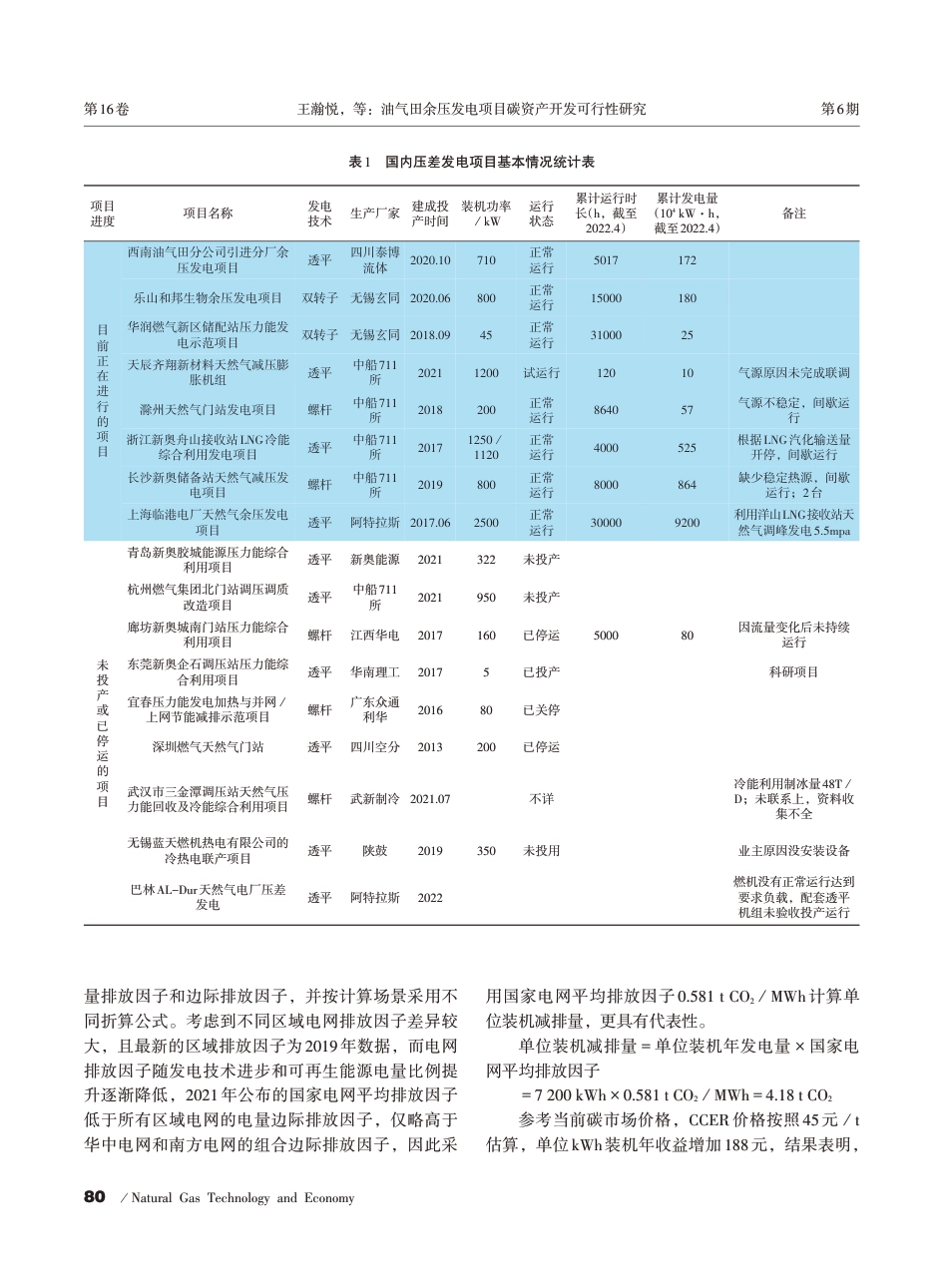

/Natural Gas Technology and EconomyVol.16,No.6Dec.20222022年第16卷·第6期天 然 气 技 术 与 经 济Natural Gas Technology and Economy修订回稿日期:2022-11-03基金项目:中国石油西南油气田公司科技项目“西南油气田碳资产开发研究 —— 课题二:西南油气田碳资产管理及碳交易策略研究”(编号:20220307-07-02)。作者简介:王瀚悦(1994-),女,硕士,从事双碳经济方面的研究工作。E-mail:Why_wanghanyue@petrochina.com.cn。油气田余压发电项目碳资产开发可行性研究Feasibility study on carbon asset development of oil & gasfield's waste pressureFeasibility study on carbon asset development of oil & gasfield's waste pressurepower generation projectspower generation projects王瀚悦1韩翠莲2陈灿1范爱娟2李映霏1(1. 中国石油西南油气田公司天然气经济研究所,四川成都610051;2. 天津排放权交易所有限公司,天津300457)WANG Hanyue1, HAN Cuilian2, CHEN Can1, FAN Aijuan2, and LI Yingfei1(1. Natural Gas Economic Research Institute, PetroChina Southwest Oil & Gasfield Company, Chengdu, Sichuan 610051, China; 2. Tian⁃jin Climate Exchange, Tianjin 300457, China)Abstract: Oil & gas fields are rich in pressure energy resources and have great potential to develop and utilizewaste natural pressure gas for power generation. The current technologies and equipment are still not matureenough, which impacts the large-scale benefit development of waste pressure power generation project, so it isin urgent need to improve the economy of the project through carbon asset development. In order to promotethe healthy and sustainable development of the waste natural gas pressure power generation industry and help oil& gasfield enterprises achieve the "dual carbon" goal as scheduled and the large-scale benefit development ofnew energy business, this paper evaluates the feasibility of the carbon asset development of the oil & gasfield'swa...