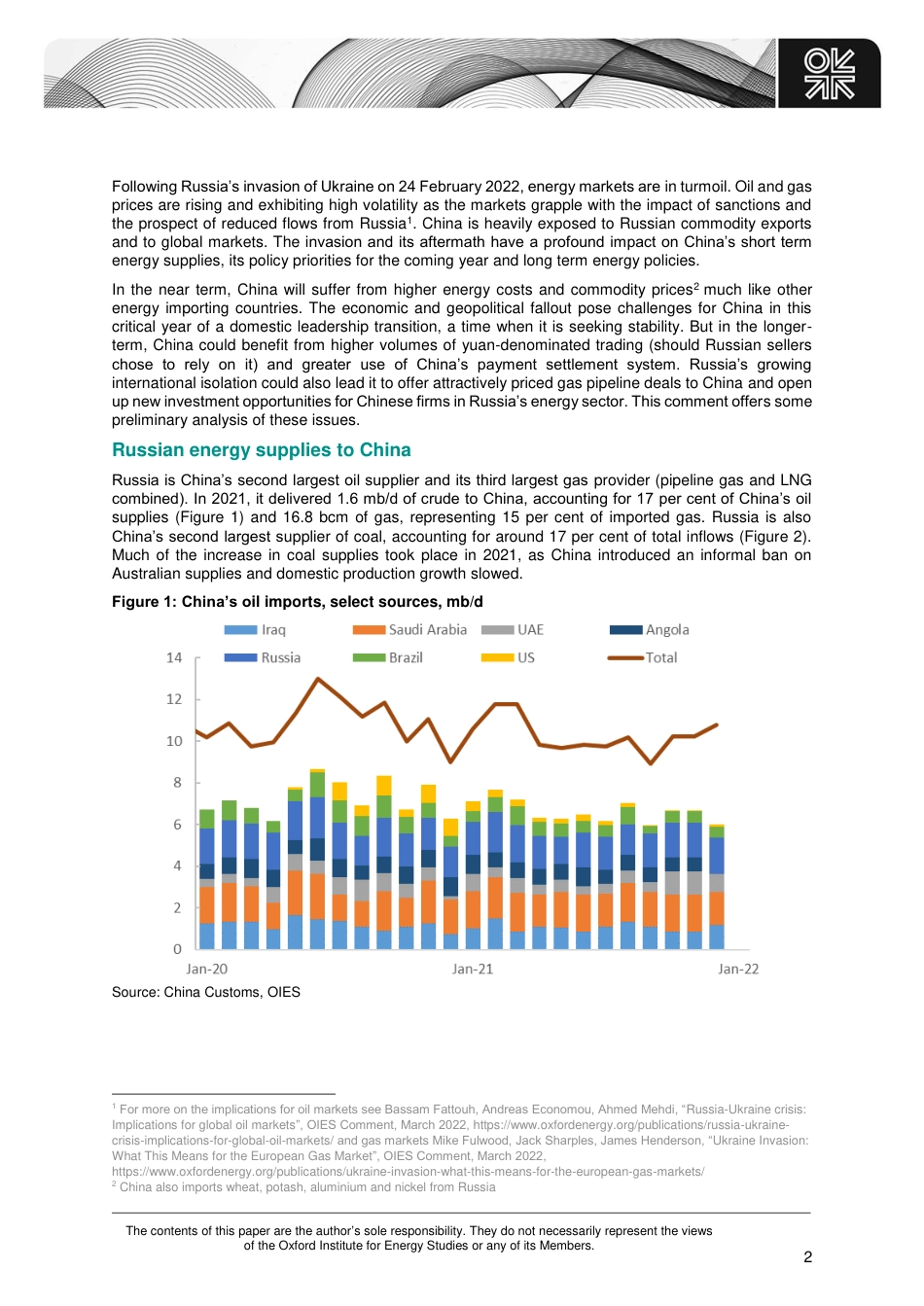

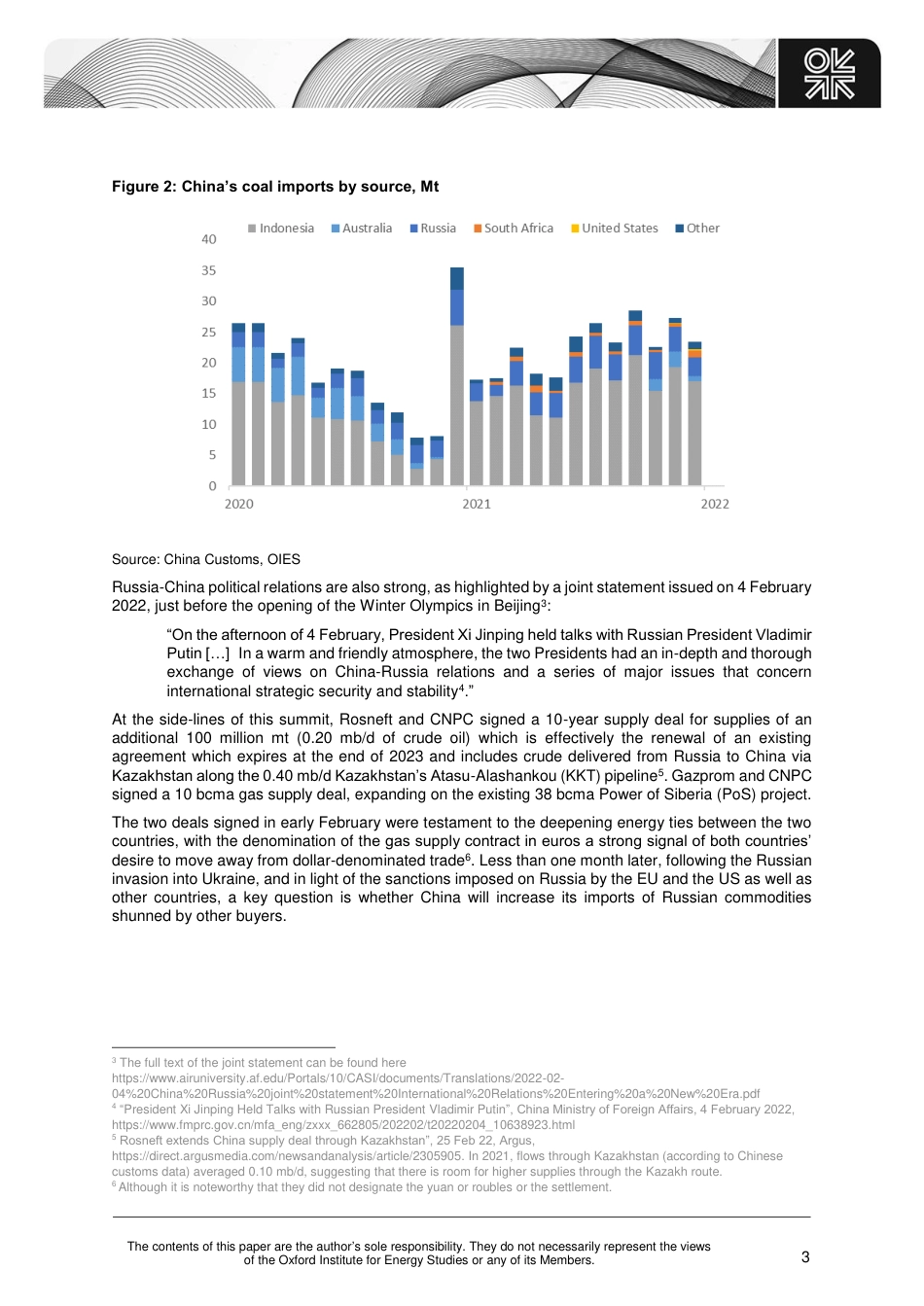

March 2022 OXFORD ENERGY COMMENT Michal Meidan The Russian invasion of Ukraine and China’s energy markets The contents of this paper are the author’s sole responsibility. They do not necessarily represent the views of the Oxford Institute for Energy Studies or any of its Members. 2 Following Russia’s invasion of Ukraine on 24 February 2022, energy markets are in turmoil. Oil and gas prices are rising and exhibiting high volatility as the markets grapple with the impact of sanctions and the prospect of reduced flows from Russia1. China is heavily exposed to Russian commodity exports and to global markets. The invasion and its aftermath have a profound impact on China’s short term energy supplies, its policy priorities for the coming year and long term energy policies. In the near term, China will suffer from higher energy costs and commodity prices2 much like other energy importing countries. The economic and geopolitical fallout pose challenges for China in this critical year of a domestic leadership transition, a time when it is seeking stability. But in the longer-term, China could benefit from higher volumes of yuan-denominated trading (should Russian sellers chose to rely on it) and greater use of China’s payment settlement system. Russia’s growing international isolation could also lead it to offer attractively priced gas pipeline deals to China and open up new investment opportunities for Chinese firms in Russia’s energy sector. This comment offers some preliminary analysis of these issues. Russian energy supplies to China Russia is China’s second largest oil supplier and its third largest gas provider (pipeline gas and LNG combined). In 2021, it delivered 1.6 mb/d of crude to China,...