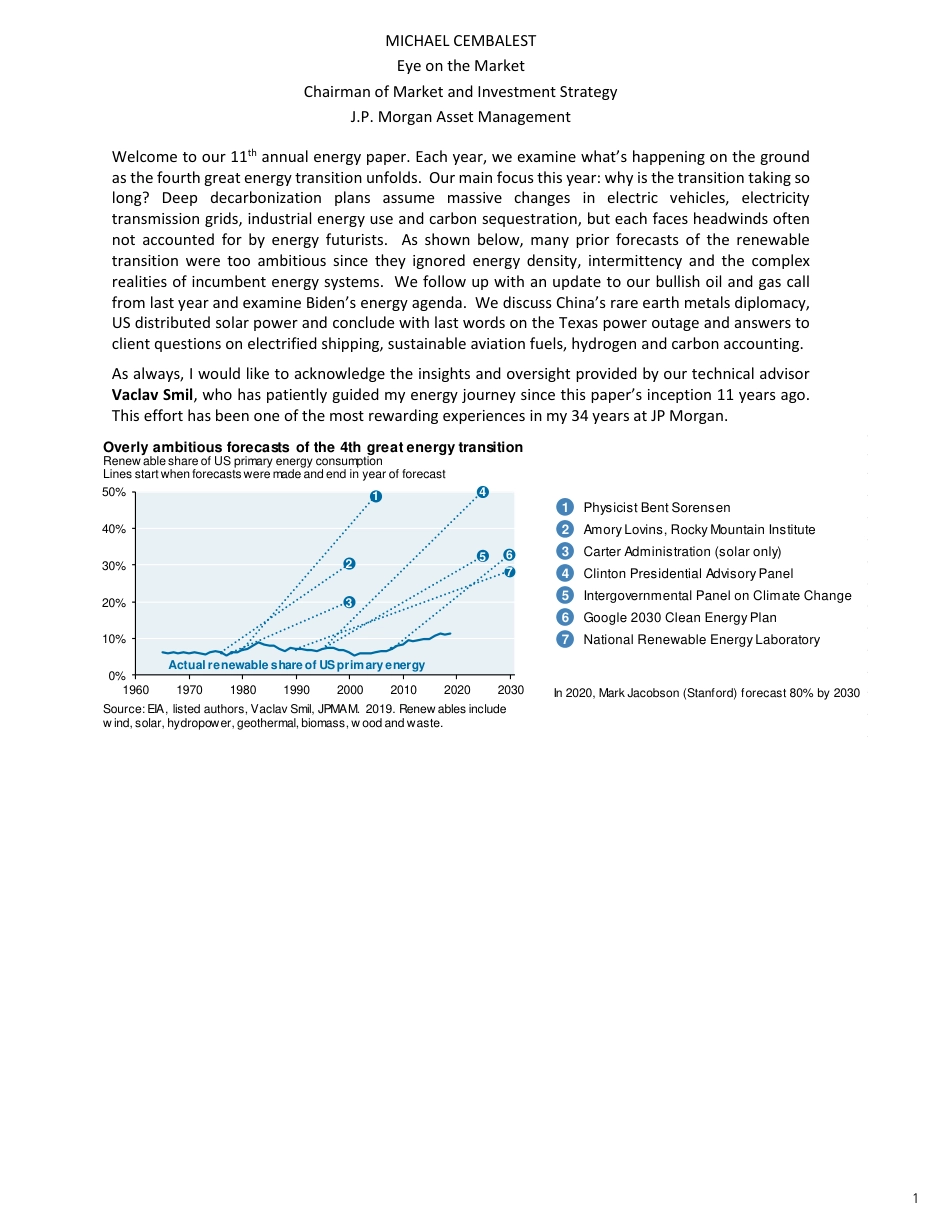

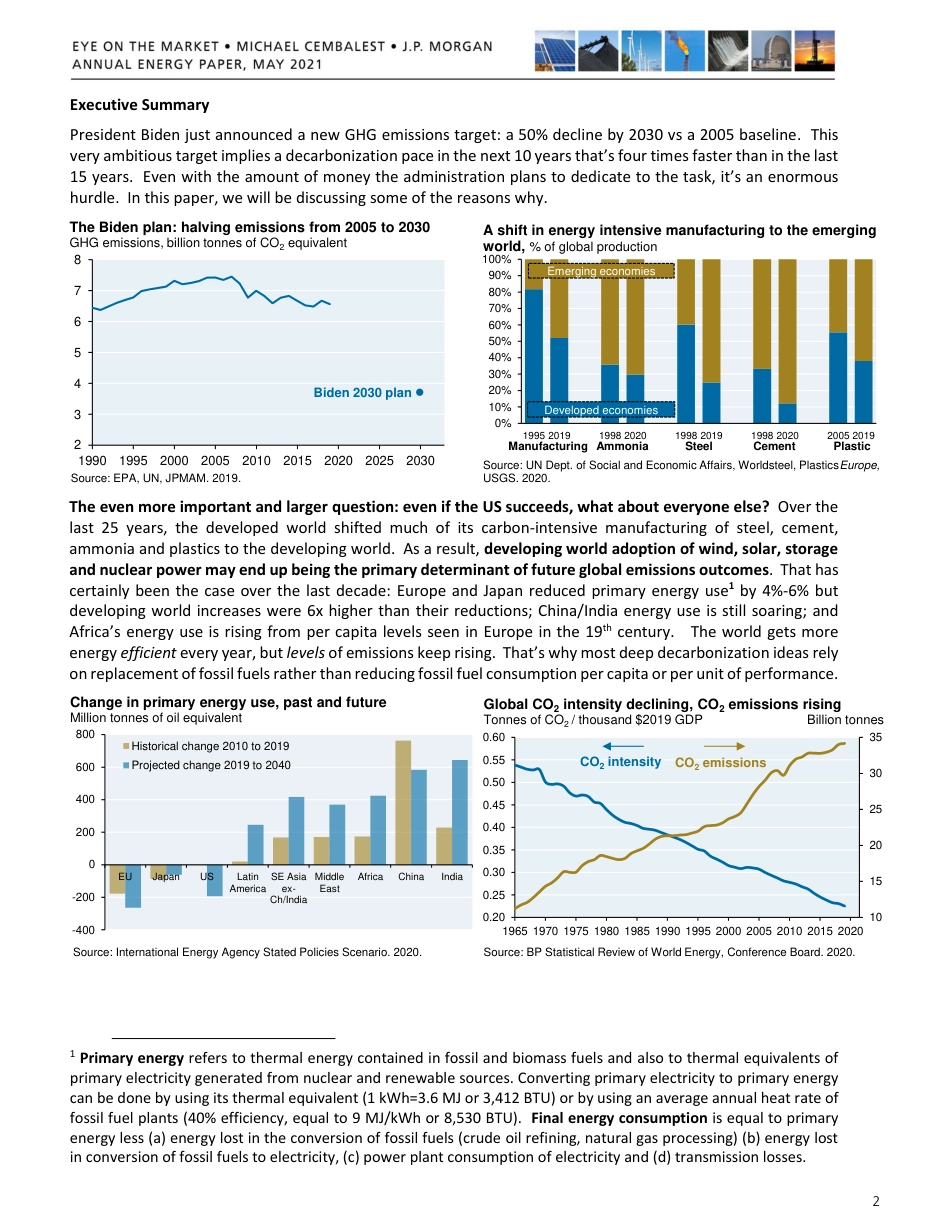

EYE ON THE MARKET 2021 Annual Energy Paper MICHAEL CEMBALEST | JP MORGAN ASSET AND WEALTH MANAGEMENT Future shock. Absent decarbonization shock treatment, humans will be wedded to petroleum and other fossil fuels for longer than they would like. Wind and solar power reach new heights every year but still represent just 5% of global primary energy consumption. In this year’s energy paper, we review why decarbonization is taking so long: transmission obstacles, industrial energy use, the gargantuan mineral and pipeline demands of sequestration and the slow motion EV revolution. Other topics include our oil & gas views, President Biden’s energy agenda, China, the Texas power outage and client questions on electrified shipping, sustainable aviation fuels, low energy nuclear power, hydrogen and carbon accounting.1 MICHAEL CEMBALEST Eye on the Market Chairman of Market and Investment Strategy J.P. Morgan Asset Management Welcome to our 11th annual energy paper. Each year, we examine what’s happening on the ground as the fourth great energy transition unfolds. Our main focus this year: why is the transition taking so long? Deep decarbonization plans assume massive changes in electric vehicles, electricity transmission grids, industrial energy use and carbon sequestration, but each faces headwinds often not accounted for by energy futurists. As shown below, many prior forecasts of the renewable transition were too ambitious since they ignored energy density, intermittency and the complex realities of incumbent energy systems. We follow up with an update to our bullish oil and gas call from last year and examine Biden’s energy agenda. We discuss China’s rare earth metals diplomacy, US distributed solar power ...