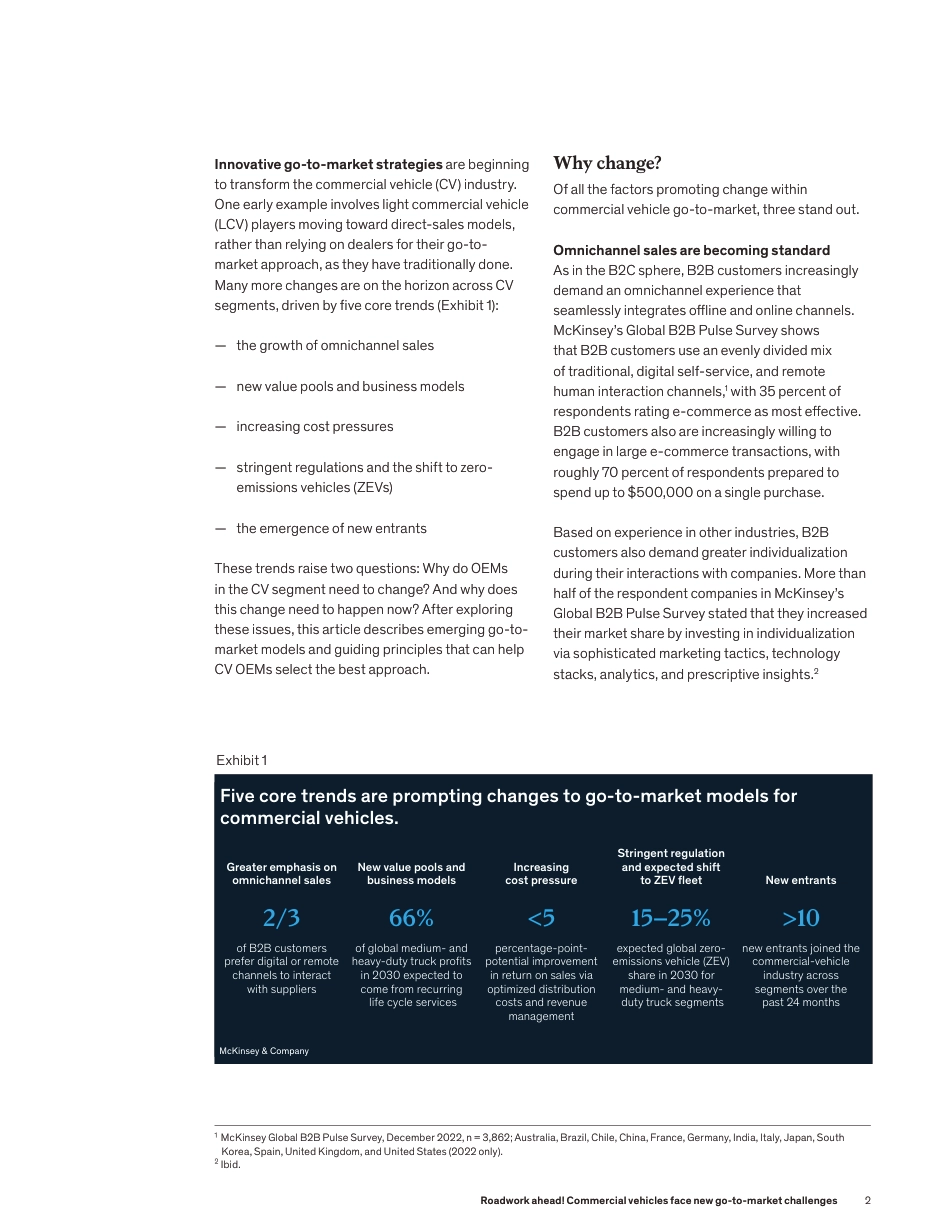

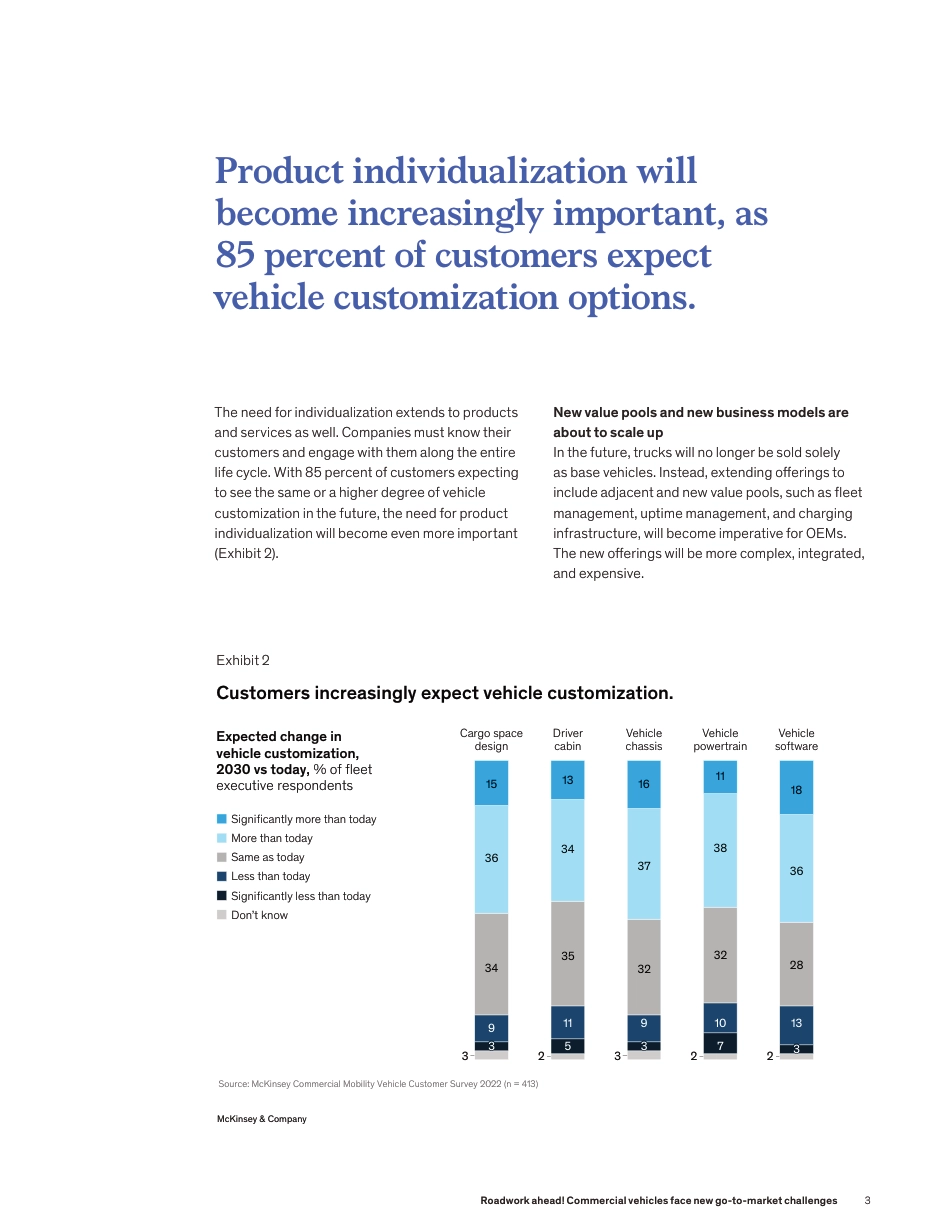

December2023Automotive&AssemblyPracticeRoadworkahead!Commercialvehiclesfacenewgo-to-marketchallengesAsshiftingcustomerpreferences,innovativebusinessmodels,andnewentrantstransformcommercialvehiclesales,OEMsmustchangewiththetimes.ThisarticleisacollaborativeeffortbyNielsDau,ThomasFurcher,AnnaHerlt,PhilippMaximilianLühr,andMatthiasSchyma,representingviewsfromMcKinsey’sAutomotive&AssemblyPractice.Innovativego-to-marketstrategiesarebeginningtotransformthecommercialvehicle(CV)industry.Oneearlyexampleinvolveslightcommercialvehicle(LCV)playersmovingtowarddirect-salesmodels,ratherthanrelyingondealersfortheirgo-to-marketapproach,astheyhavetraditionallydone.ManymorechangesareonthehorizonacrossCVsegments,drivenbyfivecoretrends(Exhibit1):—thegrowthofomnichannelsales—newvaluepoolsandbusinessmodels—increasingcostpressures—stringentregulationsandtheshifttozero-emissionsvehicles(ZEVs)—theemergenceofnewentrantsThesetrendsraisetwoquestions:WhydoOEMsintheCVsegmentneedtochange?Andwhydoesthischangeneedtohappennow?Afterexploringtheseissues,thisarticledescribesemerginggo-to-marketmodelsandguidingprinciplesthatcanhelpCVOEMsselectthebestapproach.Whychange?Ofallthefactorspromotingchangewithincommercialvehiclego-to-market,threestandout.OmnichannelsalesarebecomingstandardAsintheB2Csphere,B2Bcustomersincreasinglydemandanomnichannelexperiencethatseamlesslyintegratesofflineandonlinechannels.McKinsey’sGlobalB2BPulseSurveyshowsthatB2Bcustomersuseanevenlydividedmixoftraditional,digitalself-service,andremotehumaninteractionchannels,1with35percentofrespondentsratinge-commerceasmosteffective.B2Bcustomersalsoareincreasinglywillingtoengageinlargee-commercetransactions,withroughly70percentofrespondentspreparedtospendupto$500,000onasinglepurchase.Basedonexperienceinotherindustries,B2Bcustomersalsodemandgreaterindividualizationduringtheirinteractionswithcompanies.MorethanhalfoftherespondentcompaniesinMcKinsey’sGlobalB2BPulseSurveystatedthattheyincreasedtheirmarketsharebyinvestinginindividualizationviasophisticatedmarketingtactics,technologystacks,analytics,andprescriptiveinsights.21McKinseyGlobalB2BPulseSurvey,December2022,n=3,862;Australia,Brazil,Chile,China,France,Germany,India,Italy,Japan,SouthKorea,Spain,UnitedKingdom,andUnitedStates(2022only).2Ibid.Exhibit1Fivecoretrendsarepromptingchangestogo-to-marketmodelsforcommercialvehicles.McKinsey&Company2/366%<515–25%>10GreateremphasisonomnichannelsalesNewvaluepoolsandbusinessmodelsIncreasingcostpressureStringentregulationandexpectedshifttoZEVfeetNewentrantsofB2Bcustomerspreferdigitalorremotechannelstointeractwithsuppliersofglobalmedium-andheavy-dutytruckproftsin2030expectedtocomefromrecurringlifecycleservicespercentage-point-potentialimprovementinreturnonsalesviaoptimizeddistributioncostsandrevenuemanagementexpectedglobalzero-emissionsvehicle(ZEV)sharein2030formedium-andheavy-dutytrucksegmentsnewentrantsjoinedthecommercial-vehicleindustryacrosssegmentsoverthepast24months2Roadworkahead!Commercialvehiclesfacenewgo-to-marketchallengesTheneedforindividualizationextendstoproductsandservicesaswell.Companiesmustknowtheircustomersandengagewiththemalongtheentirelifecycle.With85percentofcustomersexpectingtoseethesameorahigherdegreeofvehiclecustomizationinthefuture,theneedforproductindividualizationwillbecomeevenmoreimportant(Exhibit2).Newvaluepoolsandnewbusinessmod...

VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP