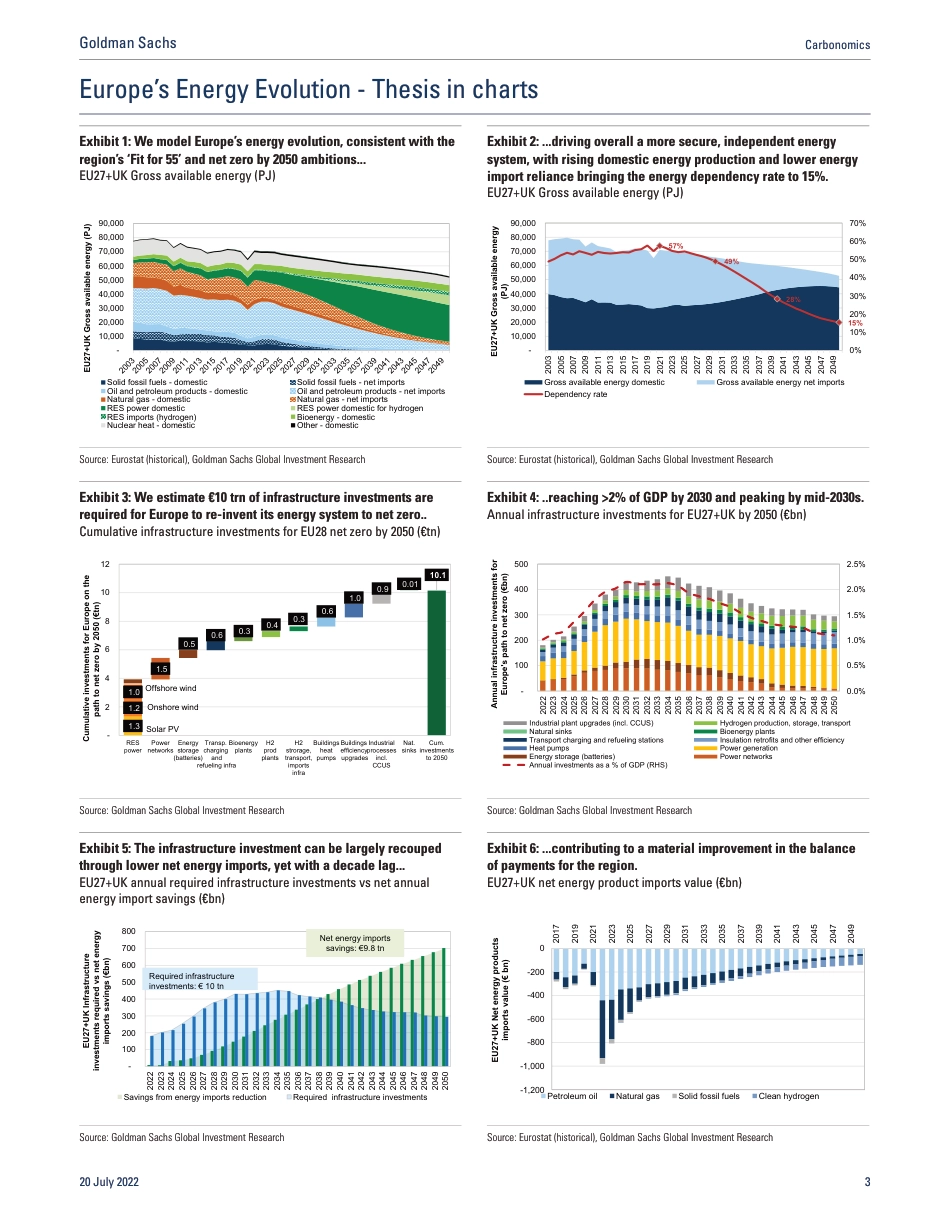

Goldman Sachs does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html. Analysts employed by non-US affiliates are not registered/qualified as research analysts with FINRA in the U.S.The Goldman Sachs Group, Inc.EQUITY RESEARCH | July 20, 2022 | 5:16 PM BSTMichele Della Vigna, CFA +44 20 7552-9383 michele.dellavigna@gs.com Goldman Sachs InternationalZoe Clarke +44 20 7051-2816 zoe.clarke@gs.com Goldman Sachs InternationalRe-Imagining Europe's Energy System Can Europe strengthen its energy independence in the face of the Russia-Ukraine crisis without compromising its climate change goals? We use our Carbonomics framework to model the evolution of Europe’s energy system towards a lower cost, lower imports, lower carbon system. Our analysis leads to five main conclusions: 1) Cumulative infrastructure investments of €10 trn will be needed by 2050 forEurope's energy transformation, reaching the equivalent of >2% of GDP by 2030.This incremental investment is fully offset by a €10 trn reduction in net energyimports, reducing the net energy import dependency rate of the region from58% to 15% by 2050. Efficient financing and a reliable regulatory environment arekey to bridge the 10-year time gap between the two flows.2) Europe's new energy system would improve affordability. We estimate thedirect energy cost to the average European consumer cou...