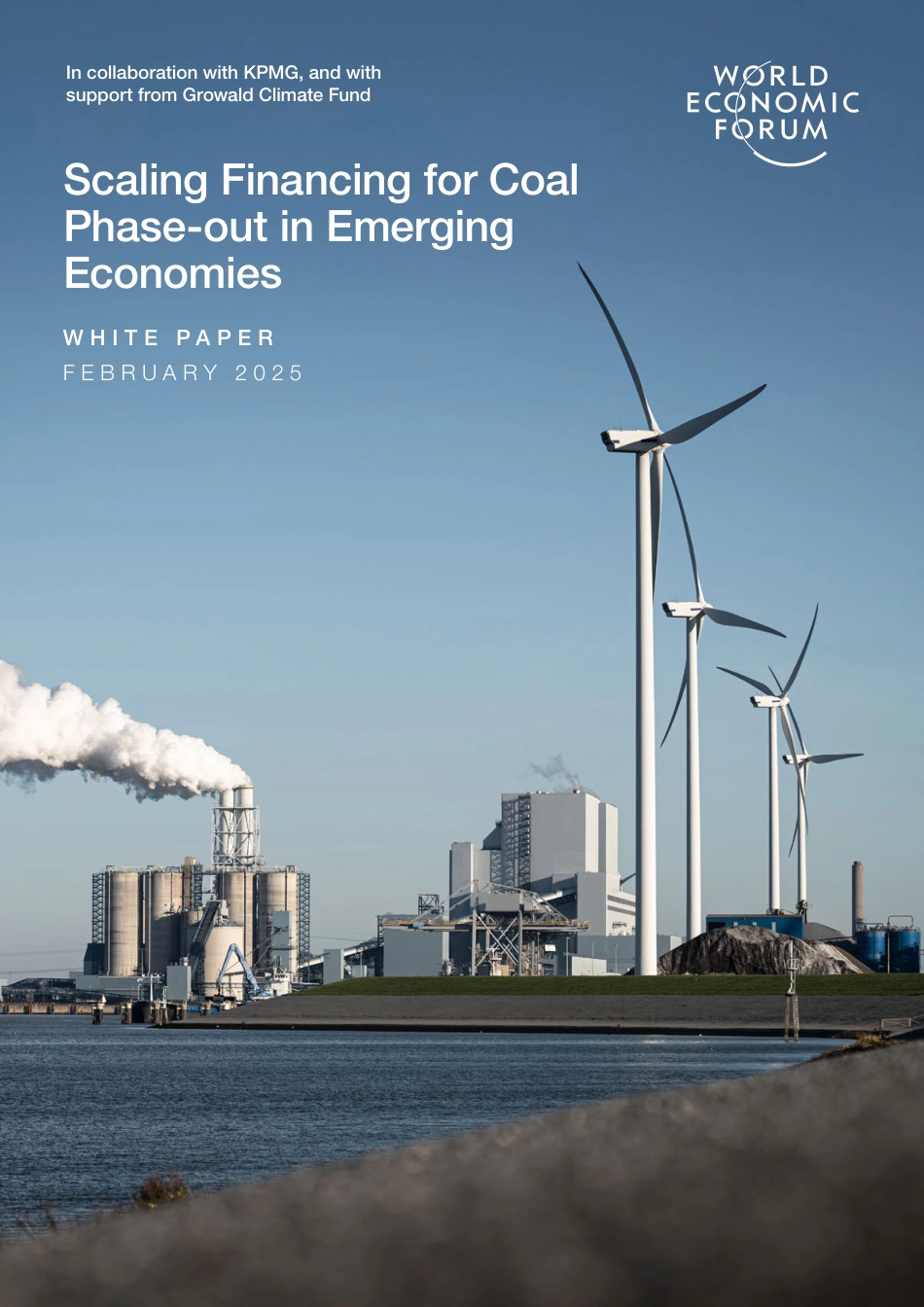

ScalingFinancingforCoalPhase-outinEmergingEconomiesWHITEPAPERFEBRUARY2025IncollaborationwithKPMG,andwithsupportfromGrowaldClimateFundImages:GettyImagesDisclaimerThisdocumentispublishedbytheWorldEconomicForumasacontributiontoaproject,insightareaorinteraction.Thefindings,interpretationsandconclusionsexpressedhereinarearesultofacollaborativeprocessfacilitatedandendorsedbytheWorldEconomicForumbutwhoseresultsdonotnecessarilyrepresenttheviewsoftheWorldEconomicForum,northeentiretyofitsMembers,Partnersorotherstakeholders.©2025WorldEconomicForum.Allrightsreserved.Nopartofthispublicationmaybereproducedortransmittedinanyformorbyanymeans,includingphotocopyingandrecording,orbyanyinformationstorageandretrievalsystem.ContentsForeword3Executivesummary4Introduction51Bridgingtheeconomicgap:Financingleversforearlyphase-out72Strategicuseofconcessionalfinancing:InsightsfromthePhilippines82.1.Overviewoftheanalysis82.2.Findings122.3.Implicationsforcoalphase-outfinancing152.4.Accesstofinance172.5.Mobilizingcomplementarycoalphase-outtools183Buildingcrediblephase-outplans21Conclusion23Acronyms24Glossary25Contributors27Endnotes28ScalingFinancingforCoalPhase-outinEmergingEconomies2ForewordThetaskoftransitioningfromcoaltocleanerenergysourceshasneverbeenmoreurgent.Withcoalpowergenerationin2024expectedtohavereachedrecordlevelsaccordingtotheInternationalEnergyAgency(IEA),thepathtoalow-carbonfuturedependsonacceleratingthisshift.Yet,financingcoalphase-outremainsoneofthemostcomplexandpressingclimatechallengesofourtime.Thispaper,developedthroughexpertconsultationsundertheWorldEconomicForum’sCoal-to-CleanInitiative,offerscriticalnewinsightsintoscalingfinancingsolutionsforcoalretirementinemerginganddevelopingeconomies(EMDEs).Ithighlightstheimportantrolecoalretirementmechanisms(CRMs)basedonfinancialrestructuringcanplayinhelpingretiresomeplantsearly.Thesemechanismsofferasimpleandreplicableapproach,providingstrongincentivesforassetownersconcernedabouttransitionrisks.Byenablingearlyequitypayouts–potentiallytiedtoreinvestmentinrenewables–re-gearingCRMscanmakethebusinesscasemoreattractiveandhelpexpandthepipelineofcoal-firedpowerplants(CFPPs)willingandeligibleforearlyretirement,akeybottleneckinacceleratingthecoal-to-cleantransition.Ofcourse,financialrestructuringisjustpartofthesuiteoffinancialtoolsandpolicieswhichwillbeneededtoacceleratethistransition.Governmentscanplayacrucialrolebysettingclearlong-termgoalsbackedbypolicieswhichimposecostsonassetownersandaddressbarrierstocleanenergyscale-up.Meanwhile,concessionalfinancingremainskeytocrowdinginprivatecapital,particularlygiventhatfewdemonstrationprojectsexist,whilelargerandnewercoalassets,whichstillhavesubstantialcapitalinvestmentstorecoup,mayrequiremechanismsliketransitioncreditstofacilitateearlyclosure.Furthertestinganddiscussionoftheseapproachesarecrucialtoscalingthecoal-to-cleantransition.TheWorldEconomicForum’sCoal-to-CleanInitiativelooksforwardtoworkingwithitscommunitytodevelopthebroadsuiteoffinancingtoolsandpolicies,andtheinvestiblefinancingsolutionsneededtoacceleratecoalphase-out,whileensuringenergysecurityandsafeguardingtherightsandinterestsofworkersandcommunities.ScalingFinancingforCoalPhase-outinEmergingEconomiesFebruary2025EspenMehlumHead,EnergyTransitionIntelligenceandRegionalAcceleration,CentreforEnergyandMaterials,WorldEconomicForumMikeHayesGlob...

VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP