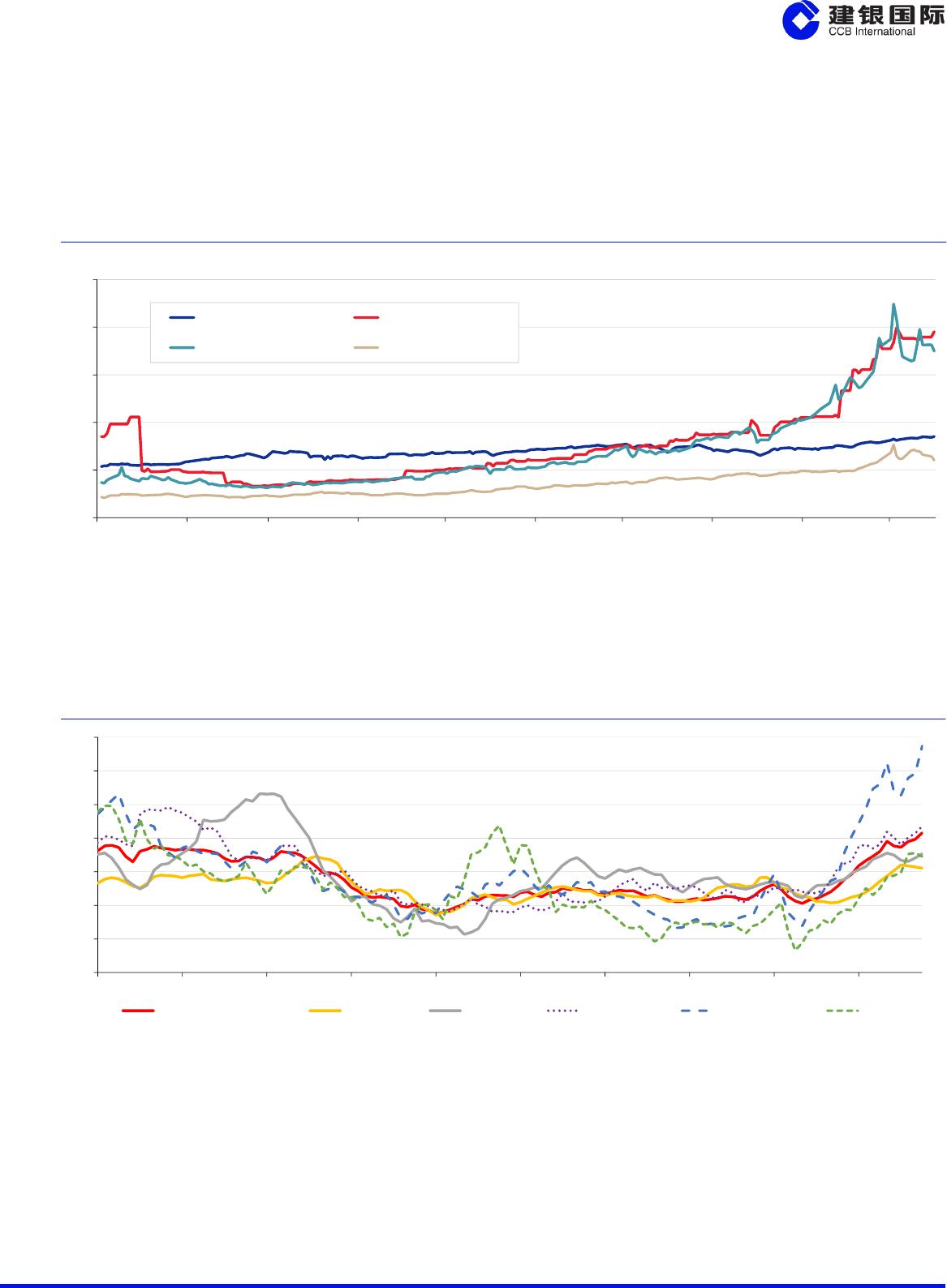

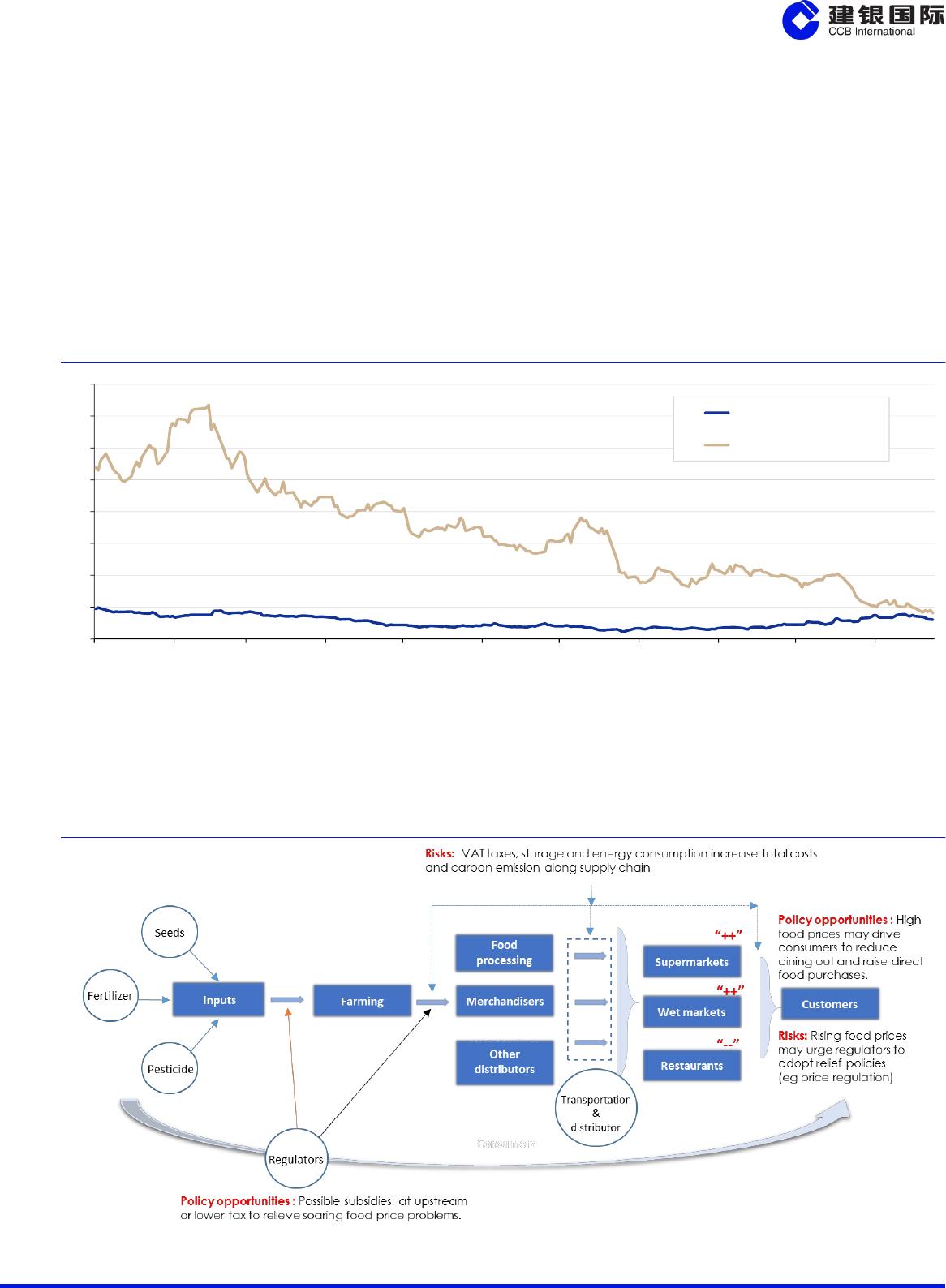

CCBISECURITIES1ESG简报2021年12月3日关于氢能在本期ESG报告中,我们将讨论如何利用ESG投资来降低通胀风险,并深入探讨氢能领域的投资机会。氢虽然是最常见的化学元素,但它与其他元素以及与化合物的反应性都很强,因此很少自然存在。高反应性恰恰使氢成为一种很好的燃料,无论是与氧气燃烧还是在电化学反应中结合产生电能。氢资源丰富,零排放,而且非常轻。它可以储存来自可再生能源发电的过剩能量,并从改装的燃煤发电站输送电力,取代煤炭在钢铁、水泥以及其他高热工业中的应用;它可以注入天然气管网;它可以为车辆、轮船和飞机提供动力。多功能性意味着氢能的潜在市场是巨大的。然而,氢气也有缺点。到目前为止,由于其生产、运输和储存成本很高,几乎没有在上述任何工业/生活应用中使用。制造氢气需要很大的能量,储存氢气需要更多的能量。氢气不是一种能源,它是一种能量载体,很难携带。虽然在燃料电池载具等某些工业/生活应用中,氢气可能从来都不是最好的解决方案,但随着时间的推移,技术和规模经济将大幅降低制造氢气的成本。成功开发和应用氢气技术的公司,以及能够利用氢产生规模性经济效益的公司,未来具备了指数级增长的前景。例如,绿色氢产能预计未来十年以每年至少50%的增速,以及在之后的二十年里以每年15%的增长。氢的投资案例很具有吸引力,同时,氢气市场是充满活力的。颠覆性技术正在到来。当它们到来时,它们将颠覆某些技术、应用,甚至可能颠覆整个国家的绿色能源战略。在这份报告中,我们研究氢的潜在市场,以大概地确定氢所涉及不同技术的规模,以及其未来使用的规模。有了这一视野,我们开始研究并发掘投资机会为以下五个主要的氢气市场相关领域:1)氢生产;2)氢生产设备;3)氢基础设施和基础设施设备(运输、储存和分散);4)燃料电池和燃料电池驱动链;以及5)海运和空运。报告中,我们提供了已经参与每个细分市场的中国公司的例子。一些公司正在跨多个细分市场运营。每个细分市场中表现最好的公司不一定是市场最大的参与者。对于一些大型公司来说,氢在未来几年内只占他们收入的一小部分。那些氢为主营业务的小公司将迎来最佳的表现机会。表现最好的公司也不一定是属于那些增长最快的行业,如电解槽,将吸引大量的行业进入者。我们认为,表现最好的公司将是那些在生产成本最低的地区并享受早期规模优势的绿色氢生产商;拥有技术壁垒的参与者,以及具有规模优势的利基领域(nicheareas)的参与者。技术壁垒的例子包括燃料电池、海运应用和低温冷却。规模优势的例子将包括电解槽和其他上游设备的专用部件制造商。聚合物和陶瓷膜的专业制造商将比电解槽制造商拥有更好的规模经济。这同样适用于阀门、泵、通风口、分离器和储罐的制造商,这些产品必须经过改造,以应对小的氢分子。中国氢气需求和电解槽产能预计增长来源:《中国氢燃料与电池产业发展白皮书(2020)》氢需求(百万吨)产生电解比例(%)电解(百万吨)电解槽容量(吉瓦)202033.42<10.10.7202535.531.078.1203037.15103.72382050977067.9608206013080104930MarkJolley全球策略师(852)39118255jolleymark@ccbintl.com苏国坚博士研究部主管(852)39118238peterso@ccbintl.com苏卡(852)39118242christso@ccbintl.com姚笛柳(852)39118269yaodiliu@ccbintl.comESGBulletin3December2021CCBISECURITIES2HedgeagainstInflationwithhighESGscorersHighenergypricesandtheresultedskyrocketinginflationratesacrosscountrieshavebeenanightmarein2021,hittingcorporateprofitmargins.However,thenegativeeconomicimpactfromhighinflationislikelytoextendinto2022intheformofrisingfoodprices.Energypricessoaredmorethan80%fromJantoNov2021Source:Bloomberg,WorldBankInJan-Nov2021,theUnitedNations’FAOFoodPriceIndexroseby17%,thestrengthofwhichisexpectedtocontinueinto202,giventherisingpricesforenergy,inputmaterialprices(includingfertilizersandpesticides)andtransportationcostsamidstincreasingregulatorypoliciestolowercarbonemissions.FAOFoodPriceIndexrisingtoatenyearhighSource:Bloomberg,WorldBankRisingenergyandfoodpricesnotonlydriveupinflationbutalsowillhiteconomicactivitiesalongthesupplychainsofdifferentindustries.Evenproducersofenergyandfoodproductswillultimatelysufferfromacontractioninaggregateconsumption.Thesetwodrivers,energyandfoodprices,maybecometriggersofsystematicrisk,impactingvariousindustriesandunavoidablethroughsimpleassetdiversification.ThoseinvestorswishingtohedgeagainstthenegativeimpactofrisingeconomicvolatilityanduncertaintymayconsiderahigherweightinginassetclasseswithhighESGratings,includinggreenbonds.CompanieswithhighESGratingsarealsoexposedtofinancialrisk(forearnings,cashflows,andvaluation),buttoalesserextentthanthemarketastheirexposuretoenvironmentalorsocialfactorsaffordsameasureofreliefenabling050100150200250Jan-21Feb-21Mar-21Apr-21May-21Jun-21Jul-21Aug-21Sep-21Oct-21BrentoilpriceNaturalgas(Asia)Naturalgas(Europe)CoalUS$/bbl5070901101301501701902012201320142015201620172018201920202021FoodPriceIndexMeatDairyCerealsEdibleoilsSugarESGBulletin3December2021CCBISECURITIES3themtoperformbetterinrelativeterms.Forexample,companiesthatderivesomeoftheirenergyfromnon-fossilfuelstopowertheirfoodprocessingchainsorelsethosefirmsthatsellproductsatanearlystageofthesupplychain(likegrainsorvegetableproducers)ratherthanatalaterstage(likehotpotoperators)willbenefitmore.WensFoodstuffGroup(300498CH,NotRated)isprincipallyengagedinthebreedinganddistributionofbroilerchickenandpigs.Beingintheupstreamofthesupplychain,itisrelativelylessaffectedbytherapidsurgeofenergyandagriculturecommoditiespricescomparedwiththerestaurantchain,Haidilao(6862HK,NotRated)situatedinthedownstreamstageofthesupplychain.WensFoodstuffsalso(1)employsrenewableenergyduringproduction,(2)enjoysareductionofenergywasteasaresultofproductionprocessinnovation,and(3)increasesdirectsaleslocallytodecreasethedistributioncoststoloweritscarbonfootprint.Intermsofpriceperformance,WensoutperformedHaidilaoin2021.WensFoodstuffsversusHaidilao2021sharepriceperformanceSource:BloombergGenerally,againstthebackdropofinflation,downstreamcompaniesarefacingmorecostpressure(andregulatoryorsocialrisks)thanupstreamcompaniesastheincreaseinfoodpricesisgraduallytransmittedineachstagedownthesupplychain,andincreasesconsumptionofenergyandthuscarbonemissionfortheraworsemi-processedmaterialsfordownstreamcompanies.HedgeagainstfoodinflationwithhighESGscorers++positivetoESG--negativetoESG102030405060708090Jan-21Feb-21Mar-21Apr-21May-21Jun-21Jul-21Aug-21Sep-21Oct-21Nov-21WensFoodstuffGroupHaidilaoESGBulletin3December2021CCBISECURITIES4Source:CCBISestimatesBothBloombergandMSCIprovidesomemetricsforcorporateESGratingsforreference,whichconsiderenvironmental,socialandgovernancefactorsasbelow.ComponentsofESGindices:BloombergandMSCISource:Bloomberg,CCBISestimatesThefollowingchartshowstheESGratingagainstthe2022PERvaluationofstocks.WeexpectthosestockswithrelativelyhigherESGratingsandlowerPERratingstooutperformamidrisingrisksofenergyandfoodpriceinflation.PreferstockswithhighESGratingsandlowPERvaluationSource:MSCI,Bloomberg,CCBISestimatesEnvironmentalClimatechangeNaturalresourcesPollution&wasteEnvironmentalopportunitiesSocialHumancapitalProductliabilityStakeholderoppositionSocialopportunitiesGovernanceCorporategovernanceCorporatebehaviorEnvironmental-Greenhousegas(”GHG”)/revenue-GHG/MBOE-Carbonreserves-Oilintotalproduction%-Energy/MBOESocial-WomenemployeesManagementratio-Womenemployees%-Employeeturnover%-Employeesunionized%-LosttimeincidentrateGovernance-Independentdirectors%-Directoravgage-Directormeetingattd%-BoardsizeBloombergESGindicatorMSCIESGindicator0102030405060708090100010203040506070MSCIESGscores2022P/E(x)ESGratingagainst2022PERBCAEA:ChinaMengniuDairy(2319.HK,NotRated)B:Marston(MARS.LN,NotRated)C:Danone(DANO.PA,NotRated)D:HaidilaoInternational(6862.HK,NotRated)E:WensFoodstuffGroup(300498.SZ,NotRated)F:KweichowMoutai(600519.SS,Notrated)DFESGBulletin3December2021CCBISECURITIES5Focusonhydrogen–theaddressablemarketThehydrogenmarketoffersinvestmentopportunitiesinfivesectors:(1)hydrogenproducers,(2)electrolysisandotherupstreamequipmentmakers,(3)hydrogeninfrastructure,(4)fuelcellandfuelcelldrivetrains,and(5)marineandairtransport.Inordertounderstandtheinvestmentcaseforhydrogenineachsectoritisimportanttohavesomeappreciationofthevariouswaysthathydrogencanbeproduced,transported,storedandused.Forexample,howmuchhydrogenislikelytocomefromfossilfuelusingCCUSversusfromwaterusingrenewableenergy?Howmuchhydrogen,forexample,mightbeusedinretro-fittedthermalpowerstations,inexistinggasgridstoheatbuildings,andinammoniafuelcellsforships?Howrapidwilltheadoptionofhydrogenbe?Whatfactorswillaffecttheadoptionineacharea?Traditionalusesofhydrogenhavebeenpurelyindustrial.Hydrogenhasalwaysbeenintegraltooilrefining.Refineriesusehydrogentolowerthesulfurcontentoffuels,especiallydiesel.Othertraditionalusesforhydrogenincludethesynthesisofammoniaforfertilizerandmethaneinthechemicalindustry.Refinerydemandforhydrogenhasincreasedasdemandfordieselfuelhasrisenandassulfur-contentregulationshavebecomemorestringent.Refineriesproducesomehydrogenasaby-productofcatalyticreformingofnaphthaintohighervaluehigh-octaneproducts.However,supplyfromnaphthatypicallymeetsonlyaboutathirdofrefineryhydrogenneeds.Asidefromhydrogenproducedasaby-productofrefining,hydrogenhastraditionallycomefromtwosources:steammethanereforming(SMR),andasaby-productofotherchemicalprocessessuchaschlorineproduction.IntheSMRprocess,methanefromnaturalgasorgasifiedcoalisheatedwithsteam,usuallywithacatalyst,toproduceamixtureofcarbonmonoxideandhydrogen.SMRtechnologyis90%efficientinproducinghydrogen.Whilehydrogenitselfisacleanfuel,manufacturinghydrogenisenergy-intensive.Traditionalproductionsourceshavecarbonbyproducts.Hydrogencreatedthroughcoalgasificationthrowsoffthemostcarbonwasteandiscalledblackorbrowndependingonthecoalused.Hydrogenfromnaturalgasthrowsofffeweremissionsthancoalandiscalledgreyhydrogen.Thesetraditionalhydrogensourcesareasignificantsourceofglobalwarmingrepresenting2.2%ofglobalenergy-relatedemissions.About60%ofChina’shydrogenproductioncomesfromgasifiedcoal.Globaldemandforpurehydrogen,1975-2018CumulativeemissionsreductionbymitigationmeasureintheNetZeroScenario,2021-2050Source:IEASource:IEAHydrogenfitsintoacleanenergyfuturebecauseitcanbeproducedwithalternativetechnologiesthatloweroreliminateemissionsandbecauseitisaversatilefuelthatcangreatlyassistthetransitiontoanetzeroworld.BluehydrogenusesCCUStoreducethegreenhousegasesproducedinthecreationofgreyhydrogen.Greenhydrogenproductionusesrenewableenergytocreatehydrogenfuelfromwater.Inthefuture,wemayalsoseehydrogen-basedsynthetichydrocarbonfuelsproducedusingCO2frombiogenicoriginorcaptureddirectlyfromtheatmosphere,thoughthecostofthesewillbeprohibitiveforalongwhileyet.010203040506070801975198019851990199520002005201020152018ERefiningAmmoniaOtherMtRenewables35%Electrification19%CCUS11%Otherfuelshifts5%Behaviourandavoideddemand11%Technologyperformance13%Hydrogen6%ESGBulletin3December2021CCBISECURITIES6Hydrogenisanidealfuel.Tobeginwith,itisabundant,themostabundantelementintheuniverse;itisalsolight;sixtytimeslighterthangasolinevapor;itisenergy-dense,non-corrosive,andstorable;itproducesnodirectemissionsofpollutantsorgreenhousegases.Mostimportant,hydrogenoffersflexibility.Itcanbeusedinhighheatapplicationswhereelectrificationisimpractical,suchassteelorcementproduction.Itcanreplacecoalinretrofittedcoal-firedgenerationplants.Itcanbetransportedthroughexistinggaspipelinesforheating.Itcanstoreexcessrenewableenergyproductionandbeusedtomeetpeakdemandwhenrenewablesupplyisinsufficient.Itcanbeusedinfuelcellsandwillbeusefulinapplicationswhereelectrificationisimpracticalsuchasseaandairtransportandlongdistancelandfreight.Dependingupontechnologyadvances,itcouldpotentiallyprovemorecostadvantageousthanelectrificationinmotorvehiclesandbuses.Akeybarriertothedevelopmentoflow-carbonhydrogenhasbeentheadditionalcostversushydrogenproducedfromunabatedfossilfuels.ThecostofgreenhydrogencurrentlyrangesfromUS$3.00toUS$8.00perkilogram,dependingonthecostofrenewablepower.ThiscompareswithacostfromunabatednaturalgasragingfromUS$0.50toUS$3.20perkilogramusingtherangeinthenaturalgaspricesince2020.CCUSraisesthecostofgreyenergybybetweenUS$1.00toUS$2.00perkilogram.Thecostofgreenhydrogendependsuponwhereitisproduced.In2018theIEAgavelong-termprojectionsofgreenhydrogencostsindifferentregionsbasedontheirsolarpotential.Atthattime,theIEAwasprojectingcostsofbetweenUS$1.60andUS$3.00intheareasmostsuitableforsolarpowergeneration.China’swesternprovincesarehighlysuitableforlowcostgreenhydrogenproduction.HydrogencostsfromhybridsolarPVandonshorewindsystemsinthelongtermasof2018Source:IEAThechartsbelowshowhowglobalhydrogenconsumptionandproductionwillchangeinthecomingdecadebasedonthehydrogencostsassumedbytheIEAinitspreferredNetZeroScenario.ESGBulletin3December2021CCBISECURITIES7GlobalHydrogendemandbysectorintheNetZeroScenarioSupplybyproductiontechnologyintheNetZeroScenarioSource:IEASource:IEAIn2020,virtuallyallhydrogenwasconsumedbyrefiningandindustry.By2030,theIEApositsthattherefiningshareoftotalconsumptionwillfallfrom42%in2020tojust12%.Theshareofconsumptionbyindustrysimilarlyfallsfrom58%to36%.Theconsumptionshareofhydrogeninjectedintothegasgridrisesfromzeroto25%.Consumptionofhydrogenusedinpowergenerationandammoniafuelbothrisefromzeroto9%.Consumptionintransport(fuelcells)andsynfuelsbothriseto4%(synfuelisaliquidfuelmadefromhydrogenandcarbonmonoxide).Synthetickeroseneforsustainableaviationfuelwillonedaybethelargestsynfuelmarketbutisnotexpectedtobecommercialbefore2030.Intermsofproductionsources,theshareofhydrogensourcedfromfossilfuelandasarefineryby-productwillfallfrom90%in2020to30%by2030.ThesharecomingfromfossilfuelwithCCUSrisefrom10%to32%.Thesharecomingfromelectrolysiswillrisefromzeroto38%.WebelievethattheseIEAestimateslikelyunderestimatethegrowthofhydrogenproductionandusage.SolarPVcosts,andhencegreenhydrogencosts,havefallenappreciablyfasterthantheIEAanticipatedin2018.Moreover,technologicalimprovementsmeanthattheefficiencyofPVsystemsinhotaridregions,wherepeoplearescarceandlandischeap,havebecomemarkedlymoreefficient.InitsGlobalHydrogenReview2021,theIEAprofferedthatgreenhydrogenfromregionswheresolarismostabundantcouldbecompetitiveandevencheaperthanhydrogenfromunabatednaturalgasassoonas2030.Greenhydrogenfromlowcostregions,includingWesternChina,willbetransportedregionallyandglobally,requiringinfrastructuresolutions.IndustrysourcestendtobemoreoptimisticaboutthepaceofhydrogenadoptionthanthegenerallymoreconservativeIEA.TheHydrogenCouncil,anindustryassociationofcompaniesassociatedwithhydrogenproductionandconsumption,suggeststhatUS$2/kgistheapproximatetippingpointthatwillmakegreenhydrogenanditsderivativefuelscompetitiveinmultiplesectors,includingsteelandfertilizerproduction,powergeneration,andlong-rangeshippingindustry.1Thefollowingchartshowstheestimatedcompetitivenessversuscompetinglowcarbonsolutionsby2030assumingagreenhydrogencostofUS$2.40/kg.ThechartisbasedondatacollectedbytheMcKinseyCenterforFutureMobilityfromcompaniesengagedinlowcarbonsolutionsintheUS,theEU,China,andJapan/Korea.Forthenineapplicationsinthetop-rightquadrant,greenhydrogenbecomesmorecompetitivethanconventionalfossilfueloptions,regardlessofcarbonprices,andmorecompetitivethanalternativelowcarbonsolutions.Applicationsinthisquadrantshouldexperiencethefastestrateofgrowthinthecomingdecade.Alternativestotheleftofthisgroupwillrequirehighercarbonpricestomakegreenhydrogeneconomic.Applicationstothefarleftofthechart,includinguseinturbines,industryfeedstock,orsyntheticfuelforaviation,willrequireacarbontaxofatleastUS$100pertonneifhydrogenistobecompetitivewithconventionalfuels.1Forexample,Pathtohydrogencompetitiveness:Acostperspective,TheHydrogenCouncil,20January2020050100150200250202020252030RefiningIndustryTransportPowerAmmonia-fuelSynfuelsBuildingsGridInjectionMt050100150200250202020252030Refineryby-productFossilFossilwithCCUFossilwithCCSElectrolysisMtESGBulletin3December2021CCBISECURITIES8Competitivenessofhydrogenapplicationsversuslow-carbonandconventionalalternativesSource:TheHydrogenCouncil,McKinseyCenterforFutureMobilityFocusonHydrogen–theaddressablemarketinChinaChinaconsumed25Mtofhydrogenin2020,mainlyfromfossilfuels.Electrolysis-basedhydrogencurrentlyaccountsforaroundof1%ofthetotaloutput.Refiningandindustryaccountforalmostallcurrenthydrogendemand.Onlyasmallamountisusedasindustrialfuelandlessthan0.1%isconsumedastransportationfuels.Asof2020therewere124hydrogenrefuelingstationsinChinacomparedwith120,000petrolstations.UndertheIEA’sNetZeroscenario,China’shydrogenconsumptionrisesto31Mtin2030(2.1%CAGR)andto90Mtin2060(3.6%CAGR).By2060,hydrogenmeets10%ofChina’sfinalenergydemand.Itwillsupply40%oftheenergyneedsofheavyindustry,25%fortransport,and20%forconversiontootherfuels,mainlyammoniaforshipping.TheIEAassumesthatwaterelectrolysisusingelectricitygeneratedfromrenewablesandgridelectricity(withsignificantlylowercarbonintensitythantoday)willaccountfor80%oftotalhydrogenproductionby2060,withcoalandnaturalgaswithCCUSaccountingfor9%and7%of2060production.RecentdatasuggestthatChina’shydrogenusageandproductionisrisingmuchfasterthantheIEAassumes,primarilyduetochangesinChina’srenewablespolicy.Theenergyregulatorhasrequirednewrenewableconstructiontodevelopmatchingenergystoragesolutions,ofwhichpower-to-gas(i.e.hydrogen)isoneofthefavoredoptions.Thispolicyemphasisonrenewable-plus-storageisnowdrivinggreenhydrogenupstreamdevelopment.TheChinaHydrogenAllianceestimatesthatthehydrogenindustrywillgeneraterevenueofRMB1.0trillionby2025FandRMB12trillionby2050F,figuresthatassumesahigherCAGRthanactualhydrogenconsumptionbecausetheytakeintoaccountinvestmentinhydrogenproduction,infrastructure,andequipment.TheyalsoassumeChinawillgrabalargesliceoftheglobalhydrogenequipmentindustry.ThealliancehassuggestedChinawillneed100GWofinstalledcapacityingreenhydrogenproductionby2030toachieveitsde-carbonizationgoal.Bycomparison,theEUtargets15GWofinstalledcapacitybythesamedate.TheChinesegovernment’stop-levelplanforhydrogendevelopmentwillbereleasedin2022F.WesuspectitwillbemoreaggressiveinmostareasthantheIEAassumes.Thepolicyislikelytosupport,amongotherthings,thedevelopmentofhydrogenengines,electrolysisandotherequipmentmaking,storage,transportation,andrefuelingstations.Additionally,weexpectitwillallowfortheretrofittingofexistingthermalpowerstationstohydrogenincitieswithhighrenewableenergyproduction.InnerMongolia,Guangdong,andShanxiwerethetopprovincesintermsofhydrogeninvestmentin2020.Mostofthenewinvestmentwasinfuelcells,followedbypureandintegratedhydrogenproductionprojects.Thetwotablesbelowillustrateaselectionofhydrogenproductionprojectsandthecompaniesinvolved.Investmentinupstreamequipmentmakinganddownstreamhydrogenfuelcellsisalsoontherise.MuchoftheR&Dandmanufacturinghasmovedtohydrogen-specificindustrialparksinfossilfuel-centricareaslikeHebeiandSichuan.ESGBulletin3December2021CCBISECURITIES9Investmentinhydrogenisreboundingin2021andisexpectedtoacceleratepostthereleaseoftop-levelpolicyChina’shydrogeninvestmentflockedintofuelcellsegment(mixintermsofno.ofprojectsin7M21)Source:QingyunlianSource:Qingyunlian85180163253-501001502002503002018201920207M21Domesticinvestmentinhydrogen(RMBb)(RMBb)Integrated19%Vehicles6%Fuelcells&systems37%Refuellingstations7%Storage&transportation3%Hydrogenproduction14%Others14%ESGBulletin3December2021CCBISECURITIES10SelectedhydrogenprojectsinChinaProjectCompaniesinvolvedLocationStartdateTechnologyPowersource(forelectrolysis)ProductDesignedcapacityInoperationGuangdongSynergyHydrogenPowerTechnologyCoPhase1GuangdongSynergyBallardHydrogenPowerTechnology(notlisted),BallardPower(BLDPUS)Guangdong2019PEMRenewableH24MWTongjisolarhybridhydrogenrefuelingstationLongji(601012CH)N/A2018ElectrolysisSolarH225m3H2/hourCPIZaoquanthermalpowerplantCPI(2380HK),ZhejiangEnergy(notlisted)Ningxia2017ALKOther/unknownH220m3/hourLanzhouFineChemicalParkN/AGansu2020ALKSolarMeOH1,000m3H2/hour-1440tMeOHHaipererhydrogenproductionPhase1BeijingSinoHytec(688339CH)Hebei2020ElectrolysisOnshorewindH24.3tH2/dayGuyuanhydrogenproductionPhase1HebeiConstruction&InvestmentGroup(notlisted),McPhy(MCPHYFP),Encon(notlisted)Hebei2020ALKOnshorewindH24MWZhongyuanOilfieldEORSinopecGroupHenan2015Coal+CCUSN/AAmmonia100ktCO2/yearChangqingOilFieldEORPetroChina(857HK,Outperform)Jinan2015Coal+CCUSN/AMeOH50ktCO2/yearKaramayDunhuaOilTechnologyCCUSEORXinjiangDunhuaOilTechnology(notlisted)Xinjiang2015Oil+CCUSN/AMeOH100ktCO2/yearZhonghuanZhangjiakouHydrogenDemoProjectZhonghuanEnergy(notlisted),HebeiQixinInvMgmt(notlisted)Hebei2016PEMSolar+WindH220MWUnderconstructionGuyuanhydrogenproductionPhase2HebeiConstruction&InvestmentGroup(notlisted),McPhy(MCPHYFP),Encon(notlisted)Hebei2022ElectrolysisOnshorewindH210MWGuangdongSynergyHydrogenPowerTechnologyPhase2GuangdongSynergyBallardHydrogenPowerTechnology(notlisted),BallardPower(BLDPUS)Guangdong2021PEMRenewableH29MWChonglihydrogenproductionPhase1ChinaSuntien(956HK/600956CH)Hebei2021PEMSolar+windH21.7tH2/dayYanchangIntegratedCCSDemonstrationShaanxiYanchengPetroleum(notlisted)Shaanxi2021Coal+CCUSCoalH2410ktCO2/yearBaichengCityBusFAWJiefang(000800CH)Jilin2021ElectrolysisOther/UnknownH2N/AQiluPetrochemicalCCSSinopecGroupShandong2021Coal+CCUSN/AH2700ktCO2/yearZhangjiakouhydrogenproductionCIICTiangong(notlisted)Hebei2022ElectrolysisSolar+WindH220MWJintonglingbiomassgasificationPhase1Jintongling(300091CH)Heilongjiang2022BiomassN/AH2200mm3H2/yearInnerMongoliahydrogenproductionN/AInnerMongolia2023ElectrolysisSolar+WindH2465MW-66.9ktH2/yearOtogFrontBannerhydrogenproductionBeijingJingneng(579HK)InnerMongolia2021ElectrolysisSolar+WindH2500ktH2/yearSolarhydrogenproductionBaofengEnergy(600989CH)Ningxia2021ALKSolarH2100MWESGBulletin3December2021CCBISECURITIES11SelectedhydrogenprojectsinChina(…continued)ProjectCompaniesinvolvedLocationStartdateTechnologyPowersource(forelectrolysis)ProductDesignedcapacityInvestmentdecisionHaipererhydrogenproductionPhase2BeijingSinoHytec(688339CH)Hebei2021ElectrolysisOnshorewindH227.8tH2/daySiemensEnergyandBeijingGreenHydrogenTechDevHRSSiemens(SIEGR),ChinaPower(2380HK)Beijing2021PEMOther/UnknownH21MWChonglihydrogenproductionPhase2ChinaSuntien(956HK/600956CH)Hebei2022PEMSolar+WindH2N/AShellChina-ZhangjiakouShell(RDSANA)Hebei2022ElectrolysisRenewableH220MWHuanengChengduelectrolysisHuanengPower(902HK)W.SichuanTBCElectrolysisHydropowerH26km3H2/hourDatongCitysolarplantPhase2DatangPower(991HK/601991CH)ShanxiTBCElectrolysisSolarH250MWDemoprojectsQingnengInstitutedemoplantHuanengGroup(notlisted)N/A2020ElectrolysisRenewableH2N/AHTGRP2GdemoChinaNationalNuclearPower(601985CH)N/A2020ElectrolysisNuclearH20.1m3H2/hourBaichenghydrogenproductionCGNNewEnergy(1811HK,Outperform)Jilin2022ElectrolysisNuclearH250m3H2/hourUnderfeasibilitystudy/preparationYanqingHydrogenEnergyIndustrialParkChinaPower(2380HK)Beijing2022ElectrolysisRenewableH22.8tH2/dayOrdosSinopecGroup(386HK,Outperform)InnerMongoliaPhase1:2022ElectrolysisRenewableH220ktH2/yearKuqaSinopecGroup(386HK,Outperform)XinjiangTBCElectrolysisSolarH220ktH2/yearHydrogenequipmentLongji(601012CH)N/A2022ElectrolysisN/AH21.5GWHBISDRIinXuanshanHBISGroup(notlisted),Tenova(notlisted)ZhejiangTBCElectrolysisRenewableH2N/A600MWHTGRP2GforsteelChinaNationalNuclearPower(601985CH)TBCTBCElectrolysisNuclearH250km3H2/hourHydrogenEnergyEquipmentIndustrialClusterProjectinHandanEcon&TechDevZoneCSSC(600150CH),CISR(notlisted)Hebei2026ElectrolysisOnshorewindH2N/ADatongCitysolarplantPhase1DatangPower(991HK/601991CH)ShanxiTBCElectrolysisSolarH210MWConceptual/MOUBaichenghydrogenproductionCEEC(3996HK/601868CH),Windey(300772CH)Jilin2035ElectrolysisSolar+WindH21MtH2/yearWeifangBinhaisolar100MWhydrogenproductionChinaHuadian(1071HK),WeichaiPower(2338HK/000338CH)HebeiTBCElectrolysisSolarH2N/AFoshanhydrogencityPhase1N/AGuangdongTBCPEMRenewableH23MWFoshanhydrogencityPhase2N/AGuangdongTBCPEMRenewableH210MWCangzhouBohaiNewDistricthydrogenproductionAviationHydrogen(Cangzhou)Gas(notlisted),HebeiZhengyuanHydrogenTechnology(notlisted)HebeiTBCElectrolysisOther/UnknownH2N/AChengdewindpowerheatingandhydrogenproductionChengdeNobeiliaoNewEnergyTechnology(notlisted)Hebei2022ElectrolysisOnshorewindH21700tH2/yearZhangjiakouYangyuanJingxiNewEnergyBaseProjectN/AHebei2024ElectrolysisSolar+WindH2N/AJinzhongYushehydrogenproductionSungrow(300274CH)ShanxiTBCElectrolysisSolarH250MWChangzhiLiutunhydrogenproductionSungrow(300274CH)ShanxiTBCElectrolysisSolarH250MWYushuhydrogenproductionSungrow(300274CH)JilinTBCElectrolysisOnshorewindH210MWYellowSeahydrogenproductionShandongZhongneng(notlisted)ShandongTBCElectrolysisOffshorewindH22,000MWUlanhothydrogenproductionTBEA(600089CH),BeijingJingneng(579HK)InnerMongoliaTBCElectrolysisRenewableH2500MWHongdonghydrogenproductionBeijingJingneng(579HK)ShanxiTBCElectrolysisSolarH215,000nm3H2/hourUnlessotherwisestated,companiesmentionedaboveareNotRatedbyCCBISSource:IEA,localgovernments,Companydata,CCBISESGBulletin3December2021CCBISECURITIES12Investinginhydrogen–hydrogenproducersChinaisalreadytheworld’slargestproducerofhydrogen.In2020,totalgasproductionwas25Mt,ofwhichlessthan3%wasrenewable-basedelectrolysisandphotolysis.Asnoted,theIEAisprojectingthatoutputwillgrowto31Mtby2030and90Mtby2060.Inourview,theseforecastsaretooconservativegiventhatthetotalsupplyanddemandforgreenhydrogenisgrowingatamuchfasterratethantheIEAassumes.Inthefirsthalfof2021,totalhydrogengasproductionjumped25%YoYwhiletheshareofgreenhydrogenincreasedby30%,accordingtoChinaHydrogenEnergyIndustryPromotionAssociation(CN-HEIPA).TopcompaniesengagedintheproductionofhydrogenwillincludeChina’smajorrefineriesandpowergenerators,especiallycleanpowergeneratorssuchashydroandnuclear.Foraconsiderableperiod,hydrogenwillnotrepresentasignificantshareoftheearningsofthesecompaniesand,hence,theyarenotbenefittingashydrogenconceptplays.Infutureyears,oncehydrogencomestorepresentasignificantshareoftherevenueofthesefirms,thesebusinesseswillincreasinglycometoreflectthehydrogencomponent.Asthisoccurs,thesecompanieswillevolveintoahedgeagainsthigherenergyprices.ThelargesthydrogenproducersamongtheseestablishednameswillincludeStatePowerInvestmentCorp(SPIC,unlisted),ChinaPetroleum&ChemicalCorporation(Sinopec,386HK,Neutral),ChinaHuaneng(902HK,notrated),ChinaEnergyInvestmentCorp(CEIC,unlisted),ChinaNationalOffshoreOilCorp(CNOOC,883HK,Outperform),ChinaThreeGorges(CTG,600905CH,notrated),ChinaHuadian(1071HK,notrated),ChinaDatangPowerandChinaDatangRenewable(991HK,notratedand1798HK,outperform,),ChinaGeneralNuclear(CGN,unlisted),andChinaNationalNuclearCorp(CNNC,notlisted).Althoughthesebusinesseswillnottradeashydrogenconceptstocks,someofthesecompanieswilleventuallylisthydrogensubsidiaries.Thetwomostlikelytodoso,inourview,areSPICandSinopec.SPICrecentlyformedSPICHydrogenTechnologyDevelopmentCorp.Weexpectthiswillbeoneofthefirstpuregreenhydrogenplaystobespunoffofanexistinghydrogenproducer.SPICisbetterpositionedthanotherpowerutilitiesandpetroleumcompaniesindevelopinggreenhydrogenasitownstheworld’slargestsolarpowerportfolioandsizablehydrogen,nuclear,andwindassets.Furthermore,itistheonlyoneofthe“BigFive”powercompaniesthatcanclaimthatcleanpowercapacityaccountsforover50%ofitspowerportfolio.Thelargethermalpowernamesarelikelytoneedtokeepbluehydrogenprojectsin-housetomeettheirCO2emissionpledges.Meanwhile,thehydroandnuclearpowercompanieswilllikelynotseealargebenefitfromspinningoffhydrogenassetssincerevenuefromhydrogenwillsubtractfromconventionalelectricityrevenue.Sinopecmightprefertokeepgreenenergyproductionin-housetoassistwithitsemissionpledgesbutithasextensiveinvestmentstomakeinitsH2refuelingnetworkthatwouldtradeasafuelcellconceptstock.ItmightwellbenefitSinopectospinofftheseassetsatanearlystage.Itispossiblethattherewillbeadvantagesinattachinggreenandbluehydrogenassetstothisnetworkwheretherearesharedinfrastructureassets.Sinopecalsohasfuelcellandelectrolysistechnologyitmaywishtolistseparatelyorinacombinedhydrogenportfolio.Itbehoovesinvestorswishingtoplaythehydrogenthemetofocusonsmallernamesastheseofferpurerexposure.AmongthesmallerproducersthathavedemonstratedaggressivehydrogenintentionswewouldincludeSungrow(300274CH,notrated),BaofengEnergy(600989CH,notrated),andYangmeiChemicalLtd(600691CH,notrated).YangmeiChemicaltradesmoreasafuelcellconceptstockbecauseitisinvolvedinhydrogenrefuelingstationsthoughitisalsoaproducer,albeitneithergreennorblueatthisstage.Sungrowisconstructinga500kwhydrogenpowerstation.Korealaunchedtheworld’sfirstfuel-cellbasedpowergenerationplantthisyearandSungrow’sisontracktobethesecond.TheChairmanofSungrowrecentlystatedthatwiththecostoffuel-cell-basedpowerforecasttofallaslowas¥0.5/kWhifthenoontimePVpowerisstoredasgreenhydrogenBaofengEnergy,acoalproducerinChina'snorthwesternNingxiaautonomousregion,isconstructingtheworld’slargestsolarhydrogenproject.Baofengisshapinguptobeamajorproducerofthecheapestgreenhydrogeninthecountry.ItslocationandscalesuggestitwillbeoneofChina’slowestcostgreenenergyproducers.ESGBulletin3December2021CCBISECURITIES13Investinginhydrogen–electrolysisandotherupstreamequipmentmakersTheprimaryopportunitiesontheequipmentsideforhydrogenproductionlieincompaniesthatmakeelectrolyzersandinthevariouscomponentsthatgointotheelectrolysisprocesssuchasthepolymerandceramicmembranesusedforgasseparation.Valves,pumps,vents,andstoragetanksareotherkeycomponents.Topreventleakage,allofthesemustbeengineeredtocopewiththesmallhydrogenmolecule.Ingeneral,webelievetheelectrolyzermarketwillquicklybecomeover-suppliedandpossiblyvulnerabletotechnicaldisruption.Weexpectcomponentmakerswillgainearlyscaleadvantagesconferringmorepricingpowerthantheproducersofelectrolyzers.Atthisearlystage,however,itisdifficulttodeterminewhichplayerswillgeneratethestrongestlong-termreturns.Inanycase,thehydrogeneconomywillrequirealotofelectrolyzingequipment,asshowninthediagrambelow.HowelectrolyzersfitintoagreeneconomySource:CumminsIncAccordingtotheIEA,China’selectrolyzercapacitywillapproach25GWby2030and750GWby2060fromlessthan100MWtoday.Ina2020whitepaper,capacitywasforecasttogrowbyatleast50%p.a.inthecomingdecadeand15%p.a.inthesubsequenttwentyyears,givingacapacityof930GWby2060.Itremainstobeseenhowtheseprojectionswillcomparewiththegovernment’sestimatesintheupcomingtop-levelplanonhydrogendevelopment.Regardlessoftheeventualnumber,growthinelectrolyzersaleswillbefarhigherthanforthehydrogenproduction.Thesamewillapplytomembranesuppliers.Actualindustrygrowthwilldependasmuchonexportsuccessasondomesticsales.AccordingtoIEAprojections,Chinaaccountsforcloseto40%ofglobalelectrolysercapacityadditionsovertheprojectionhorizonasitssharerisesquicklyuntil2040beforeplateauing.Theseplantswillconsumehugeamountsofelectricity–closeto3300TWhin2060.Bycontrast,coaluseforhydrogenproductionisprojectedtofallfrom115Mtcein2020tolessthan90Mtcein2060–15%ofChina’stotalcoaldemand–morethan80%ofwhichisinconjunctionwithCCUS,whiletheuseofnaturalgasdeclinesfrom30bcmtojustabove20bcmin2060(morethan90%withCCUS).Intotal,morethan200MtofCO2iscapturedintheseplantsin2060.ESGBulletin3December2021CCBISECURITIES14EstimatedgrowthinChina’sH2gasdemandandelectrolyzercapacitySource:ChinaHydrogenFuelandCellIndustryDevelopmentWhitePaper(2020)Aswithotherareasofhydrogen,themarketappearstobegrowingmuchfasterthananticipatedbyforecasters.China’selectrolysismarkethasexperiencedexplosivegrowthinthepastsixmonths,exceeding90%YoYaccordingtoindustryestimates.Industryshipmentsareontracktoreach1.8GWin2022accordingtoBloombergNEF,morethandoublethetotalcapacityattheendof2020.SuchexplosivegrowthisprimarilyduetoChina’srenewablepolicychanges.Theenergyregulatorhasrequirednewrenewableconstructiontodevelopmatchingenergystoragesolutions,ofwhichpower-to-gas(i.e.hydrogen)isoneofthefavoredoptions.Thispolicyemphasisonrenewable-plus-storageisthekeyfactordrivinggreenhydrogenupstreamdevelopment.Onedifficultywiththissegment,meaningbothelectrolyzersandtoalesserextentmebranes,isthatasignificantnumberofplayersrangingfromsolar/windequipment,dieselengines,shipbuildersandpetrochemicalengineeringtoaerospacetechnologyareswarmingintothespaceattractedbythegrowthpotential.Themarketissimilartothatofphotovoltaicmanufacturingaround2010whenChineseOEMsemergedandeventuallybecamethedominantglobalsupplier.Currently,thethreeleadingmanufacturersofelectrolyzersareChinaShipbuildingIndustryCorporation(601989CH,NotRated)basedontheoutputofboththe718thResearchInstituteandCSSCPeruiHydrogenEnergyCompany(unlisted),SuzhouJingli(unlisted),andShandongSaikesaisi(unlisted).Thecombinedmarketshareofthethreewasaround60%inSep2021.Encouragedbysurgingordersinthepastsixmonths,allthreeoftheabovehaveannouncedexpansionplansfortheirmanufacturingcapacity.Therealwinnersinthemediumtermwillbethosefirmswiththebesttechnology.ThreeelectrolyzertechnologiesareemployedinChinaandworldwide:theAlkalineElectrolyzer(AELorALK),thePolymerElectrolyteMembraneElectrolyzer(PEM),andthesolidoxideelectrolyzer(SOEC).Rightnow,themajorityoftheelectrolyzerintheChinesemarketisalkalinewater-based(orALK)whichhasbeenamatureandcost-effectivetechnology.Nevertheless,thetechnologyrequiresthechemicalalkalinewater.AndtheALKmethodislessefficientandrequiresalongerrespondingtimecomparedwithPEM.GreenhydrogentendstobemostlyproducedusingPEMwhichproduceshydrogenfrompurewater.PEMtechnologyisseenasthekeysolutionforpower-to-gasinthenext5-10years.However,PEMconsumespreciousmetals(platinum)andisveryenergyintensive.Itisthereforehighcost.Researchersaroundtheworldarestrivingtofindlowercostimprovementsontheexistingtechnology.TherehavebeenbreakthroughsinSOECinrecentyearsandsomeseeitasatechnologyofthefuture.CostdeclinesinPEMelectrolyzercomponentsincludingbipolarplates,GDL,andMEAwilloccurastheindustrygainsscale.Buttheultimategoalistoreducerelianceonpreciousmetals,notablyplatinum.ChinesemanufacturersarelessdevelopedinPEMtechnology,unlikeinternationalplayerslikeSiemenswithdecadesofexperience.Weexpectmarketdynamicswillchangequicklyasnewplayersenterandasnewtechnologiesareuncovered.NewChinesearrivalsintheelectrolyzermarketin2021include:ACumminsJVwithEnzeCapital(aSinopecsubsidiary),aJVbetweenShanghaiElectric(2727HK,NotRated)andtheDalianInstituteofChemicalPhysics(DICP);Sungrow(300274CH,NotRated)withitsSEP50PEMelectrolyzer,dubbedthefirstlargePEMproductinChina;LONGiGreenEnergyTechnology(601012CH,NotRated),whichisinvestingRMB300milliontodevelopanelectrolyzerproductioncentre;leadingfuelcelltechnologycompanyBeijingSinoHytec(688339CH,NotRated)inaJVwithMingtalGroup(notlisted);JiangsuLinyangEnergy(601222CH,NotRated),whichcurrentlymakeselectricitymetersandequipmentinaJVwithShanghaiSunwise(notlisted);materialscompanyBaotailongNewMaterials(601011CH),NotRated)inaJVwithoilgiantCNPC.AllofthelargersolarPVplayerswillhaveaninterestinjoiningtheelectrolysismarketinanattempttogainacostadvantage.InadditiontoSungrowandLONGi,GCL-PolyEnergyHoldings(3800HK,Underperform)hasanambitiouspower-to-gasstrategyandstrategiccontractswithSiemens,Toshiba,Peric,andSPIC,allemergingplayersintheelectrolyzermarket.ManyfuelcellcompaniessuchasWeichaiPower(2338HK,NotRated)haveelectrolyzerbusinessesbecausetheyarecomplementarytothefuelcellbusiness.H2GasDemand(Mt)ElecrolysisShare(%)ElectrolysisGas(Mt)ElectrolyzerCapacity(GW)202033.42<10.10.7202535.531.078.1203037.15103.72382050977067.9608206013080104930ESGBulletin3December2021CCBISECURITIES15Wehavejustscratchedthesurfaceinthisdiscussion.Wehavenotyetinvestigatedthemembraneplayersandmakersofcomponentryforelectrolyzers.Theseareindustriesworthyofourattention.Afewnamestogetthereaderstartedinclude:QingdaoGuolinEnvironmentalTechnologyCo.,Ltd(300786CH,NotRated),makerofceramicmembranes;ShaanxiBaoguangVacuumElectricDevice(600379CH,NotRated),vacuuminterrupters;BefarGroupLtd(601678CH),whichownsShandongBinhuaHydrogenEnergyCo.(601678CH,NotRated),developerofthefirstplantforhydrogenpurificationfromchlor-alkaliforfuelcellhydrogen.Befaristreatedasafuelcellconceptstock.Ingeneral,theelectrolysisnamesassociatedwithfuelcellsarelikelytohavethelowestfundingcostbecausetheyenjoythehighestvaluations.Playerswiththelargeststockofsolargenerationcapacity,suchasSPIC,willhaveascaleadvantage.Investinginhydrogen–infrastructureManychallengesremaintobuildoutChina’shydrogenindustry.Increasingly,giventherapidgrowthofproductioncapacity,themainbarriertothewidespreadutilizationofhydrogenisthelackofinfrastructuretomoveandstoreitpriortoitsend-useapplications,whetherthroughdirectcombustionorinfuelcellsthatconvertittoelectricity.Keyinfrastructureelementsincludepipelines,storagetanks,refuelingstations,andtheequipmentrequiredtosupportthesefunctions.Refillingstations:Differentcitiesaretestingdifferentstrategies.InChengdu,forinstance,HoupuCleanEnergy(300471CH,NotRated)haspioneeredasolutionthatinvolvesdeliveringcontainerizedhydrogenrefuelingstations.Thecontainersaresimplyreplacedwithanewcontainerwhenempty.Itisaneatsolutionthatrequiresnoonsiteinfrastructureandsocanpotentiallyberolledoutrapidly.Houputradesasafuelcellconceptstock.Othercompaniesarefollowingthecontainerizedroute.Hydrogencanbetransportedandstoredinoneoffourways:1)Itcanbetruckedunderpressureingaseoustubetrailersandstoredincontainerizedrefuelingstations.2)Itcanbeshippedandstoredintankersasaliquid3)Itcanbetransportedinspecializedandexpensivepipelines4)Itcanbemovedininliquidchemicalcarriers,withammoniabeingthemostlikelyoptionAllfourapplicationsarelikelytoplayaroleinthehydrogeneconomy,witheachservingadifferentpurposedependinguponthedistancethehydrogenistobetransportedandthescaleofdemandattheenduse.Researchersarealsoinvestigatingsolidstatetransporttechnologiesbutthecommercialrealizationofthisislikelydecadesintothefuture.GaseoustrucktransportThisisthemostcommonformofdeliveryinChinaatthepresenttime.SpecializedequipmentisneededbecausehydrogenisstoredatahigherpressurethanLNGorLPG.Existinggasolineretailersaretheobviousfront-runnersforhydrogenrefillingstations.SinopecwillleadtheconstructionofChina’shydrogenrefuelingnetwork,backedbyits30,000operatinggasstations,someofwhichwillturnintohybridstationscombinedwithEVchargingandH2refueling.AmajorplayerinthisfieldandvirtualpipelinerefuelingstationsisCIMCEnric(3899HK,NotRated),agloballeaderinhigh-pressure&cryogenicpressurevesselmanufacturingwithinthegasindustry.OtherplayersincludeHoupuCleanEnergy(300471CH,notrated)whichoperatesinChengduandChangchunZhiyuanNewEnergyEquipment(300985CH,NotRated).YangmeiChemicalLtd(600691CH,NotRated)ownerofHebeiZhengyuanHydrogenEnergyTechnologyCo.(notlisted),whichoperateshydrogenrefuelingstationsinYangquan.LiquidtrucktransportGaseoustransportationbytruckfacesexponentialcostincreaseswhenthetransportationrangeexceeds200km.Sincesmallerscaleliquidchemical(ammonia)solutionsarenotyetsufficientlydevelopedtobeviable,liquidhydrogen(LH2)transportationisseenastheobvioustransportationsolution.UseofLH2shipmentoverlongerdistancesandforindustrialapplicationsthatrequirelargeamountsofgasisexpectedtogrowexponentiallyinthenextfiveyears.Liquefactionincreasesthetankerloadbyaboutfivetimesversuspressurizedgasbutinvolveshighcosts.Itusesabout35%ofthetotalenergycontenttoliquefythehydrogento-250°C.ThereisthereforeintensecompetitionamongcompaniesinvolvedinLH2tolowertheenergyloss.Priorto2020,therewerejustahandfulofhydrogenliquefactionfacilitiesinChinaandalloftheLH2producedservedtheaerospaceindustryasrocketpropellant.TotalcurrentChinesecapacityisjustover7t/daycomparedwitha480t/dayglobalcapacity.Since2020,however,thecivilLH2markethasgainedtractionthankstoexplodinginvestmentinfuelcellinfrastructureprojects.ChinesealkaliproducerHongdaXingye(002002CH,NotRated)launchedthefirstcivilianliquefactionproject,ofwhichLH2productioncapacityissettoreach30,000t/year.LH2isESGBulletin3December2021CCBISECURITIES16generatedbyrecoveringbyproductgasfromthealkaliprocess.CompaniesengagedinhydrogenliquefactionandLH2transportationhaveenjoyedstronginvestorinterestoverthepastyear.Giventhehighlevelofinvestorinterest,mostofthecompaniesinvolvedingaseoustanktransportabovearedevelopingLH2capability.CompaniesengagedincryogeniccoolingequipmentandLH2coolingfacilitiesarealsoreceivinginvestorattention.ExamplesincludeHangzhouZhongtaiCryogenicTechnology(300435CH,NotRated),andJinTongLingTechnologyGroup(300091CH,NotRated).ESGBulletin3December2021CCBISECURITIES17SeveralchemicalproducershavebeguntoinvestinLH2.ForanEnergyGroup(002911CH,NotRated)inGuangdongisagoodexample.SeveralcitiesarepromotingLH2infrastructureandprojects.ThecityofJiaxinginZhejiangisagoodexample,withthreeLH2projectsunderdevelopmentinvolvingSatelliteChemicalCoLtd.,(002648CH,NotRated);Linde(LINUS,NotRated),ShanghaiHuayiGroupCoLtd.(600623CH,NotRated);ZhejiangJiahuaEnergyChemicalIndustryCo.,Ltd.(600273CH,NotRated);ZhejiangProvincialNewEnergyInvestmentGroupCo.Ltd(600032CH,NotRated)andJiahuaEnergyChemicalIndustryCoLtd.(600273CH,NotRated).HydrogengaspipelinesItisgenerallyexpectedthathigh-pressurepipelinetransportationwillbetheprimarylong-termsolutionforChina’shydrogenmarket.Pipelinesaretheonlypracticalsolutionforlongdistancelandtransportation.However,aspipelineconstructionistypicallyslow,itislikelytobeinsufficientforfuturehydrogentransportationdemandformanyyears.Hydrogenpipelinesrequirespecialtechnologybecausehydrogenembrittlessteelpipelinesunlessthehydrogenismixedwithmethane.Inaddition,becausehydrogenisasmallmolecule,pipelines,valvesandswitchesneedtobeengineeredtopreventleakage.Hydrogencan,however,beinjectedintoexistingnaturalgaspipelineswithamaximumshareof20%withoutrequiringmajormodificationtoexistingpipelines.Thiswillbeaviableoptionforsomeheatingandindustrialapplications.WhenitcomestopipelinesandhighvolumestorageweexpectthatSinopecanditssubsidiarieswillhaveasignificantadvantagegiventhatSinopecwillbeoneofthelargestproducersofhydrogenandisalreadyinvolvedingasinfrastructure.SinopecEngineeringGroup(2386HK,NotRated)engagesinengineering,procurement,andconstruction(EPC)forpipelinesandgasstorage.ItisinaprimepositiontobuildtheinfrastructureformuchofSinopec’sCCUSbusinessandisequallywellplacedtohandleitspipelineandstoragerequirementsforhydrogen.Inmanycases,bothwillbeintegraltothesamehydrogenprojects.ChinaNationalPetroleumPipelineEngineeringCorp(CPP,notlisted),istoCNPCwhatSinopecEngineeringistoSinopecandwillalsoplayakeyroleinpipelines.Infact,CPPbuiltChina’sfirstdemonstration7.4kmhydrogentransmissionpipelineandahydrogenandnaturalgasblendingfacilityinNingxia.LiquidorganicorinorganiccarriersHydrogencanbemovedinliquidcarriersthatabsorborreleasehydrogenbymeansofchemicalreactions.Theleadingorganiccarrierislikelytobemethylcyclohexane(MCH).Theleadinginorganiccarrier(thatis,lackinganycarbon-hydrogenbonds),islikelytobeammonia(NH3).Ammoniastandsoutasthemostobviouscarrierbecauseitiscarbonfreeandbecausesignificantammoniainfrastructurealreadyexists.Itisthesecondmostwidelyusedinorganicchemicalintheworld,withaglobalconsumptionlevelestimatedat180milliontonsperyear.Withammonia,thehydrogenisreadilyaccessible.Thereisjustoneatomofnitrogenbondedtothreeatomsofhydrogenandthecostofammoniaischeaperthandiesel.ThegreatbenefitofammoniaisthatitcanbecarriedintheexistinginfrastructurealreadyusedforgasolineandLNG.ByusingtheexistingLNGinfrastructureammoniacanbeusedtotransporthydrogenoverlongdistancesbysea.Forthisreasoncountriesthatwillbehighlydependentuponimportedhydrogen,suchasKoreaandJapan,areheavilyfocusedonammonia-basedfuelcellsolutions.Themainhurdletousingammoniaasacarrieristhecostofextractinghydrogenfromtheammonia,eitherfordirectuseinfuelcells(forvehicles,shipsortrains)orconvertedtoelectricityforelectricmotors.Thisrequiresacrackingdevicethatreleasesnitrogenfromtheammoniaintotheatmospherewhiletheremaininghydrogenisfedintotheadjacentfuelcell.Thekeyistouseonlyasmallpartoftheenergyfromthereactionitselftodrivethecontinuedcrackingprocess,meaningnogridpowerisrequiredintheprocess.Severaltechnologieshavebeendevelopedandareexpectedtobecommerciallyviableby2025.Afurthertechnicalhurdleistofindcheapercatalyststhatcanbreakwaterintoitsconstituenthydrogenandoxygenatoms,andthenaddnitrogenfromtheatmospheretocreateammonia.Ammoniaiswellsuitedtooff-gridsolutionstosupporthigh-valueremoteapplicationsinneedofcontinuouspowersuchasruralmedicalclinics,minesandremotetelecomtowers.Localizedammonia-basedpowergenerationfromfuelcellsmayhelptoavoidhighhydrogeninfrastructurecosts,thusloweringtheall-indeliverycost.Themaininitialuseforammoniawillbeintheshippingindustry,asdiscussedinthemarinetransportsection.ESGBulletin3December2021CCBISECURITIES18Investinginhydrogen–Fuelcells,fuelcelldrivetrainsTheChineseFuelCellElectricVehicle(FCEV)marketiswellcoveredbyChinesebrokersandislikelywellunderstoodbymostinvestorssoweshallnotexpandonthissegmenthaswehaveothers.TodateChinahaslaggedinthedevelopmentofitsFCEVcapacity,mostlybecauseofastrongerpolicyfocusonEVssince2015.However,theChinesefuelcellvehiclesubsidypolicyadoptedin2020hasshiftedtheindustryintoahighergear.ThepolicyaimstoenhancethemanufacturingcapacitiesofChina’sFCEVindustryandfocusesonusingfuelcellsinmedium-andheavy-dutycommercialvehicles.ThisfocusiswelltargetedbecausethisispreciselythesegmentwhereFCEVsaremostcompetitive.Mostothernationshavefocusedonpassengervehicleswherefuelcellsarelesscompetitive.Chinanowdominatesthebusandcommercialvehiclesegmentswith93%and99%oftheglobalstockofthesesectors,respectively.TheFCEVpilotprogramisgenerallyviewedashavingbeenasuccessandwillgreatlyinfluencenextyear’scomprehensivegovernmentplanforhydrogen.Thepilotprogramrewardsclustersofcitiesthatdeploymorethan1,000FCEVsthatmeetcertaintechnicalstandards,achieveamaximumdeliveredhydrogenpriceofRMB35/kg(~US$5/kg)andestablishatleast15operationalrefuelingstations.Weexpecttheprogramwillbeenlargedandgivenprogressivetargets.ThereremainssomedebateabouttheefficacyofFCEVsversusbatteryelectricvehicles(BEV)withtherespectiveCEOsofTeslaandVolkswagenbeingparticularlyvocalarguingthatFCEVswillneverbecompetitiveagainstBEVs.WhileitistruethatFCEVsmightneverbecompetitiveversusBEVsinurbancarsandbusesthattravelshortdistances,thebulkoftheresearchsuggeststhatFCEVswhichareheavydutytrucks,taxifleetsandbusesandlargercarstravelinglongerdistanceswillbecompetitivewithBEVsby2030ifnotbefore.TotalcostofownershipratiobetweenFCEV/BEVvehiclesSource:McKinseyCenterforFutureMobilityThechartabovecomparesnotthefuelcostbutthetotalcostofownershipofFCEVsversusBEVsforarangeofdifferentvehiclesbasedonprojectedcostsanddevelopmentsbytheMcKinseyCenterforFutureMobility.Whentheratiofallsbelow100%,FCEVsarecheaperthanBEVs.McKinsey’sfindingssuggestthatfuelcelltechnologiesareidealforheavy-dutyorlong-rangetransportapplications.Thesesegmentsincludeheavy-dutytrucks,largepassengervehicleswithlong-ranges,andlong-distancecoaches.McKinseyexpectsheavy-dutytrucksandcoacheswillachievecostparitywithBEVspriorto2025withoutamajorbreakthroughinbatterytechnologyduetothehighcostandweightofbatteriesandrelativelylongrechargingtimes.Meanwhile,largepassengervehicleswithlongrangesbreakevencloserto2030.ESGBulletin3December2021CCBISECURITIES19FindingssuchasthesearelikelytoreinforceChinesepolicymakers’emphasisonroadfreightandcoaches.AswithChina’sautoindustryasawhole,thefuelcellindustryisfragmentedwithalotofplayersandcollaborativepartnerships.OneoftheearliestJVspopularwithinvestorswasthatbetweenBallardPowerSystems,aleadingprovideroffuelcellsolutions,andwellknowndieselmanufacturerWeichaiPower(2338HK,NotRated).WeichaiPowerhasanindustrialchainforhydrogenfuelcommercialvehiclesthatcombinesbatteries,enginesandvehicles.Ithasalsodemonstratedinnovationcapabilityinthefuelcellindustry.IthasinvestedatotalofRMB4binR&Dandapplicationsinthefuelcellpowertrainsegment.WeichaiPower,alongwithBeijingSinoHytecCo.,Ltd(688339CH,NotRated),hastendedtobetheposterchildofthefuelcellconceptstocks.Aswellasmanufacturingitsownsystems,BeijingSinoHytecisamemberofthelargestfuelcellJV,calledUnitedFuelCellSystemR&D(FCRD).ThisgroupcomprisesofToyotaMotor,ChinaFAWCorporationLimited(Unlisted),DongfengMotorCorporation(600006CH,NotRated),GuangzhouAutomobileGroupCo.,Ltd.(2238HK,Outperform),BeijingAutomotiveGroupCo.,Ltd.(1958HK,Neutral),andBeijingSinoHytec.Toyotawillhavea65%stakeintheJV,meaningthattheotherswillhaverelativelylittleexposureviathepartnership.ItisessentiallyafinancialvehicletogeneratetechnologylicensingrevenueforToyota.OtherfuelcellcompaniesarelesswellestablishedthanWeichaiandSinoHytec.Thebetterestablishedoftheconceptplays,meaningtheyareactuallyproducing,wouldincludeShanxiMeijinEnergyCo(000723CH,NotRated),ShenzhenCenterPower(002733CH,NotRated),andAnhuiQuanchaiEngine(600218CH,NotRated).LesswellestablishednameswouldincludeKerongenvironment(300152CH,NotRated),ZhongshanBroad-OceanMotor(002249CH,NotRated),ZhejiangXinnengSolarPhotovoltaicTechnologyCoLtd(603105CH,NotRated),HanweiElectronicsGroupZhongtaiCo.,Ltd.(300007CH,NotRated),andGuangzhouSanfuNewMaterialsTechnologyLtd(688359CH,NotRated).ESGBulletin3December2021CCBISECURITIES20Investinginhydrogen–airandmarinetransportAirtransportTheIEA’sNetZeroscenarioforairtransportrestonthedevelopmentofsustainableaviationfuel(SAF)toreplaceconventionaljetfuel.Forshort-haulflightsinsmallairplanes(upto20passengers),hydrogenandfuelcellsareaviableoptionandarebeingtrialed.Mostemissionsinaviation,however,stemfromlong-haulflightsforwhichkeroseneiscurrentlytheonlyviableoption.Synthetickerosene,producedbycombiningcapturedcarbonwithgreenhydrogen,iscurrentlyseenasthemostpromisinglong-termoptiongiventheenormousvolumesrequiredtoprogressaviationtowardsnet-zeroemissions.IntheIEAscenario,China’suseofsynthetickerosenederivedfromhydrogenexpandsrapidly,especiallyafter2030,meetingone-quarterofthecountry’saviationfueldemandby2060.SynthetickerosenetookamajorstepforwardinFeb2021whenaKLMBoeing737flewascheduledpassengerservicefromAmsterdamtoMadridfueledwith500litersofzerocarbonsynthetickerosenemixedwithregularjetfuel.RoyalDutchShelliscurrentlytheonlyoilcompanymakingsynthetickerosene.Sinopec(386HK,NotRated)isalreadyresearchingsynthetickeroseneandwillprobablybetheonlyproducerinthecomingdecade.Themaindrawbackwithsynthetickerosenederivedfromhydrogenisthatitisexpensivecomparedtoconventionaljetfuelandbiofuelalternatives.Today,kerosenecostsapproximatelyUS$0.50perlitre,whilebiofuelscostUS$1.20toUS$1.50andhydrogen-basedsynfuelcostsUS$2.00toUS$2.30perlitre,dependingonthesourceofcarbon.Asgreenhydrogenproductioncostsdrop,synfuelwilleventuallybecomecostcompetitivewithbio-kerosenewhenusingcarboncapturedfromanindustrialprocess.HydrogenmustreachacostofUS$2.70perkgtobecomecompetitivewithbiofuels.MarinetransportTheIEA’sNetZeroscenariosformarinetransportrelyontheadoptionofhydrogenfuelcellsforcoastalshippingandammonia/hydrogen-basedsyntheticfuelininternalcombustionengines(ICEs)todrivelongdistanceshipping.Ammoniahasahighervolumetricenergydensitythaneitherhydrogenorelectricbatteriesandisanidealfuelforshipping.However,theburningofammoniaininternalcombustionenginesasafuelrequiresbreakthroughsincertaintechnicalareas,includingitstoxicityandnitrousoxideemissions.Theworld’sfirstammoniafuel-readyvessel(aSuezmaxtankerof160000DWT)isunderconstructionataChineseshipyardforaGreekshipowner.ThreeChineseharbors–Nanjing,CaojingandZhanjiang–haveammoniaterminalswithoverallstoragecapacityofaround120kt.Withsomemodifications,theseterminalscouldbeusedtorefuelvesselspoweredbyammoniaICEs.UndertheIEA’sNetZeroscenario,China’sammoniaproductionrisesfrom54Mtin2020to80Mtin2060,whentwo-thirdsgoestomaritimeshipping(meeting40%ofthesector’stotalenergyneeds).TherapidadoptionoftechnologiesneededtoreducedomesticandinternationalshippingemissionsenvisionedintheAPShingesontheinstallationofammoniabunkeringfacilities.ThehighestprioritywillneedtobegiventoShanghai,ShenzhenandNanjingastheyareamongthedozenmainportsworldwidethatwillneedtoleadthetransitiontoammonia.Chinaalsoneedstobuildpowersupplyfacilitiesforcoldironingandhydrogenbunkeringfacilitiestoserviceferries,cruiseshipsanddomesticfreightshipsthatswitchtoelectricityandfuelscells.TheleadplayerinChinesehydrogenapplicationsformarinetransportisthe718thResearchInstitute,whichisaresearcharmoftheworld’slargestshipbuilderChinaShipbuildingIndustryCorporation(601989CH,NotRated).CSICrecentlymoveditsR&DheadquartersforthedevelopmentofhydrogentotheHandanHydrogenEnergyEquipmentIndustrialParkintheHandanEconomicDevelopmentZoneinHebeion28Sep.Thisparkwillserveasakeyhubforhydrogenresearch,especiallyformarineapplications.Thiswillmakeitconvenientasitwishestomonitordevelopmentsinmarinetransport.Todate,itappearsthatthe718thInstitutehasbeenmostlyfocusedonthetechnologyofhydrogenproductionbyelectrolysisofwater.Itwasthefirstnationalscientificresearchunitengagedinhydrogenproductionbyelectrolysisofwater,andhascompletelyindependentintellectualpropertyrightsforanumberofhydrogenenergytechnologies.However,the718thInstitutehasalsobeenworkingonfuelcells.Itrecentlycompletedamooringtestforashipequippedwitha70KWcellinthewatersofYangzhou.CSSCPeruiHydrogenEnergyCompany(unlisted)wasformerlyaresearchinstituteofCSSCpriortothere-merger.Sincethere-mergerofCSSCwithCSIC,thisgrouphasassumedacommercialorientation.ThiscompanywillalsousetheHandanHydrogenEnergyEquipmentIndustrialParkasitsmainR&Dheadquartersandmanufacturingbase.ItseemslikelythatPeruiwillalsobethecommercialfrontofthe718thInstitute.Weexpectthiscompanywillbeoneofthemoreexcitinghydrogenopportunitieswhenitlists.ESGBulletin3December2021CCBISECURITIES21CSSCPeruiHydrogenTechnologyhasbegunexporting.Itrecentlydeliveredasetofcabinet-typePEMelectrolyzerstoalargechemicalcompanyinMalaysia,markingthefirstexportofthefirm’sPEMequipmentoverseas.Meanwhile,PeruirecentlyrevealedthatithassoldtwoelectrolyzerstoanIndianandaNepaleseclient,respectively.Thelattertwohavecompletedtestingrecently.TheIndiancontractfeatureda500m³/helectrolyzerwhichusessolarpowertoproducehydrogentobeusedforammonia(forfertilizer)production.WeexpectthatmostoftheresearcheffortsofCSICgoingforwardwillbeonfuelcellapplicationsforshipsandondevelopingnewtechniquesforproducinglowercostammoniafromhydrogen.Previously,theCSSC’s605Institutehasunveileda500KWfuelcelldesignforaprototypehydrogen-poweredcargovessel.Webelieveeffortsareunderwaytocommercializethisproduct.WhileCSICisthemainR&Dplayerinhydrogenapplicationsformarinetransport,othercompanieshavebegundevelopfuelcellandotherhydrogentechnologiesforshipping.TheannouncementofR&Dactivitiesforhydrogen-poweredshipshavebeenincreasedinthepastsixmonths.Effortstocommercializehydrogenarecurrentlyfocusedonusingfuelcellshipstopowersmalltomedium-sizedshipswithpowerratingsbelow1MW.OneR&DeffortinvolvesYaGuangTechnology(300123CH,NotRated)andtwosubsidiariesofQingyanHuake(000985CH,NotRated).ThisprojectusestechnologylinkedtoseveralresearchteamsatTsinghuaUniversity.WuhanbasedTroowinPowerSystemTechnologyCo(Unlisted)wasgrantedthefirstfuelcellapprovalformarinetransportbytheChinaClassificationSocietyinJanuary2021.Thesystemwillbetestedonapurpose-built2,100DWTbulkcarrierpoweredbyfour130kWhydrogenfuelcells.ESGBulletin3December2021CCBISECURITIES22Ratingdefinitions:Outperform(O)–expectedreturn>10%overthenexttwelvemonthsNeutral(N)–expectedreturnbetween-10%and10%overthenexttwelvemonthsUnderperform(U)–expectedreturn<-10%overthenexttwelvemonthsAnalystcertification:Theauthor(s)ofthisdocument,herebydeclarethat:(i)alloftheviewsexpressedinthisdocumentaccuratelyreflecthis/herpersonalviewsaboutanyandallofthesubjectsecuritiesorissuersandwerepreparedinanindependentmanner;(ii)nopartofanyofhis/hercompensationwas,is,orwillbedirectlyorindirectlyrelatedtothespecificrecommendationsorviewsexpressedinthisdocument;and(iii)he/shereceivesnoinsiderinformation/non-publicprice-sensitiveinformationinrelationtothesubjectsecuritiesorissuerswhichmayinfluencetherecommendationsmadebyhim.Theauthor(s)ofthisdocumentfurtherconfirmthat(i)neitherhe/shenorhis/herrespectiveassociate(s)(asdefinedintheCodeofConductforPersonsLicensedbyorRegisteredwiththeSecuritiesandFuturesCommissionissuedbytheHongKongSecuritiesandFuturesCommission)hasdealtin/tradedorwilldealin/tradethesecuritiescoveredinthisdocumentinamannercontrarytohis/heroutstandingrecommendation,orneitherhe/shenorhis/herrespectiveassociate(s)hasdealtinortradedinthesecuritiescoveredinthisdocumentwithin30calendardayspriortothedateofissueofthisdocumentorwillsodealinortradesuchsecuritieswithin3businessdaysafterthedateofissueofthisdocument;(ii)neitherhe/shenorhis/herrespectiveassociate(s)servesasanofficerofanyofthecompaniescoveredinthisdocument;and(iii)neitherhe/shenorhis/herrespectiveassociate(s)hasanyfinancialinterestsinthesecuritiescoveredinthisdocument.CCBIGrouphashadaninvestmentbankingrelationshipwithGCL-PolyEnergyHoldingsLtd[3800HK].Disclaimers:ThisdocumentispreparedbyCCBInternationalSecuritiesLimited.CCBInternationalSecuritiesLimitedisawholly-ownedsubsidiaryofCCBInternational(Holdings)Limited(“CCBIH”)andChinaConstructionBankCorporation(“CCB”).InformationhereinhasbeenobtainedfromsourcesbelievedtobereliablebutCCBInternationalSecuritiesLimited,itsaffiliatesand/orsubsidiaries(collectively“CCBIS”)donotguarantee,representandwarrant(eitherexpressorimplied)itscompletenessoraccuracyorappropriatenessforanypurposeoranypersonwhatsoever.Opinionsandestimatesconstituteourjudgmentasofthedateofthisdocumentandaresubjecttochangewithoutnotice.CCBISseekstoupdateitsresearchasappropriate,butvariousregulationsmaypreventitfromdoingso.Besidescertainindustryreportspublishedonaperiodicbasis,thelargemajorityofreportsarepublishedatirregularintervalsasappropriateaccordingtotheanalyst'sjudgment.Forecasts,projectionsandvaluationsareinherentlyspeculativeinnatureandmaybebasedonanumberofcontingencies.Readersshouldnotregardtheinclusionofanyforecasts,projectionsandvaluationsinthisdocumentasarepresentationorwarrantybyoronbehalfofCCBISthattheseforecasts,projectionsorvaluationsortheirunderlyingassumptionswillbeachieved.Investmentinvolvesriskandpastperformanceisnotindicativeoffutureresults.Informationinthisdocumentisnotintendedtoconstituteorbeconstruedaslegal,financial,accounting,business,investment,taxoranyprofessionaladviceforanyprospectiveinvestorsandshouldnotberelieduponinthatregard.Thisdocumentisforinformationalpurposesonlyandshouldnotbetreatedasanofferorsolicitationforthepurchaseorsaleofanyproducts,investments,securities,tradingstrategiesorfinancialinstrumentsofanykindinanyjurisdiction.CCBISmakesnorepresentationsontheavailabilityofthesecuritiescoveredinthisdocument(orrelatedinvestment)totherecipients.Thesecuritiesdescribedhereinmaynotbeeligibleforsaleinalljurisdictionsortocertaincategoriesofinvestors.NeitherCCBISnoranyotherpersonsacceptanyliabilitywhatsoeverforanylossordamages(whetherdirect,indirect,incidental,exemplary,compensatory,punitive,specialorconsequential)arisingfromanyuseofthisdocumentoritscontentsorotherwisearisinginconnectiontherewith.Securities,financialinstrumentsorstrategiesmentionedhereinmaynotbesuitableforallinvestors.Theopinionsandrecommendationshereindonottakeintoaccountprospectiveinvestors’financialcircumstances,investmentobjectives,orparticularneedsandarenotintendedasrecommendationsofparticularsecurities,financialinstrumentsorstrategiestoanyprospectiveinvestors.Therecipientsofthisdocumentshouldconsiderthisdocumentasonlyasinglefactorinmarkingtheirinvestmentdecisionandshallbesolelyresponsibleformakingtheirownindependentinvestigationofthebusiness,financialconditionandprospectsofcompaniesreferredtointhisdocument.Readersarecautionedthat(i)thepriceandvalueofsecuritiesreferredtointhisdocumentandtheincomederivedfromthemmayfluctuate;(ii)pastperformanceisnotaguidetofutureperformance;(iii)anyanalysis,ratingsandrecommendationsmadeinthisdocumentareintendedforlong-term(atleastfor12months)andisnotlinkedtoanear-termassessmentofthelikelyperformanceofthesecuritiesorcompaniesinquestion.Inanyevent,futureactualresultsmaydiffermateriallyfromthosesetforthinanyforward-lookingstatementsherein;(iv)futurereturnsarenotguaranteed,andalossoforiginalcapitalmayoccur;and(v)fluctuationsinexchangeratesmayadverselyaffectthevalue,priceorincomeofanysecurityorrelatedinstrumentreferredtointhisdocument.Itshouldbenotedthatthisdocumentcoversonlythosesecuritiesorcompaniesasspecifiedhereinanddoesnotextendtoanyderivativeinstrumentsthereof,thevalueofwhichmaybeaffectedbymanyfactorsandmaynotcorrespondwiththevalueoftheunderlyingsecurities.Tradingintheseinstrumentsisconsideredriskyandarenotsuitableforallinvestors.Whileallreasonablecarehasbeentakentoensurethatthefactsstatedhereinareaccurateandthattheforward-lookingstatements,opinionsandexpectationscontainedhereinarebasedonfairandreasonableassumptions,CCBIShasnotbeenabletoverifyindependentlysuchfactsorassumptionsandCCBISshallnotbeliablefortheaccuracy,completenessorcorrectnessthereofandnorepresentationorwarrantyismade,expressorimplied,inthisregard.Allpricingreferredtointhisdocumentisasofthecloseoflocalmarketforthesecuritiesdiscussed,unlessotherwisestatedandforinformationpurposesonly.Thereisnorepresentationthatanytransactioncanorcouldhavebeeneffectedatthoseprices,andanypricesdonotnecessarilyreflectCCBIS’internalbooksandrecordsortheoreticalmodel-basedvaluationsandmaybebasedoncertainassumptions.Differentassumptionscouldresultinsubstantiallydifferentresults.Anystatementswhichmaybecontainedhereinattributedtoathird-partyrepresentCCBIS’interpretationofthedata,informationand/oropinionsprovidedbythatthirdpartyeitherpubliclyorthroughasubscriptionservice,andsuchuseandinterpretationhavenotbeenreviewedorendorsedbythethirdparty.ReproductionanddistributionofthesethirdpartycontentsinanyformisprohibitedexceptwiththepriorESGBulletin3December2021CCBISECURITIES23writtenconsentofsuchthirdparty.Therecipientsmustmaketheirownassessmentsoftherelevance,accuracyandadequacyoftheinformationcontainedinthisdocumentandmakesuchindependentinvestigationastheymayconsidernecessaryorappropriateforsuchpurpose.Recipientsshouldseekindependentlegal,financial,accounting,business,investmentand/ortaxadviceiftheyhaveanydoubtaboutthecontentsofthisdocumentandsatisfythemselvespriortomakinganyinvestmentdecisionthatsuchinvestmentisinlinewiththeirowninvestmentobjectivesandhorizons.Useofhyperlinkstootherinternetsitesorresources(ifany)asreferredtointhisdocumentisatusers’ownrisk.Theyareprovidedsolelyforthepurposeofconvenienceandinformationandthecontentoftheseinternetsitesorresourcesdoesnotinanywayformpartofthisdocument.Thecontents,accuracy,opinionexpressed,andotherlinksprovidedatthesesitesarenotinvestigated,verified,monitored,orendorsedbyCCBIS.CCBISexpresslydisclaimsanyresponsibilityforanddoesnotguarantee,representandwarrant(eitherexpressorimplied)thecompleteness,accuracy,appropriateness,availabilityorsecurityofinformationfoundonthesewebsites.Usersofthesewebsitesaresolelyresponsibleformakingallenquiries,investigationandriskassessmentbeforeproceedingwithanyonlineorofflineaccessortransactionwithanyofthesethirdparties.Allactivitiesconductedbyusersviaoratthesewebsitesareattheirownrisk.CCBISdoesnotguaranteethesecurityofanyinformationusersmayforwardorberequestedtoprovidetoanythirdpartiesviathesewebsites.UsersaredeemedtohaveirrevocablywaivedanyclaimsagainstCCBISforanylossordamagesufferedasaresultofanyaccesstoorinteractionwithanyofthesewebsites.UponrequestCCBISmayprovidespecializedresearchproductsorservicestocertaincustomersfocusingontheprospectsforspecificsecuritiesascomparedwithothercoveredsecuritiesovervaryingtimehorizonsorunderdifferingmarketconditions.Whiletheviewsexpressedinthesesituationsmaynotalwaysbedirectionallyconsistentwiththelong-termviewsexpressedintheanalyst'spublishedresearch,CCBIShasproceduresinplacetopreventselectivedisclosureandwillupdatetherelevantreaderswhenourviewshaschanged.CCBISalsohasproceduresinplacetoidentifyandmanagepotentialconflictsofinterestthatmayariseinconnectionwithitsresearchbusinessandservices.ChineseWallproceduresarealsoinplacetoensurethatanyconfidentialand/orpricesensitiveinformationisproperlyhandled.CCBISwilluseitsbestendeavorstocomplywiththerelevantlawsandregulationsinthisrespect.Nevertheless,therecipientsshouldbeawarethatCCB,CCBIS,theiraffiliatesand/ortheirofficers,directorsandemployeesmaydobusinesswiththeissuer(s)ofthesecuritiescoveredinthisdocument,includinginvestmentbankingbusinessordirectinvestmentbusinessormayholdinterestin(and/orlateraddordispose)suchsecurities(orinanyrelatedinvestment)forthemselvesand/oronbehalfoftheirclientsfromtimetotime.Asaresult,investorsshouldbeawarethatCCBISmayhaveaconflictofinterestthatcouldaffecttheobjectivityofthisdocumentandCCBISwillnotassumeanyresponsibilityinrespectthereof.Further,theinformationcontainedhereinmaydifferorbecontrarytoopinionsexpressedbyotherassociatesofCCBISorothermembersoftheCCBorCCBIHgroupofcompanies.Wherethisdocumentreferstoanyproducts,investments,securities,financialinstrumentsorindustrysectors,thisisfortheinformationoftheinstitutionalandprofessionalcustomersofCCBISonlyandthisdocumentshouldnotbedistributedtoretailcustomers.ThisdocumentisnotdirectedatyouifCCBISisprohibitedorrestrictedbyanylegislationorregulationinanyjurisdictionfrommakingitavailabletoyou.YoushouldsatisfyyourselfbeforereadingitthatCCBISispermittedtoprovideresearchmaterialconcerninginvestmentstoyouandthatyouarepermittedandentitledtoreceiveandreadthedocumentunderrelevantlegislationandregulations.Inparticular,thisdocumentisonlydistributedtocertainUSPersonstowhomCCBISispermittedtodistributeaccordingtoUSsecuritieslaws,butcannototherwisebedistributedortransmitted,whetherdirectlyorindirectly,intotheUSortoanyotherUSperson.AnyUSperson(asdefinedundertheExchangeActortheU.S.InternalRevenueCodeof1986,asamended)whoisarecipientofthismaterialwishingtoeffectanytransactiontobuyorsellsecuritiesorrelatedfinancialinstrumentsbasedontheinformationprovidedhereinshoulddirectsuchtransactionexclusivelytoandsuchtransactionshallbeeffectedonlythroughCCBInternationalOverseas(USA),Inc.Thisdocumentalsocannotbedistributedortransmitted,whetherdirectlyorindirectly,intoJapanandCanadaandnottothegeneralpublicinthePeople’sRepublicofChina(forthepurposeofthisdocument,excludingHongKong,MacauandTaiwan)unlessunderapplicablelaws.Anyunauthorizedreproductionorredistributionbyanymeanstoanypersons,inwholeorinpartofthisdocumentisstrictlyprohibitedandCCBISacceptsnoliabilitywhatsoeverfortheactionsofthirdpartiesindistributingthisresearchreport.Ifthisdocumenthasbeendistributedbyelectronictransmission,suchase-mail,thensuchtransmissioncannotbeguaranteedtobesecureorerror-freeasinformationcouldbeintercepted,corrupted,lost,destroyed,arrivelateorincomplete,orcontainviruses.CCBISthereforedoesnotacceptliabilityforanyerrorsoromissionsinthecontentsofthisdocument,whichmayariseasaresultofelectronictransmission.ThedisclosurescontainedinthisdocumentpreparedbyCCBISshallbegovernedbyandconstruedinaccordancewiththelawsofHongKong.DistributioninSingapore:Theinformation/researchhereinispreparedbyCCBInternationalSecuritiesLimited(“CCBIS”),aforeignaffiliateofCCBInternational(Singapore)PteLtd(“CCBISG”)(Co.Reg,No.201531408W).CCBISGholdsacapitalmarketsserviceslicensefromtheMonetaryAuthorityofSingaporeforfundmanagement,dealingincapitalmarketproducts(specificallysecuritiesandcollectiveinvestmentschemes)andprovidingcustodialservices,andisanExemptFinancialAdviserundertheFinancialAdvisersActinrespectofadvisingothersbyissuingorpromulgatingresearchanalysisorresearchreports.CCBISmaydistributeinformation/researchpursuanttoanarrangementwithCCBISGunderRegulation32CoftheFinancialAdvisersRegulations.CCBISislicensedinHongKongtoprovidesuchinformation/researchreports.SingaporerecipientsshouldcontactCCBISGat+65-68071880formattersarisingfrom,orinconnectionwiththeinformationdistributed.Copyright2021CCBIS.Thesigns,logosandinsigniausedinthisresearchreportandthecompanyname“CCBInternationalSecuritiesLimited”aretheregisteredandunregisteredtrademarksofCCB,CCBIHand/orCCBIS.Allrightsareherebyreserved.Allmaterialpresentedinthisdocument,unlessindicatedotherwise,isundercopyrighttoCCBIS.Thisdocumentoranyportionhereofmaynotbereproduced,soldorredistributedwithoutthewrittenconsentofCCBIS.CCBInternationalSecuritiesLimited12/F,CCBTower,3ConnaughtRoad,Central,HongKongTel:(852)39118000/Fax:(852)25370097

VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP