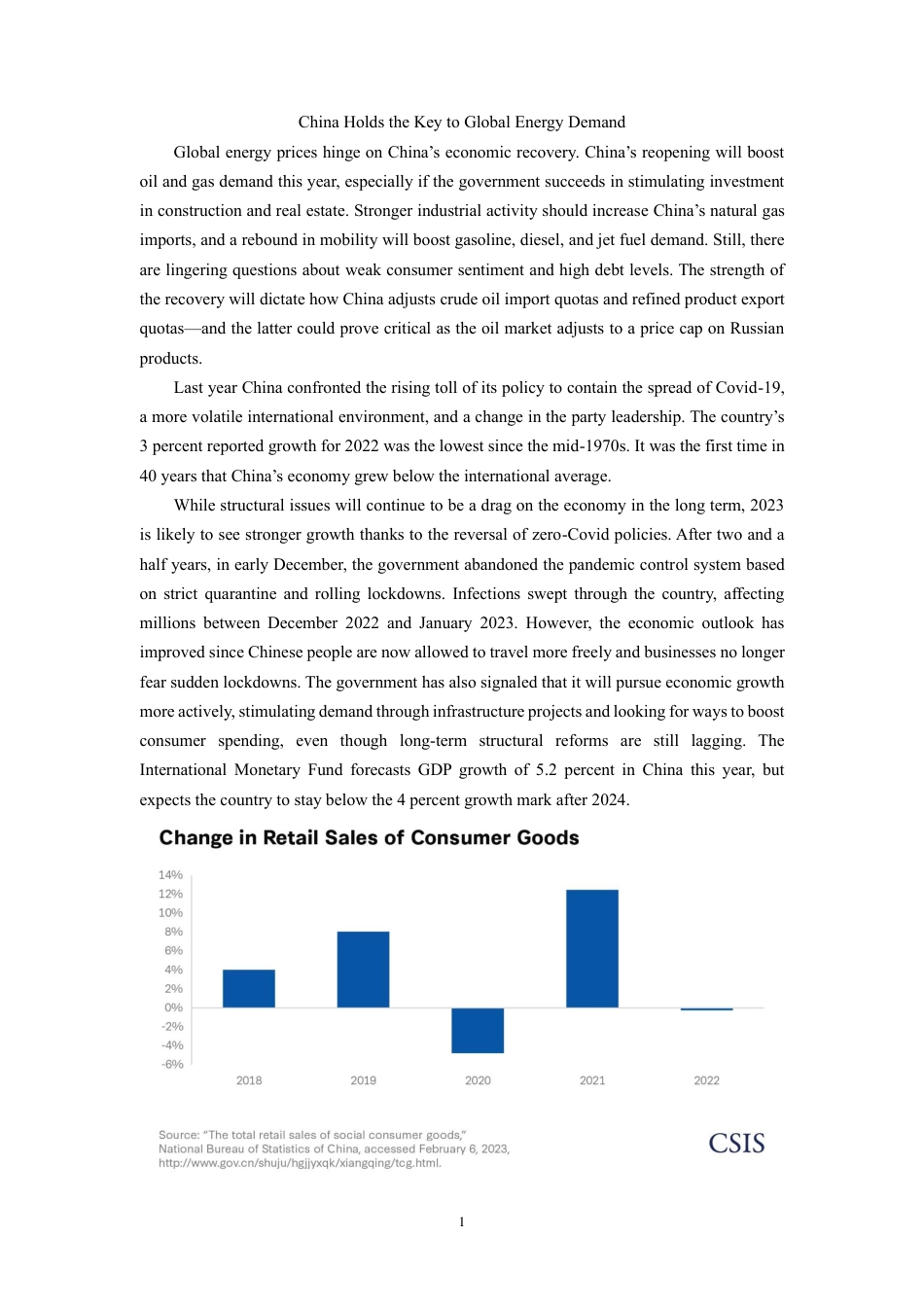

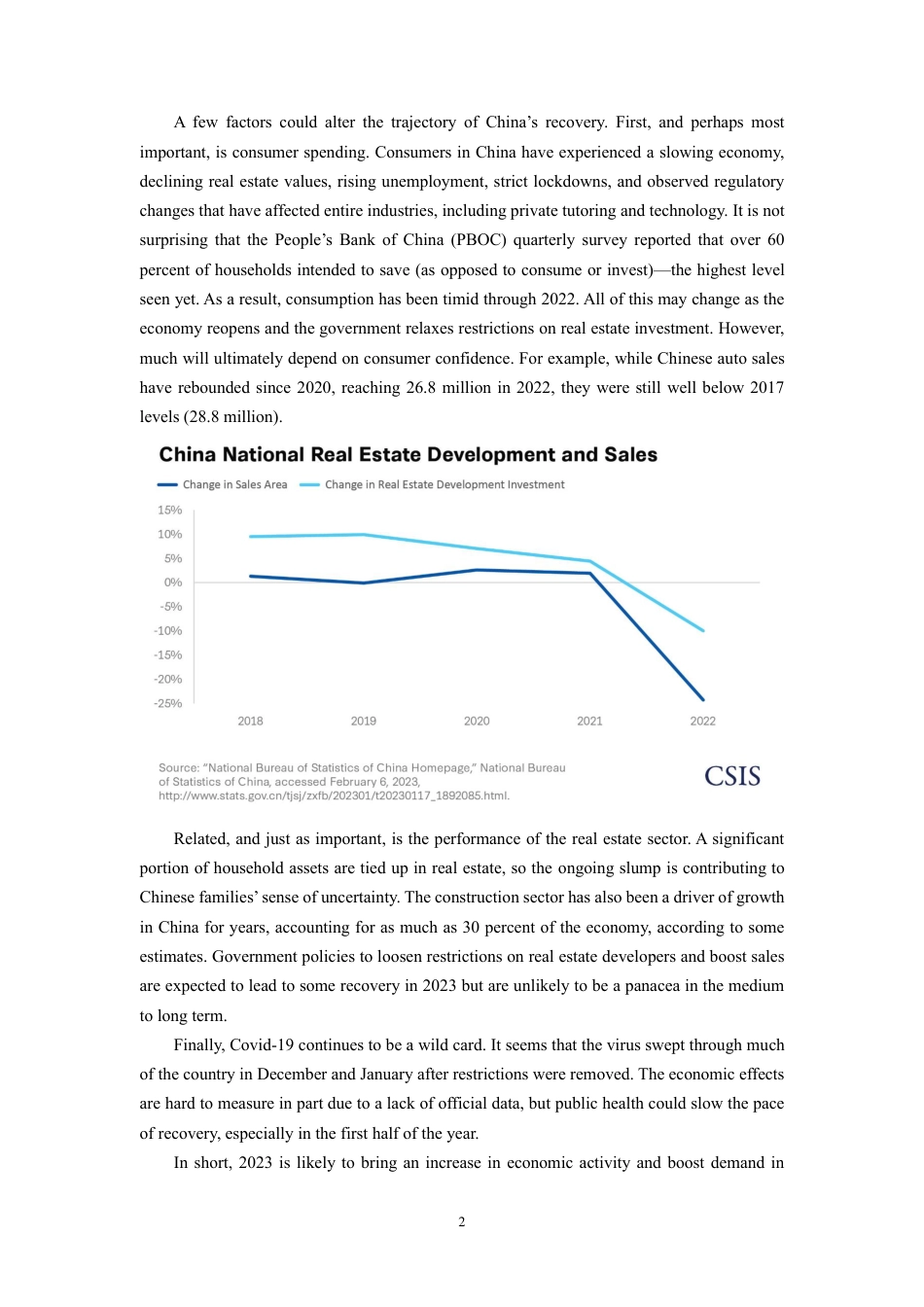

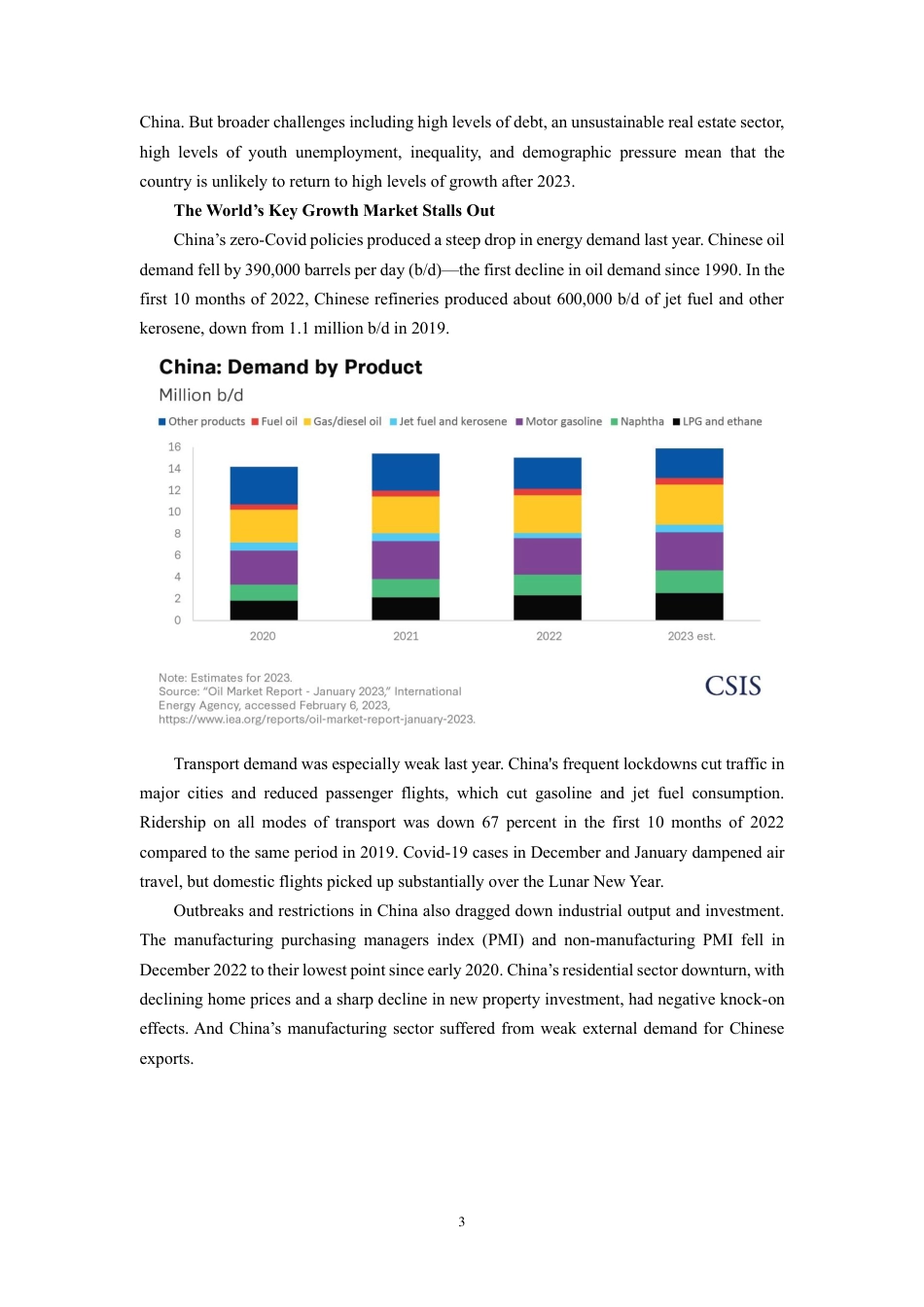

1 China Holds the Key to Global Energy Demand Global energy prices hinge on China’s economic recovery. China’s reopening will boost oil and gas demand this year, especially if the government succeeds in stimulating investment in construction and real estate. Stronger industrial activity should increase China’s natural gas imports, and a rebound in mobility will boost gasoline, diesel, and jet fuel demand. Still, there are lingering questions about weak consumer sentiment and high debt levels. The strength of the recovery will dictate how China adjusts crude oil import quotas and refined product export quotas—and the latter could prove critical as the oil market adjusts to a price cap on Russian products. Last year China confronted the rising toll of its policy to contain the spread of Covid-19, a more volatile international environment, and a change in the party leadership. The country’s 3 percent reported growth for 2022 was the lowest since the mid-1970s. It was the first time in 40 years that China’s economy grew below the international average. While structural issues will continue to be a drag on the economy in the long term, 2023 is likely to see stronger growth thanks to the reversal of zero-Covid policies. After two and a half years, in early December, the government abandoned the pandemic control system based on strict quarantine and rolling lockdowns. Infections swept through the country, affecting millions between December 2022 and January 2023. However, the economic outlook has improved since Chinese people are now allowed to travel more freely and businesses no longer fear sudden lockdowns. The government has also signaled that it will pursue economic growth more actively, stimu...