produce green hydrogen due to the higher power

densities, higher capacities and quicker start-up times

supported by PEM electrolysis compared to other

electrolysis methods. PEM’s share of technology is

increasing.

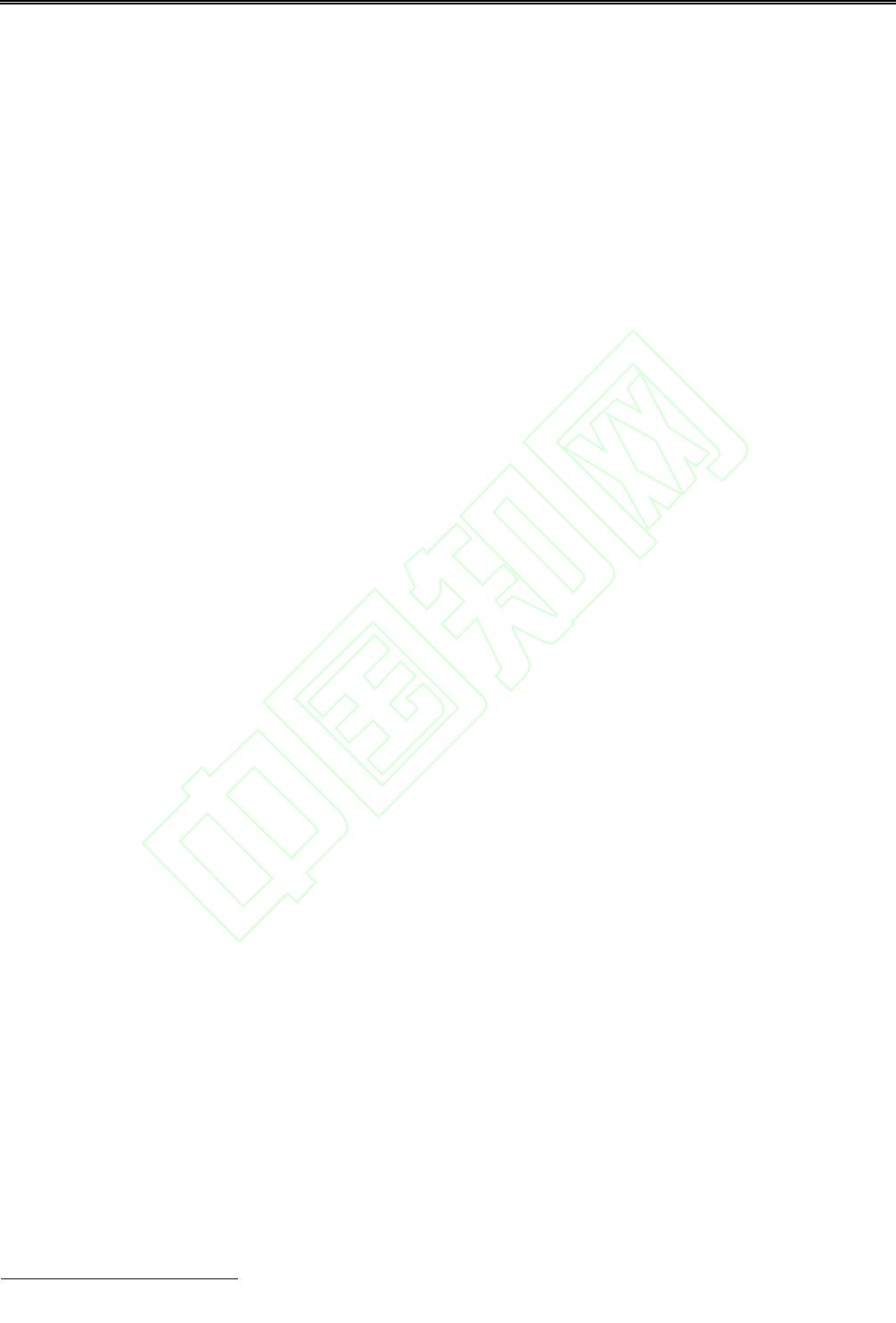

Fig.1 Diagram showing the basic principles of PEM

electrolysis: Water molecules are split into hydrogen and

oxygen using electrical energy

1 How much iridium does PEM electrolysis

use today?

At present, every GW of PEM electrolysis

capacity installed reportedly uses about 1.5 tonnes of

iridium, according to Heraeus, a leading provider of

precious metals services and products[1]. At these

loadings, we estimate PEM electrolysis accounts for

several hundred kg of iridium demand per year today.

This demand can easily be met from existing

production. At present, around seven tonnes of iridium

is mined each year, the vast majority of which comes

from South Africa (see Fig.2).

Fig.2 Mined output of iridium from South Africa

(Source: SA Govt statistics)

2 How much could iridium demand from

this sector grow over the next decade?

Future iridium demand from this sector will

depend on two factors; the demand for PEM

electrolysers and the loading of iridium that they need.

There is growing interest from governments in

hydrogen and fuel cell technologies. The uptake of

hydrogen technology is primarily being driven by

government policies, many of which are predicated on

the availability of carbon-neutral hydrogen. The drivers

for promoting hydrogen and fuel cells in energy policy

relate to improving the reliability, efficiency and

security of energy systems, reducing environmental

impacts, and developing new low-carbon industries,

with their associated employment opportunities and

skills.

There are a variety of government targets for new

PEM electrolysis capacity. A cumulative installation of

35 GW of PEM electrolysis capacity worldwide by

2030 would be a reasonable estimate relative to

government targets, and is in line with the IEEFA’s

estimates[2], published in August 2020.

There is a heavy focus on thrifting iridium

loadings on PEM electrolysers to a small fraction of

today’s levels. There is widespread consensus that this

will occur, and we are confident loadings in the future

will be far lower than they are today. How far could

they fall? Heraeus suggests loadings could fall up to 90%

from current amounts i.e. as low as 100 kg/GW.

Another estimate by E4tech, a consultancy, suggests

low-case iridium loadings could be as little as 50

kg/GW.

On the basis that PGM loadings will fall heavily

from today’s level, we think it would be reasonable to

expect annual iridium demand from PEM electrolysis

to be somewhere up to 1 tonne per year in 2030. Again,

this could easily be met from mined iridium production

of around 7 tonnes per year.

VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP