Houthi attacks in the Red Sea hurt global trade

and slow the energy transition

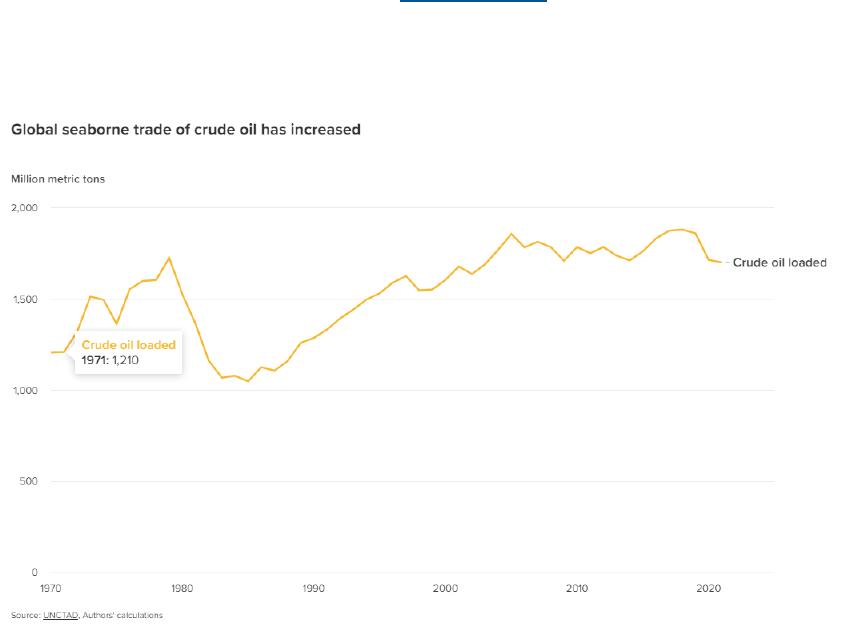

Recent attacks on commercial ships in the Red Sea have underscored the

importance of seaborne international trade, and challenged the role of the

United States in safeguarding commerce in the global commons. Maritime

choke point disruptions have worldwide consequences because the price of

oil is set globally. Simply increasing oil supply will not solve the problem of a

major disruption, such as in the Strait of Hormuz, which has been

overtly threatened by Iran. This is why the United States has a deep interest

in freedom of navigation. Maritime trade of energy is of fundamental

importance to the security of supply for energy and to the price felt by

consumers worldwide. In addition, the effects of a major disruption to freedom

of navigation would hold many damaging but indirect consequences—

including slowing progress on addressing climate change.

The danger created by Houthi attacks

The Houthi movement, or Ansar Allah, is a Shia Islamist group that seeks to

maintain control of critical territory in Yemen. It operates as a proxy group for

Iranian influence, especially the Islamic Revolutionary Guard Corps. The

Houthi movement has ramped up attacks on merchant vessels transiting the

Red Sea since November 19, 2023, according to US Central Command.

The United States’ response to the attacks, Operation Prosperity Guardian,

concentrates naval assets and command-and-control bandwidth on the Bab

el-Mandeb Strait, wedged between the Horn of Africa and the southwestern

corner of the Arabian Peninsula. It is a key choke point for commercial traffic

transiting between the Arabian Sea and Red Sea toward the Suez Canal—

another choke point through which more oil is flowing than ever before.

Due to Russia’s invasion of Ukraine and the subsequent trade diversion, the

Suez Canal is increasingly used for Middle East-to-Europe flows of energy, as

well as Russia-to-India shipments. About 8.8 million barrels per day of oil and

VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP