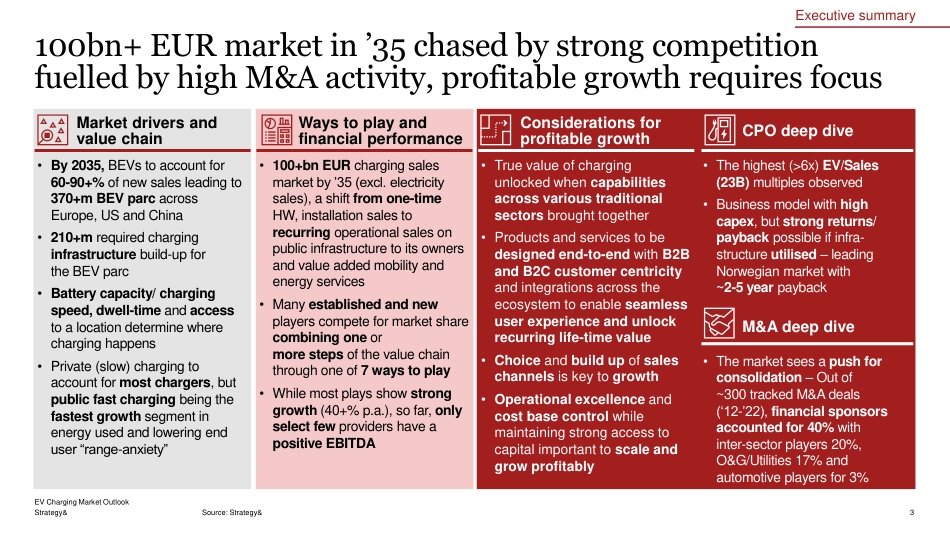

EV Charging Market OutlookA quest for profitable growth in the fast growing, yet highly competitive, EV charging market Strategy&EV Charging Market Outlook2Global viewpoint focused on key regions (Europe, US and China) developed by Strategy& and PwC covering:✓Underlying market drivers, value chain definition and key revenue pools ✓Ways to play to realize the revenue pools, their 2035 potential and current financial performance per way to play✓Considerations for profitable growth going forward per way to playDeep dives:Public fast charging operator and owner way to playDeal making activity by deal type, way to play and acquirerOur insights are based on:✓Interviews with industry executives and analysts and ✓Insights from work by PwC Autofacts® and Data Insights teams ✓Customer survey with a focus on the US, EU+ Norway and China (n = 3,000+)EV Charging Market OutlookFocus areas and our approachStrategy&100bn+ EUR market in ’35 chased by strong competition fuelled by high M&A activity, profitable growth requires focusSource: Strategy&EV Charging Market Outlook3• By 2035, BEVs to account for 60-90+% of new sales leading to 370+m BEV parc across Europe, US and China• 210+m required charging infrastructure build-up for the BEV parc• Battery capacity/ charging speed, dwell-time and accessto a location determine where charging happens • Private (slow) charging to account for most chargers, but public fast charging being the fastest growth segment in energy used and lowering end user “range-anxiety”• 100+bn EUR charging sales market by ’35 (excl. electricity sales), a shift from one-time HW, installation sales to recurring operational sales on public infrastructure to its owners and value added mobility and...