一、BC 电池结构优势凸显,产业化进程加速 ............................................................................... 3

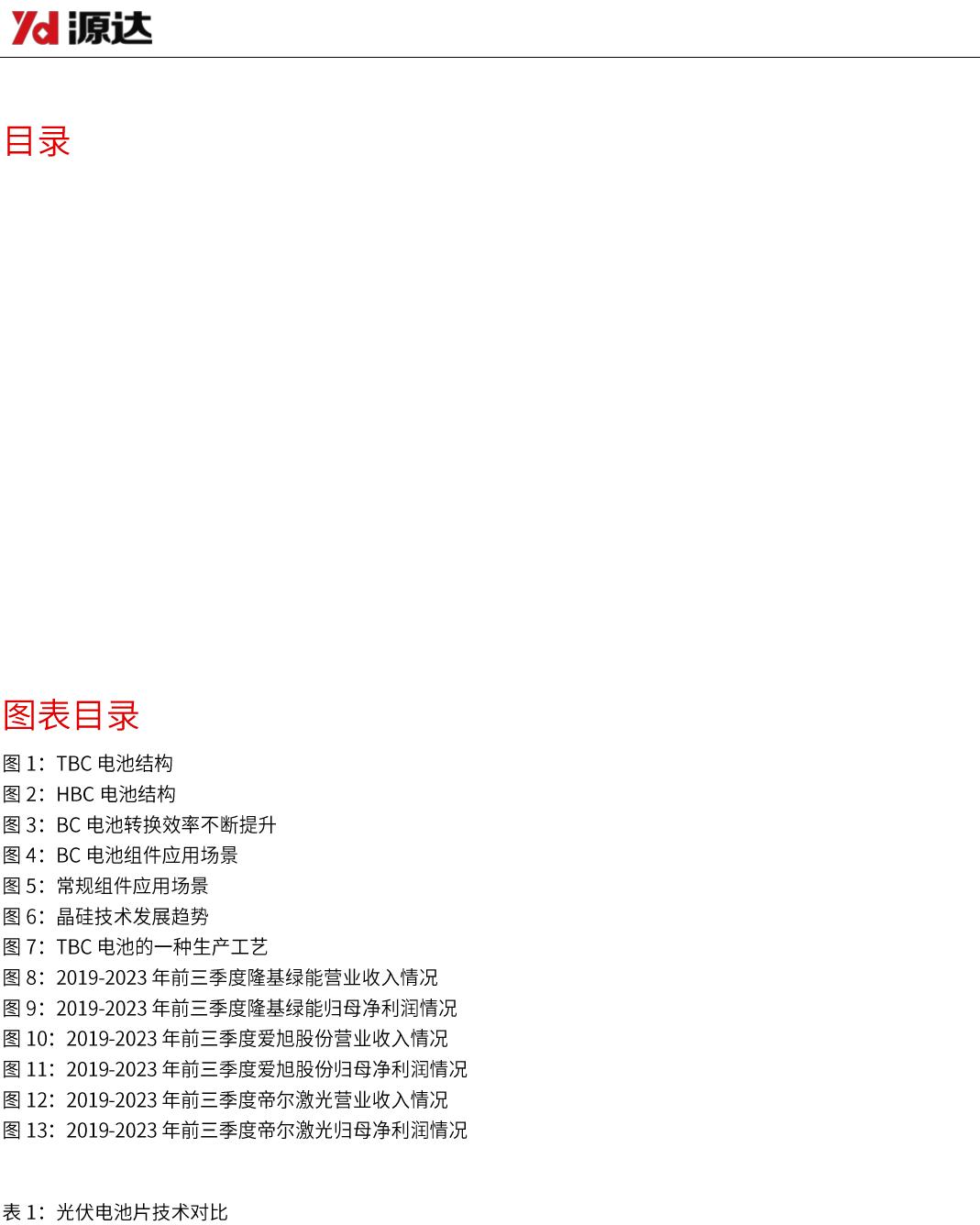

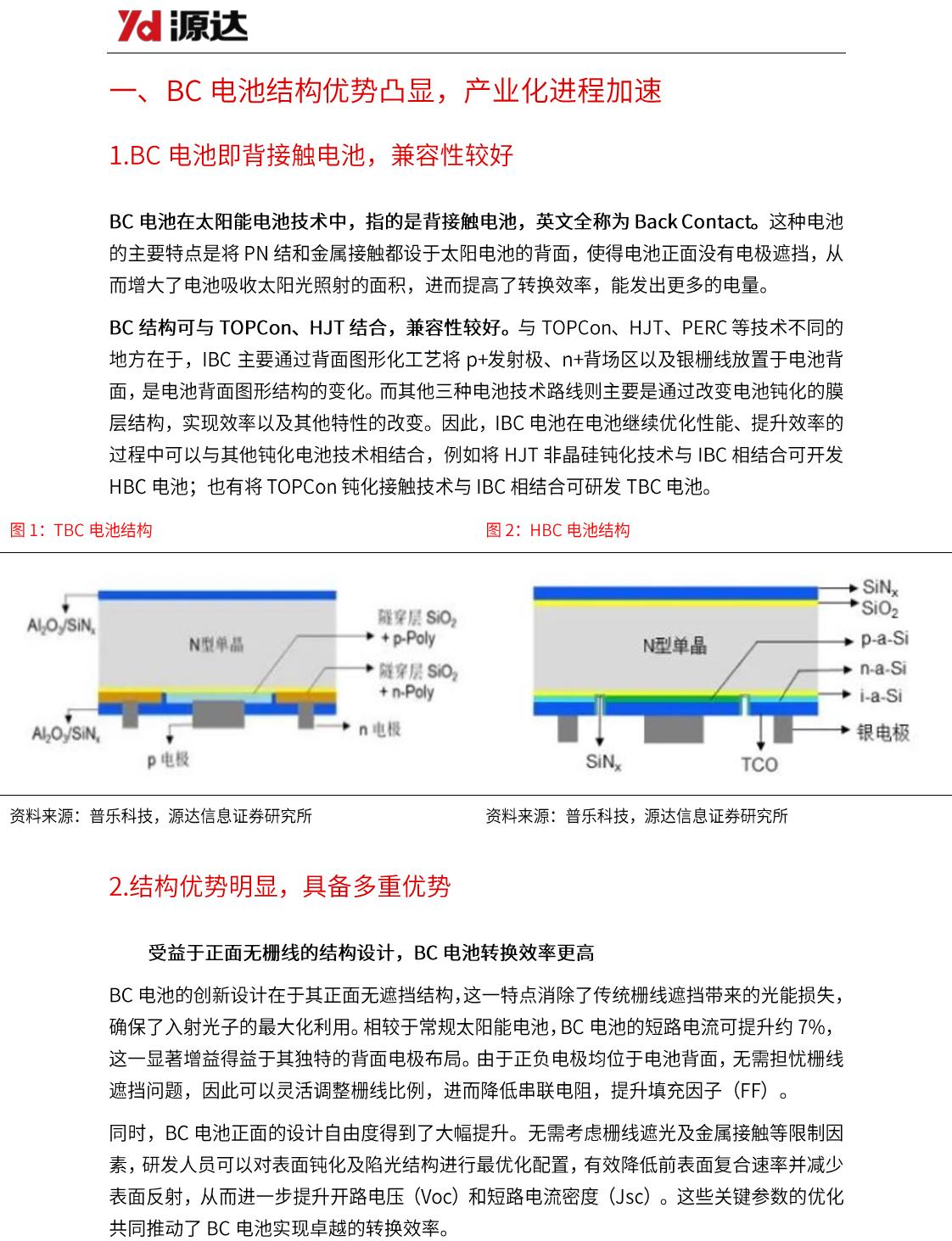

1.BC 电池即背接触电池,兼容性较好 ........................................................................................................... 3

2.结构优势明显,具备多重优势 ..................................................................................................................... 3

3.BC 电池研究历史悠久,龙头入局有望加速产业化...................................................................................... 5

二、制备工艺流程复杂,产业化壁垒高 ........................................................................................ 6

1.BC 电池的生产制造难度大、壁垒高 ........................................................................................................... 6

2.激光技术有望缩短工序,激光设备重要性显著提升 .................................................................................... 6

三、投资建议 ............................................................................................................................... 8

1.隆基绿能 ...................................................................................................................................................... 8

2.爱旭股份 ...................................................................................................................................................... 8

3.帝尔激光 ...................................................................................................................................................... 9

四、风险提示 ............................................................................................................................. 11

...................................................................................................................................................... 3

..................................................................................................................................................... 3

.................................................................................................................................. 4

......................................................................................................................................... 4

............................................................................................................................................... 4

............................................................................................................................................... 5

.................................................................................................................................... 7

.................................................................................................... 8

................................................................................................ 8

.................................................................................................. 9

.............................................................................................. 9

................................................................................................ 10

............................................................................................ 10

........................................................................................................................................... 6

VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP