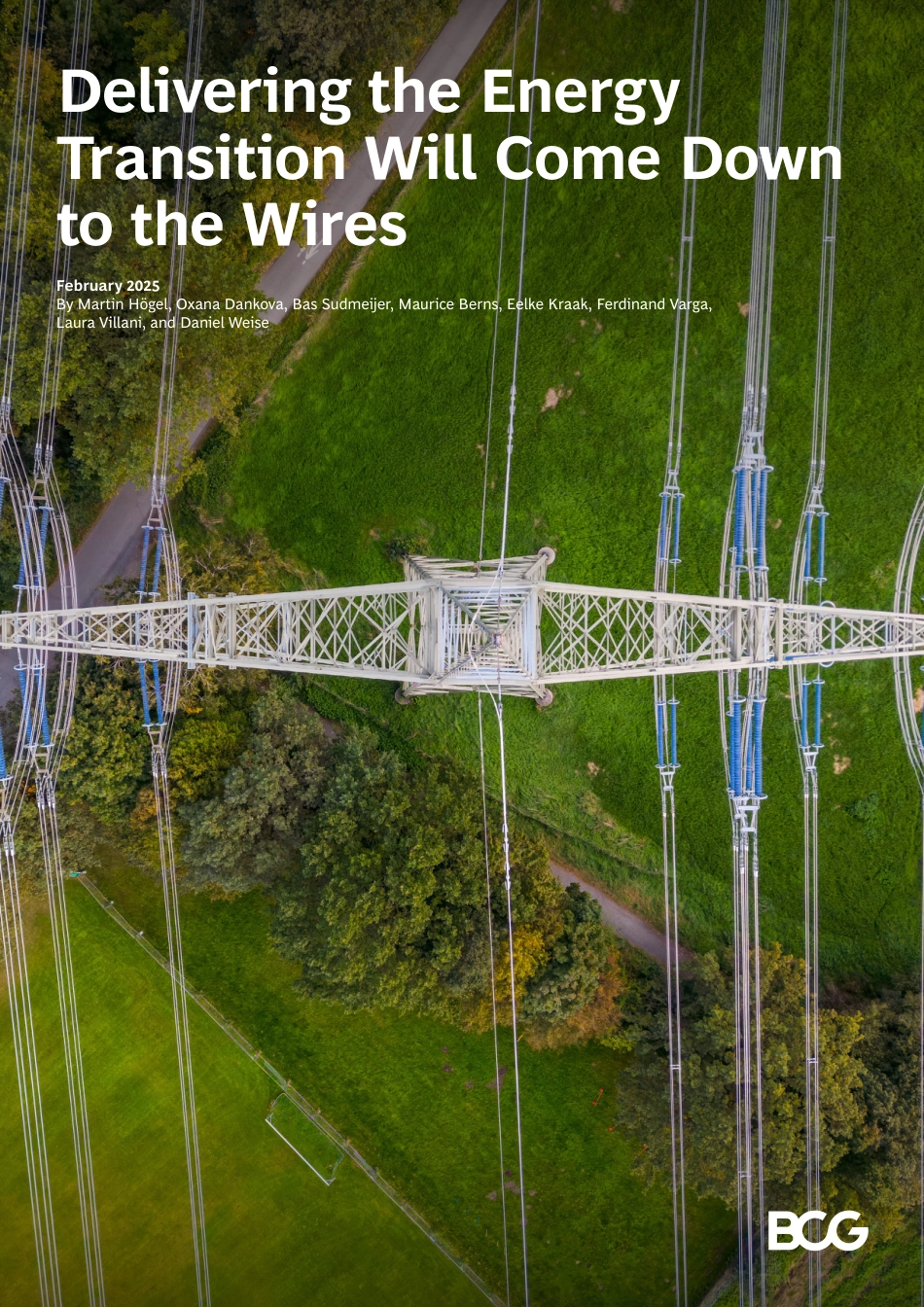

DeliveringtheEnergyTransitionWillComeDowntotheWiresFebruary2025ByMartinHögel,OxanaDankova,BasSudmeijer,MauriceBerns,EelkeKraak,FerdinandVarga,LauraVillani,andDanielWeiseBostonConsultingGrouppartnerswithleadersinbusinessandsocietytotackletheirmostimportantchallengesandcapturetheirgreatestopportunities.BCGwasthepioneerinbusinessstrategywhenitwasfoundedin1963.Today,weworkcloselywithclientstoembraceatransformationalapproachaimedatbenefitingallstakeholders—empoweringorganizationstogrow,buildsustainablecompetitiveadvantage,anddrivepositivesocietalimpact.Ourdiverse,globalteamsbringdeepindustryandfunctionalexpertiseandarangeofperspectivesthatquestionthestatusquoandsparkchange.BCGdeliverssolutionsthroughleading-edgemanagementconsulting,technologyanddesign,andcorporateanddigitalventures.Weworkinauniquelycollaborativemodelacrossthefirmandthroughoutalllevelsoftheclientorganization,fueledbythegoalofhelpingourclientsthriveandenablingthemtomaketheworldabetterplace.DELIVERINGTHEENERGYTRANSITIONWILLCOMEDOWNTOTHEWIRES3Electricitytransmissionanddistributiongridshaveapivotalroletoplayintheenergytransition.Today,politiciansandenergyexpertsalikearetakingastheirmotto:"Thereisnotransitionwithouttransmission,nosolutionwithoutdistribution."Creatingelectricitygridsthatarefitforadecarbonizedworldwillrequirehugeinvestment.AccordingtotheInternationalEnergyAgency(IEA),$25trillionwillbeneededforgridinvestmentfromnowthroughto2050toachievenetzero.Thatfigureisequivalenttoaboutone-quarteroftheworld'sannualeconomicoutputtoday.Itisalsoaboutthesameamountthatwillberequiredtopayforincreasedglobalsolarandwindcapacityby2050.Transmissionanddistributiongridsplaydifferentbutequallyimportantrolesintheenergytransition.Yettransmissiongrids(themainfocusofthisarticle)tendtoreceivemorepublicattentionbecauseoftheirbiggervisualimpact,variousrepercussionsoftheirconstruction,andtheirsymbolicrole.Astransmissiongridcompaniesembarkonthisonce-in-a-generationtask,theyfacecriticalchallengesinfiveareas:•Gridcompaniesarealreadyoperatingwithconstrainedsupplychains,resultinginsevereshortagesandhigherpricesforcriticalequipmentandservices.Thepriceofhigh-voltage,directcurrent(HVDC)cables,forexample,hasrisenby50%overthepastfewyearsevenasorderleadtimeshavetripled.•Mostgridcompanieslackthecapabilitiesandworkforcecapacitytodeliverthethree-tofivefoldincreaseincapitalexpenditures(capex)neededifplayersaretoachievetheirbuild-outgoals.•Governmentleadersareexertingsubstantialpressureoncompaniestobuildfaster.Butlocaloppositiontoprojects—togetherwithcomplexplanningrulesand,attimes,theregulatoryenvironment—createsadditionalhurdlesforgridcompanies.•Theamountofcapitalinvolvedwillputpressureonelectricitybillsandtriggerassociatedresistancefromconsumers.Furthermore,thefinancingofgridinvestmentsisalreadyseverelystrainingmanycompanies'balancesheets.•Manygridcompaniesfacegrowinggridcongestion,furthercomplicatinggridbuild-outs.Itwilltaketimeforcompanies'plannedgridexpansionstoalleviatethisproblem.AlthoughtheachievabilityoftheIEA’sNetZeroEmissionsscenarioisreceivingincreasingscrutiny,thesechallenges(andtheanalysesandconclusionsinthisarticle)holdtruewithalternativescenariosaswell.WhethertheissueisnetzeroorloadgrowththroughAIormoreefficientuseofexistinggridcapacity—suchasthroughmoreflexibledemandmanagement—wewillneedalotmoreelectricitygrid.Todelivert...

VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP