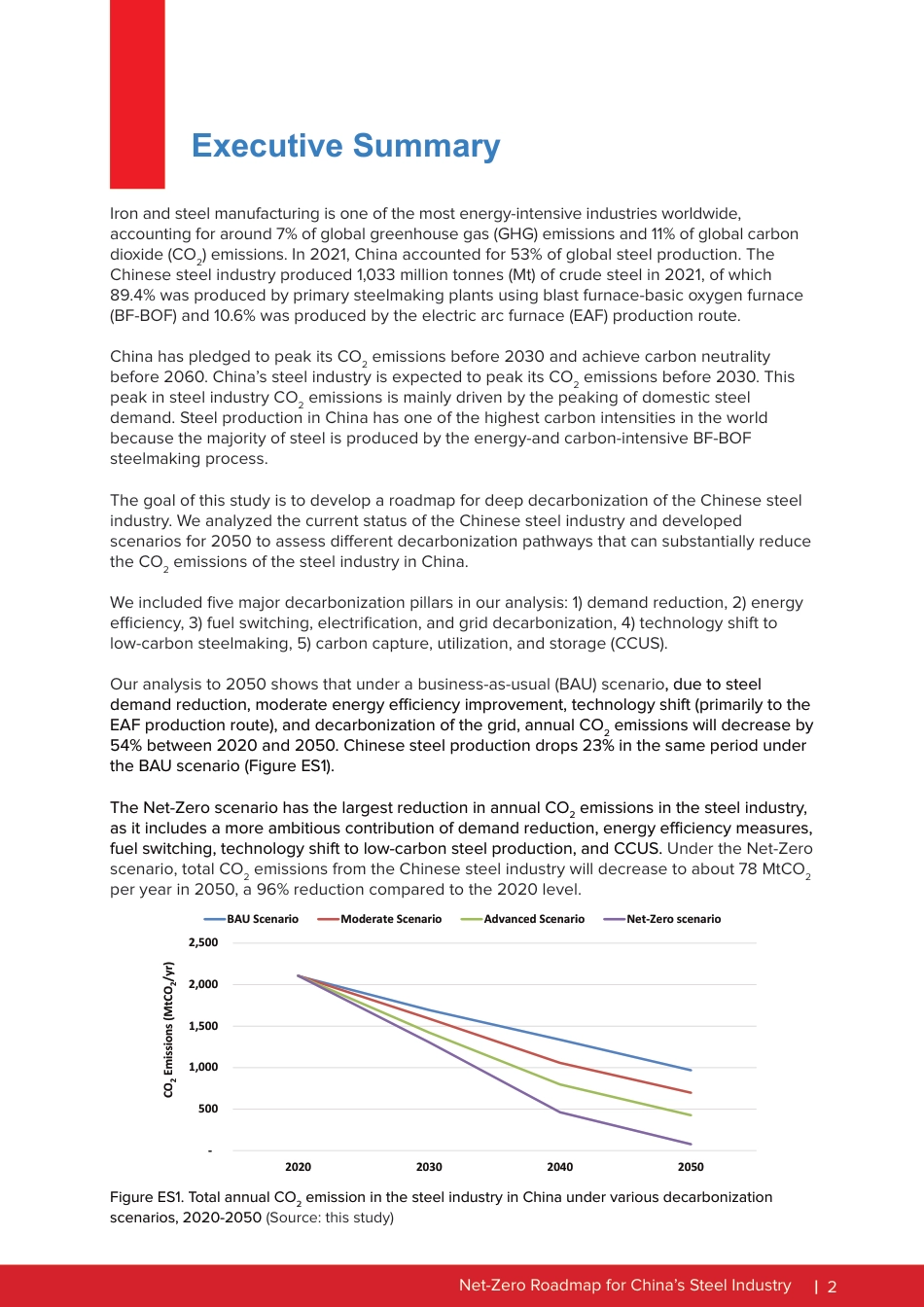

Ali Hasanbeigi 1, Hongyou Lu 2, Nan Zhou 21 Global Efficiency Intelligence2 Lawrence Berkeley National LaboratoryNet-Zero Roadmap for China’s Steel Industry March 2023 1Net-Zero Roadmap for China’s Steel IndustryThe author would like to thank Dr. Yang Fuqiang, Dr. Chen Jiong, and Zhu Hong of Peking University, Dr. Chen Yu of the China Steel Development Research Institute, Dr. Zhang Chunxia of the Chinese Society of Metals, Dr. Li Bing of the Metallurgical Planning Institute, Dr. Zhang Qi of the Northeastern University, and Dr. Li Xiuping of the China Iron and Steel Research Institute, Chan Yang of European Climate Foundation, Lynn Price of Lawrence Berkeley National Laboratory, Chris Bataille of Columbia University, and Navdeep Bhadbhade of Global Efficiency Intelligence for their valuable input on this study and/or their insightful comments on the earlier version of this document. AcknowledgementsLawrence Berkeley National Laboratory (LBNL) and Global Efficiency Intelligence, LLC (GEI) have provided the information in this publication for informational purposes only. Although great care has been taken to maintain the accuracy of the information collected and presented, GEI and LBNL do not make any express or implied warranty concerning such information and does not assume any responsibility for consequences that may arise from the use of the material. Any estimates contained in the publication reflect our current analyses and expectations based on available data and information. Any reference to a specific commercial product, process, or service by trade name, trademark, manufacturer, or otherwise does not constitute or imply an endorsement, recommendation, or favoring by GEI or LBNL.This manuscript has been ...