPENDIXATTHEBACKOFTHISREPORTCONTAINSIMPORTANTDISCLOSURES,ANALYSTCERTIFICATIONS,LEGALENTITYDISCLOSUREANDTHESTATUSOFNON-USANALYSTS.USDisclosure:CreditSuissedoesandseekstodobusinesswithcompaniescoveredinitsresearchreports.Asaresult,investorsshouldbeawarethattheFirmmayhaveaconflictofinterestthatcouldaffecttheobjectivityofthisreport.Investorsshouldconsiderthisreportasonlyasinglefactorinmakingtheirinvestmentdecision.ResearchAnalystsGlobalSectorThemesMarketing85221017067globalsectorthemes.marketing@credit-suisse.comManishNigam85221017067manish.nigam@credit-suisse.comVaibhavJain85221017061vaibhav.jain@credit-suisse.com8February2022GlobalThemesMonitor2FocuschartsandtablesFigure2:KeydetailedreportsoverthepastfewmonthsSectorReportResearchAnalystMonthGlobalRenewablesSectorDisruptiveinnovationsforNetZeroAlexLiuJan-2022GlobalESGResearchSustainableInvestingin2022:FocusonregulationanddecarbonisationEugeneKlerkDec-2021SustainableEnergyInitiatingcoverageofEuropeanHydrogen&Renewablepure-playsChrisLeonardDec-2021GlobalESGResearchTakingStockofCOP26-WhatMatteredMostBettyJiang/PhineasGloverNov-2021TheCarbonCycleSeriesChinareleasesNetZeropolicyframeworkandactionplanforpeakingemissionsby2030PhineasGloverNov-2021ChinaMarketStrategyEmbracingCarbonNeutralityEdmondHuangSep-2021-Monthofpublication.Source:CreditSuisseFigure3:Globaltemperatureriseprojectionsby2100basedonpledgesandcurrentpoliciesFigure4:GlobalGHGemissionsandexpectedwarmingpathwaysbasedonpledgesandcurrentpoliciesSource:ClimateActionTrackerSource:ClimateActionTrackerFigure5:14disruptiveinnovationsinsolar/windandourestimatedglobalmarketsharechangesSource:CreditSuisseestimates;TOPCon=TunnelOxidePassivatedContact;HJT=HeterojunctionwithIntrinsicThin-layer;MBB=MultiBusbars;MWT=MetalWrapThrough;CdTe=CadmiumTelluride;EBOS=electricalbalanceofsystemsWindsupplychainCarbonfibre(2021:9%,2025:20%)VerticalAxis(2021:0%,2025:1%)Medium-voltageIGCT(2021:10%,2025:30%)BladePitchcontrolGearboxGeneratorConverterTurbineTowerWindfarmIndividualpitch(2021:40%,2025:75%)SolarsupplychainGranularsilicon(2021:4%,2025:25%)Largerwafer(2021:50%,2025:95%)MBB/MWT2021:25%,2025:48%)N-typewafer(2021:10%,2025:20%)TOPCon(2021:6%,2025:18%)Advancedinverters(2021:50%,2025:80%)PolysiliconWaferCellModuleSolarfarmEBOS(2020:32%,2023:60%)HJT(2021:3%,2025:19%)Thinfilm-CdTe(2020:4%,2023:5%)Trackingsystem(2021:34%,2025:54%)8February2022GlobalThemesMonitor3Figure6:GlobalelectricitymixscenariosFigure7:InvestmentrequirementstodecarbonisetheworldaresubstantialSource:IEA(2021)WorldEnergyOutlook,CreditSuisseresearchSource:IEA,CreditSuisseresearchFigure8:GlobalHydrogenElectrolysisdemandFigure9:ImpliedRenewableCapacity(GW)Source:Companydata,CreditSuisseestimatesSource:Companydata,CreditSuisseestimatesFigure10:GreenH2valuechainimpliedby40GWtargetFigure11:CarbonCapturestoragerequiredforbluehydrogenSource:CreditSuisseestimatesSource:CreditSuisseestimates-10,00020,00030,00040,00050,00060,00070,00080,0002020AnnouncedPledgesScenarioNetZeroScenarioAnnouncedPledgesScenarioNetZeroScenarioAnnouncedPledgesScenarioNetZeroScenario203020402050TWhSolarWindOtherrenewablesNuclearHydrogen,fossilfuelswithCCUSUnabatedfossilfuels$0$500$1,000$1,500$2,000$2,50020182019202020212021-2030CurrentPledge2021-2030NetZero($bn)969453,925010002000300040005000203020402050GWofElectrolysisRefiningAmmonia(exMarine)MethanolOtherChemicalsSteelRoadAviationMarineResidentialHeating,Cooking,WaterSeasonalStorageGlobalHydrogenElectroylsisdemand1951,8377,568010002000300040005000600070008000203020402050GWimpliedrenewablecapacityPowerdemandfromelectrolysisImpliedRenewablecapacity40GWElectrolyserInstalledCapacity~210TWhRenewablePowerOutput80-120GWRenewableInstalledCapacity(e.g.~60GWsolar+~40GWonshorewind)~4.5mtpaGreenHydrogenOutputAvailabilityandloadfactors:e.g.Availability97.5%SolarLF20%,OnshoreWindLF33%ElectrolyserinstalledcapacityrequiredNB.Utilisationof60%Electrolyserefficiency(70%)Utilisation(60%)HydrogenLHVconversion~50mtCO2paEmissionsFootprint~5mtpaGreyHydrogenOutput0.8QBtuNaturalGasFeedstock~45mtpaCCSRequiredforBlueHydrogenUsingstandardproductconversionfactorsAssuming70%NaturalGasreformingefficiencyAssuming10tonnesCO2pertonneH2Assumingcaptureratesof90%8February2022GlobalThemesMonitor4GlobalRenewablesSectorDisruptiveinnovationsforNetZero(Jan-2022)Whilerenewablesarebringingaboutsignificantchangestotheglobalenergymix,thereareseveraldisruptiveinnovationshappeningwithintherenewablesspaceitself.InthisglobalConnectionsSeriesreport,wefocusonsomesuchinnovationswhicharelikelytoacceleratetheglobalprogressinachievingthesustainabilitygoalsinenergytransitionandcarbonneutrality.Weleverageeffortsofmultipleglobalteamsandestimatethepotentialimpactof14innovationsacrosssolar/windsupplychainsandwhatwebelievehasn’tbeenpricedinbythemarket.Renewableenergyinnovationstopavetheroadbeyondgrid-parity:Inthepastdecade,we’vewitnesseddramaticcostreductionsinrenewablesdrivenbytechnologyimprovements,whichhelpedmostoftheworldachievegrid-parity.Forthenextdecade,anewroundofinnovationsalreadyinprogresswillbringglobalrenewablesdemandtoanewlevel,bymakingrenewablesmoreeconomical,efficientandavailable.Withthoseinnovations,weexpectsolar/windcoststofallbyanother33%/25%by2025,andglobalsolar/windannualinstallationtorisefrom165/67GWin2021to386/112GWin2025.Existingleaderswillbestrengthenedbytheinnovations:Incontrasttosomeviews,webelievedisruptiveinnovationswon’tbeathreattoexistingrenewablesleaders,because:(1)thenextinnovationcycleshouldgetprolonged;(2)squeezedmarginsreducetheincentiveandcapabilityofexistingcapacities’replacement;and(3)capitalandR&Dstrengthsofexistingleadersallowthemtodiversifytheirtechportfolios.Weestimatetheglobalcapacitysharesofthetop5solarpolysilicon/wafer/cell/modulemakerswillbefurtherincreasedfrom66/85/40/53%in2020to74/87/51/59%in2023.Figure12:14disruptiveinnovationsandourestimatedmarketsharechangesSource:CreditSuisseestimates;TOPCon=TunnelOxidePassivatedContact;HJT=HeterojunctionwithIntrinsicThin-layer;MBB=MultiBusbars;MWT=MetalWrapThrough;CdTe=CadmiumTelluride;EBOS=electricalbalanceofsystemsWindsupplychainCarbonfibre(2021:9%,2025:20%)VerticalAxis(2021:0%,2025:1%)Medium-voltageIGCT(2021:10%,2025:30%)BladePitchcontrolGearboxGeneratorConverterTurbineTowerWindfarmIndividualpitch(2021:40%,2025:75%)SolarsupplychainGranularsilicon(2021:4%,2025:25%)Largerwafer(2021:50%,2025:95%)MBB/MWT2021:25%,2025:48%)N-typewafer(2021:10%,2025:20%)TOPCon(2021:6%,2025:18%)Advancedinverters(2021:50%,2025:80%)PolysiliconWaferCellModuleSolarfarmEBOS(2020:32%,2023:60%)HJT(2021:3%,2025:19%)Thinfilm-CdTe(2020:4%,2023:5%)Trackingsystem(2021:34%,2025:54%)AlexLiu85221017115alex.liu@credit-suisse.comGaryZhou,CFA85221016648gary.zhou@credit-suisse.com8February2022GlobalThemesMonitor5Figure13:GlobalsolarcellmanufacturingcapacityforecastFigure14:TrendsofpoweroutputpersolarwaferandmoduleSource:Multiplesolarcellmakers,CPIA,CreditSuisseestimates.BSF=BackSurfaceField;PERC=PassivatedEmitterandRearContact;IBC=InterdigitatedBackContact.Source:PV-Tech,Longi,Zhonghuan,Shangji,CreditSuisseestimatesFigure15:WindpowergenerationcostreductiontocontinueFigure16:GlobalelectricitymixscenariosSource:IRENA,CreditSuisseestimatesSource:IEA(2021)WorldEnergyOutlook,CreditSuisseresearch2553274385114235515631136164-1002003004005006007008009001,00020202021E2023E2025E(GW)BSFPERCTOPConHJTIBCMWTOthers4034144505406205.65.86.37.610.30.02.04.06.08.010.012.00100200300400500600700M2(156.75mm)G1(158.75mm)M6(166mm)M10(182mm)G12(210mm)(W/piece)(W)Poweroutputpermodule(LHS)Poweroutputperwafer(RHS)0.0890.0830.0820.0790.0710.0630.0600.0570.0510.0450.0390.0290.020.030.040.050.060.070.080.090.10201020112012201320142015201620172018201920202025E(US$/kWh)-10,00020,00030,00040,00050,00060,00070,00080,0002020AnnouncedPledgesScenarioNetZeroScenarioAnnouncedPledgesScenarioNetZeroScenarioAnnouncedPledgesScenarioNetZeroScenario203020402050TWhSolarWindOtherrenewablesNuclearHydrogen,fossilfuelswithCCUSUnabatedfossilfuels8February2022GlobalThemesMonitor6Figure17:Summaryofthenext-generationrenewabletechnologyinnovationsandthekeybeneficiariesSectorSegmentKeytechnologyinnovationsWhatisthepurpose?OurestimatedmarketshareofthistechKeyplayers/beneficiariesSolarPolysiliconGranularsiliconReducingproductioncostandcarbonemissionduringtheproductionprocess2020:0%,2021:4%,2025:25%GCLPolyWaferLargersizedwaferImprovingpoweroutputandreducingunitpowergenerationcost2020:5%,2021:50%,2025:95%Longi,Zhonghuan,Shangji,Shuangliang,Jingsheng,KBC,MetronN-typewaferImprovingasolarcell’sconversionefficiency;Bettersuitabilitytovariousenvironments2020:3%,2021:10%,2025:20%Longi,Zhonghuan,Jingsheng,Daqo,GCLPoly,TongweiCellHJTImprovingconversionefficiencyandpoweroutput;Reducingproceduresintheproductionprocess2020:1%,2021:3%,2025:19%Tongwei,Longi,RisenEnergyAkcome,CanadianSolar,Trina,MeyerBurger,MaxwellTechnologies,S.CNewEnergyTechnologyTOPConImprovingconversionefficiencyandpoweroutput;EasiertoupgradeexistingPERCcapacity2020:2%,2021:6%,2025:18%Tongwei,Longi,JolywoodSunwatt,Zhongli,Jinko,JASolar,Trina,S.CNewEnergyTechnologyModuleMBB/MWTImprovingasolarmodule’sconversionefficiencyandpoweroutput2020:10%,2021:25%,2025:48%Longi,TrinaSolar,JinkoSolar,JASolar,CanadianSolarThinfilm-CdTeReducingthedependenceoncrystallinesiliconsupplychain;Lowerpaneldegradation2020:4%,2023:5%FirstSolarSolarpowerprojectTrackingsystemImprovingenergyefficiencyandpoweroutputofthesolarsystemandreducingunitpowergenerationcost2020:29%,2021:34%,2025:54%ArrayTechnologies,ArctechSolarAdvancedinverterProvidingbetterfeasibilityofhighvoltageandenergystorage2020:40%,2021:50%,2025:80%SungrowPower,GinlongTechnologies,GoodWe,SinengElectric,Enphaseenergy,SolarEdge,GeneracEBOSAdvancedwiringandconnectorsforfasterprojectconstruction2020:32%,2023:60%ShoalsTechnologiesWindBladeCarbonfibreCansupportlongerbladesasthematerialisstrongerandlighter.2020:7%,2021:9%,2025:20%Toray,Hexcel,WeihaiGuangweiCompositesPitchcontrolIndividualpitchsystemAdjustingthepitchofeachrotorbladeindependentlyfromotherblades,thusreducingtheloadsonthewindturbineinblades,hubandtower.2020:30%,2021:40%,2025:70-80%VestasConverterMedium-voltageconverterAspowerratingsofwindturbinesincrease,medium-voltageconvertersbecomemorecompetitivewithlowpowerloss,highefficiency,smallsizeandeaseofinstallation&maintenance.2020:8%,2021:10%,2025:30%ABB,SIEMENS,HopewindTurbineVerticalAxisLowcentreofgravityofVAWTs,whichsitwellwithoffshorefloatingplatforms.2020:0%,2021:0%,2025:2%foroffshorewindSeaTwirl,VestasSource:CreditSuisseestimates;Note:Usingglobalannualsolar/windinstallationvolumetoestimatethemarketshares.8February2022GlobalThemesMonitor7GlobalESGResearchSustainableInvestingin2022:Focusonregulationanddecarbonisation(Dec-2021)Aswereviewtheperformancethisyearofourapproachtosustainableinvesting,wehighlightthetopicsthatwebelievewilldominatetheESGagendain2022.Wealsopresentkeystockideasusingfourdifferentscreensandreviewthemainissuesassociatedwith17SDG-relatedthemesthatwetrack.ESGassetsgloballyreachedUS$35tnthisyear;however,generatingalphaisbecomingmorechallengingastheaverageactivelymanagedESGfundthatwetrackunderperformedglobalequitiesbyc140bpinthepast12months.Theoverarchingtopicsthatwebelievewilldominatetheinvestoragendain2022aretighteningregulationanddecarbonisation.Thelatterisrepresentedthroughourrenewableenergy,energyefficiencyandinfrastructurethemes.PickingstocksandthemesbasedonCreditSuisseHOLT®QualityandMomentumcontinuestowork:Yeartodate,ourapproachhasgeneratedareturnof21.2%,comparedwith13%fortheMSCIACWorldIndex.SincelaunchinNovember2019,ourapproachhasyielded60.2%,equatingtoanalphavsMSCIACWorldof1,920bp.Ourpreferredthemes:EnergyEfficiency(IndustrialandBuildings),AutomationandcompaniesthatscoreaboveaverageonDiversitymetrics(womenonboardsandLGBTQ+).Lowest-scoringthemesareInfrastructure,Solar,WindandHydrogen.Weshowfourstockscreenshighlightingcompaniesthat(1)havehighHOLTQualityandMomentumandarepartofourtop-rankedthemes;(2)areexposedtodecarbonisation;(3)maybeattractivetoinvestorswishingtohaveaParis-alignedornet-zeroportfolio;and(4)representouranalysts’keyOUTPERFORM-ratedideasandalsohaveanabove-averagescorefromthreeESGratingproviders.Figure18:AssetinflowsintoESGfundsremainverystrong;however,generatingoutperformanceismorechallengingFigure19:InvestmentrequirementstodecarbonisetheworldaresubstantialSource::Morningstar,Refinitiv,CreditSuisseresearchSource::IEA,CreditSuisseresearch-300-200-1000100200300400500-30-20-10010203040506070Nov-19Jan-20Mar-20May-20Jul-20Sep-20Nov-20Jan-21Mar-21May-21Jul-21Sep-21Nov-21bps(%)ActiveMSCIACWIActiverelativeMSCIACWI(r.h.s)$0$500$1,000$1,500$2,000$2,50020182019202020212021-2030CurrentPledge2021-2030NetZero($bn)EugeneKlerk442078834678eugene.klerk@credit-suisse.comBaharSezerLongworth442078834315bahar.sezer@credit-suisse.com8February2022GlobalThemesMonitor8Figure20:KeytopicsrelatedtoESGinvesting(1/2)Source:CreditSuisseresearchThemeKeytopicAgeingAgeingcoversarangeofproductsandservices.Hearinglossinanageingpopulationposesamajorpublichealthchallenge.AccordingtoWHO,by2050,nearly2.5billionpeopleareprojectedtohavesomedegreeofhearingloss.Keyfor2022willbetoseeifpenetrationratesforhearingaidsintheUSwillstarttopickupfollowingtheFDA'sdraftguidanceissuedin2021.AutomationMedicalroboticsispartofourautomationtheme.Thekeyquestionfortheroboticsurgerysub-themein2022iswhetherthecompetitivelandscapewillbegintonormaliseandbecomemorebalancedacrosscompetitors;oriftheasymmetricadvantagesofscale,maturityandproductivityofinstalledbaseandnetworkeffectpropelmarketleaderstowardevengreaterdominance.BuildingEnergyEfficiencyBuildingconstructionandoperationsaccountfor40%oftotalenergy-relatedcarbonemissions.Effortstodecarboniseneedtobecoupledwithdigitisationandautomationofbuilding-productsolutions.SoftwaresolutionsbuiltonthebackofAI/MLmodelsenablemoreefficientenergyconsumption.CircularEconomy-PlasticThereismountingevidenceoftheimpactofsomeplasticchemicalsandparticlesonhumanhealth.Newresearchhasfoundlinkswithlargeeverydayexposuretothesehazardouschemicals,especiallythroughfoodpackaging,toysandmedicalitemstoreproductivehealthissues,brainhealth,obesity,diabetesandsometypesofcancer.Thisislikelytoincreasethescrutinyofrelatedsectors.DiversityDiversityisatargetfocusareaforcompaniestohighlighttheir‘S’credentials.TheCOVID-19pandemicuncovered,andinmanyinstances,exacerbatedexistinginequalitiesacrossgender,race,health,economy,securityandsocialprotection.Weexpectrecentregulatoryinitiativesaround‘S’issuestoaddtothegrowingpressureoncompaniestoshowcasetheircorporatesocialresponsibilitywellinto2022.EducationInChina,arecentregulationthatrequiresK9academictutoringproviderstoberegisteredas“non-profit”institutionsandachangeofforeignownershiprulesthroughtheVIEstructurehasreshapedtheentireafter-schooltutoringindustry.Companiesthatmanagetopivottowardsdifferentpaths,suchasvocationaloradulteducationandB2Bbusiness,maybenefitin2022becausetheseareasofeducationenjoystronggovernmentsupport.EnergyStorageRecentcasesofbatteryfiresinsomemajorEVmodelsandenergystoragesystemshaveincreasedsafetyconcernsaroundhigh-nickelNCM(nickel-cobalt-manganese;highenergydensitysolutions)batteries.Asaresult,EVOEMsandenergystorageoperatorsarelookingforalternativesolutionsfortheirbatteryneeds,especiallyforcheapapplications,whichdonotrequirehighlevelsofenergydensity.GreenInfrastructureTheelectrificationofenergysupplyrequiressubstantialinvestment.InEuropealone,upto€425bnneedstobespentbetween2020and2030.Thisincludesconnectingnewrenewablecapacityandmodernisingageinginfrastructure.Exposedcompaniesbenefitfromthelong-termgrowthinrenewableenergybeingunderpinnedbytheneedforenergytransition.HealthyLivingHealthandwellnessproductssawalmostdouble-digitgrowthin2020andthroughthefirstthreequartersof2021asaconsequenceofthecoronaviruspandemicandgreaterfocusonhealthyliving.As2022approaches,adebatehasemergedaroundthestabilityofhealthandwellnessconsumerpackagedgoodsdemand,particularlyintheabsenceoffurthersignificantdisruptionstoconsumers’lifestyles.HydrogenThekeyquestionsfor2022inrelationtohydrogenare:(1)howquicklycanthecostofgreen(andpossiblyblue)bebroughtdowntoparitywithgreyhydrogen;(2)whetherintheearlystagesofdevelopment,electrolysercapacitywillbebuiltclosetoexistinggreyhydrogenconsumption,orintheproximityofcheaprenewableoutput;and(3)whichendmarketswillbeprioritised(refineryandchemicals,steel,heavytransportandmasstransportationorhouseholdheatingandcars).IndustrialEnergyEfficiencyWithincreasingproductcomplexityandadoptionofdigitisationandIndustrialInternetofThings(IIoT),softwareisplayinganincreasinglyimportantroleintheimprovementofmanufacturingprecisionandefficiency.Industrialsoftwarevendorshaveshownbetterandmoreresilientgrowththanhardwarevendorsinrecentyears.Weexpectthistocontinue.OtherInfrastructureWithdatatrafficvolumesgrowingby40-50%painEurope(andglobally),operatorswillneedtoaddcapacity.Additionalcapacitycanbecreatedby(1)increasingtheamountofspectruminthenetwork;(2)improvingthespectralefficiencythroughuseofnewtechnology;or(3)addingnewsites.Towercompanieswillbekeybeneficiaries,inourview,asorganicsitedeploymentaccelerateswith5G.8February2022GlobalThemesMonitor9Figure21:KeytopicsrelatedtoESGinvesting(2/2)Source:CreditSuisseresearchSustainableEnergyInitiatingcoverageofEuropeanHydrogen&Renewablepure-plays(Dec-2021)Greenhydrogenisagrowthmarket,witharapidscale-upexpectedin2030sand2040s:Weforecastthatgreenhydrogenproduction,whichwaslessthan1mtpain2020,canexpandto9mtpaby2030andto380mtpaby2050.Thismodelsmarketgrowthofc.9xto2030eand380xto2050e.Weassumethiswillrequire3,925GWofinstalledelectrolysiscapacityby2050,increasingfrom96GWby2030and945GWin2040onourestimates,abovetheIEA’sassumptionof3,854GW(IEAassumes325mtpaofgreenhydrogenvs.CSeat380mtpa)andcomparestoglobalinstalledelectrolysiscapacityofc.300MWin2020(0.3GW).Thisimplies7,570GWofrequiredrenewableenergyinstalledcapacityby2050:Fortheothersideofourcoverage,greenhydrogenhasmajorimplicationsforrenewablepowergeneration,inadditiontocountrytargetsfordecarbonisationoftheirexistingenergysupplytoreachnetzero.Weforecast195GWofrenewableinstalledcapacityrequiredby2030,vs.2,916GWinstalledgloballyin2020(IRENA).Thiswillthenpotentiallyneedtoincreaseto7,570GWby2050.Continuedcostreductionsinrenewableenergyiscrucialtoenablinggreenhydrogentogainparitywithgreyhydrogen(fossil-fuel-poweredhydrogen),giventhatenergycostscontributec.60-70%oftheLCOH.Electrolysistechnologyracewillintensify,givengrowthindemandin2030sand2040s;weleverageourindustryexpertsforinsights:Installedelectrolysiscapacitygrowthwillbematerialinthe2020s,butthe2030scanshowa26%CAGRand15%CAGRinthe2040sonourmodelling.Consequently,weseecompetitionfortheelectrolysissystems(ALK,PEM,SOE,AEM)todevelopfurthertoreducetheirrespectiveLCOHbypullingtheleversof:(1)systemefficiencyimprovements(energycostsc.60-70%ofLCOH),and(2)lowersystemcost(c.15-25%ofLCOH).Weintendtouseourgrowingindustrynetworktoinformusofkeychangesinthedynamicswithinthisperceivedtechnologyrace.ThemeKeytopicSolarIn2021,thesolarindustryhasfacedaperfectstormofregulatoryuncertainty,globalsupplychainsqueezes,andhigherrawmaterialcosts.Keyfor2022isarecoveryintheoutlookforsolarcompanies(whichweexpect)asdemandforrenewablesremainsstrong.Inaddition,weexpectgovernmentsintheUSandEuropetotryandfindwaystoreducetheirrelianceonChinaasthekeysupplierofglobalsolarpolysiliconandwafers.SustainableFoodTheplant-basedalternativemeatmarketsawstronggrowthin2020withanestimatedvalueofover$2bnandathree-yearCAGRof24%.However,recentsalesdatafromBeyondMeatandretailconsumptiondatafromNielsenforthecategoryintheUSsuggestthatthecategorymaybereachingmarketsaturationfasterthanexpected.Thequestioniswhethergrowthcanreacceleratein2022.TransportEnergyEfficiencyToreachnetzeroby2050,100%oflight-dutyvehiclessalesand50%ofheavy-dutytrucksalesneedtobeelectricby2035,inourview.Weexpectvehiclefuel-economystandardstobecomemorestringentaroundtheworldastheyaretheprimarygovernmentenforcementtoolstoaccelerateadoptionofzero-emissionvehicles.WaterTheneedforwaterinfrastructuremaintenanceandrepairisgrowingglobally.IntheUS,theaverageagewaterpipesis45yearscomparedwith25yearsin1970.Lookingacrossthe2020sustainabilityreportspublishedbyindustrialcompanies,efficientandsustainablewaterusageisakeyfactor.PotentialgovernmentstimulusannouncementsandESGinvestingcouldcontinuetosupportglobalinterestsinmanagingwater.WindThecostsofproducingwindturbinesandinstallationsareupbyc15-20%acrossthepastyear,whichnegativelyaffectedmarginsgeneratedbythewindequipmentOEMs.Withtheriskofreducedreturnsandgrowthfordevelopersinthenearterm,ourkeyconcerniswhetherandhowcostinflationcanbeoffset.ChrisLeonard442078883012christopher.leonard@credit-suisse.comAmyWong442078837286amy.wong@credit-suisse.com8February2022GlobalThemesMonitor10Figure22:GlobalHydrogenElectrolysisdemandFigure23:ImpliedRenewableCapacity(GW)Source:Companydata,CreditSuisseestimatesSource:Companydata,CreditSuisseestimatesFigure24:GreenH2valuechainimpliedby40GWtargetFigure25:CarbonCapturestoragerequiredforbluehydrogenSource:CreditSuisseestimatesSource:CreditSuisseestimatesTheCarbonCycleSeriesChinareleasesNetZeropolicyframeworkandactionplanforpeakingemissionsby2030(Nov-2021)Lastweek,ChinareleaseditsActionPlanforCarbonDioxidePeakingBefore2030,settingoutthespecificpolicymeasuresandtargetsitisimplementingtoreachitsintermediateclimategoal,aspartofitsNetZeroby2060commitment.Inthisreport,weidentifythekeypolicymeasuresandoutlinetheCSviewonindividualstocksthatwouldbebeneficiariesunderthechanges.Withtheadditionofthemorespecificpolicesannouncedundertheactionplanandnowmoreconcreteindustrydrivers,thisbuildsonCS’searlierreportEmbracingcarbonneutrality.Energytransitionpolicies–nomajorsurprises:SolarandWindcontinuedtobethebigwinnersfromthepolicymix,withatargetof1200GWinstalledcapacityby2030.Butthiswasalsosupportedbymeasuressuchasthat>50%ofelectricitytransmittedinnewlyconstructedlinesmustcomefromrenewablesand50%coverageofsolarforallnewpublic969453,925010002000300040005000203020402050GWofElectrolysisRefiningAmmonia(exMarine)MethanolOtherChemicalsSteelRoadAviationMarineResidentialHeating,Cooking,WaterSeasonalStorageGlobalHydrogenElectroylsisdemand1951,8377,568010002000300040005000600070008000203020402050GWimpliedrenewablecapacityPowerdemandfromelectrolysisImpliedRenewablecapacity40GWElectrolyserInstalledCapacity~210TWhRenewablePowerOutput80-120GWRenewableInstalledCapacity(e.g.~60GWsolar+~40GWonshorewind)~4.5mtpaGreenHydrogenOutputAvailabilityandloadfactors:e.g.Availability97.5%SolarLF20%,OnshoreWindLF33%ElectrolyserinstalledcapacityrequiredNB.Utilisationof60%Electrolyserefficiency(70%)Utilisation(60%)HydrogenLHVconversion~50mtCO2paEmissionsFootprint~5mtpaGreyHydrogenOutput0.8QBtuNaturalGasFeedstock~45mtpaCCSRequiredforBlueHydrogenUsingstandardproductconversionfactorsAssuming70%NaturalGasreformingefficiencyAssuming10tonnesCO2pertonneH2Assumingcaptureratesof90%PhineasGlover61282054448phineas.glover@credit-suisse.com8February2022GlobalThemesMonitor11buildingsandfactories.Hydrowasthebigsurprisewinnerwith40GWofadditionalcapacityadditionsupto2030,andthisformedpartofabiggerpushtowardspumpedhydroforenergystorageat120GWandcapableofpeakloadresponsesupto5%ofthegrid.30GWof‘newtypesofenergystorage’istargetedandanobjectivetoenhancetheoveralladjustablecapacityoftheelectricgrid,expeditingtheconstructionofflexiblepowersourcesforthe‘newenergy+energystorage’model.LNGdemandcontinuestobesupportedwithnewinvestmentingaspeakshavingpowerplants.Demandsideabigfocus–transportandenergyefficiency:WhiletheEV-relatedpoliciesweresomewhatexpected,theydidnotdisappoint,withatargetfor40%ofnewvehiclessalestobeNEVby2030.Thiswasalsosupportedbystrongerfuelefficiencymeasuresforcommercialvehiclesand,perhapsthebiggestsurpriseofall,atargettopeakpetroleumconsumptionforalllandtransportbefore2030.Thiswassupportedbymultimodaltargets,suchasthat70%oftraveltobeconductedthroughenvironmentallyfriendlymeansin>1mnpopulationcities.Therewerebroad-basedenergyefficiencymeasuresacrossbuildings,transport,industryandmanufacturingandastrongfocusoneconomy-wideenergyconservation.Therefore,inadditiontocontinuedgrowthacrosstheEVvaluechain,weseestrongbeneficiariesinbuildingandindustrialenergyefficiency.Downsiderisksinbalance:Strictcontrolswillbeplacedoncoalconsumptiongrowthupto2025anddeclinestargetedby2030.Weexpectdirectcoalsupplycutsandforecasttheshareofcoalinenergyconsumptiontofallto~50%in2025,fromthecurrent~57%.InO&G,thereisdirectreferencetoregulatingconsumptionandthetargettopeakpetroleumconsumptionfortransportby2030.China’soildemandisseentobeenteringadecliningphaseduetotheriseofEVs,withmutedgrowthupto2025andapeakupto2030.Weremainbroadlyconstructiveoncoalandoilintheshortterm,duetothepaceofsupplydeclines>demandreduction,bodingwellforpricesintheshortterm.However,onalong-termview,itisinevitablethatdemanddeclineswillimpactearningsandassetvalues.ChinaNetZero–keystockcalls:Weidentify35stocksthatareclearbeneficiariestotheActionPlanandengageChinaresearchsectorteamstooutlinethereasonstheyareattractivelypositioned.Thisincludesrelativesectorpositioningaswellaslong-termcalls.Figure26:30%ofglobalCO2emissions(2018),andc.64%oftheincreaseinglobalCO2emissionssince2000...Figure27:despiteasubstantialreductionintheCO2intensityofitseconomicoutput.Source:EUJointResearchCentre;EDGARv6.0,CreditSuisseestimatesSource:EUJointResearchCentre;EDGARv6.0,WorldBank,CreditSuisse0%5%10%15%20%25%30%35%02468101220002006201220182000200620122018200020062012201820002006201220182000200620122018ChinaUnitedStatesAsia(exChina,India)EuropeIndiaCO2Emissions(GtCO2)ShareofGlobalCO2Emissions(%)GtCO2ShareofglobalCO2emissions(%)-70-60-50-40-30-20-100UnitedKingdomChinaEU27+UKUnitedStatesAustraliaKorea,RepublicofMexicoJapan%Reductionsince2010%Reductionsince2005%Reductionsince20008February2022GlobalThemesMonitor12Figure28:CO2emissionsinChinaareskewedtowardsindustryandpowergeneration(c.80%oftotal)Figure29:GlobalshareofGHGemissionscoveredbyNetZeroSource::EUJointResearchCentre;EDGARv6.0,CreditSuisseestimatesSource:ClimateActionTracker,CreditSuisseresearchGlobalESGResearchTakingStockofCOP26-WhatMatteredMost(Nov-2021)AftertwoweeksofheadlinesandannouncementscomingoutoftheCOP26climatesummit,wetakestockoftheincrementaldevelopmentsandbreakdownwhatwasmostimportant,inourview.Whilereactionsaremixedastowhatwasactuallyachievedatthesummit,thefactofthematteristhattheeventcementsthedirectionoftravelontheglobalclimateagendaandthequestionisthespeedoftransition.Keyfocusnowisonspecificpolicies&privatesectoractions.CarbonmarketagreementbiggestwinfromCOP26:AgreementonArticle6oftheParisAgreementisthemostconsequentialasitbuildsaglobalcarbontradingmarketwhichshouldsupportstronggrowthinthecoverageofexistingemissionstradingschemesaswellasthevoluntarycarbonoffsetmarket.ThelatterhasthepotentialtostimulateuptoUS$1tnperyearoftransitioncapitaltowardsdevelopingcountriesby2050(IETA).Morestringentdefinitionforqualifyingcreditsalongwithgrowinggovernment/corporatedemandshouldresultinhighercarbonprices,whichinturnacceleratesthetransition.Privatesectorcommitmentsbiggestupsidesurprise:Fromfinancialmarketparticipantstoindividualcompanies,COP26sawunprecedentedsupportfromtheprivatesectorwhichisthebiggestdifferencefromanyotherCOPmeetinginyearspast.Financialinstitutionsmadeitabundantlyclearthattheclimateconsiderationswillbeembeddedineverycapitalallocationdecisionacrossthefinancialvaluechain.CorporatesarealsosteppingupnetzerocommitmentsinandaroundCOP26,mostnotablyautomakers(ledbytheUSOEMs),shippingandairlineindustrygroups.Sectoralpledgesareencouragingbut(unsurprisingly)missingkeycountries:ThepoliticalcompromisesmadeduringCOP26wastobeexpectedinordertoreachaunanimousdecisionfromnearly200countries.WhiletheGlasgowClimatePactaimstokeep1.5°Cgoalalive(vscurrentpledges&targetstracking2.1°Candcurrentpoliciestracking2.7°C,accordingtoClimateActionTracker),themosttangibledevelopmentsduringCOP26camefromvarioussectoralcommitmentsonkeyissues,suchasendingcoalpower,globalmethanepledge,roadtransportanddeforestation.However,theirimpactisdilutedbythefactthatChina,IndiaandRussiaarenotablymissingfrommostofthenewinitiatives.0%10%20%30%40%50%60%70%80%90%100%SectoralsplitofCO2emissionsOtherIndustrial,WasteandAgricultureIndustrialCombustionBuildingsTransportPowerIndustryCountrieswithnonetzerotarget,26%Othercountrieswithsimilarnetzeroannouncements,29%EuropeanUnion(EU27),8%China,25%USA,12%BettyJiang,CFA2123256259betty.jiang@credit-suisse.comPhineasGlover61282054448phineas.glover@credit-suisse.com8February2022GlobalThemesMonitor13Implicationsforinvestors:Sustainableinvestingisbecomingsynonymouswithnetzeroalignment.Portfolioconstructionwillincreasinglyconsiderthetrajectoryofinvestees’carbonintensityovertimeacrossallsectors,whichshoulddriveintra-sectorvaluationdispersion.Netzeroalignmentcouldalsohaveaprofoundimpactonlong-termbusinessstrategiesgivenchangesnecessarytoreduceabusiness’carbonfootprintbothupstream(e.g.,supplychain)anddownstream(e.g.,productsandservices).Implicationsforcorporates:Asinvestorsmoreformallyincorporatenetzeroalignmentintoportfoliomanagementdecisions,weexpectittoincreasinglyimpactthecostofcapitalforcompanies,drivingamoreformaldeltabetweenhighandlowemittingbusinesses.ThefocusbyregulatorsonESG/climatedisclosuresandfromfinancialmarketparticipantsonnetzeroalignmentmeanscorporateswillneedtoengageonclimate-relateddisclosureandriskmanagement.WeexpecttoseeanincreaseinM&Aactivityresultingfromthesepressures,ascompaniesrespondtothesestructuralandcostofcapitalrisks.Figure30:Globaltemperatureriseprojectionsby2100basedonpledgesandcurrentpoliciesFigure31:GlobalGHGemissionsandexpectedwarmingpathwaysbasedonpledgesandcurrentpoliciesSource:ClimateActionTrackerSource:ClimateActionTrackerFigure32:ImpactofrecentNDCsubmissions+sectoralpledgessinceSept.2020onthe2030emissionsgapSource:ClimateActionTracker8February2022GlobalThemesMonitor14ChinaMarketStrategyEmbracingcarbonneutrality(Sep-2021)Pathwaytosustainability.Afterdecadesofsuccessfulreformsandopening-up,itistherighttimeforChinatoseektoachievehigh-qualitydevelopmentinagreenerandmoresustainableway.Carbonneutralityofferssuchapathwaytosustainability.Followingyearsofregionalpilotprojects,China’sfirstnationalcarbonmarket—akeypolicyinstrumenttoachievethenation’sambitiousgoalofcarbonneutrality—startedtradinginJuly.Currentlyonlycoveringpowercompanies,themarketislikelytoexpandtradingactivitiestomoresectors,suchasautoandcement.On-the-groundinsights.OurCQiteamconductedsurveystounderstandtheopportunitiesandchallengesofdecarbonisation.Themajorityofsurveyedcompaniesexpectcoststoincreasebothintheshortandlongterm,whilemostcompaniesbelieveprofitabilitywillbeimpactedintheshortterm,butholddivergentopinionsonthelongerrun.Ridingonthesupertrend.NEVandrenewableenergyarethemajorbeneficiariesfromthereplacementofICEcarsandfossilfuels.NEVsaleswillcontinuetosupportxEVbatterydemandwhenweseelithiumpricesupportedbytightsupplyamidsoliddemand.Hydrogenissettobecomeanimportantandfast-growinglow-carbonenergysourceinthenext30yearswhennaturalgascanbealsohelpfulasatransitionalenergysourceduringdecarbonisation.Asalargecarbonemitter,thebasicmaterialssectorincludingcement,steel,coalandaluminiumwillseecapacityreductionandupgrades,leadingtobettersupply-demanddynamics.Theindustrialssectorwillalsoembracerisingdemand.Figure33:China’snewenergyvehiclesalesvolumeoutlookFigure34:Greenhydrogenmixestimatedtobe45%by2050Source:Thinkercar,CreditSuisseestimatesSource:IEA,CreditSuisseestimates3.55.77.48.39.510.812.113.414.716.10%20%40%60%80%100%120%140%160%180%02468101214161820212022E2023E2024E2025E2026E2027E2028E2029E2030EMillionunitTotalnewenergyvehiclesalesYoYgrowth(RHS)0%10%20%30%40%50%-10020030040050020192030204020502060(mntons)Grey/Brown/blackhydrogenBluehydrogenGreenhydrogen%ofgreenhydrogen(RHS)EdmondHuang85221016701edmond.huang@credit-suisse.com8February2022GlobalThemesMonitor15Valuationmatrix–HydrogenthemeFigure35:ValuationtableofAPACcompaniesexposedtoHydrogenthemeSource:Companydata,IBESestimates,CreditSuisseestimates;Pricedasof07-Feb-22.LC=Localcurrency.O=Outperform,N=Neutral,U=Underperform,NC=NotCovered.Nm=Notmeaningful.ForMar/Junyear-endcompanies,CY22impliesFY23andsoon.Materiality:denoteshighermaterialityofthetheme.CompanyCountryCurrencyMktcapPrice(LC)TP(LC)Upside(%)RatingMateriality2021-23ERoESourceUSDbnCY22/FY23CY23/FY24CY22/FY23CY22/FY23EPSCagrCY22/FY23ProductionFortescueMetalsAustraliaAUD46.821.5314(35)U11.410.66.63.0(4.2)27.8CSWoodsidePetroleumAustraliaAUD18.327286O12.314.85.71.3(5.5)10.8CSAPAGroupAustraliaAUD8.4109(12)N36.433.012.97.58.018.8CSOriginEnergyAustraliaAUD7.4661O17.816.16.31.09.65.9CSAGLEnergyAustraliaAUD3.47917O13.110.25.00.829.76.3CSPetroChinaChinaHKD138.64527O6.17.32.80.5(5.2)7.7CSSinopecChinaHKD76.544(7)N5.95.52.40.53.18.6CSCNOOCChinaHKD54.5101334O3.94.22.20.78.818.7CSZhejiangSatellitePetrochemChinaCNY11.443NANANC8.97.47.12.824.930.3IBESDongyueGroupChinaHKD2.7923155O5.94.51.91.131.419.0CSAirWaterJapanJPY3.51,750NANANC9.28.70.10.94.610.8IBESHitachiZosenJapanJPY1.1743NANANC12.210.57.30.918.27.5IBESDoosanFuelCellS.KoreaKRW2.036,800NANANC64.833.045.15.0134.98.0IBESPunggukIndustrialS.KoreaKRW0.216,500NANANCNmIBESStorage/InfrastructureWorleyAustraliaAUD4.41210(13)N16.115.17.51.113.06.8CSCIMCEnricChinaHKD2.4101339O12.611.68.81.821.015.1CSHangzhouZhongtaiCryogenicChinaCNY1.119NANANCNmIBESHunanBailiChinaCNY1.114NANANCNmIBESChengduShenlengLiq.ChinaCNY0.526NANANCNmIBESENEOSHoldingsJapanJPY12.9469NANANC6.96.15.20.6(9.5)7.9IBESTorayIndustriesJapanJPY9.2671NANANC10.59.26.30.812.87.8IBESMitsubishiHeavyIndustriesJapanJPY8.83,193NANANC9.48.72.70.712.97.7IBESTaiyoNipponSansoJapanJPY8.72,283NANANC14.313.68.91.67.811.7IBESTokyoGasJapanJPY8.72,299NANANC11.911.75.70.813.67.0IBESOsakaGasJapanJPY7.32,037NANANC11.211.17.90.77.56.4IBESKawasakiHeavyIndustriesJapanJPY3.12,172NANANC11.48.46.30.749.16.5IBESIwataniJapanJPY2.85,280NANANC11.711.41.10.79.1IBESKobelcoJapanJPY1.9569NANANC5.13.96.00.33.15.5IBESChiyodaJapanJPY0.8373NANANC10.76.80.5Nm225.530.5IBESNittoKohkiJapanJPY0.31,608NANANCNmIBESMitsubishiKakokiKaishaJapanJPY0.12,020NANANCNmIBESHyundaiRotemS.KoreaKRW1.819,150NANANC28.224.11.431.15.0IBESHyosungHeavyS.KoreaKRW0.451,600NANANC5.64.90.536.110.0IBESIljinDiamondS.KoreaKRW0.326,150NANANCNmIBESJNKHeatersS.KoreaKRW0.15,370NANANCNmIBESApplicationWeichaiPowerChinaHKD20.114156N9.38.54.71.57.316.5CSShanxiMeijinEnergyChinaCNY8.914NANANC25.024.13.50.913.9IBESDongfangElectricChinaHKD8.0111642O10.710.06.00.810.98.0CSHebeiSteelChinaCNY4.02NANANC6.50.4Nm4.3IBESZhongshanBroad-OceanChinaCNY2.57NANANC84.975.427.41.913.42.3IBESBeijingSinoHytecChinaCNY2.320330048O184.589.995.36.5497.03.6CSToyotaJapanJPY272.92,2762,60014O10.29.611.11.27.912.5CSHondaJapanJPY51.23,4034,05019O7.26.48.40.617.68.3CSPanasonicJapanJPY24.51,2021,40017N10.44.81.0Nm10.0CSIsuzuJapanJPY10.31,4911,5504N9.18.13.90.911.210.8CSHinoJapanJPY5.31,0601,1004N13.512.46.21.056.57.7CSHyundaiMotorS.KoreaKRW33.9186,500260,00039O7.67.11.80.727.99.0CSHyundaiMobisS.KoreaKRW18.2230,000290,00026O8.07.25.10.713.88.3CSHyundaiSteelS.KoreaKRW4.439,10056,00043O4.34.84.50.3(13.8)6.8CSMotonicS.KoreaKRW0.39,260NANANCNmIBESSejongIndustrialS.KoreaKRW0.27,630NANANCNmIBESDaewonKangupS.KoreaKRW0.23,280NANANCNmIBESP/EEV/EBITDAP/B8February2022GlobalThemesMonitor16Figure36:ValuationtableofEuropeancompaniesexposedtoHydrogenthemeSource:Companydata,IBESestimates,CreditSuisseestimates;Pricedasof07-Feb-22.LC=Localcurrency.O=Outperform,N=Neutral,U=Underperform,NC=NotCovered.Nm=Notmeaningful.ForMar/Junyear-endcompanies,CY22impliesFY23andsoon.Materiality:denoteshighermaterialityofthetheme.CompanyCountryCurrencyMktcapPrice(LC)TP(LC)Upside(%)RatingMateriality2021-23ERoESourceUSDbnCY22/FY23CY23/FY24CY22/FY23CY22/FY23EPSCagrCY22/FY23ElectrolysersGreenHydrogenDenmarkDKK0.431NANANCNmNm15.32.4(33.9)(18.6)IBESMcPhyEnergyFranceEUR0.516NANANCNmNmNm2.7(1.8)(11.6)IBESSiemensEnergyGermanyEUR15.9193057O27.718.55.81.0388.23.5CSThyssenkruppGermanyEUR6.491786O5.29.53.10.569.39.8CSNelNorwayNOK2.2131949NNmNmNm4.1(59.2)(9.1)CSHydrogenProNorwayNOK0.117NANANCNm24.4Nm2.1Nm25.5IBESITMPowerUKGBp2.125534033UNmNmNm4.1(24.0)(6.5)CSCeresPowerHldgUKGBp1.45331,450172ONmNmNm4.0(27.8)(5.5)CSFuelCellsPowercellSwedenSwedenSEK0.8141NANANCNmNm(4.2)(15.5)IBESCeresPowerHldgUKGBp1.45331,450172ONmNmNm4.0(27.8)(5.5)CSAFCEnergyUKGBp0.436NANANCNmNmNm22.9IBESProtonMotorUKGBp0.316NANANCNmIBESServicesTechnipFMCFranceUSD3.07NANANC39.818.35.70.8Nm1.6IBESAkerSolutionsNorwayNOK1.425NANANC23.017.06.41.4102.15.9IBESAkerCarbonCaptureNorway18NANANCNmIBESBurckhardtCompressionAGSwitzerlandCHF1.644548910O20.818.113.56.322.732.9CSWoodPlcUKGBp2.1227NANANC10.28.55.60.529.24.4IBESUtilitiesVerbundAustriaEUR18.49474(22)U29.227.88.44.425.215.9CSØrstedDenmarkDKK44.0681590(13)U17.129.010.02.9(3.6)18.1CSFortumOyjFinlandEUR24.925279N14.917.98.61.6(14.6)10.6CSEDFFranceEUR31.18NANANC6.85.37.40.614.94.3IBESE.ONGermanyEUR37.012132O13.113.29.15.50.544.5CSRWEGermanyEUR30.137396O19.527.49.81.4(15.2)7.2CSUniperGermanyEUR16.74039(2)N17.620.79.91.3(13.8)7.4CSEnelItalyEUR74.86943O11.110.27.22.66.723.6CSScatecNorwayNOK2.3125NANANC36.832.112.62.023.86.1IBESEDPPortugalEUR18.04628O18.316.39.11.712.09.5CSIberdrolaSpainEUR68.591120N14.513.39.61.610.010.9CSEndesaSpainEUR22.7192320N11.010.57.42.73.325.3CSAccionaSpainEUR9.3148NANANC19.417.29.62.016.011.3IBESSolariaEnergíaSpainEUR2.1142146O27.718.521.95.648.721.9CSOil&gasOMVAustriaEUR20.655NANANC6.47.33.41.0(5.6)17.5IBESNesteFinlandEUR34.739NANANC21.417.215.24.026.519.6IBESTotalFranceEUR154.851NANANC9.19.84.11.32.015.1IBESEniItalyEUR54.413NANANC9.010.13.11.25.813.2IBESRoyalDutchShellplcNetherlandsGBp280.72,062NANANC8.99.13.71.215.213.6IBESEquinorNorwayNOK97.4262NANANC9.311.62.02.1(5.5)22.6IBESGalpEnergiaPortugalEUR9.510NANANC12.412.34.02.421.020.8IBESBPUKGBp108.7409NANANC7.57.83.51.37.217.3IBESChemicalsUmicoreBelgiumEUR9.332332U14.215.38.42.4(12.3)16.4CSAirLiquideFranceEUR79.714717016O23.021.312.23.311.414.8CSBASFGermanyEUR70.4678019O10.810.88.01.6(5.3)15.4CSJohnsonMattheyUKGBp4.61,7842,50040N8.47.55.51.27.014.5CSLindeUSUSD152.0296NANANC25.322.816.23.410.912.9IBESFullValueChainEverfuelNorway41NANANCNmIBESNetworksFluxysBelgiumBelgiumEUR0.431NANANC29.329.910.32.9(1.4)10.3IBESSNAMItalyEUR18.0559N14.614.614.02.2(4.2)15.5CSEnagasSpainEUR5.719NANANC12.612.77.91.7(1.3)13.9IBESStorageFaureciaFranceEUR6.839NANANC8.36.03.61.461.417.2IBESVopakNetherlandsEUR4.431NANANC11.010.97.41.25.610.6IBESHexagonNorwaySEK36.5128NANANC29.127.019.64.210.915.0IBESHexagonCompositesNorwayNOK0.729NANANCNmNm1.3Nm(4.5)IBESEnd-useMarketsThyssenkruppGermanyEUR6.491786O5.29.53.10.569.39.8CSSalzgitterGermanyEUR2.23120(36)U7.68.47.20.5(38.1)6.8CSYaraInternationalASANorwayNOK13.5466400(14)U9.29.26.01.71.518.7CSSSABSwedenSEK5.85551(7)O8.115.63.70.8(49.4)9.8CSLafargeHolcimSwitzerlandCHF33.7516529O9.98.75.41.018.710.6CSAero,TransportAirbusSEFranceEUR101.611313923O22.118.29.97.714.438.5CSSafranFranceEUR52.6108NANANC26.820.713.53.341.412.3IBESAlstomFranceEUR11.3264777O10.88.76.61.032.79.6CSDassaultAviationFranceEUR10.2107NANANC14.112.44.61.68.211.0IBESDaimlerGermanyEUR82.768NANANC6.36.01.81.0(3.4)15.8IBESBMWGermanyEUR67.590NANANC6.26.12.00.8(5.9)13.7IBESMTUAeroEnginesGermanyEUR11.3185NANANC23.919.413.73.328.614.7IBESElringKlingerGermanyEUR0.710NANANC9.87.55.50.726.87.0IBESFincantieriItalyEUR1.11NANANC6.96.15.81.022.514.9IBESRollsRoyceUKGBp13.1116NANANC24.115.68.8Nm187.3(7.3)IBESP/EEV/EBITDAP/B8February2022GlobalThemesMonitor17Figure37:CompaniesinAmericasexposedtoHydrogenthemeSource:Companydata,IBESestimates,CreditSuisseestimates;Pricedasof07-Feb-22.LC=Localcurrency.O=Outperform,N=Neutral,NC=NotCovered.Nm=Notmeaningful.ForMar/Junyear-endcompanies,CY22impliesFY23andsoon.Materiality:denoteshighermaterialityofthetheme.CompanyCountryCurrencyMktcapPrice(LC)TP(LC)Upside(%)RatingMateriality2021-23ERoESourceUSDbnCY22/FY23CY23/FY24CY22/FY23CY22/FY23EPSCagrCY22/FY23USUtilitiesNextEraEnergyUSUSD148.575.78512O28.125.925.53.08.010.9CSSempraEnergyUSUSD43.7137.0NANANC16.215.412.41.73.910.9IBESNorthwestNaturalHoldingUSUSD1.446.9NANANC18.017.06.81.54.78.4IBESUSRenewablesFirstSolarUSUSD7.469.78826N29.217.58.81.2(4.4)4.2CSShoalsTechnologiesUSUSD2.615.73197O28.118.020.731.786.1240.7CSArrayTechnologiesUSUSD1.39.522131O12.19.48.63.4146.936.1CSFTCSolarUSUSD0.33.8NANANC41.75.144.42.2Nm8.0IBESUSChemicals/GasesAirProducts&ChemicalsUSUSD56.4254.430219O25.313.83.2Nm12.9CSUSMachineryCumminsInc.USUSD32.5226.530434O13.210.57.73.622.028.1CSNorthAmericanMidstreamEnterpriseProductsPartnersUSUSD52.724.22920O10.810.19.62.04.619.4CSKinderMorganUSUSD42.717.52015N15.915.710.31.3(8.1)8.0CSWilliamsCompaniesUSUSD37.330.73411O19.417.210.23.312.916.9CSNewFortressEnergyUSUSD4.521.63876O12.26.69.22.159.718.3CSEnergyInfra-CanadaEnbridgeInc.CanadaCAD88.055.0550N17.716.911.81.77.39.7CSTCEnergyCanadaCAD50.365.0708O15.514.210.82.14.014.8CSBrookfieldRenewableCanadaUSD9.233.44638O67.182.814.41.6102.43.6CSCanadianUtilitiesCanadaCAD7.735.8399N16.816.513.41.91.011.2CSKeyeraCorp.CanadaCAD5.230.03620N17.916.510.32.17.111.8CSUSEEMIGeneralElectricUSUSD109.799.912222O29.818.013.520.180.18.8CSEmersonElectricUSUSD57.495.711217O19.017.612.05.09.828.2CSIngersoll-RandUSUSD22.254.66214N24.020.218.53.117.311.3CSChartIndustriesUSUSD4.2116.519467O19.816.613.12.856.713.3CSFlowserveCorp.USUSD4.332.94022O15.012.79.52.534.516.8CSUSAutosGeneralMotorsCompanyUSUSD73.750.77548O7.37.73.41.2(3.3)18.4CSFuelcellBallardPowerCanadaCAD2.811.8NANANCNmNmNm2.1(15.0)(4.5)IBESLoopEnergyCanadaCAD0.12.9NANANCNm1.5NmIBESPlugPowerUSUSD12.421.5NANANCNmNmNm2.7(63.7)(3.8)IBESBloomEnergyUSUSD2.514.430108O23.014.010.97.2Nm38.0CSFuelCellEnergyUSUSD1.64.4NANANCNmNmNm437.0(20.4)(13.1)IBESP/EEV/EBITDAP/B8February2022GlobalThemesMonitor18CSreportsonHydrogenthemeoverpastyearDateCompany/SectorReportResearchAnalyst27-Jan-22ITMPowerH1'22showsloweraveragepricingsinceDecupdate,andguidanceforFY22maybeatriskChristopherLeonard26-Jan-22HydrogenthemeHydrogenExpertSeries:ElectrolysisTechnology,PartIIChristopherLeonard18-Jan-22ThyssenkruppElectrolyserread-across:FeedbackfromThyssenkrupp'selectrolysisCMDChristopherLeonard13-Jan-22HydrogenthemeFeedbackfromHydrogenExpertSeries:Electrolysistechnology,PartIChristopherLeonard22-Dec-21AlternativeEnergyReducingTPforlowerBBBprobabilityMaheepMandloi16-Dec-21SustainableEnergyInitiatingcoverageofEuropeanHydrogen&Renewablepure-playsChristopherLeonard10-Dec-21ESGResearchDevelopmentsDownUnder–Boron,Rioaluminium,morehydrogen,PFAStrialPhineasGlover26-Nov-21ESGResearchDevelopmentsDownUnder:Vanadium,coalpowerclosures,WHC,blowtohydrogen,carbonpricesPhineasGlover08-Nov-21BloomEnergyQ3EarningsReview–Electrolyzer/MarineCatalystsAheadMaheepMandloi29-Oct-21USRenewablesDirectCurrents-RenewableinRevisedReconciliationBillMaheepMandloi29-Oct-21ESGResearchDevelopmentsDownUnder–AusNetZeroPlan,COP26,hydrogen,CWN‘super’directorPhineasGlover13-Oct-21HydrogenthemeHydrogen:DisruptionseriesMarkFreshney04-Oct-21HydrogenthemeExpertcall:TheUKHydrogenStrategyStefanoBezzato15-Sep-21ChinaMarketStrategyEmbracingcarbonneutralityEdmondHuang13-Aug-21ESGResearchDevelopmentsDownUnder–BHP/WPL,ESGde-listing,hydrogen,baseloadcoalpowerPhineasGlover13-Aug-21ESGResearchDevelopmentsDownUnder–IPCC,PFAS,CWN,Hydrogen,TomagoPhineasGlover06-Aug-21ESGResearchDevelopmentsDownUnder–IPCCreport,EVs,steel,plasticchems,hydrogenPhineasGlover04-Aug-21BloomEnergyFirstImpression-Q2miss,but2021reiteratedMaheepMandloi11-Jun-21ESGResearchDevelopmentsDownUnder–shortcoal/longlithium,hydrogen,moneylaunderingrisksPhineasGlover28-Apr-21USESGResearchCantheUSHalveEmissionsby2030?BettyJiang28-Apr-21EnergysectorEURecoveryFund-Italy'sEnergyTransitionplanStefanoBezzato26-Apr-21AlternativeEnergyKeytopicsforQ1–SupplyshortagesandaBidenPlanMichaelWeinstein21-Apr-21SnamESGwebinar:keytake-awaysStefanoBezzato19-Apr-21HydrogenthemeHydrogenSeries:Truckingdecarbonisation–insightsfromanindustryexpertcallCharlesBentley16-Apr-21OffshoreWindCreditSuisseExpertCall:LookingatthePolishoffshoremarketWandaSerwinowska13-Apr-21HydrogenthemeUpdatetoEuropeanHydrogenBackbonestudyStefanoBezzato05-Apr-21HydrogenthemePart4:AprimerontheAmericasValueChainMichaelWeinstein01-Apr-21HydrogenthemeRecentdevelopmentsinthevaluechain(Europeanregion)StefanoBezzato31-Mar-21USESGResearchFirstLookatBiden’sInfrastructureBillBettyJiang31-Mar-21USRenewablesDirectCurrents-Biden'srenewableregistryMichaelWeinstein24-Mar-21AirLiquideTheHydrogenOpportunityandbeyond–keyfeedbackfromAirLiquideSustainabilityDayChrisCounihan22-Mar-21ChinaMarketStrategyDualCirculation2.0:EnergysecurityandrevolutionEdmondHuang18-Mar-21SnamRaising2021guidance,whilesendingamessageofhopeforregulatoryreviewStefanoBezzato17-Mar-21GlobalOffshoreWindReviewingthelandscapefollowingrecentweaknesses.PreferstocksinthesupplychainMarkFreshney15-Mar-21ChinaNewEnergyHydrogen:HowbesttoplaytheChinahydrogenthemeHoraceTse15-Mar-21DongyueGroupEvolvingintoakeyfuelcellplayKayleeXu12-Mar-21GlobalESGResearchDecarbonisingthemesandstocksEugeneKlerk12-Mar-21CleanEnergythemeExpertevent:Lookingatcarbonpricesin2021andbeyondStefanoBezzato10-Mar-21AirLiquideHydrogenunderpinsgroupgrowthaccelerationChrisCounihan10-Mar-21HydrogenthemePart3:AnewChemicalsfrontier-Mappingsupplyanddemandto2050enroutetonetzeroCharlesBentley10-Mar-21ChinaUtilities&RenewablesWhattoexpectoverthenextfiveyearsGaryZhou08-Mar-21BloomEnergyUpgradetoOutperformonValuationMichaelWeinstein01-Mar-21CleanEnergythemeConferencekeytake-aways:CCSisintegraltoEUGreenDealambitionsStefanoBezzato26-Feb-21CleanEnergythemeExpertcall:CCUSisadvancedintheUKStefanoBezzato24-Feb-21EndesaFY2020callconfirmspositiveoutlookStefanoBezzato19-Feb-21GlobalESGEquityStrategyUpdatingCreditSuisse’sEstimatesofGlobalGreenStimulusPhineasGlover18-Feb-21AlternativeEnergyRatesandOtherThoughtsonDistributedSolarPerformanceMichaelWeinstein18-Feb-21EndesaGrowingroleinenergytransitionthroughhydrogenandnetworks;upgradetoOPStefanoBezzato11-Feb-21BloomEnergyServiceprofitabilityearlierthanexpectedMichaelWeinstein11-Feb-21RoyalDutchShellUppingCarbonIntensityReductionTargetsThomasAdolff10-Feb-21BloomEnergyFirstimpression-BacklogremainsflatafterQ4beatonhigheracceptancesandprofitabilityMichaelWeinstein8February2022GlobalThemesMonitor19DateCompany/SectorReportResearchAnalyst09-Feb-21GlobalOffshoreWindAuctionoptionfeesaddc£9/MWhtotheLCOEMarkFreshney08-Feb-21CleanEnergythemeCallwithCCUSexperts-Keytodecarbonisationinhard-to-abatesectorsStefanoBezzato05-Feb-21APACESGDigestAGL,Remediation,Hydrogen,ChinaAntitrust,APTPhineasGlover04-Feb-21APACHydrogenExpertcalltakeaways:China’shydrogenvaluechaindevelopmenttoexpediteHoraceTse01-Feb-21EndesaGreenhydrogen:apossiblenewangleforEndesa'sequitystoryStefanoBezzato28-Jan-21Aerospace&DefenceHydrogen,arisingbutchallengingdecarbonisationoptionforaerospaceOlivierBrochet20-Jan-21USRenewablesAlternativeEnergy:2021Outlook-AcceleratingtheEnergyTransitionMichaelWeinsteinSource:CreditSuisse8February2022GlobalThemesMonitor20CompaniesMentioned(Priceasof07-Feb-2022)AFCEnergy(AFEN.L,35.9p)AGLEnergy(AGL.AX,A$7.26)APAGroup(APA.AX,A$9.96)AccionaSA(ANA.MC,€147.5)AirLiquide(AIRP.PA,€146.5)AirProducts&Chemicals(APD.N,$254.38)AirWater(4088.T,¥1,750)AirbusSE(AIR.PA,€112.94)Alstom(ALSO.PA,€26.49)ArrayTechnologiesInc(ARRY.OQ,$9.53)BASF(BASFn.DE,€66.97)BLEST(603959.SS,Rmb14.4)BMW(BMWG.DE,€89.86)BP(BP.L,408.65p)BallardPowSyst(BLDP.TO,C$11.78)BeijingSinoHytecCo.,Ltd(688339.SS,Rmb203.0)BloomEnergy(BE.N,$14.41)Broad-OceanMotor(002249.SZ,Rmb6.79)BrookfieldRenewablePartners(BEP.N,$33.41)BurckhardtCompression(BCHN.S,SFr444.5)CIMCEnric(3899.HK,HK$9.59)CNOOC(0883.HK,HK$9.9)CanadianUtilitiesLimited(CU.TO,C$35.8)CeresPower(CWR.L,533.0p)ChartIndustries,Inc.(GTLS.N,$116.47)ChengduShenleng(300540.SZ,Rmb25.7)ChiyodaCorp(6366.T,¥373)CumminsInc.(CMI.N,$226.54)DaewonKangup(000430.KS,W3,280)DongfangElectricCorporationLimited(1072.HK,HK$11.26)DongfangElectricCorporationLimited(600875.SS,Rmb17.53)DongyueGroup(0189.HK,HK$9.01)DoosanFuelCell(336260.KS,W36,800)E.ON(EONGn.DE,€12.23)EDF(EDF.PA,€8.382)EDP(EDP.LS,€4.292)ENI(ENI.MI,€13.186)Elringklinger(ZILGn.DE,€10.15)EmersonElectric(EMR.N,$95.73)Enagas(ENAG.MC,€18.895)EnbridgeInc.(ENB.TO,C$54.99)Endesa(ELE.MC,€18.74)Enel(ENEI.MI,€6.431)EnterpriseProductsPartnersLP(EPD.N,$24.16)EquinorASA(EQNR.OL,Nkr262.25)Faurecia(EPED.PA,€39.0)Fincantieri(FCT.MI,€0.553)FirstSolar(FSLR.OQ,$69.74)FlowserveCorp.(FLS.N,$32.9)FluxysBelgium(FLUX.BR,€30.5)FortescueMetalsGroupLtd(FMG.AX,A$21.53)FortumOyj(FORTUM.HE,€24.53)FtcSolar(FTCI.N,$3.75)FuelcellEnergy(FCEL.OQ,$4.37)GalpEnergia(GALP.LS,€10.045)GeneralElectric(GE.N,$99.9)GeneralMotorsCompany(GM.N,$50.71)GreenHydroSyst(GREENH.CO,Dkr30.6)HBIS(000709.SZ,Rmb2.48)HexagonAB(HEXAb.ST,Skr128.15)HexagonComposit(HEX.OL,Nkr28.54)HinoMotors(7205.T,¥1,060)HitachiZosen(7004.T,¥743)HondaMotor(7267.T,¥3,403)Hydrogenpro(HYPRO.OL,Nkr17.06)HyosungHeavyInds(298040.KS,W51,600)HyundaiMobis(012330.KS,W230,000)HyundaiMotorCompany(005380.KS,W186,500)HyundaiRotem(064350.KS,W19,150)HyundaiSteelCo.(004020.KS,W39,100)ITMPower(ITM.L,255.4p)Iberdrola(IBE.MC,€9.498)IljinDiamond(081000.KS,W26,150)Ingersoll-RandInc.(IR.N,$54.57)IsuzuMotors(7202.T,¥1,491)Iwatani(8088.T,¥5,280)JNKHeaters(126880.KQ,W5,370)JXHoldings(5020.T,¥469)JohnsonMatthey(JMAT.L,1784.0p)KawasakiHeavyIndustries(7012.T,¥2,172)KeyeraCorp.(KEY.TO,C$30.04)KinderMorganInc.(KMI.N,$17.46)KobeSteel(5406.T,¥569)LindePlc.(LIN.N,$296.47)LoopEnergy(LPEN.TO,C$2.88)MJNY(000723.SZ,Rmb13.75)MTUAeroEngines(MTXGn.DE,€184.65)8February2022GlobalThemesMonitor21McPhyEnergy(MCPHY.PA,€15.96)Mercedes-Benz(DAIGn.DE,€67.56)MitsubishiHeavyIndustries(7011.T,¥3,193)MitsubishiKakoki(6331.T,¥2,020)Motonic(009680.KS,W9,260)Nel(NEL.OL,Nkr12.99)Neste(NESTE.HE,€39.4)NewFortressEnergy(NFE.OQ,$21.56)NextEraEnergyInc.(NEE.N,$75.68)NittoKohki(6151.T,¥1,608)NorthwestNatrl(NWN.N,$46.94)OMV(OMVV.VI,€54.88)OriginEnergy(ORG.AX,A$6.04)Orsted(ORSTED.CO,Dkr681.4)OsakaGas(9532.T,¥2,037)Panasonic(6752.T,¥1,202)PetroChina(0857.HK,HK$4.1)PetroChina(601857.SS,Rmb5.48)PlugPower(PLUG.OQ,$21.46)PowercellSweden(PCELL.ST,Skr140.6)ProtonMotor(PPS.L,16.25p)PungkukAlcholnd(023900.KQ,W16,500)RWE(RWEG.F,€36.79)Rolls-Royce(RR.L,115.58p)SATELLITECHEM(002648.SZ,Rmb42.88)SSAB(SSABa.ST,Skr54.94)Safran(SAF.PA,€107.54)Salzgitter(SZGG.DE,€31.44)SejongInd(033530.KS,W7,630)SempraUSA(SRE.N,$137.0)ShoalsTechnologies(SHLS.OQ,$15.7)SiemensEnergy(ENR1n.DE,€19.065)Sinopec(0386.HK,HK$4.21)Sinopec(600028.SS,Rmb4.36)Snam(SRG.MI,€4.677)SolariaEnergíayMedioAmbiente(SLRS.MC,€14.395)TCEnergy(TRP.TO,C$64.97)TaiyoNipponSanso(4091.T,¥2,283)TechnipFMC(FTI.N,$6.76)ThyssenKrupp(TKAG.DE,€8.932)TokyoGas(9531.T,¥2,299)TorayIndustries(3402.T,¥671)ToyotaMotor(7203.T,¥2,276)Umicore(UMI.BR,€32.41)Uniper(UN01.DE,€39.92)Verbund(VERB.VI,€94.3)Vopak(VOPA.AS,€30.76)WeichaiPower(2338.HK,HK$14.34)WeichaiPower(000338.SZ,Rmb15.79)WilliamsCompaniesInc(WMB.N,$30.71)WoodPlc(WG.L,226.5p)WoodsidePetroleum(WPL.AX,A$26.76)Worley(WOR.AX,A$11.89)YaraInternationalASA(YAR.OL,Nkr466.4)Zhongtai(300435.SZ,Rmb18.84)DisclosureAppendixAnalystCertificationTheanalystsidentifiedinthisreporteachcertify,withrespecttothecompaniesorsecuritiesthattheindividualanalyzes,that(1)theviewsexpressedinthisreportaccuratelyreflecthisorherpersonalviewsaboutallofthesubjectcompaniesandsecuritiesand(2)nopartofhisorhercompensationwas,isorwillbedirectlyorindirectlyrelatedtothespecificrecommendationsorviewsexpressedinthisreport.AsofDecember10,2012Analysts’stockratingaredefinedasfollows:Outperform(O):Thestock’stotalreturnisexpectedtooutperformtherelevantbenchmarkoverthenext12months.Neutral(N):Thestock’stotalreturnisexpectedtobeinlinewiththerelevantbenchmarkoverthenext12months.Underperform(U):Thestock’stotalreturnisexpectedtounderperformtherelevantbenchmarkoverthenext12months.Relevantbenchmarkbyregion:Asof10thDecember2012,Japaneseratingsarebasedonastock’stotalreturnrelativetotheanalyst'scoverageuniversewhichconsistsofallcompaniescoveredbytheanalystwithintherelevantsector,withOutperformsrepresentingthemostattractive,Neutralsthelessattractive,andUnderperformstheleastattractiveinvestmentopportunities.Asof2ndOctober2012,U.S.andCanadianaswellasEuropean(excludingTurkey)ratingsarebasedonastock’stotalreturnrelativetotheanalyst'scoverageuniversewhichconsistsofallcompaniescoveredbytheanalystwithintherelevantsector,withOutperformsrepresentingthemostattractive,Neutralsthelessattractive,andUnderperformstheleastattractiveinvestmentopportunities.ForLatinAmerica,TurkeyandAsia(excludingJapanandAustralia),stockratingsarebasedonastock’stotalreturnrelativetotheaveragetotalreturnoftherelevantcountryorregionalbenchmark(India-S&PBSESensexIndex);forChinaAsharetherelevantindexistheShanghaiShenzhenCSI300(CSI300);priorto2ndOctober2012U.S.andCanadianratingswerebasedon(1)astock’sabsolutetotalreturnpotentialtoitscurrentsharepriceand(2)therelativeattractivenessofastock’stotalreturnpotentialwithinananalyst’scoverageuniverse.ForAustralianandNewZealandstocks,theexpectedtotalreturn(ETR)calculationincludes12-monthrollingdividendyield.AnOutperformratingisassignedwhereanETRisgreaterthanorequalto7.5%;UnderperformwhereanETRlessthanorequalto5%.ANeutralmaybeassignedwheretheETRisbetween-5%and15%.TheoverlappingratingrangeallowsanalyststoassignaratingthatputsETRinthecontextofassociatedrisks.Priorto18May2015,ETRrangesforOutperformandUnderperformratingsdidnotoverlapwithNeutralthresholdsbetween15%and7.5%,whichwasinoperationfrom7July2011.8February2022GlobalThemesMonitor22Restricted(R):Incertaincircumstances,CreditSuissepolicyand/orapplicablelawandregulationsprecludecertaintypesofcommunications,includinganinvestmentrecommendation,duringthecourseofCreditSuisse'sengagementinaninvestmentbankingtransactionandincertainothercircumstances.NotRated(NR):CreditSuisseEquityResearchdoesnothaveaninvestmentratingorviewonthestockoranyothersecuritiesrelatedtothecompanyatthistime.NotCovered(NC):CreditSuisseEquityResearchdoesnotprovideongoingcoverageofthecompanyorofferaninvestmentratingorinvestmentviewontheequitysecurityofthecompanyorrelatedproducts.VolatilityIndicator[V]:Astockisdefinedasvolatileifthestockpricehasmovedupordownby20%ormoreinamonthinatleast8ofthepast24monthsortheanalystexpectssignificantvolatilitygoingforward.Analysts’sectorweightingsaredistinctfromanalysts’stockratingsandarebasedontheanalyst’sexpectationsforthefundamentalsand/orvaluationofthesectorrelativetothegroup’shistoricfundamentalsand/orvaluation:Overweight:Theanalyst’sexpectationforthesector’sfundamentalsand/orvaluationisfavorableoverthenext12months.MarketWeight:Theanalyst’sexpectationforthesector’sfundamentalsand/orvaluationisneutraloverthenext12months.Underweight:Theanalyst’sexpectationforthesector’sfundamentalsand/orvaluationiscautiousoverthenext12months.Ananalyst’scoveragesectorconsistsofallcompaniescoveredbytheanalystwithintherelevantsector.Ananalystmaycovermultiplesectors.CreditSuisse'sdistributionofstockratings(andbankingclients)is:GlobalRatingsDistributionRatingVersusuniverse(%)Ofwhichbankingclients(%)Outperform/Buy56%(30%bankingclients)Neutral/Hold33%(21%bankingclients)Underperform/Sell9%(19%bankingclients)Restricted2%PleaseclickheretoviewtheMARquarterlyrecommendationsandinvestmentservicesreportforfundamentalresearchrecommendations.ForpurposesoftheNYSEandFINRAratingsdistributiondisclosurerequirements,ourstockratingsofOutperform,Neutral,andUnderperformmostcloselycorrespondtoBuy,Hold,andSell,respectively;however,themeaningsarenotthesame,asourstockratingsaredeterminedonarelativebasis.(Pleaserefertodefinitionsabove.)Aninvestor'sdecisiontobuyorsellasecurityshouldbebasedoninvestmentobjectives,currentholdings,andotherindividualfactors.ImportantGlobalDisclosuresCreditSuisse’sresearchreportsaremadeavailabletoclientsthroughourproprietaryresearchportalonCSPLUS.CreditSuisseresearchproductsmayalsobemadeavailablethroughthird-partyvendorsoralternateelectronicmeansasaconvenience.CertainresearchproductsareonlymadeavailablethroughCSPLUS.TheservicesprovidedbyCreditSuisse’sanalyststoclientsmaydependonaspecificclient’spreferencesregardingthefrequencyandmannerofreceivingcommunications,theclient’sriskprofileandinvestment,thesizeandscopeoftheoverallclientrelationshipwiththeFirm,aswellaslegalandregulatoryconstraints.ToaccessallofCreditSuisse’sresearchthatyouareentitledtoreceiveinthemosttimelymanner,pleasecontactyoursalesrepresentativeorgotohttps://plus.credit-suisse.com.CreditSuisse’spolicyistoupdateresearchreportsasitdeemsappropriate,basedondevelopmentswiththesubjectcompany,thesectororthemarketthatmayhaveamaterialimpactontheresearchviewsoropinionsstatedherein.CreditSuisse'spolicyisonlytopublishinvestmentresearchthatisimpartial,independent,clear,fairandnotmisleading.FormoredetailpleaserefertoCreditSuisse'sPoliciesforManagingConflictsofInterestinconnectionwithInvestmentResearch:https://www.credit-suisse.com/sites/disclaimers-ib/en/managing-conflicts.html.Anyinformationrelatingtothetaxstatusoffinancialinstrumentsdiscussedhereinisnotintendedtoprovidetaxadviceortobeusedbyanyonetoprovidetaxadvice.Investorsareurgedtoseektaxadvicebasedontheirparticularcircumstancesfromanindependenttaxprofessional.CreditSuissehasdecidednottoenterintobusinessrelationshipswithcompaniesthatCreditSuissehasdeterminedtobeinvolvedinthedevelopment,manufacture,oracquisitionofanti-personnelminesandclustermunitions.ForCreditSuisse'spositionontheissue,pleaseseehttps://www.credit-suisse.com/media/assets/corporate/docs/about-us/responsibility/banking/policy-summaries-en.pdf.Theanalyst(s)responsibleforpreparingthisresearchreportreceivedcompensationthatisbaseduponvariousfactorsincludingCreditSuisse'stotalrevenues,aportionofwhicharegeneratedbyCreditSuisse'sinvestmentbankingactivitiesFordateandtimeofproduction,disseminationandhistoryofrecommendationforthesubjectcompany(ies)featuredinthisreport,disseminatedwithinthepast12months,pleaserefertothelink:https://rave.credit-suisse.com/disclosures/view/report?i=684504&v=r4sryijy5fn4txr0y4ncrzvm.ImportantRegionalDisclosuresSingaporerecipientsshouldcontactCreditSuisseAG,SingaporeBranchforanymattersarisingfrom,orinconnectionwith,thisresearchreport.Analystswhoconductsitevisitsofcoveredissuersarenotpermittedtoacceptpaymentorreimbursementfortravelexpensesfromtheissuerforthesitevisit.ForCreditSuisseSecurities(Canada),Inc.'spoliciesandproceduresregardingthedisseminationofequityresearch,pleasevisithttps://www.credit-suisse.com/sites/disclaimers-ib/en/canada-research-policy.html.Investorsshouldnotethatincomefromsuchsecuritiesandotherfinancialinstruments,ifany,mayfluctuateandthatpriceorvalueofsuchsecuritiesandinstrumentsmayriseorfalland,insomecases,investorsmaylosetheirentireprincipalinvestment.TotheextentanyCreditSuisseequityresearchanalystemployedbyCreditSuisseInternational(a"UKAnalyst")hasinteractionswithaSpanishdomiciledclientofCreditSuisseAGoritsaffiliates,suchUKAnalystwillbeactingforandonbehalfofCreditSuisseBank(Europe),S.A.,withrespectonlytotheprovisionofequityresearchservicestoSpanishdomiciledclientsofCreditSuisseAGoritsaffiliates.8February2022GlobalThemesMonitor23PursuanttoCVMResolutionNo.20/2021,ofFebruary25,2021,theauthor(s)ofthereportherebycertify(ies)thattheviewsexpressedinthisreportsolelyandexclusivelyreflectthepersonalopinionsoftheauthor(s)andhavebeenpreparedindependently,includingwithrespecttoCreditSuisse.Partoftheauthor(s)´scompensationisbasedonvariousfactors,includingthetotalrevenuesofCreditSuisse,butnopartofthecompensationhasbeen,is,orwillberelatedtothespecificrecommendationsorviewsexpressedinthisreport.Inaddition,CreditSuissedeclaresthat:CreditSuissehasprovided,and/ormayinthefutureprovideinvestmentbanking,brokerage,assetmanagement,commercialbankingandotherfinancialservicestothesubjectcompany/companiesoritsaffiliates,forwhichtheyhavereceivedormayreceivecustomaryfeesandcommissions,andwhichconstitutedormayconstituterelevantfinancialorcommercialinterestsinrelationtothesubjectcompany/companiesorthesubjectsecurities.Thisresearchreportisauthoredby:CreditSuisse(HongKong)Limited.......................................GlobalSectorThemesMarketing;ManishNigam;VaibhavJainTotheextentthisisareportauthoredinwholeorinpartbyanon-U.S.analystandismadeavailableintheU.S.,thefollowingareimportantdisclosuresregardinganynon-U.S.analystcontributors:Thenon-U.S.researchanalystslistedbelow(ifany)arenotregistered/qualifiedasresearchanalystswithFINRA.Thenon-U.S.researchanalystslistedbelowmaynotbeassociatedpersonsofCSSUandthereforemaynotbesubjecttotheFINRA2241restrictionsoncommunicationswithasubjectcompany,publicappearancesandtradingsecuritiesheldbyaresearchanalystaccount.CreditSuisse(HongKong)Limited.......................................GlobalSectorThemesMarketing;ManishNigam;VaibhavJainImportantdisclosuresregardingcompaniesthatarethesubjectofthisreportareavailablebycalling+1(877)291-2683.Thesameimportantdisclosures,withtheexceptionofvaluationmethodologyandriskdiscussions,arealsoavailableonCreditSuisse’sdisclosurewebsiteathttps://rave.credit-suisse.com/disclosures.Forvaluationmethodologyandrisksassociatedwithanyrecommendation,pricetarget,orratingreferencedinthisreport,pleaserefertothedisclosuressectionofthemostrecentreportregardingthesubjectcompany.8February2022GlobalThemesMonitor24ThisreportisproducedbysubsidiariesandaffiliatesofCreditSuisseoperatingunderitsSustainability,Research&InvestmentSolutionsDivision.Formoreinformationonourstructure,pleaseusethefollowinglink:https://www.credit-suisse.com/who-we-areThisreportmaycontainmaterialthatisnotdirectedto,orintendedfordistributiontooruseby,anypersonorentitywhoisacitizenorresidentoforlocatedinanylocality,state,countryorotherjurisdictionwheresuchdistribution,publication,availabilityorusewouldbecontrarytolaworregulationorwhichwouldsubjectCreditSuisseoritsaffiliates("CS")toanyregistrationorlicensingrequirementwithinsuchjurisdiction.Allmaterialpresentedinthisreport,unlessspecificallyindicatedotherwise,isundercopyrighttoCS.Noneofthematerial,noritscontent,noranycopyofit,maybealteredinanyway,transmittedto,copiedordistributedtoanyotherparty,withoutthepriorexpresswrittenpermissionofCS.Alltrademarks,servicemarksandlogosusedinthisreportaretrademarksorservicemarksorregisteredtrademarksorservicemarksofCSoritsaffiliates.Theinformation,toolsandmaterialpresentedinthisreportareprovidedtoyouforinformationpurposesonlyandarenottobeusedorconsideredasanofferorthesolicitationofanoffertosellortobuyorsubscribeforsecuritiesorotherfinancialinstruments.CSmaynothavetakenanystepstoensurethatthesecuritiesreferredtointhisreportaresuitableforanyparticularinvestor.CSwillnottreatrecipientsofthisreportasitscustomersbyvirtueoftheirreceivingthisreport.Theinvestmentsandservicescontainedorreferredtointhisreportmaynotbesuitableforyouanditisrecommendedthatyouconsultanindependentinvestmentadvisorifyouareindoubtaboutsuchinvestmentsorinvestmentservices.Nothinginthisreportconstitutesinvestment,legal,accountingortaxadvice,orarepresentationthatanyinvestmentorstrategyissuitableorappropriatetoyourindividualcircumstances,orotherwiseconstitutesapersonalrecommendationtoyou.Pleasenoteinparticularthatthebasesandlevelsoftaxationmaychange.InformationandopinionspresentedinthisreporthavebeenobtainedorderivedfromsourcesbelievedbyCStobereliable,butCSmakesnorepresentationastotheiraccuracyorcompleteness.CSacceptsnoliabilityforlossarisingfromtheuseofthematerialpresentedinthisreport,exceptthatthisexclusionofliabilitydoesnotapplytotheextentthatsuchliabilityarisesunderspecificstatutesorregulationsapplicabletoCS.Thisreportisnottoberelieduponinsubstitutionfortheexerciseofindependentjudgment.CSmayhaveissued,andmayinthefutureissue,othercommunicationsthatareinconsistentwith,andreachdifferentconclusionsfrom,theinformationpresentedinthisreport.Thosecommunicationsreflectthedifferentassumptions,viewsandanalyticalmethodsoftheanalystswhopreparedthemandCSisundernoobligationtoensurethatsuchothercommunicationsarebroughttotheattentionofanyrecipientofthisreport.SomeinvestmentsreferredtointhisreportwillbeofferedsolelybyasingleentityandinthecaseofsomeinvestmentssolelybyCS,oranassociateofCSorCSmaybetheonlymarketmakerinsuchinvestments.Pastperformanceshouldnotbetakenasanindicationorguaranteeoffutureperformance,andnorepresentationorwarranty,expressorimplied,ismaderegardingfutureperformance.Information,opinionsandestimatescontainedinthisreportreflectajudgmentatitsoriginaldateofpublicationbyCSandaresubjecttochangewithoutnotice.Theprice,valueofandincomefromanyofthesecuritiesorfinancialinstrumentsmentionedinthisreportcanfallaswellasrise.Thevalueofsecuritiesandfinancialinstrumentsissubjecttoexchangeratefluctuationthatmayhaveapositiveoradverseeffectonthepriceorincomeofsuchsecuritiesorfinancialinstruments.InvestorsinsecuritiessuchasADR's,thevaluesofwhichareinfluencedbycurrencyvolatility,effectivelyassumethisrisk.Structuredsecuritiesarecomplexinstruments,typicallyinvolveahighdegreeofriskandareintendedforsaleonlytosophisticatedinvestorswhoarecapableofunderstandingandassumingtherisksinvolved.Themarketvalueofanystructuredsecuritymaybeaffectedbychangesineconomic,financialandpoliticalfactors(including,butnotlimitedto,spotandforwardinterestandexchangerates),timetomaturity,marketconditionsandvolatility,andthecreditqualityofanyissuerorreferenceissuer.Anyinvestorinterestedinpurchasingastructuredproductshouldconducttheirowninvestigationandanalysisoftheproductandconsultwiththeirownprofessionaladvisersastotherisksinvolvedinmakingsuchapurchase.Someinvestmentsdiscussedinthisreportmayhaveahighlevelofvolatility.Highvolatilityinvestmentsmayexperiencesuddenandlargefallsintheirvaluecausinglosseswhenthatinvestmentisrealised.Thoselossesmayequalyouroriginalinvestment.Indeed,inthecaseofsomeinvestmentsthepotentiallossesmayexceedtheamountofinitialinvestmentand,insuchcircumstances,youmayberequiredtopaymoremoneytosupportthoselosses.Incomeyieldsfrominvestmentsmayfluctuateand,inconsequence,initialcapitalpaidtomaketheinvestmentmaybeusedaspartofthatincomeyield.Someinvestmentsmaynotbereadilyrealisableanditmaybedifficulttosellorrealisethoseinvestments,similarlyitmayprovedifficultforyoutoobtainreliableinformationaboutthevalue,orrisks,towhichsuchaninvestmentisexposed.Thisreportmayprovidetheaddressesof,orcontainhyperlinksto,websites.ExcepttotheextenttowhichthereportreferstowebsitematerialofCS,CShasnotreviewedanysuchsiteandtakesnoresponsibilityforthecontentcontainedtherein.Suchaddressorhyperlink(includingaddressesorhyperlinkstoCS'sownwebsitematerial)isprovidedsolelyforyourconvenienceandinformationandthecontentofanysuchwebsitedoesnotinanywayformpartofthisdocument.AccessingsuchwebsiteorfollowingsuchlinkthroughthisreportorCS'swebsiteshallbeatyourownrisk.Thisresearchreportdoesnot,andisnotintendedtobe,anadvertisementwithinthemeaningofarticle68oftheSwissFinancialServicesActand/orarticle95oftheSwissFinancialServicesOrdinance.Thisresearchreportisnotaprospectus,basicinformationsheet(BIB)orakeyinformationdocument(KID).Anyrecipientsofthisdocumentshould,however,notethatanycommunicationforwardingorusingthisresearchreportasabasisfordiscussion,wouldqualifyassuchadvertisementifitisintendedtodrawtherecipient'sattentiontospecificfinancialinstrumentscoveredbythisresearchreport.ThisreportisissuedanddistributedinUnitedKingdomandEuropeanUnion(exceptGermanyandSpain):byCreditSuisseSecurities(Europe)Limited,OneCabotSquare,LondonE144QJ,England,whichisauthorisedbythePrudentialRegulationAuthorityandregulatedbytheFinancialConductAuthorityandthePrudentialRegulationAuthority;Spain:CreditSuisseBank(Europe),S.A.regulatedbytheComisionNacionaldelMercadodeValores;Germany:CreditSuisse(Deutschland)AktiengesellschaftregulatedbytheBundesanstaltfuerFinanzdienstleistungsaufsicht("BaFin").UnitedStates:CreditSuisseSecurities(USA)LLC;Canada:CreditSuisseSecurities(Canada),Inc.;Switzerland:CreditSuisseAG;Brazil:CreditSuisse(Brasil)S.A.CorretoradeTítuloseValoresMobiliáriosoritsaffiliates;Mexico:BancoCreditSuisse(México),S.A.,InstitucióndeBancaMúltiple,GrupoFinancieroCreditSuisse(México)andCasadeBolsaCreditSuisse(México),S.A.deC.V.,GrupoFinancieroCreditSuisse(México)("CreditSuisseMexico").ThisdocumenthasbeenpreparedforinformationpurposesonlyandisexclusivelydistributedinMexicotoInstitutionalInvestors.CreditSuisseMexicoisnotresponsibleforanyonwarddistributionofthisreporttonon-institutionalinvestorsbyanythirdparty.TheauthorsofthisreporthavenotreceivedpaymentorcompensationfromanyentityorcompanyotherthanfromtherelevantCreditSuisseGroupcompanyemployingthem;Japan:byCreditSuisseSecurities(Japan)Limited,FinancialInstrumentsFirm,Director-GeneralofKantoLocalFinanceBureau(Kinsho)No.66,amemberofJapanSecuritiesDealersAssociation,TheFinancialFuturesAssociationofJapan,JapanInvestmentAdvisersAssociation,TypeIIFinancialInstrumentsFirmsAssociation.ThisreporthasbeenpreparedandissuedfordistributioninJapantoCreditSuisse’sclients,includinginstitutionalinvestors;HongKongSAR:CreditSuisse(HongKong)Limited;Australia:CreditSuisseEquities(Australia)Limited;Thailand:CreditSuisseSecurities(Thailand)Limited,regulatedbytheOfficeoftheSecuritiesandExchangeCommission,Thailand,havingregisteredaddressat990AbdulrahimPlace,27thFloor,Unit2701,RamaIVRoad,Silom,Bangrak,Bangkok10500,Thailand,Tel.+6626146000;Malaysia:CreditSuisseSecurities(Malaysia)SdnBhd;Singapore:CreditSuisseAG,SingaporeBranch;India:CreditSuisseSecurities(India)PrivateLimited(CINno.U67120MH1996PTC104392)regulatedbytheSecuritiesandExchangeBoardofIndiaasResearchAnalyst(registrationno.INH000001030)andasStockBroker(registrationno.INZ000248233),havingregisteredaddressat9thFloor,CeejayHouse,Dr.A.B.Road,Worli,Mumbai-18,India,T-+91-2267773777;SouthKorea:CreditSuisseSecurities(Europe)Limited,SeoulBranch;Taiwan(ChineseTaipei):CreditSuisseAGTaipeiSecuritiesBranch;Indonesia:PTCreditSuisseSekuritasIndonesia;Philippines:CreditSuisseSecurities(Philippines)Inc.,andelsewhereintheworldbytherelevantauthorisedaffiliateoftheabove.AdditionalRegionalDisclaimersAustralia:CreditSuisseSecurities(Europe)Limited("CSSEL")andCreditSuisseInternational("CSI")areauthorisedbythePrudentialRegulationAuthorityandregulatedbytheFinancialConductAuthority("FCA")andthePrudentialRegulationAuthorityunderUKlaws,whichdifferfromAustralianLaws.CSSELandCSIdonotholdanAustralianFinancialServicesLicence("AFSL")andareexemptfromtherequirementtoholdanAFSLundertheCorporationsAct(Cth)2001("CorporationsAct")inrespectofthefinancialservicesprovidedtoAustralianwholesaleclients(withinthemeaningofsection761GoftheCorporationsAct)(hereinafterreferredtoas“FinancialServices”).ThismaterialisnotfordistributiontoretailclientsandisdirectedexclusivelyatCreditSuisse'sprofessionalclientsandeligiblecounterpartiesasdefinedbytheFCA,andwholesaleclientsasdefinedundersection761GoftheCorporationsAct.CreditSuisse(HongKong)Limited("CSHK")islicensedandregulatedbytheSecuritiesandFuturesCommissionofHongKongunderthelawsofHongKongSAR,whichdifferfromAustralianlaws.CSHKLdoesnotholdanAFSLandisexemptfromtherequirementtoholdanAFSLundertheCorporationsActinrespectofprovidingFinancialServices.InvestmentbankingservicesintheUnitedStatesareprovidedbyCreditSuisseSecurities(USA)LLC,anaffiliateofCreditSuisseGroup.CSSUisregulatedbytheUnitedStatesSecuritiesandExchangeCommissionunderUnitedStateslaws,whichdifferfromAustralianlaws.CSSUdoesnotholdanAFSLandisexemptfromtherequirementtoholdanAFSLundertheCorporationsActinrespectofprovidingFinancialServices.CreditSuisseAssetManagementLLC(CSAM)isauthorisedbytheSecuritiesandExchangeCommissionunderUSlaws,whichdifferfromAustralianlaws.CSAMdoesnotholdanAFSLandisexemptfromtherequirementtoholdanAFSLundertheCorporationsActinrespectofprovidingFinancialServices.ThismaterialisprovidedsolelytoInstitutionalAccounts(asdefinedintheFINRArules)whoareEligibleContractParticipants(asdefinedintheUSCommodityExchangeAct).CreditSuisseEquities(Australia)Limited(ABN35068232708)("CSEAL")isanAFSLholderinAustralia(AFSL237237).Malaysia:ResearchprovidedtoresidentsofMalaysiaisauthorisedbytheHeadofResearchforCreditSuisseSecurities(Malaysia)SdnBhd,towhomtheyshoulddirectanyquerieson+60327232020.Singapore:ThisreporthasbeenpreparedandissuedfordistributioninSingaporetoinstitutionalinvestors,accreditedinvestorsandexpertinvestors(eachasdefinedundertheFinancialAdvisersRegulations)only,andisalsodistributedbyCreditSuisseAG,SingaporeBranchtooverseasinvestors(asdefinedundertheFinancialAdvisersRegulations).CreditSuisseAG,SingaporeBranchmaydistributereportsproducedbyitsforeignentitiesoraffiliatespursuanttoanarrangementunderRegulation32CoftheFinancialAdvisersRegulations.SingaporerecipientsshouldcontactCreditSuisseAG,SingaporeBranchat+65-6212-2000formattersarisingfrom,orinconnectionwith,thisreport.Byvirtueofyourstatusasaninstitutionalinvestor,accreditedinvestor,expertinvestororoverseasinvestor,CreditSuisseAG,SingaporeBranchisexemptedfromcomplyingwithcertaincompliancerequirementsundertheFinancialAdvisersAct,Chapter110ofSingapore(the“FAA”),theFinancialAdvisersRegulationsandtherelevantNoticesandGuidelinesissuedthereunder,inrespectofanyfinancialadvisoryservicewhichCreditSuisseAG,SingaporeBranchmayprovidetoyou.EU:ThisreporthasbeenproducedbysubsidiariesandaffiliatesofCreditSuisseoperatingunderitsSustainability,Research&InvestmentSolutionsDivision.InjurisdictionswhereCSisnotalreadyregisteredorlicensedtotradeinsecurities,transactionswillonlybeeffectedinaccordancewithapplicablesecuritieslegislation,whichwillvaryfromjurisdictiontojurisdictionandmayrequirethatthetradebemadeinaccordancewithapplicableexemptionsfromregistrationorlicensingrequirements.ThismaterialisissuedanddistributedintheU.S.byCSSU,amemberofNYSE,FINRA,SIPCandtheNFA,andCSSUacceptsresponsibilityforitscontents.ClientsshouldcontactanalystsandexecutetransactionsthroughaCreditSuissesubsidiaryoraffiliateintheirhomejurisdictionunlessgoverninglawpermitsotherwise.CSmayprovidevariousservicestoUSmunicipalentitiesorobligatedpersons("municipalities"),includingsuggestingindividualtransactionsortradesandenteringintosuchtransactions.AnyservicesCSprovidestomunicipalitiesarenotviewedas"advice"withinthemeaningofSection975oftheDodd-FrankWallStreetReformandConsumerProtectionAct.CSisprovidinganysuchservicesandrelatedinformationsolelyonanarm'slengthbasisandnotasanadvisororfiduciarytothemunicipality.Inconnectionwiththeprovisionoftheanysuchservices,thereisnoagreement,directorindirect,betweenanymunicipality(includingtheofficials,management,employeesoragentsthereof)andCSforCStoprovideadvicetothemunicipality.Municipalitiesshouldconsultwiththeirfinancial,accountingandlegaladvisorsregardinganysuchservicesprovidedbyCS.Inaddition,CSisnotactingfordirectorindirectcompensationtosolicitthemunicipalityonbehalfofanunaffiliatedbroker,dealer,municipalsecuritiesdealer,municipaladvisor,orinvestmentadviserforthepurposeofobtainingorretaininganengagementbythemunicipalityfororinconnectionwithMunicipalFinancialProducts,theissuanceofmunicipalsecurities,orofaninvestmentadvisertoprovideinvestmentadvisoryservicestooronbehalfofthemunicipality.IfthisreportisbeingdistributedbyafinancialinstitutionotherthanCreditSuisseAG,oritsaffiliates,thatfinancialinstitutionissolelyresponsiblefordistribution.Clientsofthatinstitutionshouldcontactthatinstitutiontoeffectatransactioninthesecuritiesmentionedinthisreportorrequirefurtherinformation.ThisreportdoesnotconstituteinvestmentadvicebyCreditSuissetotheclientsofthedistributingfinancialinstitution,andneitherCreditSuisseAG,itsaffiliates,andtheirrespectiveofficers,directorsandemployeesacceptanyliabilitywhatsoeverforanydirectorconsequentiallossarisingfromtheiruseofthisreportoritscontent.Noinformationorcommunicationprovidedhereinorotherwiseisintendedtobe,orshouldbeconstruedas,arecommendationwithinthemeaningoftheUSDepartmentofLabor’sfinalregulationdefining"investmentadvice"forpurposesoftheEmployeeRetirementIncomeSecurityActof1974,asamendedandSection4975oftheInternalRevenueCodeof1986,asamended,andtheinformationprovidedhereinisintendedtobegeneralinformation,andshouldnotbeconstruedas,providinginvestmentadvice(impartialorotherwise).Copyright©2022CREDITSUISSEAGand/oritsaffiliates.Allrightsreserved.Whenyoupurchasenon-listedJapanesefixedincomesecurities(Japanesegovernmentbonds,Japanesemunicipalbonds,Japanesegovernmentguaranteedbonds,Japanesecorporatebonds)fromCSasaseller,youwillberequestedtopaythepurchasepriceonly.

VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP