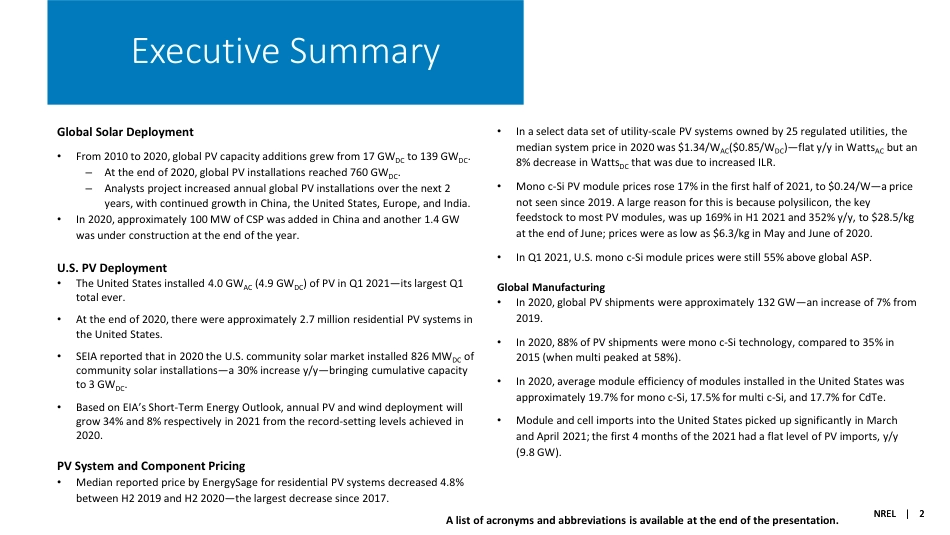

H1 2021 Solar Industry UpdateDavid FeldmanKevin WuRobert MargolisJune 22, 2021NREL/PR-7A40-80427NREL | 2NREL | 2Global Solar Deployment•From 2010 to 2020, global PV capacity additions grew from 17 GWDC to 139 GWDC.–At the end of 2020, global PV installations reached 760 GWDC.–Analysts project increased annual global PV installations over the next 2 years, with continued growth in China, the United States, Europe, and India.•In 2020, approximately 100 MW of CSP was added in China and another 1.4 GW was under construction at the end of the year.U.S. PV Deployment•The United States installed 4.0 GWAC (4.9 GWDC) of PV in Q1 2021—its largest Q1 total ever.•At the end of 2020, there were approximately 2.7 million residential PV systems in the United States. •SEIA reported that in 2020 the U.S. community solar market installed 826 MWDC of community solar installations—a 30% increase y/y—bringing cumulative capacity to 3 GWDC.•Based on EIA’s Short-Term Energy Outlook, annual PV and wind deployment will grow 34% and 8% respectively in 2021 from the record-setting levels achieved in 2020.PV System and Component Pricing•Median reported price by EnergySage for residential PV systems decreased 4.8% between H2 2019 and H2 2020—the largest decrease since 2017.•In a select data set of utility-scale PV systems owned by 25 regulated utilities, the median system price in 2020 was $1.34/WAC($0.85/WDC)—flat y/y in WattsAC but an 8% decrease in WattsDC that was due to increased ILR.•Mono c-Si PV module prices rose 17% in the first half of 2021, to $0.24/W—a price not seen since 2019. A large reason for this is because polysilicon, the key feedstock to most PV modules, was up 169% in H1 2021 and 352% y...