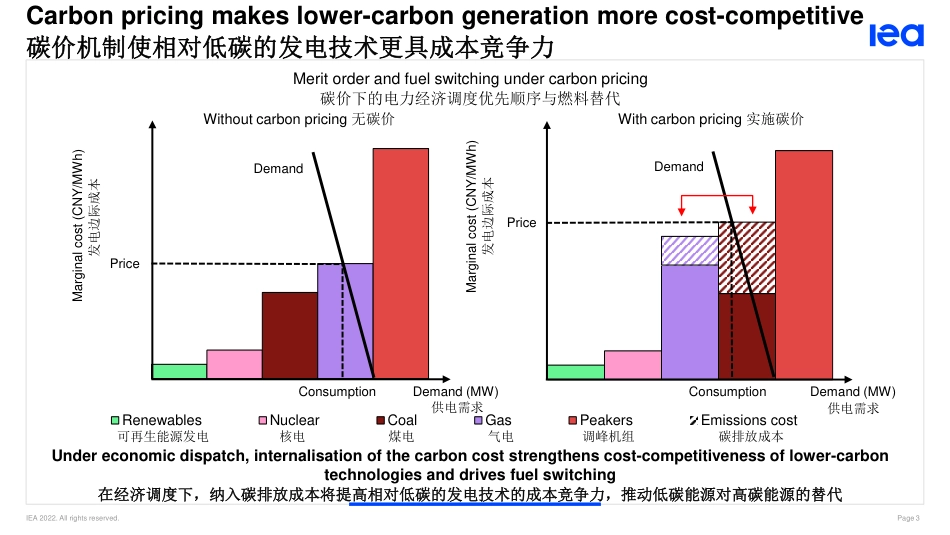

Page 1Emissions Trading System and Power Markets Reform中国碳市场与电力市场化改革Key findings from IEA-Tsinghua report Enhancing China’s ETS for Carbon Neutrality: Focus on Power Sector国际能源署-清华大学联合报告《加强中国碳市场助力实现碳中和:聚焦电力部门》主要结论David FISCHER, Project Coordinator, Environment and Climate Change Unit, IEA21 September 2022IEA 2022. All rights reserved. Page 2• In September 2020, President Xi Jinping annouced that China have CO2 emissions peak before 2030 and achieve carbonneutrality before 2060• 2020年9月,习近平主席宣布中国将“力争二氧化碳排放于2030年前达到峰值、努力争取2060年前实现碳中和”• China’s national ETS came into operation in July 2021. 99.5% compliance rate for the 1st compliance period• 中国全国碳市场于2021年7月启动交易. 碳市场第一个履约期履约率99.5% • Currently covers the power sector which emits around 4.5 Gt CO2 annually (~40% of China’s energy sector CO2 emissions)• 目前,中国碳市场纳入发电行业,每年覆盖约45亿吨二氧化碳排放量(约占中国能源体系二氧化碳排放量的40%)• Allowance price: ~CNY 40-60/t CO2 (USD 6-8/t CO2)• 碳排放配额交易价格:~40-60元/吨二氧化碳 (6-8美元/吨二氧化碳)• Output- and intensity-based allowance allocation with emission intensity benchmarks for four categories of coal- and gas-fired units, without a predetermined emissions cap• 中国碳市场采用基于实际产出和排放强度的基准法,根据四类煤电和气电机组类别设定碳排放强度基准分配配额,不预先设定排放总量上限• Free allocation, possibility to introduce auctions in the future• 碳市场初期免费分配配额,未来可能引入配额拍卖机制China’s national emissions trading system (ETS) in the context of the dual carbon goals双碳目标下的中国全国碳市场IEA 2022. All rights reserved. Page 3Carbon pricing makes lower-carbon generation more cost-competitive碳价机制使相对低碳的发电技术更具成本竞争...