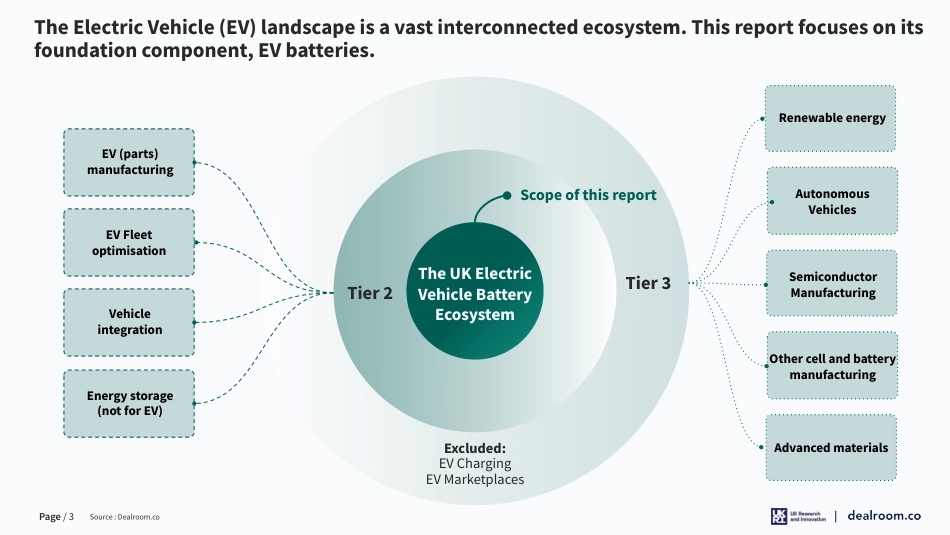

Electric Vehicle Battery Tech in the UK2023January 2023Page / 2 Dealroom.co is the foremost data provider on startup, early-stage and growth company ecosystems in Europe and around the globe. Founded in Amsterdam in 2013, we now work with many of the world's most prominent investors, entrepreneurs and government organizations to provide transparency, analysis and insights on venture capital activity.Global startup & venture capital intelligence platform. UK Research and Innovation convenes, catalyses and invests in close collaboration with others to build a thriving, inclusive research and innovation system that connects discovery to prosperity and public good.The Faraday Battery Challenge is delivered by Innovate UK for UK Research and Innovation on behalf of the UK government. With an investment of £541 million between 2017 and 2025, the challenge aims to make the UK a science superpower for batteries. By supporting the UKʼs world-class battery facilities along with growing innovative businesses that are developing the battery supply chain for our future prosperity.This is delivered through three partners; the Faraday Institution, Innovate UK, and UK Battery Industrialisation Centre, and sitting as part of a wider and interconnected support programme for battery development and commercialisation.Building a thriving, inclusive research and innovation systemPage / 3 The UK Electric Vehicle BatteryEcosystemThe Electric Vehicle (EV) landscape is a vast interconnected ecosystem. This report focuses on its foundation component, EV batteries. Vehicle integrationAutonomous VehiclesExcluded:EV ChargingEV MarketplacesRenewable energyAdvanced materialsEV (parts) manufacturing SemiconductorManufacturingEV Fleet optimisation Other cell and...