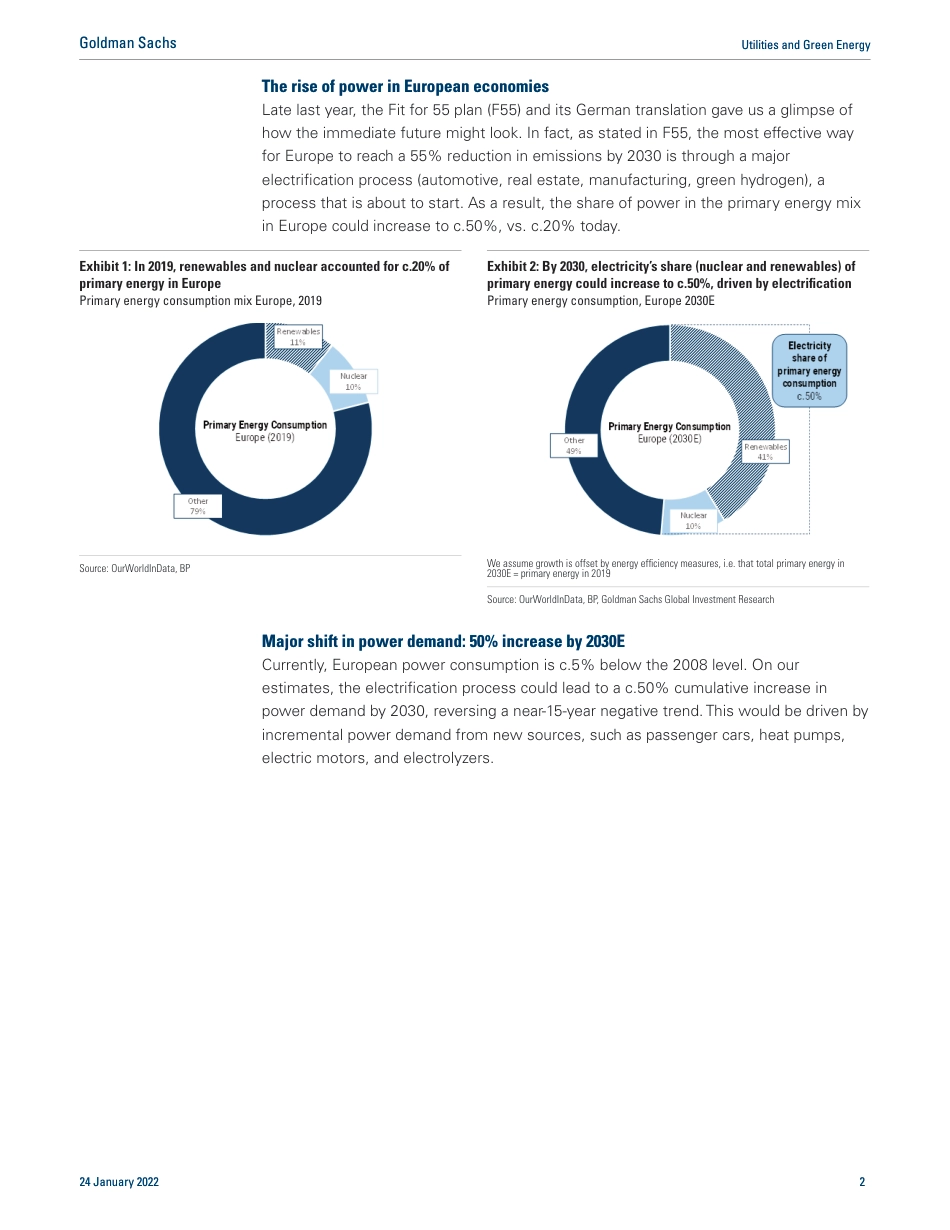

Goldman Sachs does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html. Analysts employed by non-US affiliates are not registered/qualified as research analysts with FINRA in the U.S. The Goldman Sachs Group, Inc.Alberto Gandolfi +39(02)8022-0157 alberto.gandolfi@gs.com Goldman Sachs Bank Europe SE – Milan Branch EQUITY RESEARCH | January 24, 2022 | 5:42PM ESTThe rise of Power in European EconomiesThe rise of power in European economies: While our previous research has fo-cused on the 2050 net zero end game, here we explore a more immediate, more tangible topic; one that is poised to revolutionize European economies and our everyday lives: the urgency of electrification. Late last year, the Fit for 55 plan (F55) and its German translation gave us a glimpse of how the immediate fu-ture might look – and that is, much more electric. In fact, as stated in F55, the most effective way for Europe to reach a 55% reduction in emissions by 2030 is through a major electrification process, a process that is about to start. Major shift in power demand: On our estimates, electrification could lead to a c.50% increase in power demand to 2030, reversing a near 15-year negativetrend. This should be driven by incremental demand from new sources such aspassenger cars, heat pumps, industrial motors, and electrolysers. By 2030, elec-tricity...