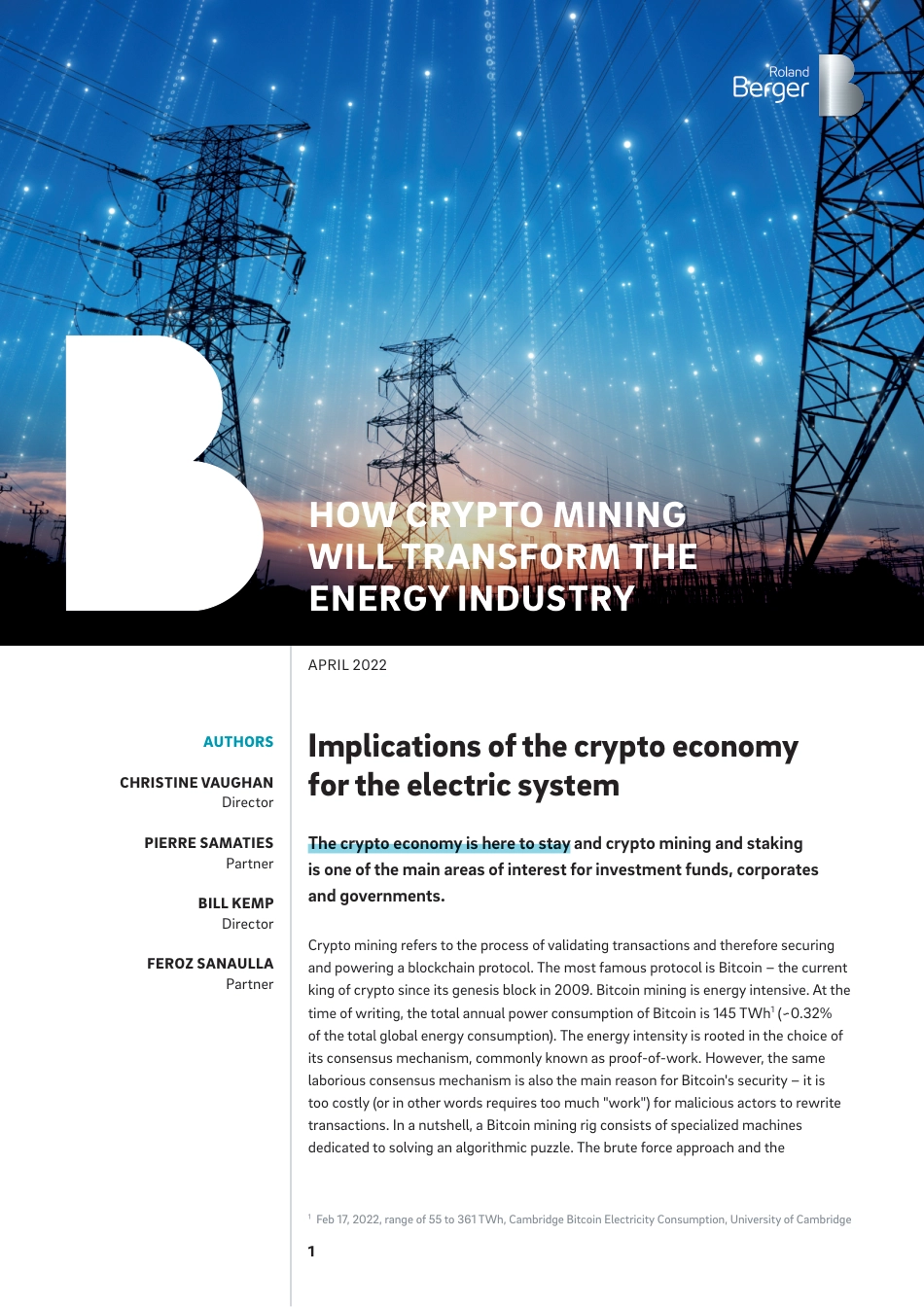

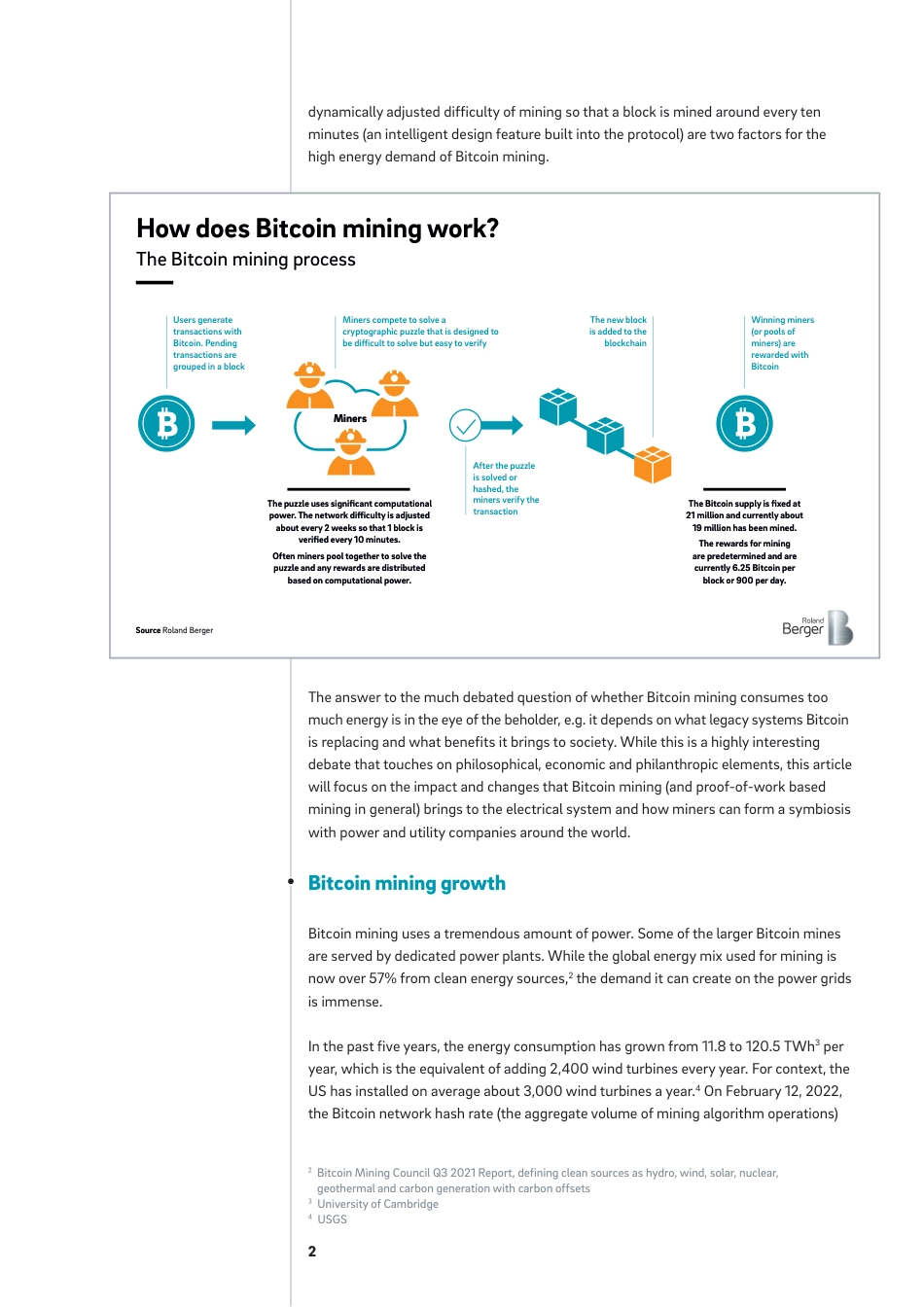

1APRIL 2022AUTHORSCHRISTINE VAUGHANDirectorPIERRE SAMATIESPartnerBILL KEMP DirectorFEROZ SANAULLA Partner1 Feb 17, 2022, range of 55 to 361 TWh, Cambridge Bitcoin Electricity Consumption, University of CambridgeHOW CRYPTO MINING WILL TRANSFORM THE ENERGY INDUSTRYImplications of the crypto economy for the electric system The crypto economy is here to stay and crypto mining and staking is one of the main areas of interest for investment funds, corporates and governments. Crypto mining refers to the process of validating transactions and therefore securing and powering a blockchain protocol. The most famous protocol is Bitcoin – the current king of crypto since its genesis block in 2009. Bitcoin mining is energy intensive. At the time of writing, the total annual power consumption of Bitcoin is 145 TWh1 (~0.32% of the total global energy consumption). The energy intensity is rooted in the choice of its consensus mechanism, commonly known as proof-of-work. However, the same laborious consensus mechanism is also the main reason for Bitcoin's security – it is too costly (or in other words requires too much "work") for malicious actors to rewrite transactions. In a nutshell, a Bitcoin mining rig consists of specialized machines dedicated to solving an algorithmic puzzle. The brute force approach and the 2dynamically adjusted difficulty of mining so that a block is mined around every ten minutes (an intelligent design feature built into the protocol) are two factors for the high energy demand of Bitcoin mining.The answer to the much debated question of whether Bitcoin mining consumes too much energy is in the eye of the beholder, e.g. it depends on what legacy systems Bitcoin is replacing and what benefits ...