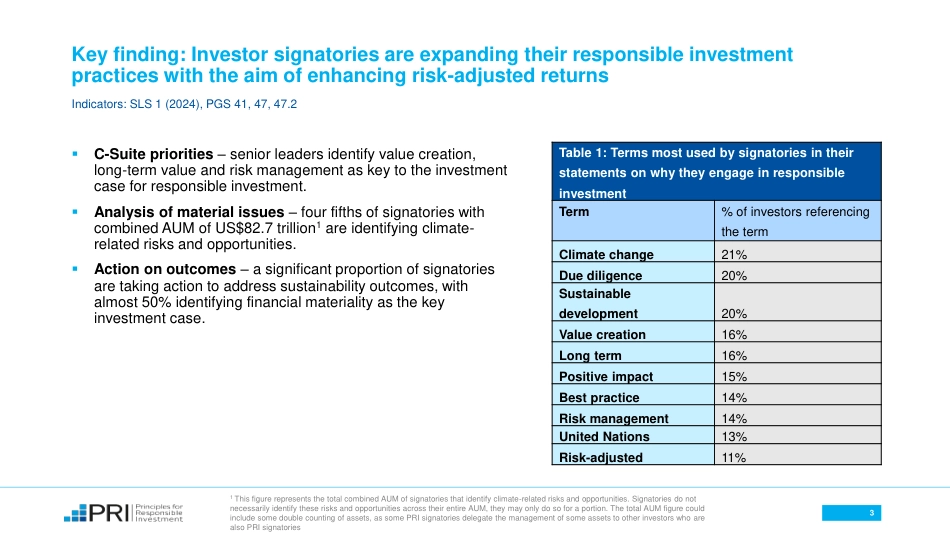

-RESPONSIBLEINVESTMENT-Globalresponsibleinvestmenttrends:insidePRIreportingdata2024/5KeyfindingsOverallsummary▪Investorsignatoriesareexpandingtheirresponsibleinvestmentpracticeswiththeaimofenhancingrisk-adjustedreturns(slide3)▪Assetownersaredemonstratinggreateractionandambition(slide4)▪Analysisofinvestmentmanagers’approachestoresponsibleinvestmentisbecomingmoregranular(slide5)▪Actioninprivatemarketsiscontinuingtoexpand(slide6)▪Moreinvestorsaretakingactiontoaddressclimate-relatedrisksandopportunities(slide7)▪Socialissuesarerisinguptheagenda(slide8)2Keyfinding:Investorsignatoriesareexpandingtheirresponsibleinvestmentpracticeswiththeaimofenhancingrisk-adjustedreturnsIndicators:SLS1(2024),PGS41,47,47.2▪C-Suitepriorities–seniorleadersidentifyvaluecreation,long-termvalueandriskmanagementaskeytotheinvestmentcaseforresponsibleinvestment.▪Analysisofmaterialissues–fourfifthsofsignatorieswithcombinedAUMofUS$82.7trillion1areidentifyingclimate-relatedrisksandopportunities.▪Actiononoutcomes–asignificantproportionofsignatoriesaretakingactiontoaddresssustainabilityoutcomes,withalmost50%identifyingfinancialmaterialityasthekeyinvestmentcase.31ThisfigurerepresentsthetotalcombinedAUMofsignatoriesthatidentifyclimate-relatedrisksandopportunities.SignatoriesdonotnecessarilyidentifytheserisksandopportunitiesacrosstheirentireAUM,theymayonlydosoforaportion.ThetotalAUMfigurecouldincludesomedoublecountingofassets,assomePRIsignatoriesdelegatethemanagementofsomeassetstootherinvestorswhoarealsoPRIsignatoriesTable1:TermsmostusedbysignatoriesintheirstatementsonwhytheyengageinresponsibleinvestmentTerm%ofinvestorsreferencingthetermClimatechange21%Duediligence20%Sustainabledevelopment20%Valuecreation16%Longterm16%Positiveimpact15%Bestpractice14%Riskmanagement14%UnitedNations13%Risk-adjusted11%Keyfinding:AssetownersdemonstratinggreateractionandambitionIndicators:PGS24,37,41,47.1(2024)•Areasofdifferencewithinvestmentmanagersinclude:oCollaborativestewardship–48%ofassetownersprioritisecollaborativestewardshipoverconductingstewardshipeffortsindependently,comparedto19%ofinvestmentmanagers.oParisAgreement–ahigherproportionofassetownersthaninvestmentmanagersusetheParisAgreementasaframeworktoidentifysustainabilityoutcomesconnectedtoinvestments(45%vs25%).oEscalationinstewardship–almostdoublethepercentageofassetownersarewillingtousepublicengagementasameansofescalatingdialogueswithcorporatedebtissuers.oIdentifyingclimate-relatedrisks–assetownersarelikeliertotakealonger-termapproachtoidentifyingclimate-relatedrisksandopportunitiesandtouseclimatescenarioanalysis(58%vs29%).42Figure1.Indicator:PGS47.1(2024).Denominators:2,651(investmentmanagers),397(assetowners)45%25%Figure1:percentageofsignatoriesusingtheParisAgreementasaframeworktoidentifysustainabilityoutcomesconnectedtoinvestments2AssetownersInvestmentmanagersKeyfinding:Analysesofinvestmentmanagers’approachestoresponsibleinvestmentbecomingmoregranularIndicators:SAM5,7,8,9,16(2024),SAM5,7,8,9,16(2023)•Broad-basedaction–integratingresponsibleinvestmentobjectivesandconsiderationsintotheselectionofmanagersisnowwelldevelopedandthedatashowspracticescontinuetomature.•Votingalignment–areasofnotableyear-on-yearchangeincludeevaluationofproxyvotingpolices.•Contracts–mostassetownersignatoriesreportincludingclausesrelatingtoRIincontractualagreementswithex...

VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP