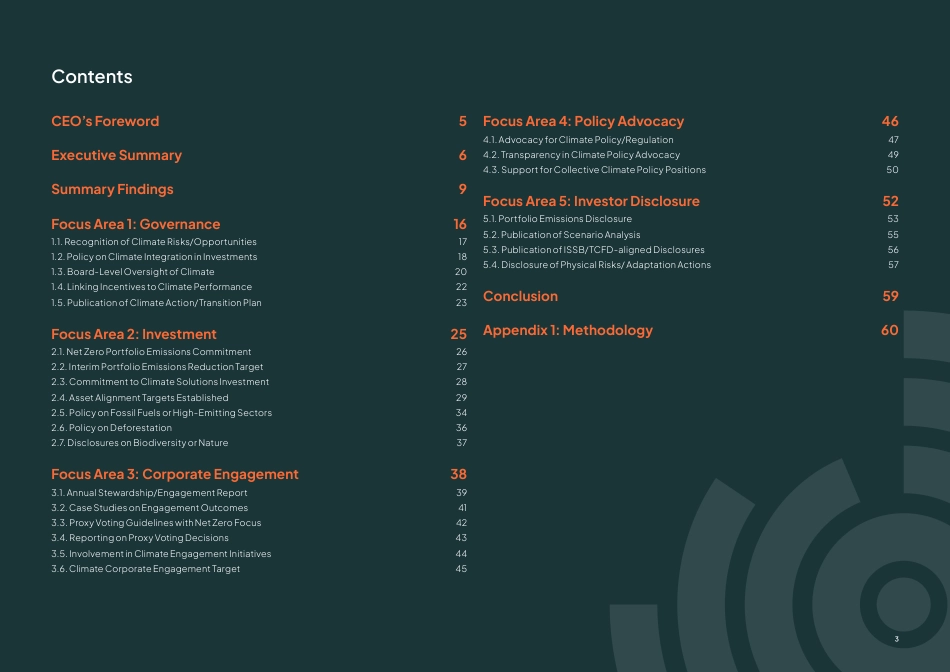

StateofInvestorClimateTransitioninAsia2025AsianInstitutionalInvestorClimateProgressApril2025SponsoredbySupportingorganisationsAbouttheAsiaInvestorGrouponClimateChange.WeareaninitiativetocreateawarenessandencourageactionamongAsia’sassetownersandassetmanagersabouttherisksandopportunitiesassociatedwithclimatechangeandlow-carboninvesting.AIGCCprovidescapacityandatrustedforumforinvestorsactiveinAsiatosharebestpracticeandtocollaborateoninvestmentactivity,creditanalysis,riskmanagement,engagementandpolicyrelatedtoclimatechange.Ourmembersarecustodiansofmorethan$28trillionglobally,includeassetowners,assetmanagersandcomefrom11differentmarketsinAsiaandinternationally.Weareanot-for-profitorganisation,fundedbymembers’fees,philanthropy,partnerships,andsponsorshipfromsupporterswhounderstandthepowerofcapitaltosupportclimateaction.Withastronginternationalprofile,AIGCCalsoengageswithgovernmentpensionandsovereignwealthfunds,familyoffices,andendowments,AIGCCrepresentstheAsianinvestorperspectiveintheevolvingglobaldiscussionsonclimatechangeandthetransitiontoanet-zeroemissionseconomy.AboutThisReportThisreportistheregion’smostcomprehensiveandrigoroussnapshotoftheindustry’sprogressinnavigatingtherisksandopportunitiesassociatedwithclimatechange,averysignificantfactorinfinancialreturnstobeneficiaries.Itisbasedonanextensivedesktopreviewof230significantinvestorsacrossAsia,withmedianassetsundermanagement(AUM)ofapproximatelyUS$100billion.Thiscohortcomprises113AssetOwnersand117AssetManagers,withapproximately80%headquarteredacross19Asianmarkets.Thisissupplementedwithmoregranulardatafrom52investorswhoparticipatedintheAIGCCClimateInvestmentSurvey2024.Assuch,thereportrepresentsmainstreamcapitalownershipandmanagementwithintheAsiaregion.Refertothemethodologyformoredetails.AcknowledgmentsSpecialthankstothememberswhoprovidedtheirperspectives,feedbackandinformationthatfedintothisproject.FromAIGCC,HarrisonSmithledthisproject,withinputfromacrossAIGCC.Thereport’sleadsponsorisMSCI,andsupportingsponsorsareASIFMA,ChinaSIF,JSIF,HKGFAandKOSIF.Wearedeeplygratefulfortheirsupport.IndividualAIGCCmembersmayholddifferentviewsandinformationfromwhatisinthispaper.TheAsiaInvestorGrouponClimateChangetakessoleandfinalresponsibilityforthecontentofthispaper.Pleaserefertothedisclaimeronthefinalpageformoreimportantlegalinformation.2ContentsCEO’sForeword5ExecutiveSummary6SummaryFindings9FocusArea1:Governance161.1.RecognitionofClimateRisks/Opportunities171.2.PolicyonClimateIntegrationinInvestments181.3.Board-LevelOversightofClimate201.4.LinkingIncentivestoClimatePerformance221.5.PublicationofClimateAction/TransitionPlan23FocusArea2:Investment252.1.NetZeroPortfolioEmissionsCommitment262.2.InterimPortfolioEmissionsReductionTarget272.3.CommitmenttoClimateSolutionsInvestment282.4.AssetAlignmentTargetsEstablished292.5.PolicyonFossilFuelsorHigh-EmittingSectors342.6.PolicyonDeforestation362.7.DisclosuresonBiodiversityorNature37FocusArea3:CorporateEngagement383.1.AnnualStewardship/EngagementReport393.2.CaseStudiesonEngagementOutcomes413.3.ProxyVotingGuidelineswithNetZeroFocus423.4.ReportingonProxyVotingDecisions433.5.InvolvementinClimateEngagementInitiatives443.6.ClimateCorporateEngagementTarget45FocusArea4:PolicyAdvocacy464.1.AdvocacyforClimatePolicy/Regulation474.2.TransparencyinClimatePolicyAdvocacy494.3.SupportforCollectiveClimatePoli...

VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP