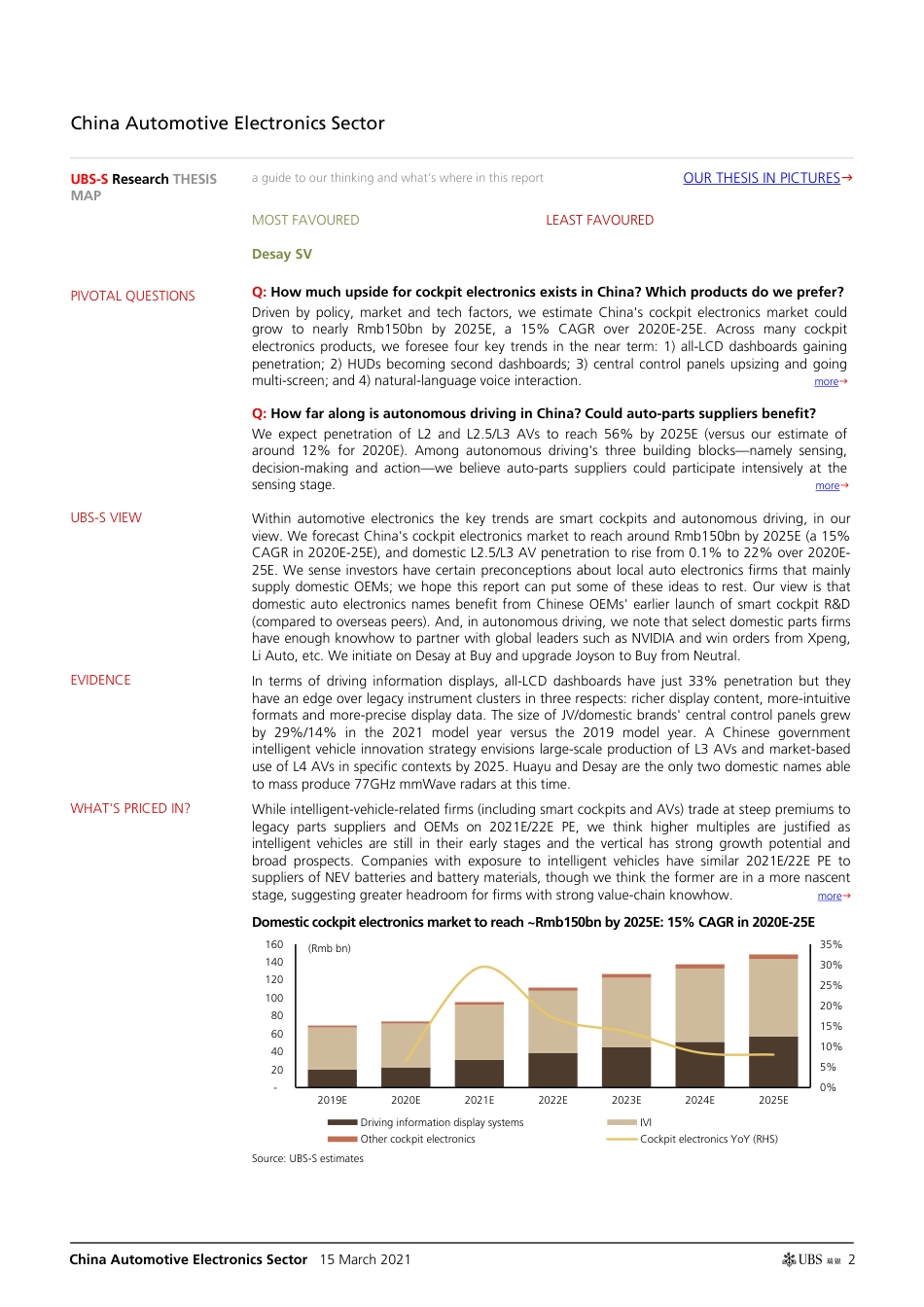

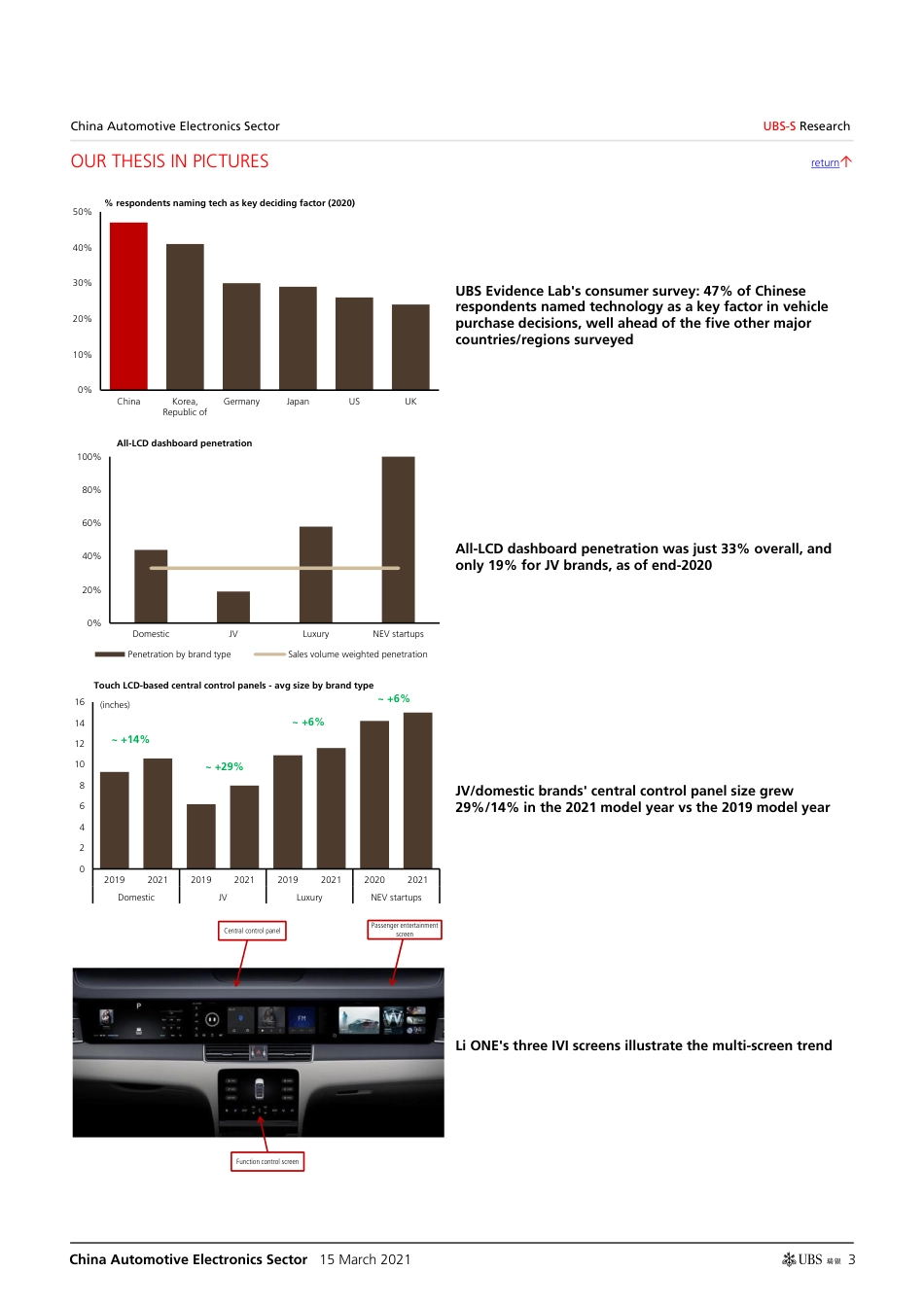

www.ubssecurities.com This report has been prepared by UBS Securities Co. Limited. This is a translation of a Chinese research note published by UBS Securities Co Ltd on 15 March 2021. ANALYST CERTIFICATION AND REQUIRED DISCLOSURES, including information on the Quantitative Research Review published by UBS, begin on page 31. UBS does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. Global Research 15 March 2021 China Automotive Electronics Sector Future of auto electronics: smart cockpits and autonomous driving Potential Rmb150bn market as cockpits go smart; expect L2.5/L3 AVs to kick-off Automotive cockpits are riding the wave of smart tech, propelled by policy, market and technological factors. We estimate these are putting China's cockpit-electronics market on track to reach nearly Rmb150bn by 2025E (a 15% CAGR in 2020E-25E). Last year was a tipping point for autonomous vehicles (AVs) in China as it unveiled an intelligent vehicle innovation strategy and autonomous-driving-level scheme. Looking ahead, we expect autonomous driving to take off in China, with L2 (level 2) and L2.5/L3 AVs reaching 56% penetration by 2025E (versus about 12% in 2020E). For auto-part suppliers, we think smart cockpits and autonomous driving are positives for parts value-added. We initiate coverage of Desay at Buy and upgrade Joyson from Neutral to Buy. Smart cockpits: Four megatrends in place We reviewed the cockpit configurations of 174 models (1,281 variants in...