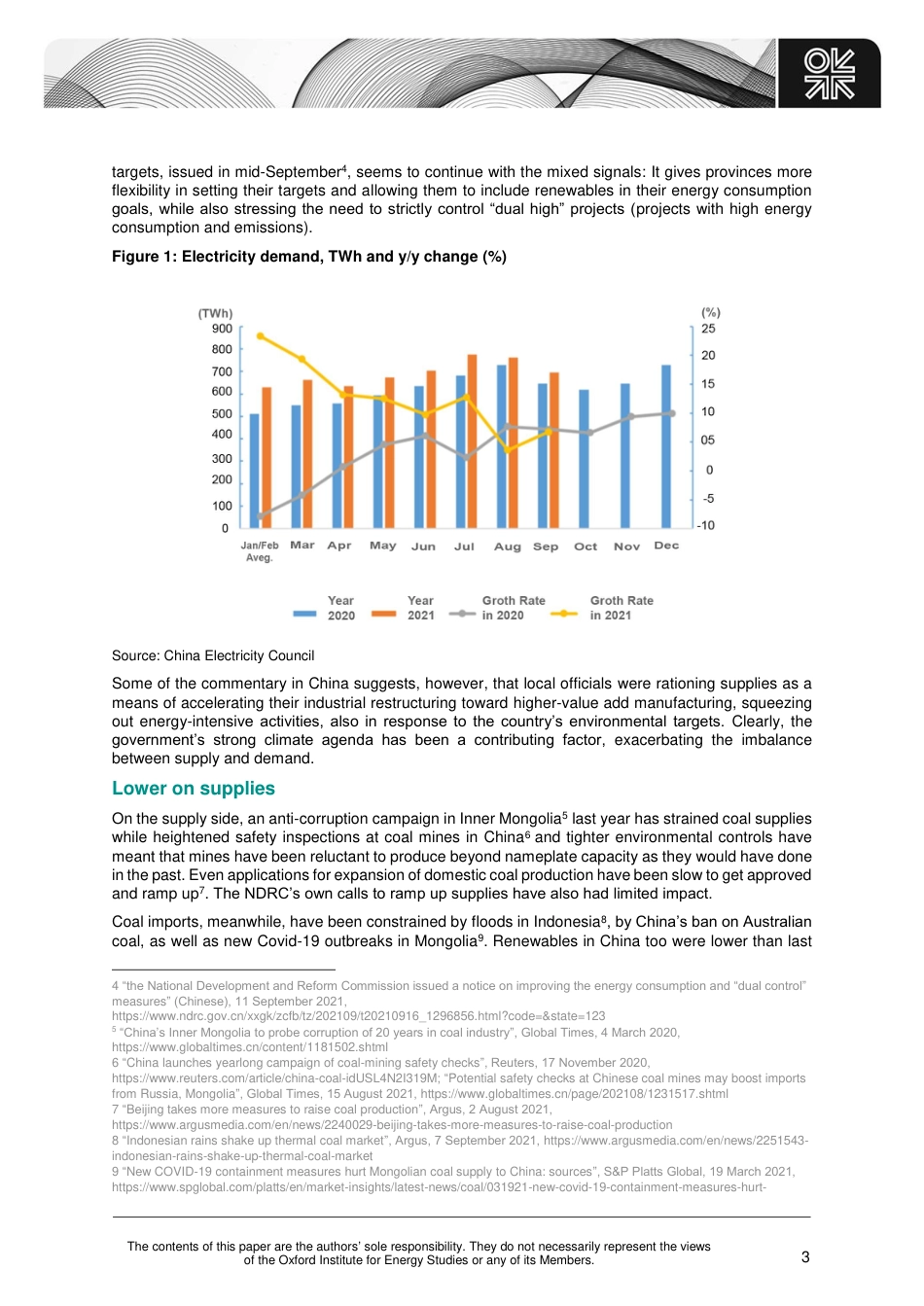

November 2021 China’s power crisis: Long-term goals meet short-term realities OIES ENERGY COMMENT Michal Meidan, Senior Research Fellow, OIES Philip Andrews-Speed, Senior Research Fellow, OIES The contents of this paper are the authors’ sole responsibility. They do not necessarily represent the views of the Oxford Institute for Energy Studies or any of its Members. 2 Power outages in China were widely expected this year after the country had experienced some rationing in December 2020 and then again over the summer. In early September, a handful of localities were seeing shortages but by October, just in time for the national holiday, over 20 Chinese provinces were curbing or rationing power supplies for end users. Large industrial users have seen their power disconnected for long stretches while others have had to limit their use. In China’s North-eastern provinces, the power shortages have also led to cuts in residential use, a rare occurrence for a country aiming to prioritise household energy supply. The reasons for these outages are widely covered but also highly debated: is it high coal prices or the “dual control” policies1—the cap on provincial energy consumption and the energy intensity reduction target set by the central government? While there are a number of factors contributing to the power outages, the mixed signals from the central government, combined with pricing distortions in China’s power market are at the heart of this crisis. A strong rebound in export-oriented manufacturing activity led to high industrial demand and therefore rising electricity consumption. But the growing emphasis on limiting energy use and reducing energy intensity has sent local officials mixed signals....