1

Could tension in the Red Sea cause a second energy crisis?

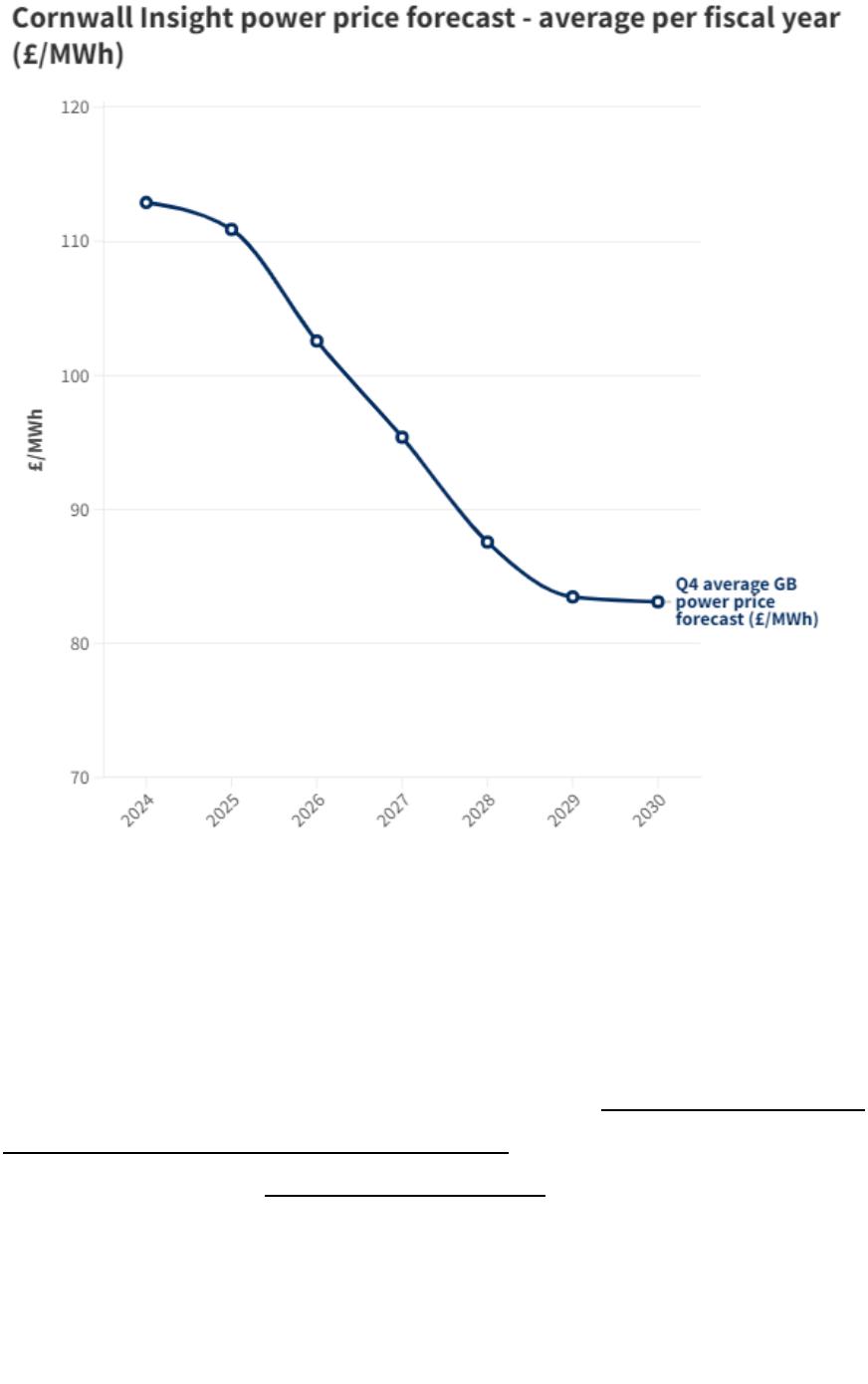

Although many across the energy industry previously forecast that energy

prices could be on the mend, recent geopolitical developments have placed

recovery on a tightrope.

As I am sure many of our readers will be aware, developments in the Middle

East, specifically in the Red Sea and the Gulf of Aden, have placed recovery in

jeopardy due to the rising tensions in the region. Attacks by the Houthi

movement, a Shia Islamist political and military organisation that emerged from

Yemen in the 1990s, on international shipping freight have led to increased

inflation and rising oil prices, as is being reported by the BBC.

The US and UK escalated the conflict by launching air and naval attacks on 11

January 2024 in retaliation. An international maritime coalition, Operation

Prosperity Guardian, was set up to protect vessels in the area but the use of

military strikes has posed the question as to whether it will be enough to protect

the key shipping lane and how long this instability and tension could last.

The BBC has also reported that the Treasury has “modelled outcomes including

crude oil prices rising by more than $10 a barrel and a 25% increase in natural

gas”. The extent of this issue has led some to believe that a second energy

crisis is looming over an already stretched Western economy.

How has the conflict in the Red Sea impacted energy prices?

According to the UK parliament, Houthis have been launching attacks against

ships it says are linked to Israel, causing shipping to be diverted away from the

Red Sea, threatening key trading lines and freedom of navigation.

The Suez Canal, one of the most integral shipping lanes in the globe, saw

22,032 ships pass through its waters in 2022. The conflict in the Red Sea has

very much deterred many ships from passing through the Canal, instead opting

to sail around the southern tip of South Africa to reach European waters.

According to Reuters, from main Asian ports, the Suez Canal route is around

8,500 nautical miles long, which equates to a 26-day trip. The South African

route, also known as the Cape Sea Route, is about 11,800 nautical miles, taking

as much as 36 days to navigate. With many UK oil imports from Australia, Asia

and the Middle East coming via the Suez Canal, this has strained what is

VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP