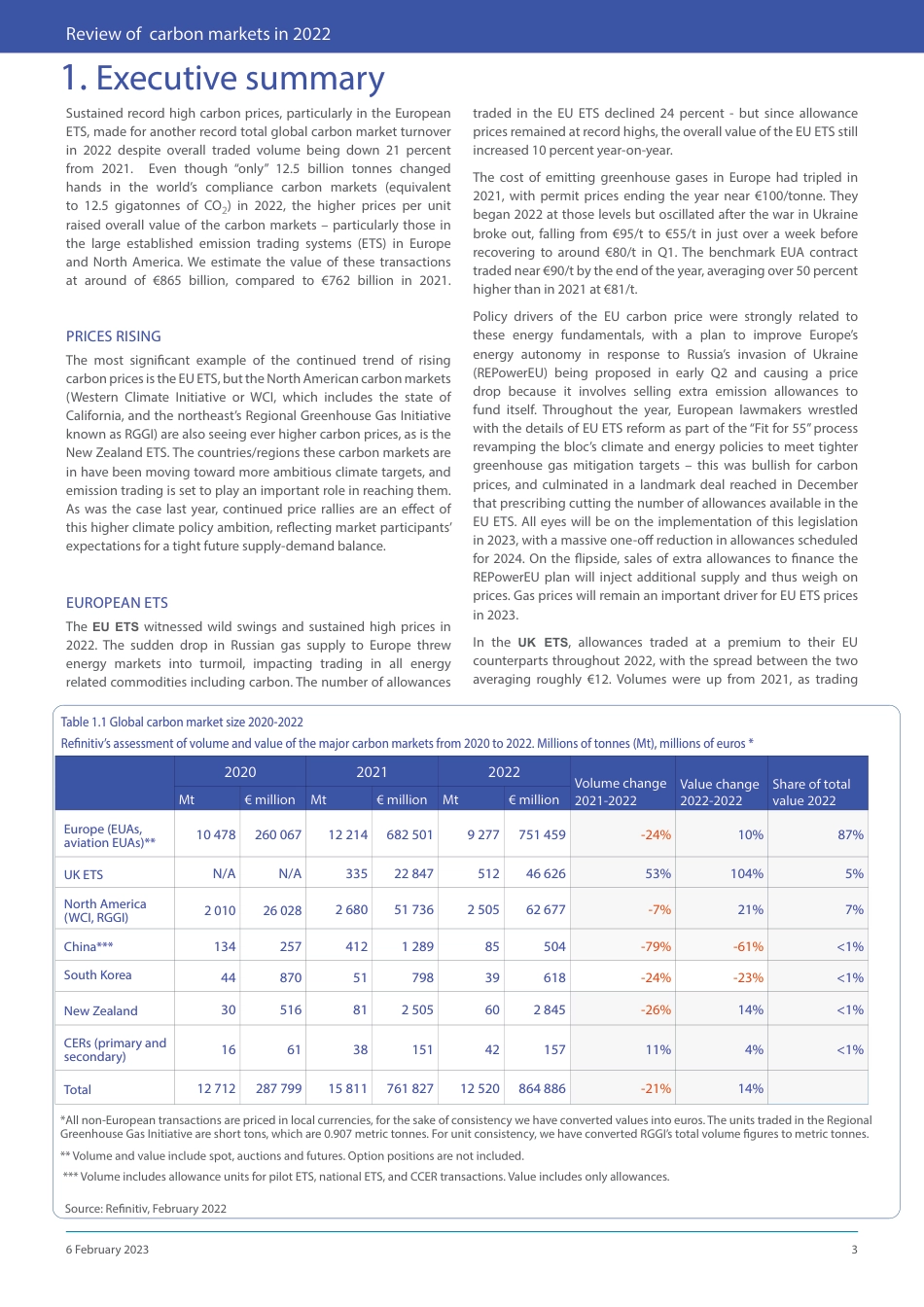

COVER TITLE (LIGHT 55/55)Sub title – here (title level 2 white, 35/35)CARBON MARKET YEAR IN REVIEW 2022• The cost of emitting greenhouse gases was higher than ever before in 2022 in themain emission trading systems (ETS). EU emission allowances averaged above €80/t – 50 percent higher than in 2021. UK allowances fetched an even higher price, andthose in both North American markets (WCI and RGGI) averaged higher than any previous year as well. • Even though 20 percent fewer transactions took place overall than in the previous year, prices in the world’s major carbon markets were so much higher in 2022 than ever before that the year set yet another record for turnover at €865 billion. That represents a 14 percent increase from the €762 bn realized in 2021.• In Europe, home to the largest carbon market by traded volume, the volatile butcontinuously high permit prices were strongly influenced by effects of the war inUkraine on energy prices overall, particularly high gas prices. Certainty that the EU’sincreased climate change mitigation ambition will lead to a tighter market balancegoing forward was bullish for prices.• China’s national ETS saw limited trading, as development of the program took abackseat to other policy priorities and relatively few permits changed hands without the government having released a new allocation plan or having relaunched itsdomestic offset program.• While South Korean permits traded at lower prices, units for compliance to NewZealand’s ETS became much more expensive. Japan launched a new program forcarbon trading featuring prices comparable to those in power-sector-only ETS suchas RGGI and China.6 February 2023CONTENTS Executive summaryEU UK North AmericaChinaSou...