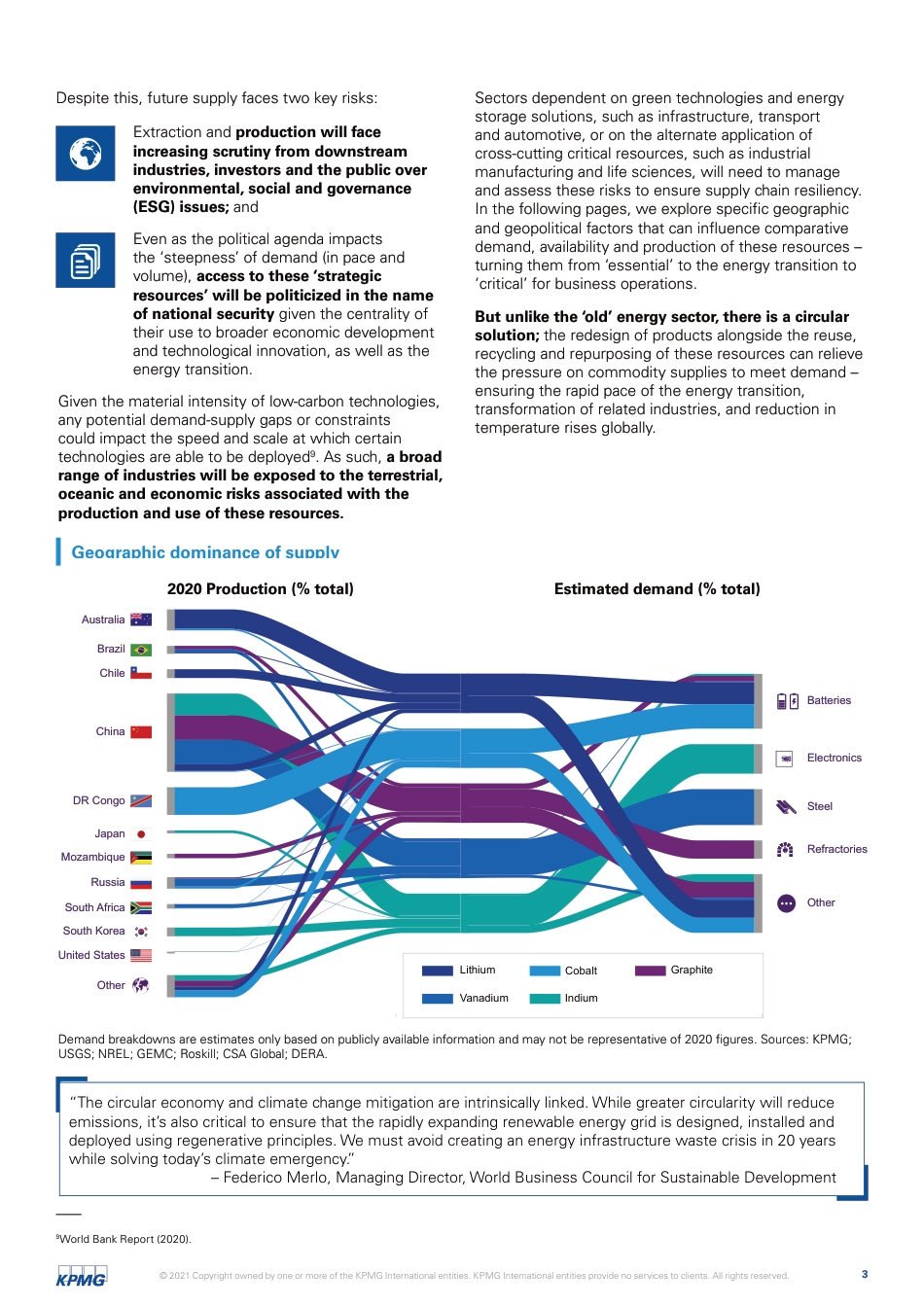

—Resourcing the Energy Transition: Making the World Go Round Geographical and geopolitical constraints to the supply of resources critical to the energy transition call for a circular economy solution. March 2021 KPMG International—home.kpmg/IMPACT 2 © 2021 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved. -From OPEC to ‘OMEC’1: the new global energy ecosystem An energy transition is occurring that relies upon new sources of power and will drastically redraw the global energy and minerals market – with economic, environmental and geopolitical consequences. Energy is, once again, at the center of the new economy and geopolitical landscape. With the past five years the warmest on record2, countries are scrambling to meet the ambitious targets established at the Paris Climate Agreement in 2015. The widely accepted target is to limit the increase in global temperatures to 1.5 degrees or 2 degrees at most; nine of the top 10 global economies today have either announced net zero plans or committed to doing so. Global firms and financial institutions are setting their own similarly ambitious goals - KPMG among many others, has pledged to become a net-zero carbon organization within the next decade. Meeting these targets means decarbonizing3 the energy sector – quickly. The necessary reduction in greenhouse gas emissions (GHGs) implied by these targets can only be met through the transition of the global economy from one based on fossil fuels, to one largely powered by renewable and low or zero-carbon production and consumption of energy. Net zero agendas adopted by energy-intensive economies will necessaril...