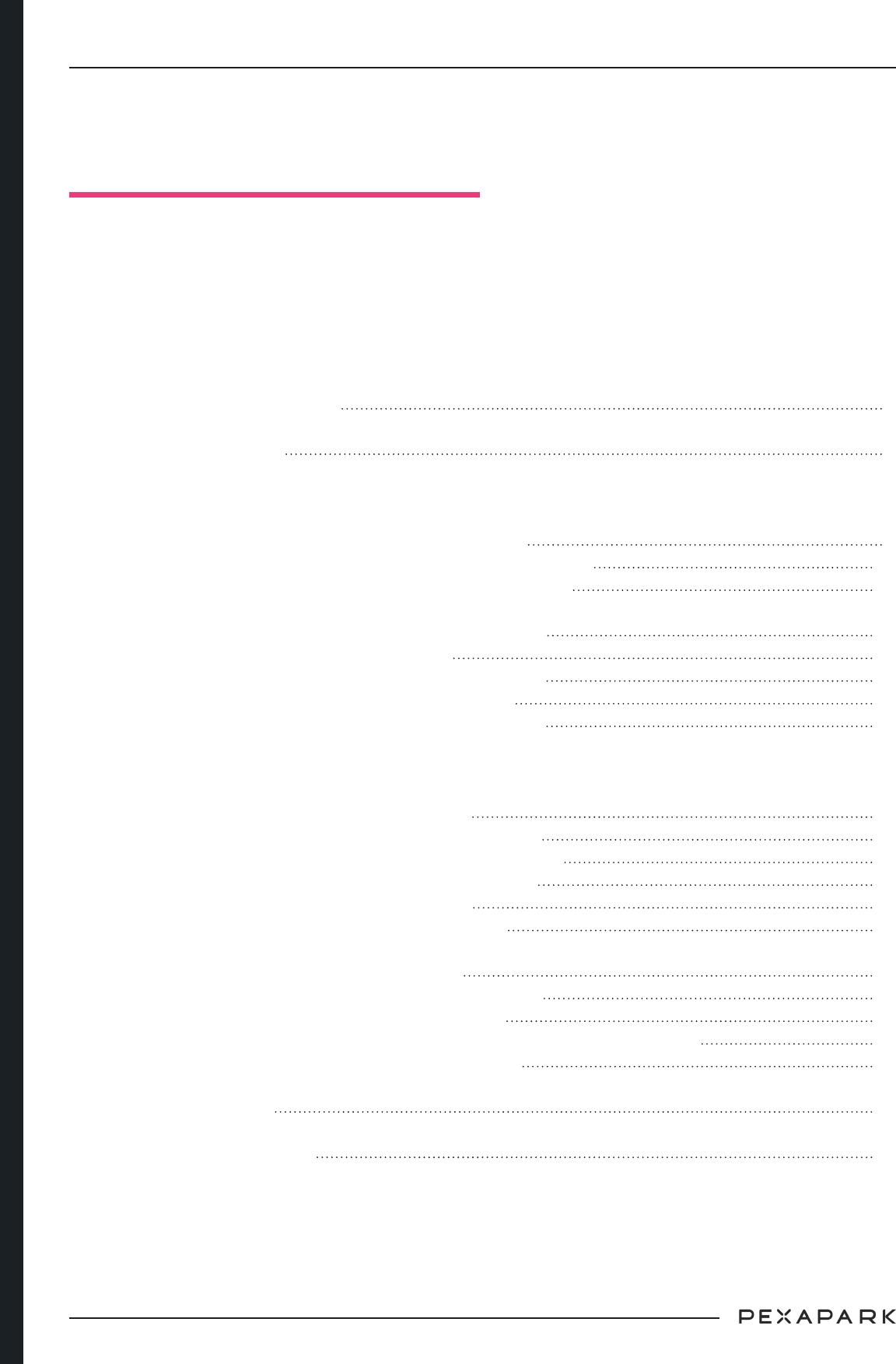

EUROPEANMARKETOUTLOOK2024Preparingforimpact:Thesilverliningaftertheclouds2EUROPEANPPAMARKETOUTLOOK2024TABLEOFCONTENTSExecutiveSummary�3Introduction�7ACTI�Chapter1:ApproachingtheGoldenPPAEra�91.1Thebigpicture:2018-2023year-by-yearevolution�101.2�Data-drivenheadlinespaintingthe2023picture�13Chapter2:PPAadvancementsandinnovations�272.1HybridPPAsenteredthescene�272.2EarlysignsofPPAsforGreenH2Production�292.3�Aggregatingdemand:Multi-buyerPPAs�312.4�Nextfrontier:24/7GreenEnergyPurchasing�32ACTII�Chapter3:Prominenteventsof2023�353.1.Volatilityandpricesenroutetostabilisation�353.2.Marketfundamentalsshookupfinancingcosts�393.3.Short-termPPAsshowedmixmovements�423.4.MoretroublewithBaseloadPPAs�443.5.Theregulatorypendulumswungback�48Chapter4:TopPredictionsfor2024�514.1.GermanywilltoppleSpaininPPAactivity�524.2.ThePPAMarketwillsurpass20GW�524.3.ThegeographicalscopeofHybridPPAswillexpandbeyondGB�534.4.TheshareofUtilityPPAswillincrease�53Conclusion�54LegalDisclaimer�553EUROPEANPPAMARKETOUTLOOK20241.EXECUTIVESUMMARYKeyfindingsfromourEuropeanPPAMarketOutlook2024report:ThePPAMarketentereditsGoldenEraPPAs,andservicesinbothbuyersandsellerswithrecordactivity–Followingastabilisingmanagingtheirrisks.environmentinthefundamentalsofdeal-making,overthepasttwelvemonthsourPPATrackerSpainandGermanyaccountedfor50%recordedahefty16.2GWofdisclosedcontractedof2023’svolumes–Eventhoughwevolumes–anincreaseofmorethan40%vis-à-sawvividactivityacrossEurope,8.4GWvis2022.Dealcountpeakedat272PPAs–anwereconcentratedinSpainandGermany,increaseofanimpressive65%from2022!accountingfor51%ofthetotal16.2GW.TheMediterraneanQueenkeptitsToppositionThebalancebetweencorporateandutilityforafifthconsecutiveyear,butitsthronewasofftakesimproved–Corporatesmaintainedchallengedforthefirsttimeever.Indealcount,theleadpositionindrivingthePPAmarket,butthepictureismorebalanced.therewasanuptickinutilityofftakeactivity.Reducedvolatilitylevels,andstrongcorporateIberdrolawastheTopSellerbothbyvolumedemandwerethekeydriversbehindutilityanddealcount–Thegoldmedalcomesdueappetite.toninedealswithcorporates,amountingto908MW.SixtookplaceinGermanyontheCorporateshowedpreferencetoPPAsbackofIberdrola’soffshorewindcapacityinthedirectlywithprojects–Outofthe216country,followedbytwosolardealsinSpain,CorporatePPAsthatdisclosedtheseller,andoneonshorewinddealagaininthelandof44%werecontractedwithautility,withtheEnergiewende.Statkraftwasthemostactiveremaining56%havingadeveloper/IPP/Fundsellerwith19deals.Managerasthecounterparty.WebelievethedatashowthepreferenceofcorporatesMrBezosisbacktotheTopBuyerpositiontocontractdirectlywithprojectstoillustrate–In2023,Amazon’sactivityreturnedtoadditionalitymoreclearly,especiallywhentheEuropeancontinent,leadingtheITtakingintoconsiderationthatmanyutilitiesconglomeratetocontractabulky1.87GWcontractwithcorporatesonthebackofownacrosssevendeals.Thecorporatealsotopsthegeneration.listbydealcount.TheroleofutilitiesinthePPAMarketInformationTechnologystillontop–ITevolved–Trackingonlytheofftakeactivityofconglomeratesmaintaintheirtopranking,withutilitiesdoesnotpaintthecompletepictureatotalof3.6GWacross25deals.ConsumeroftheirimpactinthePPAspace.AscoreriskStaplesalsomaintaineditsleadingpositioninmanagers,thecontributionsofutilitiestothetermsofdealcountwhilealsojumpingtothemarkethaveexpandedthroughback-to-backsecondpositionvolumes-wise.4EUROPEANPPAMARKETOUTLOOK2024VolatilityheadachesmadecorporatesmorePPAsforGreenH2Productionshowedrisk-aware–Lastyearprovedthatvolatilityledearlysigns–Anothernotabletrendin2023toapermanentshiftinprocurementstrategies,wastherapidgrowthofPPAsdestinedtoasmanyenergyintensivesmadecorporatePPAspowerupcominggreenhydrogenandammoniaaprominentandconsistenthedgingtool.Weplants,withamixofnuancespaintingthealsonotedincreasedawarenessofpriceandwholepicture.PPAslinkedtogreenhydrogenprofilerisk,whichtranslatestohowdifferentandammoniaproductionwereannouncedinPPAvolumesarepriced.Dueto2022’svolatility,Norway,FranceandGermany,leveragingnewsomedealswerepricedunderwrongvaluationandexistingcapacity.assumptions,potentiallyleavingcorporatespayinghigherthanmarketpricesforalongterm.RenewableenergyisheavilyneededtofeedanyPower-to-Xproject.However,thesweetSolarPPAvolumesquadruplebothonshorespotliesinthedeltabetweenprojecteconomicsandoffshorewind–SolarPVwasbyfarmoreandPPAprices–andthislandscapeisstillpopularinPPAdeal-making,holdingthelion’sevolving.sharewithatotalof10.5GW–or,almost65%oftheyear’s16.2GWPPAvolumesacross160Multi-buyerPPAsincreased–Multi-buyerdeals.Onshorewindsaw2.3GWacross58PPAs,alsoknownasAggregatedPPAs,aredeals,whileoffshorewindsaw2GWacross20notnewtotheEuropeanPPAMarket,asdeals.suchdeals,inprinciple,emergedin2016.However,2023sawtheconceptmaturinginBalancingcontractsarebecomingpivotalanacceleratedmannerwithatotaloffoursuchinarevenue’sstack–In2023,thepricingofannouncements.balancingagreementsmirroredthedownwardtrajectoryofpowerprices,butdespitedroppingInspiteofincreasedinterestintheconcept,wetoapproximatelyEUR3/MWh,theystillbelievegovernment-backedcreditguaranteeremainedathigherthanthelong-termaverage.schemeswouldbeamoreimpactfultooltoAmidtighteningmargins,bothBalancingincreasethepoolofSMEswillingtobuy.ThecontractandGoOssalesoptimisationbecomesophisticationofsellersandinclusiveguaranteeimportantpriorities.schemescouldbethemaintwodriversofthetrend.HybridPPAsenteredthescene–Themomentumaroundrenewables-plus-storageTheconceptof24/7GreenEnergyincreasedsignificantlyover2023,asmostPurchasingadvanced–Themorenichetrendplayersarelookingateitherintroducingstoragetoenergyprocurementisdrivenbycorporatesintheirportfolioorincreasingcapacity.TheinterestedinhourlymatchingofconsumptionimpetusalsomanifestedintheEuropeanPPAinlieuoftheprevalentannualconsumptionmarketthroughtheemergenceofthefirstHybridmatchingmodel.LateststudiesshowedthatPPAsforlarge-scalesubsidy-freesolarassets.ontopofimprovedgreencredentialsandmoreimpactfuladditionality,suchanapproachalsoGridconnectionsavingsareacoreattractionillustratespricehedgingbenefits.Anoptimisedforco-location.Still,thecombinationofvalueportfolioofwindandsolarPPAscouldbecreationfromgrid-levelservicesalongsideenoughtostarta24/7journeyandachieve60-optimisationofasset-levelrevenuesepitomises75%hourlymatching.thedriverbehindthepromisinglandofthebusinessmodel.5EUROPEANPPAMARKETOUTLOOK2024Volatilityandpricesenroutetostabilisation–implementationofrevenuecaps.WebelieveTheyear2023wascharacterisedbyaconsistentthatsomeplayersviewedthisapproachhighlydownwardtrajectoryofgasandelectricityprices,opportunisticallyandnotasastrategicriskresultinginreducedvolatilitylevelsinpowermanagementtool,despitetheevidentupsidemarketscomparedtotheyearbefore.Wheneveninalessextremepricingenvironment.lookingatthebigpicture,itseemsthatEuropehasenteredaneweraofprolongedvolatility,forBaseloadPPAswereinmoretrouble–Overnowmostlydrivenbyfossilfuelpricingrisksand2023,theappetiteforBaseloadPPAswasmacroeconomics,withcannibalizationriskclosemixed–withmostsellersbeingincreasinglytoenteringtheconversation.cautiousdespitethepricepremiumofthevolumestructure.CertainbankruptcieslinkedThePEXAEuroCompositedropped35%toSweden’screatedfurtheruncertaintyinyear-on-year–FromthefirstdayofJanuarythemarket.Thereweretimeswhenwesawaat78.7EUR/MWhtothelastdayofDecemberrearrangementofhowsomemarketparticipants2023at50.1EUR/MWh,theEUROCompositeviewtheriskprofileofBLPPAs,classifyingitasdecreasedby35%-withtheaverageriskierthanamerchantapproach.throughouttheyearstandingat58EUR/MWh.However,webelieveBLPPAscouldbeoneofDecreasedvolatilityreducedriskdiscounts–themostcost-optimalhedginginstrumentsonOnthebackoflowervolatilityandhighcorporateacase-by-casebasis,iftheyarestructuredindemand,riskdiscountsfactoredintoPPAarisk-adjustedmanner.BLPPAsneedtobepricingtocompensateformarket,technology,approachedwithamonitoringapproach,contraryandstructure-specificriskshavedecreasedtothe‘sell-and-forget’mindsetofPAPsellers.substantiallycomparedto2022levels.SpainandGermanyareprimeexamples.Nonetheless,Theregulatorypendulumswungback–cannibalizationriskisfactoredmoreaggressivelyFollowingtheabruptreturnofregulatoryrisk,ininPay-as-Produced(PAP)PPAs.2023thepicturechangedsignificantlyduetotheexpirationofmostwindfalltaxmechanismsandMarketfundamentalsshookupfinancingtheemergenceofsupportiveregulationformanycosts–FollowingtheprogressivesettlingoftheaspectsofthePPAmarket.EU’sDelegatedActpricingandregulatoryturmoil,therenewablescatalysedinfantactivityofrenewablePPAsforindustrywasconfrontedbyasnowballeffecthydrogenproduction.Franceintroduceditsfirstofchangesinmarketfundamentals,resultingincreditguaranteeschemewithmorecountriessethigher-than-averageconstruction,operational,tofollowsuitunderEU’sdirectives.andfundingcostsforrenewableassets.ChallengesinfinancingcostsandcapexareHowever,eventhoughEUhasgiventhePPAcatalysinginterestinsqueezingreturnmargins,marketitsblessingandsupport,there’snoasmarketplayersarelookingtomakethemostmarketconsensusonwhetheraggressiveoftheirportfolio.deploymentofCfDschemescangohandinhandwithPPAs.Short-termPPAsshowedmixedmovements–Short-termPPAsdifferlargelyintenor.TheirToppredictionsfor2024:rangespansacrossweeks,months,oruptofiveyears.Onthebackofthatnote,thepicture1GermanywilltoppleSpaininPPAactivityin2023wasbothpositiveandnegative.PPAs2ThePPAMarketwillsurpass20GWof1-year>tenor,partofadynamicselling3�ThegeographicalscopeofHybridPPAsstrategycomprisedofweeks-longandmonths-longPPAs,tookthebiggesthitduetothewillexpandbeyondGB4TheshareofUtilityPPAswillincrease6EUROPEANPPAMARKETOUTLOOK2024EUROPEANPPAMARKET2023TOPBUYERTOPSELLER16.2GW10.5GW2.3GW2GW272deals#160#58#20PPAdealflowbydisclosedcontractedcapacity,2018–2023(GW)Utility4Corporate+41%16.200.96GW2#233.7GW7.986.5913.3011.45#4133.393.7GW1GW5#41#240.95GW201820192020202120222023#9EUROComposite(EUR/MWh),2023VolatilityofDEY+1Futures(%),202380-35%100907580707065605060405855302050104507EUROPEANPPAMARKETOUTLOOK20242.INTRODUCTIONHerecomesthesunDuringthisthoroughanalyticalexercise,wehadfundiscoveringexcitingdatainsights,challengedThesignsthattheairof2023wasdifferenteachother,andspentlongperiodstryingtocrackappearedsinceitsearlydays.Itseemsthathardthecodetounderstandthemarket’schallenges–lessonsfromtheyearbefore;anunstoppablewhichwerenotabsentfromthescene,atall.corporatearmyathirstforgreenenergy;andthenon-negotiablemandatetopushthroughOurrecipeissimple:understandwhatasmartenergytransitioncatalysedafreshhappened,putitincontext,andbrainstormmindset,mostly.ourfutureexpectations.Followingthesuccessofpreviousyears,we’rethrilledtopresenttheOver2023,Europe’sPPAuniverseenteredfourtheditionofoursignatureseries,Pexapark’sitsGoldenEra.TheshadowsofthepeaksofEuropeanPPAMarketOutlook2024.theenergypricingandavailabilitycrisiswerestillvisiblethroughouttheyear.SometimesinLastbutnotleast,togetherisalwaysbetter.atoughway–likethedramaticincreasesinIfyoufeelinspired,wearelookingforwardtofinancingcosts–sometimesjustenoughtohearingyourthoughtsathello@pexapark.com.rememberthepain,inaconstructiveway.Inasense,thismayhavebeenthedrivingforceofOnceagain,enjoythedive!theindustry’sachievements.PEXAPARKTEAMAuthors:LUCAPEDRETTIMARITINAKANELLAKOPOULOUChiefOperationsOfficer(COO)&Co-founderSeniorInsightsAnalyst&ContentManagerLucahas17years’hands-onexperienceinenergyriskMaritinahas8years’experienceinresearchandanalysismanagementforrenewablesinopenmarkets–valuing,ofcleanenergytrends,havingprovidedmarketinsightsstructuring,negotiatingandmanagingPPAtransactionsonEurope’srenewableslandscapetofinanciers,projectacrossEurope.HelikesStracciatellaicecreamandsponsors,andadvisorsthroughB2Bpublications.ShePanettone,alot.believesPandoroisunderrated.Insights�MichaelWaldner,Co-founder&CEOJohnDallimore,HeadofCorporatePPA&H2AdvisoryContributors:JonasNihoj,HeadofPortfolioandTradingServicesDavidWillemsen,HeadofRiskAdvisoryMathieuVille,HeadofPPATransactionsItamarOrlandi,SeniorRiskManagerDominiqueHischier,HeadofAnalysisBrianKnowles,DirectorofStorage&FlexibilityRommeroCarillo,DirectorofBusinessDevelopmentAlexMcGregor,SeniorAnalystPPAMarketsDavidBattista,PriceReporterConiMeili,Polling&PPAMarketDataSpecialist8EUROPEANPPAMARKETOUTLOOK2024ACTI9EUROPEANPPAMARKETOUTLOOK2024CHAPTER1:APPROACHINGTHEGOLDENPPAERATheEuropeanPPAMarketneverceasestoimpress.Sincethebeginningoftheyear,thearrivaloftherainbowafterthestormhadbecomeevident.Butnotwithoutsomeclouds.What’sthefinalverdict?PPATrackerMethodologyBeforewestartthebigdive,let’sdoamemoryrefreshmentonhowtoreadPexapark’sPPAanalysis.NotallPPAsareequal,andweknowfirst-hand.OurPPATrackerincludesagreementsthatmeetspecificcriteria.Pricerisk:Pexapark’sprimarycriterionliesinaPPAcarryingpricerisk.Route-to-market(RTM)orbalancingservicesPPAsdonotmakeittoourPPATracker,eveniftheyareconcludedforlongperiods(i.e.RtMPPAsforprojectsundertheUKCfDschemethatmayneedcontractstomarkettheirpower,whileit’stheUKgovernmentthattakesthepriceriskbyofferingafloorprice).Tenor:Ourruleofthumbistotracklong-termPPAsofatleasta5-yeartenor.Nonetheless,initialPPAslinkedtonewprojectsandhaveplayedaroleinthefinancingoftheassets,arebeingaddednomatterthetenorlength.ItisworthnotingthatourdataillustratethatpubliclyavailableShort-term(ST)PPAsfornewprojectsarestillrare(4intotalacross2023).Post-subsidyPPAssuchaspost-EEGinGermanyprolongingthelifeofanasset,orPPAslinkedtoanyexistingassets(i.e.optimisationPPAsforassetsinitiallycommissionedundersubsidyschemes)needtohaveatenorlongerthan5years.PPASize:WecalculatethedealflowvolumesbasedonthePPASizeinMWandnottheProjectSize.Atthebeginningof2023,weupdatedourmethodologytoaccountfordealswithnoinformationonthePPASizeinMW,whichwereleftblankbefore.Thanksto‘MissionLucia’(whichfurtherenlightenedthequalityofourdata),wheneverweknowa)volumesinGWhb)geographyc)technologyofthePPA,weproceedtoacapacityfactor-basedestimationofthePPAsize.Luciawasretroactivelyappliedtoalltheexistingentries,whichiswhysomenumbersfromlastyearareslightlydifferent,butmorereflectiveofPPAactivity.Themegatrendsofyearlyvolumeactivityanddealcountremainedunchanged.YoucanfindourPPATrackeronPexapark’sPPApricereferenceplatformPexaQuote,alongsidemoreinformationonourmethodology.ForthesestringentrulesandtheextramilewegowhenreviewingPPAactivity,ourfindingscouldbedissimilartootherdata-driveninsightproviders.Toensureyourdealsareincludedinouranalysis,you’reinvitedtousethe‘ReportaPPADeal’functionofPexaQuoteoremailmaritina.kanellakopoulou@pexapark.com.10EUROPEANPPAMARKETOUTLOOK20241.1THEBIGPICTURE:2018-2023YEAR-BY-YEAREVOLUTIONThepastyearhasbeenbusierfortheEuropeanPPAmarketthaneverbefore,withmultiplerecordsbeingbrokenoneaftertheother.Bepatient;we’reonlygettingstarted!Overthepasttwelvemonths,ourPPATrackerrecordedahefty16.2GWofdisclosedcontractedvolumes–anincreaseofmorethan40%vis-à-vis2022.Accordingtotheupdateddata,theEuropeanPPAMarketvolumeshavebeengrowingata37%CAGRsince2018.PPAdealflowbydisclosedcontractedcapacity,2018-2023(GW)CorporateUtilityUnknown/OtherCAGR+37%13.3016.2011.953.397.986.597.9911.452.522.833.344.020.873.065.199.31202320185.06202020211.9620222019Source:PexaQuote,PPATrackerNote:‘Other’mostlyreferstoelectrolyserdevelopersLookingatthedealcount,theyear-on-yearincreaseappearsevenmoreradical.Intotal,2023saw272PPAs–anincreaseofanimpressive65%from2022!Eventhoughvolumesmakethebiggestheadlines,dealcountisequallyimportant.That’sbecausethevalueillustratesthetimessellersandbuyerssatatthetablewhethertheofftakeneedswere20GWhor1,500GWhperannum(yes,therewassuchamammothdeal,andtheofftakerwillnotcomeasasurprise).Thefactthatofftakerstransacted65%moretimesthantheyearbeforetrulyillustratestheappetitenotjustfromlargeofftakersthatcouldpotentially‘distort’thebigimagewithindividuallargeofftakes,butalsofromsmallandmediumcorporatesandindustrialsthatwanttobepartoftherevolutioninenergyprocurement.11EUROPEANPPAMARKETOUTLOOK2024PPAdealflowbydealcount,2018-2023(#deals)CorporateUtilityUnknown/OtherCAGR+52%164272218157131304834100931022022202224486095320185131202120192020Source:PexaQuote,PPATrackerNote:‘Other’mostlyreferstoelectrolyserdevelopersHedgingagainstvolatilityandsecuringlower-than-marketratesthroughagreenPPAhasbecometheprimaryreasonformanycorporatescontractingPPAs,alongsideESGtargets.Akeyelementthatenabledasignificantramp-upofactivitywasrelativelysmoothed-outregulatoryconcerns.Aswillbeanalysedinmoredetaillaterinthisreport,thepricinglandscapeof2023wasdefinedbyastabledownwardtrajectoryofbothpowerandgasfuturesprices.Consequently,PPApricesacrossEuropeancountriesmimickedthemovementatdifferentlevels,increasingbuyers’confidenceintakinglong-termpricerisk.Overall,renewableplayersentered2023witharefreshedmindsetandarelativelyincreasedsenseofstability,significantlyincreasingcertaintyonlong-termPPAdeal-making.12EUROPEANPPAMARKETOUTLOOK2024AsneakpeekoftheothersideofthecoinPricingenvironmentrequiredadjustmentsofexpectationsfromsellers–Despiteexceptionallyhighdeal-makingcatalysedbylessvolatility,somedealsdidnotgothroughbecausesomesellersmodelledrevenuesbasedonlastyear’spricinglevels.Disconnectionfromrealisticpricesandoverlyambitiousexpectationshavealwaysbeenreasonsfordealstofallthrough,andthis‘category’ofdealstemporarilyorpermanentlymovingtothevaulthasalwaysexisted.Inourview,itcomesdowntotheabilitytodistinguishpricingandvaluingaPPA.Windfalltaxesdidnothaveamajorimpactonlong-termtransactions–Over2023,theseaofcomplexregulationandrevenuecapsthroughwindfalltaxesappearedtobebetterdigestedbymarketparticipants.Despitethescarsfromlastyearandthewait-and-seeperiod,buyersandsellerswerebetterequippedtomanageregulatoryriskduringnegotiations.Ontheotherhand,Short-term(1-4y)PPAstookabiggerhit,aswillbeanalysedlaterinthisreport.Highfinancingcoststestedcertaindeals–Regulatoryuncertaintywasreplacedbypersistingchangesinmarketfundamentalsfortheinvestmentcommunity.Thecostofdebt,primarilyduetorisingbaserates,remainedatsignificantlyelevatedlevelsinlinewiththeincreaseswitnessedin2022(wherethe10-yEuroswapstartedat0.28%andendedat3.19%).2023wasthefirstfullyearwithachallengingfinancingenvironment,andcertainassetsdidnotmanagetomaketheeconomicswork,withsomePPAnegotiationsfortheseprojectshavingpausedforthetimebeing.13EUROPEANPPAMARKETOUTLOOK20241.2DATA-DRIVENHEADLINESPAINTINGTHE2023PICTUREQ1SETTHERHYTHMFORARECORDYEARContrarytothepatternsofpastyears,whereQ4usuallydepictsthemostrobustactivity,Q12023sawthehighestactivityintermsofvolumes,withatotalofanunprecedented5.5GW.Webelievethetimingoftheclosingandannouncementofthesedealswasnotrandom.Over2022,despiteEuropeanenergymarketsundergoingthemostturbulentyearintheirrecenthistory,PPAsexhibitedremarkableresiliency.Despitetheimpressivelystableactivitylastyear,ourgutfeelingwastellingusthatcorporateambitionwasmuchlargerthanthedealflownumbersindicated.Turnsout,therealappetiterevealeditselfinQ12023,aswebelievemanyofthesedealswereleftoversfromnegotiationsthatweredelayedduetothevolatilityandunfavourable-for-the-buyerspricinglevels.MonthlyPPAactivityin2023,disclosedvolumesinMWCorporateUtilityUnknown/Developer2,5492,2722,0711,6431,1941,4051,2311,7681,2041,1321,8099361,1599366998078167311,1473571,026618212866318739314469263232342388318844106JanFebMarAprMayJunJulAugSepOctNovDec‘23‘23‘23‘23‘23‘23‘23‘23‘23‘23‘23‘23Source:PexaQuote,PPATrackerNote:‘Other’mostlyreferstoelectrolyserdevelopers14EUROPEANPPAMARKETOUTLOOK2024Evenso,thehistoricalpatternhasn’twhollydeviatedfromthereality,becauseQ4wasindeedthestrongestintermsofdealcount,with81deals.Infact,October’23didnotonlyconstitutethemonthwiththemostPPAannouncementsovertheyear,butever!SuchdataconfirmthehighdealactivityinQ4overallthepastyears,asmanynegotiationsarerushingtowrapupdeal-makingaheadoftheyear-end.MonthlyPPAactivityin2023bydealcount(#deals)CorporateUtilityUnknown/Developer3429242523242424231172229152119181921191971015797264345342211111JanFebMarAprMayJunJulAugSepOctNovDec‘23‘23‘23‘23‘23‘23‘23‘23‘23‘23‘23‘23Source:PexaQuote,PPATrackerNote:‘Other’mostlyreferstoelectrolyserdevelopersForamonthlycommentaryonPPAactivity;PPApricingtrends;alongsidespotlightanalysisonkeytrendsandcommunityinsights,subscribetoourmonthlypublication,PPATimeshere.15EUROPEANPPAMARKETOUTLOOK2024THEBALANCEBETWEENCORPORATEANDUTILITYOFFTAKESIMPROVEDCorporatesmaintainedtheleadpositionindrivingthePPAmarket,buttherewasanuptickinutilityofftakes.Thenumbersrevealthatin2023,corporatesaccountedfor73%ofvolumesand80%ofdealcount.Worthremindingthateventhoughthepercentageshareremainedthesame,thepiewasactuallymuchlarger.Ineffect,corporatescontracted11.95GW–28%increasefrom2022,across218deals–66%uptickyear-on-year!Ontheotherhand,utilities’stakestoodat23%ofthevolumes–anincreasefromlastyear’s18%share,and18%ofdealcount.Thistranslatesto4.02GW–morethandoublethe1.96GWof2022,across48deals–a60%increasefromlastyear’s30deals.In2022,thedirestraitsposedbyvolatilitylevelssometimesdisarmedeventhemostrisk-savvytradingagent,resultinginreducedutilityofftakeappetite.Butaswe’verepeatedlyobservedinourdigitalmagazinePPATimes,ourmonthlyPPAactivitydigest,thestabilisingpricingenvironmentandvolatilitylevelsdroppingtomoremanageablelevelsmadeutilitiesagainreadytoonboardsomeriskintheirbooks.Thefactthatcorporateappetitewasmuchlargerthisyearalsomadeitfeasibleforutilities/traderstoperformmoreback-to-backdeals,offtakingriskfromprojectsandmanagingthatriskthroughlong-termvolumesalestocorporatesstraightafter.CorporatePPAshare,dealcountandPPAsize,2018-2023VolumesDealCount100%90%80%81%80%80%73%70%64%64%60%50%60%2022202350%48%40%35%30%20%201920202021Source:PexaQuote,PPATracker16EUROPEANPPAMARKETOUTLOOK2024CORPORATESCONTRACTEDMOREDIRECTLYWITHPROJECTSAccordingtoouranalysisofCorporatePPAactivitybysellertype,outofthe216PPAthatdisclosedtheseller,44%ofthesedealswerecontractedwithautility,withtheremaining56%havingadeveloper/IPP/FundManagerasthecounterparty.Intermsofvolumes,thistranslatesinto4.49GWand7.8GW,respectively.It’simportanttonotethatmanytrading-basedutilityplayersowngenerationandpursuetransactionslinkedtospecificprojects.Inaddition,mostoffshorewinddealsaretransactedwithutilitiessincetheyaretheprimaryprojectownersintheoffshorespace,suchasRWE.Nonetheless,inouranalysis,boththesedealclassesfallundertheutilitycategorybecauseofthesellers’riskmanagementcapabilities.CorporatePPAsbysellertype,dealcountandvolumes,2018-2023Utility/TraderOther#deals4.497.18220GWGW200180160963.855.12140GWGW1204.822.98100GWGW59801.141.20GWGW600.971.7154120GWGW3744202340G1.1W9G1.3W32021702023202220920202715201902018Source:PexaQuote,PPATrackerN�ote:‘Other’includesdevelopers,IPPs,Funds,FundManagers.UtilitieswithgenerationportfoliosuchasStatkraft,RWEcountasutilities.Throughthishigh-levelanalyticalexerciseitbecomesclearthatcorporatesenjoythebenefitsoftransactingdirectlywithprojects.Webelievetheunderlyingforcebehindthistrendistheadditionalityrequirementsofmanycorporatebuyers,whicharemoreclearlydemonstratedbyadirectPPAthathasenablednewrenewablecapacitytocomeonline.Whenautilityofftakesthevolumesfromaproject,andoffloadstoacorporatethroughaback-to-backdeal,additionalitymaynotbeasstraightforwardtodemonstrate.17EUROPEANPPAMARKETOUTLOOK2024Ontheotherhand,corporatePPAswithnon-utilitypartiestypicallytakelongertonegotiate,astheriskmanagementoftheelectronsoccursbetweentwopartieswithmorelimitedcapabilitiesofthistype.TheyalsoincreaseincontractualcomplexitybecauseincasesofsleevedPPAs(akaPhysical),there’salwaystheneedforathirdpartytotakeoverthephysicaldeliveryofthevolumes,theRtMfortheprojectandthebalancingservicesagreements.TheevolvedroleofutilitiesinthePPAMarketAsthePPAmarketmatures,theroleofutilitiesevolvesaccordingly.TrackingonlytheofftakeactivityofutilitiesdoesnotpaintthecompletepictureoftheirimpactinthePPAspace,whichismuchlargerandcriticalthanwhatthenumbersillustrate.Attheircore,energyutilitiesareriskmanagers,astheirprimarybusinessmodelliesbehindbuyingandsellingenergywhilemanagingtherisksassociatedwithenergycommoditiestomakeaprofit.Suchkindofplayersrelystronglyontheliquidityoftheforwardmarketstomanagetheirposition,andthemoreliquiditythereis,themorePPAstheycanhandle(alongsidethecapacitytowarehouserisks,suchascannibalizationrisk,thatcannotbehedgedwithmarketinstruments).AttheoutsetoftheEuropeanPPAmarket,whencorporateappetitewaslimited,utilitiescatalysedPPAdeal-makingbyoffloadingriskfromsubsidy-freeprojects.Upuntilthen,allriskswereassumedbygovernmentsthroughsubsidies.Autilitylong-termPPAwithaprojectonthesellsidecreatesalongposition,usuallymanagedinchunksthroughthestack-n-rollhedgingmethod(whichiswhyliquidityintheforwardmarketsisimportant).Aspartofriskmanagement,atradingutilitymuststripawaytherisksinherenttoaPPAbyfindinga‘newowner’forthem.Somewaysto‘digest’thevolumesarea)placingthevolumestotheforwardmarketincrementallyb)progressivelysellingbacktocorporatesthroughamixofdeals,orc)sellingbacktoacorporatetheentirevolumesatoncethroughaback-to-backPPA.ThisiswhyutilitiesarebothbuyersandsellersinPPAagreements.Extremevolatilitylevelsin2022werethefirstsignsthattherisksofthestack-n-rollmethodarebecomingmoreandmorechallengingtomanagebecauseofthehighfinancingcosts(almostprohibitiveinahighvolatilityenvironment)associatedwithmanagingtheposition.That’sbecausehedginginefficiencieswhentheforwardcurvedoesnotmoveinsyncacrosstenorscanbeverycostly,creatingcashflowchallenges.18EUROPEANPPAMARKETOUTLOOK2024Eventhoughutilityofftakespickedup(becauseofreducedvolatility),in2023,weobservedthatutilitiesareincreasinglyreluctanttokeepthefullriskontheirbooks,andthere’sapreferenceforback-to-backPPAdeals.Underthesearrangements,utilitiesenterintoPPAsasbuyersbutthenleveragetheirownoriginationteamstomatchtheprojectvolumewithcorporatedemand.Then,theutilityentersintoaback-to-backPPAwithacorporate.Indoingso,theutilityshiftssomerisk(whichwouldotherwiseneedtobekeptonitsbooksandmanagedinthewholesalemarket)tothecorporatebuyer.Ideally,thevolumesandthetenorwouldmirrortheinitialagreementwiththegeneratorascloselyaspossible,butthevolumescanalsobesplitacrossmultipledeals.WesawthepracticeinmarketssuchasSpainandGB,wherecertainutilityplayershavedemonstratedsuchcapabilities,andweexpectthistrendtodevelopfurther.Utilitieshaveanopportunitytoprovideadditionalservicestothebuyers(ontopoftheonesprovidedforthesellers),suchasshapingthedeliveryprofileofthePPAandbalancing(servicesoftenofferedbyutilitiestocorporateswhoenterphysicalPPAsdirectlywithrenewableprojects).Forcorporates,thebenefitliesinapotentiallysmoothernegotiationprocessandoffersanalternativewayofsecuringrenewableenergyfromutilitiesthat,unliketraditionalbundledgreensupplydeals,alsohavethepotentialtomeettheiradditionalityrequirements.Webelievetheincreasedprevalenceofback-to-backPPAs,whereprojectowners,utilitiesandcorporatesjoinforcestoleverageeachother’sstrengthswillcatalysefurtheractivityinthePPAmarket.Lastly,buildinguponthesilentroleofutilities/tradingagentsas‘sleevingparties’toallPhysicalPPAs,weseetheseplayersfurtherleveragingtheirriskmanagementexpertisetofacilitatemorenovelcorporateenergypurchasingapproaches,suchas24/7greensupply,aswellasBaseloadPPAs.19EUROPEANPPAMARKETOUTLOOK2024SPAINANDGERMANYACCOUNTEDFOR50%OF2023’SVOLUMESSpainremainedthetopcountrybyvolumesanddealcountforthefifthconsecutiveyear,withatotalof4.67GW.Animpressive4.3GWacross37dealscamefromthecountry’ssolarsectorwhichisreclaimingitsreign,withmerely260MWattributedtoonshorewind.Lastyear,thecountry’stopposition(3.9GW)wasmostlyduetoAlcoa’stwoonshorewindPPAsofatotal1.8GWwithGreenaliaandEndesa,whichblewthecountry’swinds.Germanyclimbedonepositionandwasawardedthesilvermedalforcontractedvolumesin2023,withatotalof3.73GW.Impressively,solarpv(1.77GWacross18deals)andoffshorewind(1.73GWacross14deals)playedanequalroleinthisachievement,bringingthecountry’ssolarsectorbacktothetopofinterest.SPAIN4.67GWPOLAND0.75GW#46#1616GERMANY3.73GWFRANCE0.64GW#41#1127ITALY1.06GWFINLAND0.48GW#24#1238UNITEDKINGDOMSWEDEN40.96GW90.48GW#11#23GREECE0.95GWPORTUGAL0.42GW#9#5510Italy,whichjumpedsixpositionstoreceivethebronzemedalwithatotalof1.06GWiswellbelowthefirsttwopositions.WiththerestoftheTop10atsimilarspreadpatterns.Thisshowsahighconcentrationof2023activityintermsofvolumesintwogeographies:SpainandGermanyaccountingfor51%ofthetotal16.2GW.However,it’sinterestingtonotethatSpain’sthronecouldbeshakingforthefirsttimeever.Usually,Spainoutperformsthevolumesanddealcountofthesecondpositionbymultipletimes.Incontrast,Germany’ssolarandoffshoresector,alongsideexceptionallyhighdemandfromindustrialsarefinallygivingthecountrythespotwealwaysbelieveditdeserved.Betterlatethannever!Greece,PortugalandSwedenarethenewentriestotheTop10rankingsforcontractedvolumes,withthefirsttwoclaimingapositionforthefirsttimeever!20EUROPEANPPAMARKETOUTLOOK2024Topcountriesin2023bydisclosedcontractedvolumes(GW)DisclosedcontractedcapacityinGW4.678.4GW3.731.060.960.950.750.640.480.480.42SpainGermanyItalyGreatGreecePolandFranceSwedenFinlandPortugalBritainSource:PexaQuote,PPATrackerIntermsofdealcount,thepictureappearsmorebalanced.France’sactivitycomprising28dealsstandsout,jumpingfourpositionssincelastyear.TheNetherlandsisthesinglenewentryintheTop10Rankingbydealcount,mostlyduetosolarandoffshorewinddeals.Topcountriesbydealcount,2023and2022comparison(#deals)RANKINGCOUNTRY2023YEAR-ON-YEARCOUNTRY2022MOVEMENT46Spain311(goldmedal)Spain41Germany2328GreatBritain152(silvermedal)Germany24Poland1423Finland123(bronzemedal)France16Denmark1212Italy104Italy11Sweden811France75GreatBritain11Norway56Poland7Sweden8Finland9Denmark10NetherlandsSource:PexaQuote,PPATracker21EUROPEANPPAMARKETOUTLOOK2024TOPSELLERS:IBERDROLATAKESGOLDBOTHBYVOLUMESANDDEALCOUNTSpanishutilityIberdrolaemergedtheTopSellerfortheyear,whichfallsunder‘Utilities’inoursellercategories.Themedalcomesdueto9dealswithcorporates,amountingto908MW.SixtookplaceinGermanyonthebackofIberdrola’soffshorewindcapacityinthecountry,twosolardealsinSpain,andoneonshorewinddealagaininthelandofEnergiewende.Norway’sStatkraftwasthemostactivesellerwith19deals.Theutilityspreadactivityacrosseightjurisdictionsleveragingamixofhydro,solarpv,onshorewindportfolio.TopSellersin2023byvolumes(MW)908869739.5728600585583496494404.9Source:PexaQuote,PPATracker22EUROPEANPPAMARKETOUTLOOK2024TOPBUYERS:MRBEZOS,WELCOMEBACK!In2023,Amazon’sactivityreturnedtotheEuropeancontinent,leadingtheITconglomeratetocontractabulky1.87GWacrosssevendeals.Accordingtoidentifiabledata(detailsarenotgivenforalldeals),thecorporateemployed1.3GWofsolarinSpain,199MWonshorewindinFinland,268MWoffshorewindinGermany,47MWsolarpvinGreatBritain,and24MWsolarpvinGreece.Intermsofdealcount,Amazonmaintainsthesummitwithsevendeals.Googlefollowssuitwithsixdeals,andminingindustrialUmicorecomesthirdwithfivedeals.TopBuyersin2023byvolumes(MW)1,87611Industrials&1Municipalutility654Source:PexaQuote,PPATracker583575539527.2496411351346.223EUROPEANPPAMARKETOUTLOOK2024INFORMATIONTECHNOLOGYSTILLONTOPITconglomeratesmaintaintheirtopranking,withatotalof3.6GWacross25deals.Amazondominatedwith1.89GW,Equinixprocured539MWandthelikesofMicrosoft,Google,Meta,andDigitalRealtyfollowedsuit.ConsumerStaplesalsomaintaineditsleadingpositionintermsofdealcountwhilealsojumpingtothesecondpositionvolumes-wiseindicatinghighappetitefromtheretail,foods,drinks,electronicsetc,thatfallunderthiscategory.Thesegmentcontractedatotalof1.51GW–120%increasevis-à-vislastyear,across47deals–anequal120%increase.Topcorporateofftakesegmentsin2023,byvolumesanddealcountVolumesinMW#dealsMW#deals504,0003,653473,50045403,000352,50030301,4442,000242525Capital1,519Goods19693201,500950Metaland14ChemicalsMining151,0851,00011121010Telecoms5005585215363516400InformationConsumerHealthcareAutomobilesTransportatConsumerTechnologyStaplesandDurablesComponentsSource:PexaQuote,PPATracker24EUROPEANPPAMARKETOUTLOOK2024ThoughtsontheCorporatePPAmarketVolatilityledtoapermanentshiftinprocurementstrategies:In2022,manyreferredtosomecorporatedealsas‘panicbuying’;indeed,someenergyintensiveswereabruptlyforcedtoleanagainstrenewablesforsomeformofpricehedging.However,thedataandourobservationsprovethatthiswasnotatemporarytrend,butastrategicshiftinprocurementstrategies,forwhichPPAswonaprominentrole.Largeindustrials,especiallyoneswhereenergyplaysacriticalpartinthecostofgoodstheyproduce,aresettoprocureatleastacertainpercentageoftheirenergyneedsthroughPPAsonasustainedbasis.Corporatesarebecomingmorefirmcounterpartiesinnegotiationtables:PPAsareavastlynewconcepttomostcorporates,buttheirsophisticationorganicallyincreasesovertheyears.In2023,weobservedmultiplepatternsthatillustratehowfartheyhavecome.Firstly,therewasmoreawarenessofpriceandprofilerisks.Inessence,thistranslatestohowdifferentPPAvolumesarepriced,andtherisksthatareassociatedtothesestructures.Forexample,Pay-as-Produced(PaP)PPAscarrysignificantprofileriskduetorenewablespricecannibalization.Insomemarkets,suchriskhasbecomeprominent,anditplaysaroleintheprice’sengineeringintheformofdiscounts.Corporatesarefirmerinnegotiatingafairpriceanddiscussingthesediscounts,wheretheyapply,especiallyaftersomeunderpricingofcannibalizationriskinthepastyears.Secondly,wenotedaheightenedfocusonperformanceguarantees.Guaranteedavailabilitytranslatesintosomeformofcertaintyinrelationtothevolumesdeliveredtotheconsumer,andthereneedstobeadiscussiononhowunderperformancewillbetreatedcontractually.ThisisaparticularrequirementforPPAforGreenH2Productionbecauseofhowcriticalsufficientvolumesareforelectrolyserstoperformwell.Still,corporatesareequallyfocusedonhowexposedtheyareinthemarket.ThishasalsoledtointerestinaPPAportfolioofdifferenttechnologiesthatreducethisrisk.Therearemorediversecorporateprofilesinthemarket:ITconglomeratesarenolongerthemaindriversofthePPAmarket,andthishasbecomeclearoverthepastyears.Newnamesandprofilesareconstantlycomingintothemix,whichincreasesthemarket’shealthycompetitionandliquidityofofftakers.Intermsofdealcount,theITsectoraccountedforaround9%ofdealcount,and21%ofvolumes.25EUROPEANPPAMARKETOUTLOOK2024SOLARPPAVOLUMESQUADRUPLEBOTHONSHOREANDOFFSHOREWINDIn2023,solarPVwasbyfarmorepopularinPPAdeal-making,holdingthelion’ssharewithatotalof10.5GW–or,almost65%oftheyear’s16.2GWPPAvolumesacross160deals.Sunshine-thirstysolarpanelsoutperformedtheironshoreandoffshorewindcounterpartiesatallendsbyfourtimes.Onshorewindsaw2.3GWacross58deals,whileoffshorewindsaw2GWacross20deals.Intotal,since2018theEuropeanPPAmarkethasseen28.4GWofsolar,19.4GWofonshorewind,and6.7GWofoffshorewind.Spainisthetopsolarcountrywith14.2GWofPPAs,andGermanyissecondwithmultiplelevelsdownat3.6GW.Swedenisthetoponshorewindmarketwith4.5GW,followedbySpainat3.8GW.Germanydominatesoffshorewindwith2.8GW,withGreatBritainsecondat1.7GW.EvolutionofPPAtechnologiesbyyearlyadditions,2018-2023(GW)SolarOnshoreWindOffshoreWind10,576,134,745,002,704,593,752,892,392,192,052,432,021,091,060,86202220200,260,062019202320212018Source:PexaQuote,PPATrackerNote:Hydro,mixedtechnologies,andunknowntechnologieshavebeenexcludedfromtheanalysis26EUROPEANPPAMARKETOUTLOOK2024BalancingcontractsarebecomingpivotalOverthepasttwoyears,asmoreintermittentpowerjoinedthegrid,imbalancepriceshaveincreasedsteadily,resultinginoftenelevatedbalancingcosts.In2022,ashighelectricitypricevolatilityexacerbatedthesemarketfundamentals,thepricesquotedbyvendorsservingasBalancingResponsibleParty(BRP)spikedtoEUR7/MWh.In2023,despitepricesdroppingtoapproximatelyEUR3/MWh,theystillremainedhigherthanthelong-termaverage.Forrenewables’ownersandoperators,suchdevelopmenthasmanifestedthroughaugmentedroute-to-marketexpensesandbalancingcosts,whichplayacriticalroleinanasset’srevenuestack.Giventhestateoftheenergytransition,elevatedsystemcostswillonlypersistfurther,becomingastapleconsiderationforaPPA’sadditionalcost.Giventhestateoftheenergytransition,elevatedimbalancecostswillpersistforaconsiderabletime.Wesawthatafter2022’svolatilityandpricinglevels,manyrenewableproducersentered2023verycautiousaboutbalancingagreements,whicharenowconsideredamaterialcontractsinanasset’srevenuestack.Amidtighteningmargins,bothBalancingcontractandGoOssalesoptimisationconstitutethelowhangingfruitstowardsachievingportfolioexcellence.Weanticipatethetrendtocontinuetogrowfurtherin2024—JonasNihoej,HeadofPortfolio&TradingServicesatPexapark27EUROPEANPPAMARKETOUTLOOK2024CHAPTER2:PPAADVANCEMENTSANDINNOVATIONS2.1HYBRIDPPASENTEREDTHESCENEThemomentumaroundrenewables-plus-storageincreasedsignificantlyover2023,asmostplayersarelookingateitherintroducingstorageintheirportfolioorincreasingcapacity.TheimpetusalsomanifestedintheEuropeanPPAmarketthroughtheemergenceofthefirstHybridPPAsforlarge-scalesubsidy-freesolarassets.Leveragingsuccessfulandwell-understoodstandalonestoragebusinessmodelscentredaroundgridservicesinpioneeringmarketssuchasGreatBritain,HybridPPAsaresettobeanimpactfulnextfrontier.Theideaistocombinethebestoftwoworlds,gridservicesandgenerationassetperformanceboostthroughprofileshaping,inastructuredcontractualmanner.It’snotrandomthatthefirstbankableHybridPPAforapurelysubsidy-freesolarprojectemergedinGreatBritain.NOTABLEMENTIONBUYER40MW/80MWhInJune’23,equityfundDIFCapitalPartnerssignedaHybrid55MWPPAwithEngiecoveringa55MWsolarPVprojectco-locatedwitha40MW/80MWhbatterystorageasset,inBedfordshire,SELLERSUK.TheHybridPPAmirrorsRenewablePPA&StorageCapacityagreement(CSA)/Optimisationagreementcontractualset-up,wherethere’sa10-yearPPAforthesolarasset,anda10-yearoptimisationagreementforthebatteryelement.10-ySolarPPAPexapark’sStorageandPPATransactionsteamcollaboratedleveragingquant-drivencapabilitiestoadviseononeofthefirstbankablepurelysubsidy-freeHybridPPAsinthecountry.SuchastructureisreadytobeexportedinfurtherEUmarkets.10-yOptimisationAgreement28EUROPEANPPAMARKETOUTLOOK2024Gridconnectionsavingsareacoreattractionforco-location.Still,thecombinationofvaluecreationfromgrid-levelservicesalongsideoptimisationofasset-levelrevenuesepitomisesthedriverbehindthepromisinglandofthebusinessmodel.Valuinghybridassetsisacorechallengetoaccelerateinvestmentdecisions,asmodellingavailablemarketopportunitiescanoftenbeamovingtarget.AcrosskeymarketsinEurope,asignificantpipelineofhybridassetsisreadytotakeifcontractualarrangementscanmakethefinancialmodelbankable.WebelieveHybridPPAsformerchantassetswillmovebeyondGreatBritain.Duetocannibalizationrisk,Spain’ssolar-plus-storagesegmentisexpectedtospikeinafewyears.—BrianKnowles,DirectorofStorage&FlexibilityWealsonotedaHybridPPAinLithuania,althoughthestructurediffers.UnderanEnergy-as-a-ServicePPAwithCarlsberg’sSvyturys-UtenosAlus(SUA),GreenGeniuswilloffertwosolar-plus-storageplantstocover100%ofthecorporate’sdemand.Thefirstprojectisanon-sitesysteminabreweryinUtena(CODbyMay2024).Itwillbuilduponanexisting1MWrooftopinstallation,bringingitstotalcapacityto2.5MWplus2MWhbattery.Thesecondproject,a5MWsolarplus4MWhbatterystorage(DCandACset-up),willcompriseanoffsitesysteminButrimonys(CODJan2025).Differentrisk-profileHybridPPAshaveemergedinGermanysince2022.Thecountryhaspioneeredgovernment-backedpartialsubsidyschemesresultinginasolar-plus-storagepipelineofmorethan1GW.ThroughitsInnovationTenders,Germanyistheonlycountrythathascreatedatangibleroute-to-marketforhybridassets.Thepartialsubsidyschemeleavesfurtherroomforcontractualinnovation,asthepremiumtariffisappliedontopofthemerchantrevenuestheprojectscanachieve.Asthewinningprojectswillseekoutfurthercontractualarrangements,theoutlookforGermany’sHybridPPAactivityisverypositive.Findoutmoreaboutthetopicinourdedicatedreport“Renewables-plus-StorageCo-locationTrends:HybridPPAsandMore”here.29EUROPEANPPAMARKETOUTLOOK20242.2EARLYSIGNSOFPPASFORGREENH2PRODUCTIONNOTABLEAnothernotabletrendin2023wastherapidgrowthofPPAsdestinedtopowerupcominggreenMENTIONhydrogenandammoniaplants,withamixofnuancespaintingthewholepicture.PPAslinkedtogreenhydrogenandammoniaproductionwereannouncedinNorway,FranceandGermany,leveragingnewandexistingcapacity.EU’sfirstDelegatedActactedasakeyregulatorydrivingforcebehindnascentactivity.Althoughnotfullydefined,theActshedenoughclarityontherequirementsforhydrogentobeconsideredarenewablefueltoleadtothetrend’semergence.Commissionedassetswereabletoexploitsomeregulatoryflexibilityaroundadditionalityexceptions.Norway’sabundant–andbaseload–hydropoweroffersacompetitiveadvantagetogreenfuelplantsrequiringheftyTWhofpowerannually.ThecountryhasseenofftakeactivitybyaspiringgreenhydrogenproducerssuchasFortescueFutureIndustriesandAkerHorizons(bothwithStatkraft),eventhoughthePPAtechnologyremainedundisclosed.Francewasnotonlyasurpriseforitsincreasedcorporateappetite,butalsofortheinnovationinthemarket.GreenhydrogenproducerLhyfesignedtwoPPAsofatotal28.2MWcapacitytofeedgreenhydrogenplantsinBrittanyandOccitanie–oneofwhichbeinga15-yearRepoweringPPAlinkedtoa17-year-oldonshorewindfarm.AshareofGermany’soffshorewindwasalsore-directedtowardsgreenfuelsproduction,withtheemergenceofdealslinkedtobothnewcapacity(Iberdola’s476MWBalticEagle),aswellasexistingassets.180MWOneofGermany’sfirstoffshorewindassetscommissionedin2015underFrom:288MWtheEEGsubsidyscheme,optedout80%ofitsoutputfromthesupportButendiekmechanismtocatertotheincreasingneedsofPPAofftakers.offshorewindGiventhemarketlandscapeof2023,PPAsoftenoffermoreattractiveOpt-outfromrevenuesthanEEG.Butendiek,similartootherassetscommissionedintheEEGschemesameperiodunderthenationalsupportscheme,wouldsoonenterEEG’sPPAforHydrogenlow-endpricetier.Tothisend,Pexaparkassistedtheproject’sinvestorsinfindingtherightofftakers,resultingintwolong-termPPAs.BothagreementswillenterintoforceinJuly2024:•�Nov‘23:Anunnamedutilitywillofftake750GWhannually,62.5%oftheproject’stotaloutputtofeedupcominghydrogenproductionplants•�Dec‘23:SwissutilityBKWEnergiewillofftake200GWhannually,18%oftheproject’stotaloutput•�Theremaining20%ofthevolumeswillstillbenefitfromEEGarrangements30EUROPEANPPAMARKETOUTLOOK2024InPPAsforGreenH2Production,regulatoryriskisoneofthelargesthurdles.TheEUDelegatedActguidelines,whichdriveelectrolyserinvestmentatthemoment,areamovingtargetwithmanyuncertainties.Oneofthebiggestchallengeswasmakingmanyassumptionsaroundwhereregulationwouldbegoing,andcomingupwithascenarioaccordingly.Regardingthestrategicnatureofthedeal,forexistingoffshorewindassetsunderEEGinthecountry,webelievetheoptimisationroutethroughoptingoutofthesubsidyschemeisasmallriskwithamajorrevenueimpact.ThelevelofopportunityinthefuturewilldependonhowPPApriceswillevolve,andwhethertheycanoffermoreattractivereturnsthanthelow-tierprice.—MathieuVille,HeadofPPATransactionsatPexaparkWealsoobservedsome‘frameworkagreements’,whichindicateanalternativesourcingstrategyforsecuringthepotentiallyhugeelectricityvolumesrequiredforGreenH2production.Forexample,SpanishO&GcompanyCepsasignedaframeworkagreementwithGrupoIbereólicaRenovablesforupto5GWofsolarandwindfortheformer’sfutureH2projectsinAndalusia.Likewise,SwedenalsosawH2GreenSteelsigningtwoframePPAswithFortumforCO2-freeelectricity,althoughrenewableenergyisnotexplicitlyreferencedintheannouncement.Allinall,in2023theEuropeanPPAmarketstartedplayingagreaterroleinfacilitatingtheuptakeofgreenhydrogen,andwebelievethetrendwillcontinuein2024dependingonsomecriticalfactors.Ouranalysisindicatesthatoutofatleast120GWofprojectannouncementsfloatinginthemarket,only1%hasachievedfinalinvestmentdecision(FID).Webelieve2024willbetheultimatetestofwhetherinvestorsareconvincedbyprojecteconomics,withthebusinesscasenotfullyclarifiedyet.Thesituationcouldbemorestraightforwardforprojectscomingoffthefirstauctions(thereforeenjoyingaformofstatesubsidies),andwehopetoseesomeaccelerationbothindevelopmentandfinancingactivityonthatfront.Lastly,moreregulatoryclarityandsupportareneededonrenewablefuelsofnon-biologicalorigin(RFNBO)compliance.Forexample,there’salotofuncertaintyaroundthefunctionof‘intermediaries’suchasutilities/traderswhooftenfacilitatedealsbetweensellersandbuyers.RenewableenergyisheavilyneededtofeedanyPower-to-Xproject.However,thesweetspotliesinthedeltabetweenprojecteconomicsandPPAprices–andthislandscapeisstillevolving.EventhoughthetrendofPPAsforGreenH2Productionemergedquickerthanmainstreamexpectations,theviabilityandrobustnessoftheconceptwillconsolidatewiththesigningofmorenon-conditionalPPAs.31EUROPEANPPAMARKETOUTLOOK20242.3AGGREGATINGDEMAND:MULTI-BUYERPPASMulti-buyerPPAs,alsoknownasAggregatedPPAs,arenotnewtotheEuropeanPPAMarket,assuchdeals,inprinciple,emergedin2016.However,2023sawtheconceptmaturinginanacceleratedmanner.Firstthingsfirst:Amulti-buyerPPAisonecontractsellingtomultipleaggregatedofftakersunderthesameumbrellaagreement.Theideaistopulltogetherthedemandofsmaller-sizedcorporateswithlowerconsumptionvolumesannually,andenablethentoformacoalitiontobuyasoneparty.It’sworthnotingthere’sasignificantdistinctionbetweenMulti-buyerPPAsandlargeassetssellingtomultiplebuyersthroughseparateagreements.Forexample,atthebeginningoftheyearRWEsignedPPAswithelevenindustrialsandonemunicipalityforahefty1,500GWhperannumfromthe295MWNordseeOstand288MWAmrumbankWestoffshorewindfarmsinGermany.Inthiscase,eachcontract’slength,startdate,andvolumestructureareindependent.InaMulti-buyerPPA,there’sajointnegotiationofcorporatesthatwanttobuytogether.Typically,there’screditworthyanchorofftakerwhichiscreditworthytobalanceoutnon-investmentgradecorporates.Still,theallocationofdefaultriskisoneofthelargestdiscussionpoints.However,requirementsfromthemarketareevolving,andsellersappeartobestandardisingandsimplifyingthecontractstructure.Forexample,inNov’23LightsourcebpinvitedcorporatestojoinacollectiveduetoofftakesolarenergyfromSpain,aimingtolaunchcollectivePPAopportunitiesregularly.TheyearalsosawarecordnumberofMulti-buyerPPAsinDenmarkandSpain.Multi-buyerPPAsannouncedin2023DATECOUNTRYPPASIZEBUYERSELLERTECHNOLOGYTENORJune’23DenmarkSolar(YEARS)Aug’23Denmarkn/a7corporatesReelSolar5Nov’23Spain29.00Bettern/a4kitchenEnergy10manufacturersLightsource127.00bpSolarn/aTheFashionDec’23SpainPactibvogtSolarn/aThermoFisherScientific,EurofinsScientificSource:PexaQuote,PPATracker32EUROPEANPPAMARKETOUTLOOK2024WhileotherEuropeanjurisdictionssuchasFrance,Finland,GreatBritainandNetherlandshaveseensimilardealsinthepast,thelargestdealcounteverwasobservedin2023.Inspiteofincreasedinterestintheconcept,webelievegovernment-backedcreditguaranteeschemeswouldbeamoreimpactfultooltoincreasethepoolofSMEswillingtobuy.Thesophisticationofsellersandinclusiveguaranteeschemescouldbethemaintwodriversofthetrend.2.4NEXTFRONTIER:24/7GREENENERGYPURCHASINGA24/7carbon-freeenergy(CFE)procurementapproacheffectivelymakesgreaterandgreenercontributionstotheenergytransition,ashasbeenprovedbyseveralstudies.Themorenichetrendtoenergyprocurementisdrivenbycorporatesinterestedinhourlymatchingofconsumptioninlieuoftheprevalentannualconsumptionmatchingmodel.Thistrendislinkedtotheincreasedsophisticationofcorporates,thistimeseenbythepioneeringones,andtheheightenedfocusonprofileandshaperiskandadditionality.Thebenefitsarethreefold.First,morerobustgreencredentialsthroughhourlymatchinggivegreenclaimsgreatercredibilitythananannually-basedapproach.Secondly,thismoregranularapproachresultsingreaterdeploymentofrenewables,asineffectdemanddrivesthedeploymentof24/7greenenergy,akaa100%renewablesgrid.Thisincreasestheadditionalityimpactoftheagreement.Veryimportantly,moregranularmatchingofrenewableenergyPPAvolumeswithdemandincreasestheeffectivenessofPPAhedgingbyreducingthebuyer’sexposuretothewholesalemarketforthedeficitandexcessvolumes.Therefore,a24/7procurementcanbeaveryimpactfulapproachtosourcingrenewableenergy.Weoftenhearrequestsfor‘smarterrenewables’typicallyaddressingthesupplyside.Butwhatifaprocurementapproachisinthedrivingseattorequestsmarterrenewables?Untilthisyear,studiesaroundtheconcepthaddemonstratedthat>90%hourlymatchingistechnologicallypossible,butcomesatahighcostprimarilybecauseoftheover-procurementtomeetthehoursthatarehardertoserve.However,thesestudiesdidn’tanalysethehedgingbenefitofreducedexposuretomarketpricesinsuchanapproach.OnbehalfofEurelectric,Pexaparkconductedapubliclyavailablestudythatprovedthata24/7approachimprovesthehedgingimpactofaPPA.Whilepreviousstudieshaveusedestimatedtechnologycosts,thePexaparkstudyusedamarket-basedapproachtoprovideaviewofthehedgingcostandbenefitfora24/7CFEsupplyportfoliousingPPAswithexistingrenewabletechnologies.Consistentwithpreviousstudies,thePexaparkandEurelectricstudyfoundthathighlevelsofhourlymatchingarepossiblewithcurrenttechnologies.AnoptimisedportfolioofwindandsolarPPAsisenoughtostarta24/7journeyandachieve60-75%hourlymatching.Storageplaysakeyroleinthisapproach,sinceportfoliosthatincludeco-locatedrenewables-plus-storageassetscanprovideupto90%hourlymatchingbasedonthelatestconfigurationsweseetoday(100%powerratiowith4hduration).33EUROPEANPPAMARKETOUTLOOK2024Ourstudydemonstratedthata24/7strategybasedonexistingtechnologiesincludingco-locatedbatterystoragecanprovidebothahighlevelofhourlymatchingandapositivefinancialhedgingbenefitunderarangeofmarketconditions.However,implementingandmanagingtheapproachrequiresahighdegreeofsophistication.Therefore,marketplayerswithenergyriskmanagementcapabilitiessuchasutilitiescanplayanimportantroleinfacilitatingcorporate24/7greensupplycommitments.—JohnDallimore,HeadofCorporatePPA&H2atPexaparkReadmoreonour24/7renewablePPAstudyonbehalfofEurelectrichere.Webelievethe24/7cleanenergyprocurementapproachwillbethenextbigfrontierinthemediumterm,andwemayseeafewintentionstomirrorthisapproachin2024.Demandfor24/7willalsoallowutilitiestofacilitatesuchagreements,havingaccesstomultiplegenerationandprofiletechnologies.So,there’sverymucharoleforutilitiesandassetownerswiththatriskmanagementcapabilitytoplaytoenablethegrowthanddevelopmentofthisPPAsegment.Finally,as24/7PPAssharesimilarbenefitsandchallengestoBaseloadPPAs,arisk-adjusteddiversifiedportfoliobygeographiesandtechnologieswillplayapositiveroletoassetownersinterestedintappingthisnewopportunityinthemarket.Inourview,understandingtheriskprinciplesandtheassociatedportfoliotoolstomanagetherisksofBaseloadPPAsisacorepre-requisiteforthenextstepof24/7PPAs.LastbutnotleastSpanishVirtualCross-borderPPAs:Spainsaw520MWofCross-borderPPAslinkedtosolarassetsacrosssevendeals.TheMediterraneanQueenistheprimechoiceofcorporatesattemptingtooffsetpan-Europeanconsumption(orpartofit)throughonedeal.However,thestructurecouldunravelsignificantlevelsofriskwhengenerationdoesnotsitinthesamepricezonewithconsumptionduetotheuncertaintyaroundwhetherthetwo(ormore)prizezonescorrelate.WebelieveCross-borderPPAsaremainlydrivenbyESGconsiderations(throughtheuseofGoOstooffsetconsumption),withoutalwaysprioritisingpricehedgingaspects.NuclearPPAs:Nuclearhasbeenattemptingtofinditsplaceintheenergytrilemma,mostlyleveragingstrengthsaroundenvironmentalsustainabilityandenergysecurity.ThediscussionhasledtothepossibleemergenceofNuclearPPAsnotonlywithinthebordersofFrance,wherethenarrativegoesinlinewiththecountry’shistoricalenergymix,butalsoacrossmoreEuropeancountriesduetoinnovationsaroundSMRs(SmallModularReactor).Thefeasibilityoftheconceptwilldependonthedeltabetweentheeconomicsofemergingtechnologies,powerprices,andthepositioningofnuclearpowerintheenergytransition.34EUROPEANPPAMARKETOUTLOOK2024ACTII35EUROPEANPPAMARKETOUTLOOK2024CHAPTER3:PROMINENTEVENTSOF20233.1VOLATILITYANDPRICESENROUTETOSTABILISATIONTheyear2023wascharacterisedbyaconsistentdownwardtrajectoryofgasandelectricityprices,resultinginreducedvolatilitylevelsinpowermarketscomparedtotheyearbefore.TakingasareferenceexamplevolatilityintheGerman1-yearfuturecontracts,fromthepeak230%volatilityinJanuary’22,lastyear’speakwasexperiencedinJanuary’23wherevolatilitystoodat90%.ByQ4,volatilityhaddroppedtolowerlevelsbelow54%.Eventhoughvolatilityisreduced,itisstillexceptionallyhighvis-à-visothercommodities,andabovehistoricaverage.Historicevolutionofannualisedrealisedvolatilityacrossassetclasses(Jul2020-Nov2023)Currency[EUR/USD]Stocks[SP500]OilPower[GermanBaseFuturesY+1]Bonds[Euro-bund]250200Jan‘22Sep‘22230%215%AnnualisedVolatilityin%p.a.150Jan‘21May‘21Jan‘23Oct‘2390%54%42%49%100500Source:PexaparkcalculationsNote:‘GermanPower’referstofront-yearBLcontractstradedonEEX.SP500isastockmarketindextrackingtheperformanceoflargelistedUScompanies.‘Brent’tracksvolatilityoftherollingfront-monthcontractsofNorthSeagradesofcrudeoil.‘GermanBunds’referstovolatilityratesofGermanbondswithan8,5-10.5yresidualtenorrange.36EUROPEANPPAMARKETOUTLOOK2024Utilitiesandtradinghousesthoroughlymonitorvolatilityduetoitscentralroleinassessingandmanagingfinancialrisk.Inatypicalyearbefore2020,annualisedvolatilitiesoffront-yearcontractsweremovingat15-35%levelsforextendedperiods,stilldisplayingamanageablelevelofriskfortradingagents.Today,allPPAsellersandbuyersareimpactedasthenewest‘tradingparties’ofgreenelectronsandvolatility’seffectonpricing.Thehistoricnumbersindicatethatwehaveenteredaneweraofprolongedvolatility,fornowmostlydrivenbyfossilfuelpricingrisksandmacroeconomics.Onthepricingfront,powerpricesacrossEuropedroppedgenerouslyfromlastyear’speaksof700EUR/MWh,butremainhigherthanhistoriclevels.Monthlyaverageday-aheadpricesinselectedEuropeancountriesEUR/MWhITCSSE4SE1DEFR180160140120100806040200JanFebMarAbrMayJunJulAugSepOctNovDec‘23‘23‘23‘23‘23‘23‘23‘23‘23‘23‘23‘23Source:Entso-e,PexaparkNote:�ITCSstandsforItaly’sCentralSouthbiddingzone;SE1andSE4areSweden’snorthernandsouthernbiddingzones,respectively.AsPPApricespartlyderivefromforwardcurvesdeterminedfromtradedforwardcontracts,theyarecontinuouslysubjecttofluctuationsandvolatility.FromthefirstdayofJanuaryat78.7EUR/MWhtothelastdayofDecember2023at50.1EUR/MWh,theEUROCompositedecreasedby35%-withtheaveragethroughouttheyearstandingat58EUR/MWh.Despiteincreasedfuturestradingactivitythrough2023,powerliquidityremainswellbelowpre-2021levels.37EUROPEANPPAMARKETOUTLOOK2024DailyevolutionofPEXAEUROComposite,2023EUR/MWh-35%807570656058555045Source:PexaQuote,PPATrendsNote:�TheEUROCompositeisanaverageof10-yearsolarandwindpay-as-producedPPApricesacrossEurope,foracommercialoperationdateinY+1andY+2(rollingaverage)Whenweputthepastyearinperspective,itderivesthattheaverage2023PPApriceslayjustabovethe58EUR/MWhaveragesince2019.ThisvalueisheavilyinfluencedbythespikeswitnessedfromQ42021onwards,butarestillhigherthanthe‘oldnormal’.IfyouwouldliketofindoutmoreaboutPPAbenchmarkpricesforaspecificEuropeanmarketonPexaQuote,pleaseclickheretobookanintroductorycall.DailyevolutionofPEXAEUROComposite,2019-2023EUR/MWh18016014012010080605540200Source:PexaQuote,PPATrends38EUROPEANPPAMARKETOUTLOOK2024Onthebackoflowervolatilityandhighcorporatedemand,riskdiscountsfactoredintoPPApricingtocompensateformarket,technology,andstructure-specificriskshavedecreasedsubstantiallycomparedto2022levels.Forexample,aspartofanongoingassessmentofPPAprices,PexaparkhasobservednotableshiftsinmaturemarketssuchasSpainandGermany,whererobustcorporatedemandforlargevolumeshassubstantiallyreducedriskdiscounts.Thisisalsoaresultofmanyutilitiesshiftingtheirfocustowardsback-to-backPPAswithcorporatesratherthanwarehousingandmanaginglargerisks.Ontheotherhand,somemarketsaredepictinganincreasingperceptionofcannibalizationrisks,withofftakersrespondingbypricinginsubstantialdiscountsintoPay-as-Produced(PAP)structures,aswillbefurtherexplainedlaterinthischapter.Althoughriskdiscountsfromofftakersaredecreasing,theremightbesome‘hangovers’from2022’shighvolatility.OfftakerswhosignedPPAswhenthemarketwasdistressedcouldnowbesittingwithanexpensivePPA,highlightingtheimportanceofunderstandingthedifferencebetweenvaluingandpricingaPPA.Eventhoughawarenessisincreasing,wearestillseeingcorporateofftakersfocusingontheoutrightpriceofthePPA,meaningtheyareforegoingmarketswheretheycanachieveahigherreturn,asthePPAshaveahighervalue.—RommeroCarrillo,DirectorofBusinessDevelopmentatPexaparkAnoteonnaturalgaspricingandavailabilityGaspricesfellsignificantlyin2023comparedtothepreviousyear,mainlyduetodemandlevelswellbelownorms,whileLNGandpipelinesupplyremainedstrong.EUstoragefullnesshitnewrecordsin2023,reachingmandatorytargetswellaheadofschedule.ApotentialescalationoftheIsrael-Hamaswarhassparkedfearsofsupplyshockstooilmarketsinparticular.However,despitedisruptionstoshippingroutesintheRedSea,supplyhasnotbeenadverselyimpacted,norhaveenergypricesbeenasbullishaspreviouslyanticipatedbythemarket.Throughout2024,gasandpowerdemandisexpectedtorecoverslowly,asdemandisstillbeneathpre-crisislevels.IncreasingconsumptionlevelswilllikelybemetbyrisingrenewablesandFrenchnuclearoutputs,squeezingthermalplantrevenues.Gasconsumptionwilllikelyslowlygrowthroughtheyear,withmostofthatextrademandbeingmetthroughLNG.DavidBattista,PPAPriceReporter&PPAMarketEditoratPexapark39EUROPEANPPAMARKETOUTLOOK20243.2MARKETFUNDAMENTALSSHOOKUPFINANCINGCOSTSThepastyearhasbeenthe‘rainbowafterstorm’inmanyaspects,butnotall.Followingtheprogressivesettlingofthepricingandregulatoryturmoil,therenewablesindustrywasconfrontedbyasnowballeffectofchangesinmarketfundamentals,resultinginhigher-than-averageconstruction,operational,andfundingcostsforrenewableassets.Thecostofdebthasrisenprimarilyduetorisingbaserates.The10-yEuroswapratesurgedtoapeakofalmost3.9%followingacontinuedupwardtrendoverthepast18months,toendtheyearataround2.5%.Suchratespresentadrasticallydifferentenvironmentthantherenewablesfinancingcommunityhaslearnedtooperatein.Lendermarginsarereportedlylargelyunchanged,indicatingcontinuedbankappetiteforthesector.Therisingcostofdebtandequitycapitalthenservedafurtherblowbyincreasingthediscountratesatwhichassetsarevalued.10-yearEuriborswaprate,2020-2023(%)%4.03.53.02.52.01.51.00.50.0-0.52020202120222023Source:investing.comThemostimmediateeffectofhighfinancingcostswasasharpdeclineinfundraisingforprivateinfrastructurefunds.AccordingtodatafromInfrastructureInvestor,fundraisingplummetedfromanannualEUR140billionin2022toEUR27billioninthefirstninemonthsof2023.40EUROPEANPPAMARKETOUTLOOK2024Fundraisingactivity,2018-Q32023EURObillion-94%1201101009080706050403020100H2H1H2H1H2H1H2H1H2H1Q3H1201820192019202020202021202120222022202320232018Source:InfrastructureInvestorChallengesinmarketfundamentalsarecatalysinginterestinsqueezingmargins,asmarketplayersarelookingtomakethemostoftheirportfolio.Eveninascenariowherefinancingcostsgodown,portfoliorisksassociatedwithsystemcostsandvolatilitywillfurthercontractmargins,andinvestorswillpushforhigherrisk-adjustedreturnsthanabondyield.Economiesofscalewillplayacriticalroleinthistrend,whichwebelieveislinkedtotheconsolidationweseeinthemarket,asthelargertheportfolio,thelargertheresourcestofocusonthedetails.Weobservedanewappreciationforthecomplexitiesaroundstructuringarisk-adjustedhedgingstrategy,butinterestremainsamonglargeplayersfornow.—ItamarOrlandi,SeniorRiskAdvisoryManageratPexaparkOptimisationofrevenueforsubsidisedassetsUnderthemegatrendofoperationalexcellence,whichisunfoldinginstagesandispioneeredbyplayerswiththelargestportfoliosinthemarket,webelievethatmoreassetswillseekoptimisationoftheirgovernment-backedrevenue.Inthepast,limitedhedgingsophisticationknowledgeinstilledthemindsetthatgovernment-backedassetsreceivingastablerevenuethroughoutthetermyearsoftheschemehadlittleleewaytoproactivelyincreasecapturedrevenue.Asrenewablesareunravellingthemysteriesoftheopenelectricitymarkets,there’sincreasedappetitetoseewhatvalueishiddenintheiroperationalportfolio.There’sanàlacartemenuofopportunitiesinthemarket,andthemostutilisedtoolsaretwo:a)Optimisingthemerchantexposurewithinthesubsidyschemeandb)optingoutpartorwholeannualvolumesfromthesubsidyrenumeration(subsidy-optout)toachievebetterpricinginthePPAmarket.Nonetheless,theextentoftheopportunitywilldependonthepricingenvironment,andtheregulatoryflexibilityoftheschemes.Germany,especiallyintheoffshoresphere,Denmark,Netherlands,FranceandPolandaresomeoftheopportunitieswe’veseenthemarketpursuing.41EUROPEANPPAMARKETOUTLOOK2024OffshorewindLCOEtroublesHighfinancingcostsimpactedoffshorewind,inparticular.Over2023,wesawaseriesofevents–highinterestrates,loweringpowerpricesandincreasedcostofmaterials–affectingoffshorewindLCOEinimpactfulways.Headlinesdidnotonlycomefromacrossthepond,withseveralUSoffshorewindprojectsindevelopmentrequestingre-negotiationoftheirallocatedCfD,butalsofromtheEuropeancontinent.InGB,Europe’slargestoffshorewindmarketbyinstalledcapacity,Vattenfallputapauseonthedevelopmentofits1.4GWNorfolkBoreas,andwillre-evaluatetheinvestmentstrategyoftheentireNorfolkzone(intotal4.2GW),whichhelda£37/MWhfromthecountry’sAR3CfDallocationroundin2019.Inaddition,UK’sAR5tenderdidnotreceiveasinglebidforthe5GWthatwereupforgrabs.TheenvironmentalsoaffectedsomePPAnegotiationsfornewoffshorewindprojectsthathaltedbecauseofdevelopmentrecalibration.ForexampleinGermany,offshorewindLCOEjumpedtonewhighsatmorethan110EUR/MWhwhilePAPPPApricesintherangebetween60-75EUR/MWh.ComparisonofLCOEandPPAPricesacrossdifferenttechnologies,GermanySolarPVOnshoreWindOffshoreWindPPAvsLCOE(EUR/MWh)12012012010-yearPPA11011011010010010-yearPPA1009010-yearPPA9090808080702024202520267020242025202670202420252026606060505050404040303030202020101010000202320232023Source:PexaQuote(January2024),BNEF(2023).Note:AveragepricesthroughoutJanuaryLCOE-LowLCOE-Highfora10-yearPay-as-Produced(PaP)PPAinGermanywithaPPAstartdateof1January2025.Nonetheless,goodnewscamefromGermany,asthecountry’s7GWoffshorewindtenderprovedoversubscribed,leadingtonegativebids.Atthesametime,GBisalreadyadaptingtherulesforthenexttenderswhileincreasingceilingpricesforoffshorewindby66%.EventhoughthisisnotdirectlyrelevanttothePPAmarket,acommonpracticeintheGBoffshorewindmarketistoputforwardpartofanoffshorewinddevelopmenttotheCfDroundstoachievealevelofinflation-linkedrevenues,sothattheyhavemoreleewaytoleverageopportunitiesinthemarket-drivenopenenvironment.Thisway,morecapacitybecomesavailableforthePPAmarket.Germanyholdsthelion’sshareof2023’s1.85GWoffshorewindPPAsacross16deals,withactivityalsonotedintheGBandNetherlandsmarkets.Thepictureisdifferentfrom2022,whereactivitywasmorebalanced.42EUROPEANPPAMARKETOUTLOOK20243.3SHORT-TERMPPASSHOWEDMIXMOVEMENTSShort-termPPAsdifferlargelyintenor.Theirrangespansacrossweeks,months,oruptofiveyears.Onthebackofthatnote,thepicturein2023wasbothpositiveandnegative.AlthoughmostSTPPAsdonotmeetthecriteriaofourPPATracker,wekeepournoteswhenSTPPAsarepubliclydisclosedtoseeiftheyaresignedfornewprojects.Iftheydo–whichisstillrare–itmeanstheyhaveplayedaroleintheprojectcomingonline,andthereforearequalifiedforthePPAcapacitywe’reinterestedintracking.Asthisisaverynascentmarket,withsomelendersstillreluctanttoacceptsuchtermyearsforfinancingatattractiverates,wewereparticularlyexcitedbysomeannouncements.InGreatBritain,OVOENERGYsignedthreedifferent3-yearPPAslinkedtoprojectsstilltobecommissioned.Theutilitysigneda3-yearPPAlinkedtothe50MWSkeebysolarpvprojectinRichmond,NorthYorkshirewithanexpectedCODinMarch2024.ROOFwasonthesaleside.OVOEnergysignedtwomore3-yearPPAsforsmallerprojectswithAmbitionCommunityandGenatec.Atthesametime,activityof1-5yearPPAsforexistingassetsincreasedsignificantlyyear-on-year,withalmosthalfofdealcountinGermany.OthercountriesincludeFrance,Italy,Ireland,DenmarkandSpain.SelectionofSTPPAsannouncedin2023DATECOUNTRYPPASIZEBUYERSELLERTECHNOLOGYTENOR(YEARS)Feb’23France12MWMintKallistaEnergyOnshoreWindJuly’23Germany2-yearNov’23Ireland[post-subsidy](retailutility)2-yearSept’23Germany1-year27.8MWDeutcheBahnRe:capSolar4-yearOnshoreWindn/aMerrionHotelFlogasSolar38.4GWhAxpoSunnicp.a.LighthouseSource:Pexaparkresearch43EUROPEANPPAMARKETOUTLOOK2024Ontheotherhand,themoresophisticatedoptimisationthroughadynamicsellingstrategycomprisedofweeks-longandmonths-longPPAstookasignificanthitbytheimplementationofthewindfalltaxes.PPAsof1-year>tenorenjoyparticularlylowdiscounts,andarepricedthehighest.TheregulatorycomplexityandtherevenuecapsacrossEuropevastlystiffenedthemarket.ThissegmentoftheSTPPAmarket(rarelypublicised)islargelydrivenbyitshighrewardprofile,whichoftenoutperformstheresourcesrequired.Despite2023stillcomprisingahigher-than-averagepricingyear,itseemsthattheappetiteforarollinghedgedecreased.Webelievethatsomeplayersviewedthisapproachhighlyopportunisticallyandnotasastrategicriskmanagementtool,despitetheevidentupside.Oneofthereasonscouldbethatmanyplayersfocusedmoreenergyonfundraisinghurdlesandlessonshort-termoptimisationofexistingassets,especiallythesmallandmediumplayers.Webelievethatthefundamentalsforrevenueoptimisationthroughamixoflong-termandshort-termPPAsremain,asthespreadsbetweenSTandLTwillproportionallypersist–andeven0.5EUR/MWhcanmakealargedifference,especiallyineconomiesofscale.Ourexpectationfor2024isthatthetrendof1-5-yearPPAswillacceleratefurtherbecausethebenefitsaremultiple,irrespectiveofmarketconditions.Leveragingamedleyoftermyearscanunlockalargerpoolofofftakers,particularlycorporates,whosebuyingneedtypicallyisskewedtoshortertenorsandhenceareexcludedordonotparticipateinthe10-yearPPAmarket.Similarly,historicallyutilitieshavehadmandatestotradeupto5-yearsahead.Hence,thereisalsoastructuraladvantageinspeedandscalabilityifshortertenorsaremoreembracedbysellersandfinanciersalike.Spreadsbetween5-and10-yearPPAsinkeymarkets(EUR/MWh)EUR/MWh28,428,430Spread252019,619,218,41512,91815105,550DK1FIFrGerGBItaPUNPLESPSource:PPAPrices,PexaQuote(asofNov2023)44EUROPEANPPAMARKETOUTLOOK20243.4MORETROUBLEWITHBASELOADPPASWhatisaBaseloadPPA?InaBaseloadvolumestructure,asellercommitstoafixedsetofMWh,eithermonthlyorannually.Dependingonthegenerationprofile,attimes,theassetwillendupwithalongposition(whenitproducesmorethancommittedvolumesandsellssurplustothemarket)orashortposition(whenitproduceslessthanwhat’scommittedandmissingvolumesneedtobemanagedinthemarkets).Thecorrespondingsaleandpurchaseistypicallyadministeredthroughaprofessionalthirdparty.Suchriskisengineeredinthepricingintheformofdiscountsbasedonthestateofthemarket.That’soneofthemainreasonsBaseloadPPAscommandapricepremiumcomparedtoPay-as-ProducedPPAs.Over2023,theappetiteforBaseloadPPAswasmixed–withmostsellersbeingincreasinglycautiousdespitethepricepremiumofthevolumestructure.SincetheEuropeanPPAmarketentereditshigh-volatilityera,therehasbeenanevolvingnarrativearoundtheopportunitiesandrisksofBaseloadPPAs.ThetrendwasinitiallydrivenbytheNordics’onshorewindsectorduetodemandfromcorporateofftakers.Later,intherestofEurope,cannibalizationincreasedrisksforPAPPPAs(asanalysedintheabovesection)duetopricediscountschallengingexpectedrevenues.However,anopportunityemergedforBL.Justwhenmomentumstartedtakingoff,inQ42021,aperfectstormofhighprices,lowcapturefactorsandunforeseendeviationsfromproductionforecastsledtoeye-poppingcashoutflowsandlossesbecauseofunmanagedopenpositionsintheNordicsregion–whichcontinuedthroughout2022.Fastforwardto2023,certainbankruptcieslinkedtoSweden’sonshorewindwerepublicised,creatingfurtheruncertaintyinthemarket.ThereweretimeswhenwesawarearrangementofhowsomemarketparticipantsviewtheriskprofileofBLPPAs,classifyingitasriskierthanamerchantapproach.45EUROPEANPPAMARKETOUTLOOK2024Nonetheless,wenotedthreenewBaseloaddeals–twoleveragingamixoftechnologies–inItaly,PolandandGermany.BaseloadPPAsannouncedin2023DATECOUNTRYPPASIZEBUYERSELLERTECHNOLOGYTENOR(YEARS)May’23Italy200GWhTIMERGMix:Solarpv,9-yearOct’23Polandp.a.(cPPA)onshorewind,Nov’23GermanyStatkrafthydro8-yearn/aCemexPolskaSunnic10-year(cPPA)LighthouseMix:Solarpv,76.5MWonshorewindBP(uPPA)SolarSource:PexaQuote,PPATrackerNote:thelistcomprisesPPAswherevolumestructurewaspubliclydisclosed.Thevolumesarefundamentallylowerthan2022’s2GW–whichweremainlycontractedbyAlcoa’stwoPPAswithGreenaliaandEndesaleveraging1.8GWofnewonshorewindcapacityinSpain.Throughouttheyear,wealsonotedsomeappetiteforrestructuringexistingBaseloadcontracts,althoughitwastoolateforsomecases.Inprinciple,webelieveBLPPAscouldbeoneofthemostcost-optimalhedginginstrumentsonacase-by-casebasis,iftheyarestructuredinarisk-adjustedmanner.BLPPAsneedtobeapproachedwithamonitoringapproach,contrarytothe‘sell-and-forget’mindsetofPAPsellers.ThetwoessentialelementsofaBLcontactneedtobe:a)hedgingratio,whichdiffersbasedonthetechnologyandwhethervolumesarecommittedonamonthlyorannualbasisandb)ongoingmonitoringandmanagementofperformance.TheriskofanopenpositionisreducedwhenadaptingthehedgingratioofthePPA.BaseloadPPAsarelikestocktrading–everyonecandoit,butit’sallaboutwhodoesitwell.Equitytradingcantrickleawaylittlebylittle,sodependingontheinvestmenthorizonandrisk-adjustedreturnexpectations,respectiveadjustmentsareinorder.Thesameprincipleappliestomanaginginflowsandoutflowsoftheagreementinatimelymanner.Moretimelyforeclosureoflossesandrisksallowsforamorebalanceddiscussionwithlenders,whennewfinancingtomanagelossesorrestructuringoftheloanisneeded.Financingbankstypicallyreceiveabi-annualupdate,wherelossesmayhaveaccumulatedlossesofmillions.Whenthemarketchanges,sellersneedtofollowuponpastassumptions.46EUROPEANPPAMARKETOUTLOOK2024ThefinancingenvironmentforBaseloadPPAsvariesbasedonthetechnologyandthecountry.OnshorewindBLPPAsstillattractsomeinterest,especiallywhenunderpinnedbytherightriskmanagementapproach.ButforsolarPVit’smorechallenging.Lastyear,weheldalargestudyintheIberianmarketacrossthefinancingcommunity,whereallparticipantlendersdisclosedtheywerenotcomfortablewithBL+PV,buttheywerewillingtodiscussonshorewindeitheronamonthlyorannualbasis.—DavidWillemsen,HeadofRiskAdvisoryatPexapark47EUROPEANPPAMARKETOUTLOOK2024Theothersideofthecoin:Cannibalization&Pay-as-ProducedOver2023,thefrequencyofnegativepricingroseseverelyinmultipleEuropeancountries.Negativepricingoccurswhenthere’savastimbalancebetweensupplyanddemand,especiallyoversupplyofgenerationwhendemandislower.FinlandsawthelargestnumberofhourswithnegativepricesinEurope,totallingover400acrosstheyear.Atthesametime,Norway’sNO1zonesawthelargestincreasefrom0toover350,withGermanyandDenmarkfollowingsuit.Atthesametime,themonthlycapturefactors(capturepricedividedbythebaseloadpriceillustratingthesynergiesbetweenthetwo)ofsolarandonshorewindassetssawsignificantdecreasesinmanypricezones.Pricecannibalizationislinkedtothegenerationseasonalityofrenewableenergyandthefactthattheycannotcapture24/7hourlyprices(baseloadprices).Asaresult,whethertheywillbeabletocapturehigh-pricinghours(peak)dependsontheirgenerationprofile.Forexample,someanalyticalevidenceofhourlydistributionofnegativepricesacrossEuropein2023showsthattheyoccurredduringsolargenerationpeaks.Droppingcaptureratesandrecord-highnumberofnegativepricesareimpactingPPApricingNegativepricehoursinaselectionofmarketsMonthlycapturefactortrendsinEU20232019-2022Numberofhourswithnegativeday-aheadpricesAveragemonthlycapturefactors050100150200250300350400450500EUR/MWhFI1.21.0SE10.80.6NO10.4DE0.2DK1202302019-2022202320222019-202220232019-202220232019-20222023Source:PexaparkAnalysis,EEXandNordpooldataSE4WindOnshoreDEWindOnshoreDESolarESSolarSource:PexaQuote,CaptureFactorsIncreasingevidenceofpricecannibalizationcontinuestopushdownPay-as-Produced(PAP)PPApricing.Nonetheless,PAPisstillKingacrosssellers,aslessthan1%of2023’sPPAscitedBaseloadasthevolumestructure.DuetothechallengesweanalysedwithBLPPAs,weanticipatethatPAPwillstillbethenumberonepreferenceforsellers,butdemandwillcontinuefromutilities(duetoexcesscannibalizationriskintheirbooksandthesimplicityofmanagingaBLvsaPAPPPA),andenergyintensiveswithtime-andavailability-sensitiveenergyrequirements.48EUROPEANPPAMARKETOUTLOOK20243.5THEREGULATORYPENDULUMSWUNGBACKOverall,in2023thetideofregulationacrossEUandindividualmemberstatesnotablychangedcomparedtotheyearbefore.In2022,therenewablesmarketexperiencedthefullreturnofregulatoryriskinhighlyabruptways.Thiswasnotonlythroughthedeploymentofrevenuecapsandwindfalltaxesbutalsothroughalengthyandheateddiscussiononwhetherthefundamentalelectricitymarketdesignassumptionswerefitforpurpose.Fastforwardto2023,andthepicturechangessignificantlyduetotheexpirationofmostwindfalltaxmechanismsandtheemergenceofsupportiveregulationformanyaspectsofthePPAmarket.Firstly,theEUunleashedhydrogen-relatedPPAsbydefiningtherequirementsforgreenhydrogenandPPAsasoneofthecentraloptionsforelectricityprocurementinaDelegatedAct,therebycreatingclarityinthemarket.Positivesignalswerealsosentaftersomeconclusionsaboutthediscussionsontheelectricitymarketdesign.Contrarytowhatwasdiscussedduringthepeakoftheenergycrisis,Brusselseventuallyoptedforasoftreformratherthanacompleteoverhaulofthemarketdesign,andhasfurtherstrengthenedPPAsasadecarbonisationinstrument.Additionally,wesawtheintroductionofnewgovernmentcreditguaranteeschemes,suchasFrances’recentlyintroducedone,whichcouldgreatlyexpandthepotentialpoolofofftakersenteringthePPAmarket.CorporateappetiteforPPAswasfurtherstrengthenedfromaregulatorypointofviewbymorestringentsustainabilityreportingrequirements,suchastheEUCorporateSustainabilityDirective,whichcameintoforceinJanuary2023.—DominiqueHischier,HeadofAnalysisatPexapark49EUROPEANPPAMARKETOUTLOOK2024DetailsonGuaranteeSchemesacrossEuropeSPAINNORWAYFRANCEWhoissuesCESCE,apublicExportFinanceNorwayBpifrance,aFrenchpublicguarantee?companyownedbythe(Eksfin),partofthesectorinvestmentbankSpanishStateNorwegianMinistryofWhichTrade,IndustryandIndustrialsintheextractiveofftakersElls(energy-intensiveFisheries.andmanufacturingareeligible?industry):sectors,withaheadGuaranteesareissuedtoofficeandconsumptionPPA•�>1GWh/yearintwopowersuppliers,banksorinFrance(noresaleofrequirementsofthepreviousthreeotherlendinginstitutions.electricity).yearsRequirementforofftakers:GuaranteePhysicalPPAswithatenorstructure•c�onsume≥50%oftheir•�RegisteredinNorwayof≥10yearsandayearlyenergyduringoff-peakvolumeof≥10GWhFinancinghours•�Activeinthetimber,&sizeofwoodproductsandTheguaranteecoversthepotPPAtenor≥5yearsandprocessing,chemicalorthedifferencebetweencover≥10%oftheEII’smetalindustrythevalueofthemonthlydemandproductiononthe•�Yearlyconsumptionof>marketand80%oftheCESCEcouldindemnify10GWhandPPAvolumeremunerationundertheupto80%ofthe>35GWhPPA.Ifthemarketpricecontractterminationfallsbelowanoptionalvaluetotheseller,andPhysicalorfinancial,withfloorprice,thedifferenceCESCEcouldbecometheatenorof7to25years.betweenthefloorandofftaker(“step-in”)80%ofthePPApriceisInthecaseofdefaultofanpaid.offtaker,EksfindisbursesthedifferencebetweenEUR67mtoguaranteethePPA-andtheannual500MWofcontracts.meanspotmarketprice,Additionalrevenuederiveduptoamaximumof80%offromproducers’annualtheremainingpaymentscommissionslinkedtotheunderthePPAoruptoguaranteeparameterssuch80%ofanylossthatasafloorprice,thebuyer’soccurs.riskprofileandtheoutlookfortheelectricitymarket.FERGEIwasendowedTheguaranteeschemeiswithEUR200mandcanself-financed,aguaranteecoverguaranteesofuptopremiumwhichisEUR600minitsfirstthreedependingonthecoveredyearsrisksmustbepaidSource:PexaparkAnalysis,CESCE(2023),Eksfin(2023),Bpifrance(2023)50EUROPEANPPAMARKETOUTLOOK2024ContractsforDifferencevsPPASEU’sElectricityMarketReformstatesthatallpublicsupportschemesshallbestructuredastwo-wayContractsforDifference(CfDs).Whenassetsareunderpinnedbypublicspending,investorsunderCfDscannolongercaptureextraprofitsfromburstsofpricevolatility–ameasurethatappearsfair.Thosewhowanttostructuretheircashflowswithmoreupsideareallowedtopursuemarket-basedandflexibleopportunitiesinthePPAmarket.Lastyear,ouronlyhopewasthatanydecisionwaswellthoughtthrough,enablingrenewablestoreachtheirfullpotentialandnotlimitingit,anditseemssuchameasureachievesthisgoal!However,certainnuancestellthefullstoryaroundpossiblecompetitionofroutestomarket,andthere’snomarketconsensusonwhetheraggressivedeploymentofCfDschemescangohandinhandwithPPAs.Forexample,somegovernments–suchasGreatBritain–adaptedtheirCfDceilingpricestoaccountforinflation,elevatedfinancingcosts,andhighelectricityprices.DependingonthePPApricingenvironment,CfDmayoffermoreattractiveopportunitiesattimes.GreatBritainisalsoconsideringannualtenders,whichsqueezestheleadtimebetweencommunicationofbudgetandauctions,leadingtoevenmoreabruptdecision-makingfromsellers.Across2023,wenotedthatsomesellerswithdrewfromcorporatetendersforlong-termPPAsbecauseCfDpricesappearedmoreattractivethatgiventime.Inaddition,somesupportschemesthatwerestructuredinaone-wayCfDmannerallowedforPPAdeal-makingtocaptureupside,withoutpenalisation.AcoreexampleisthePPAsonthebackofGermany’szero-bidoffshorewindassets,orsolarandwindcapacityunderamarketpremium.Ifsellersneedtomakeadefinitivedecisiononwhichroute-to-markettopursue,itwillallcomedowntothepricingenvironment.However,strongcorporatedemandshouldnotbeunderestimated,asthenumberoneeconomicruleisthatpricingisaresultofsupplyanddemand.Thepricingfactorwillalwaysbetheprimedeterminantofbusinessmodels,andcorporatesappearmoreeducatedandready-to-transactthaneverbefore.51EUROPEANPPAMARKETOUTLOOK2024CHAPTER4:TOPPREDICTIONSFOR2024Back-testing2023’spredictionsThePopularisationofShort-termPPAs:WepredictedthatmanagingrenewablerevenuewithamixofSTandLTPPAwillbecomethenorm.Allinall,webelievethetrendmaterialised,althoughnottotheextentweexpected.Wewereexcitedtoseetheemergenceof3-yearPPAsunderpinningprojectsthatarestilltobecommissioned,and1-5-yearPPAslinkedtoexistingassetsremainedatthesamelevels.Butdynamicsellinghedgingstrategiestappinghigh-reward1-year>opportunitiestookasignificanthitduetotheimplementationofwindfalltaxescappingtherevenues.Nonetheless,moreandmoresellersadopta‘tenorflexibility’approach.Thisisnotonlyarevenueoptimisationstrategytoreducerelianceonlong-termPPAsandtheirassociateddiscountssincethecorefundamentalsforSTPPAsarestillprominentbutalsotoattractawiderpoolofcorporatesthatfeelmorecomfortablewithshort-termpricerisk.TheEvolutionoftheTripartitePPA:YES!Wearecertainwegotthatright,assuchstructurespracticallymirrortheevolvedroleofutilitiesinthePPAmarket.Ourpredictionwasthatprojectowners,utilitiesandcorporateswilljoinforcesleveragingeachoftheirindividualstrengthsandcompetenciestoconquerthePPAmarket.Theprophecymaterialisedthroughtheemergenceofback-to-backPPAdeals,whereutilities/tradersalleviatedriskfromprojectsandmanagedthatriskthroughlong-termvolumesalestocorporatesstraightafter–apracticethatwaspossibleduetohungrycorporatesbeingreadytotransact.Also,utilitiesweremoreactiveinleveragingtheirroleasriskmanagerspositioningthemselvesas‘marketintegrators’,andwebelievethatsuchaplayerfacilitatedeveryphysicalPPA.TheComingofAgeofCo-location&Flexibility:Also,YES!Itwasnotlongbefore2018whenthetermenergystoragestartedfloatingamongindustrydiscussions,withthestandalonebusinessmodeltakingoffrapidlyinGreatBritain.Inaparalleluniverse,co-locationwasdeemedgreatintheory,buttherewerealwayschallengesaroundvaluingthebenefits.Butasmarketdynamicsevolved,sodidavailabletoolstobuildarobustbusinesscase,andthesurfaceofthefirstHybridPPAsforsubsidy-freeassetwastheultimatetestamenttotheprogressinthemarket.52EUROPEANPPAMARKETOUTLOOK2024Approachingthegrandfinale,afterathoroughreviewandexpectationscommentaryofallthemajordevelopmentsintheEuropeanPPAmarket,thisisourpickofourTopPredictionsfor2024.Thisyear,wedecidedtogobolderandpickspecificmicro-trendstomakeback-testingmoremeasurable(andexciting!).4.1GERMANYWILLTOPPLESPAININPPAACTIVITYWehavelongwaitedforGermany’sstrongPPAmarketfundamentalstoshine,anditseemsthewordisoutforgood.ThelandofEnergiewendehassomeofthemostrobustliquidityinforwardtradingamongitsEuropeanpeers,makingpricediscoverylesschallengingthaninvastlyilliquidmarkets.Theavailabilityoflargevolumesofdifferenttechnologiesisalsomakingthemarkethighlyinteresting,astheheadlinesaremovingawayfromanexclusivefocusonthecountry’svibrantoffshorewindsegment.2023’ssolardealcountandvolumesindicatethatthesectormeansbusinessandsynergieswithenergystoragearespicingupexpectations.Exceptionallyhighdemandfromindustrialswilldriveactivity,butwe’llkeepaneyeonregulatorydevelopmentsaroundthecountry’sgovernment-backedsubsidyschemesandpotentialcompetitionwiththePPAmarket.4.2THEPPAMARKETWILLSURPASS20GWTheGoldenEraoftheEuropeanMarkethasarrived.Basedontheofftakeappetitedrivenmainlybycorporatehedgingneeds,webelievethelong-termPPAsmarketwillsurpass20GWacrossaround350deals.SpainandGermanywillcontinuetobekeymarketsfortheyear,althoughtheirshareofoverallvolumescoulddecreasebecausemoreup-and-comingjurisdictionscouldclaimalargerstake.Forexample,FrancecouldconsolidateitsTop3positionbydealcountin2023,againdependingonsynergieswithsubsidyschemesandthecountry’snuclearavailabilityforlargeconsumers.France’snewlyimplementedcreditguaranteeschemecanpotentiallyattractalargerpoolofSmall&Mediumcorporates,enhancingdealcountevenwithsmallerPPAs.WealsoexpectgrowingactivityinSoutheasternEuropeanmarkets,withmultipleeyes,particularlyinGreeceandRomania.53EUROPEANPPAMARKETOUTLOOK20244.3THEGEOGRAPHICALSCOPEOFHYBRIDPPASWILLEXPANDBEYONDGBAdvancedgridservices,industrymaturityandexpertisearoundcommercialisationofenergystorageassetsresultedinthefirstHybridPPAforasubsidy-freeassettoemergeinGreatBritain.Theoutlookforthecountryisverypositive,asthevastmajorityofsolarpermitapplicationsinthecountryincludeco-locationwithstorage.Besides,webelievetheconceptwillbeexportedtonewjurisdictions.Spainisaprimecandidateduetoincreasedsolarcannibalizationrisk,makingportfolioownersseekoutphysicalhedgesagainstvolatilityanddepressedwholesalepriceswhenmorethan19GWofsolarisinjectedintothegridatthesametime.Germany’ssolar-plus-storageprojectsunderitsInnovativeTendersamounttomorethan890MWofhybridcapacity.Partofthispipelinecouldseekoutfurthercontractualarrangements,albeitwithanenhancedriskprofileduetothepricepremiumofthesubsidy.TheNordicscouldseetheemergenceofwind-plus-storageHybridPPAsduetocannibalizationriskmostlylinkedtoonshorewind.4.4THESHAREOFUTILITYPPASWILLINCREASEReducedvolatilityin2023createdamorefavourableenvironmentforutilityofftakes,whichtranslatedto4.02GW–morethandoublethe1.96GWof2022,across48deals–60%increasefromlastyear’s30deals.Marketfundamentalsaroundvolatilityseemtobeimproving,althoughsubstantialriskremains.Nonetheless,withamorestabilisingenvironmentandrobustcorporatedemand,weexpectthattheshareofutilityofftakeswillincreasefurtherin2024.AsextensivelyanalysedinourspecialnoteontheevolvingroleofutilitiesinthePPAmarketinChapter1,utilitiesarepursuinginnovativeroutestoreducerelianceonthestack-n-rollmethodtomanagerisks.Theprimaryexampleisback-to-backPPAswithcorporateofftakers,whichfallunderanumbrellasetofofferingstohelpbuyersandsellersmanagepricevolatility,intermittencyandhighergreenstandards.Projectowners,utilitiesandcorporateswillcontinuejoiningforcestoleverageeachother’sstrengths,andtheroleofmorestructuredPPAswillbecomemoreprominent.Riskmanagerssuchasutilitieshaveanopportunitytoevolvefurtherinto‘marketintegrators’,unlockingsignificantinnovationinthemarket.54EUROPEANPPAMARKETOUTLOOK2024CONCLUSIONCoulditbethatthelessonswe’velearnedfromtheever-evolvingpeaksandvalleysoftheenergytransitionmakethecomplexitiesmoreintriguingthanconcerning?Revolutionisingtheenergysystemhasalwaysbeenanexcitingtask,butthisdayayearago,thesentimentwasclosertothedangerzone.Butrenewablesarelearninghowtoswimintheocean’sdeeperend,unleashingawholenewsparkleinthemarket.Weconcludedthisanalyticalexercisewithfeelingsofoptimism,butalsoinaweofthemagnitudeoftheenergytransition’skaleidoscope.Asetofkeymirrorsreflectingaplethoraofcoloursresultinginever-changingpatterns.Sometimespositive,sometimesgloomy.Butintheend,whatmattersisnottheexpertisewebuild.Buttheabilitytobuildmore,andleveluptheriddles(andtherespectiverewardswhensolvingthem).OurkeyconcernisthespreadoftheOstrichSyndrome,commonlyknownashidingourheadsunderthesand.Lessonslearnedthehardwayarelessonsneverforgotten–andtheyshouldn’t.Wearelookingforwardtowhat2024willbring!Togetherisalwaysbetter,soifyou’dlikesupportinyourendeavours,clickheretobookacoffeechat.Onwardsandupwards!55EUROPEANPPAMARKETOUTLOOK2024ABOUTPEXAPARKPexaparkisanaward-winningmarketintelligence,softwareandadvisorycompany,specialisedinrenewableenergy.Withmorethan30,000MWofrenewablePPAtransactionssupported,Pexaparkisthereferenceforbuying,sellingandmanagingrenewableenergy.Pexapark’sPPAreferencepricesincreasetransparencyacross19markets.OuradvisoryteamandsoftwaresuiteenableleadingcompaniestoclosesuccessfulPPAtransactions,managetheirmarketriskandmonetisetheirrenewableenergyinvestments.Pexaparkwasfoundedin2017withthepurposeofacceleratingtheenergytransitiontowardsnetzerobycreatinganefficientmarketforrenewableenergy.Formoreinformation,pleasevisitwww.pexapark.comorgetintouchwithusathello@pexapark.comDISCLAIMERThisdocumentcontainsgeneralinformationaboutcommercialandlegalmatters.Theinformationisnotadviceandshouldnotbetreatedassuch.Theinformationisthenprovided“asis”withoutanyrepresentationsorwarranties,expressorimplied.Pexaparkmakesnorepresentationsorwarrantiesinrelationtotheinformationprovidedinthisdocument.Youmustnotrelyontheinformationasanalternativetolegaladvicefromyourattorneyorotherprofessionallegalservicesprovider.Ifyouhaveanyspecificquestionsaboutanylegalmatteryoushouldconsultyourattorneyorotherprofessionallegalservicesprovider.Nothinginthislegaldisclaimerwilllimitanyofourliabilitiesinanywaythatisnotpermittedunderapplicablelaworexcludeanyofourliabilitiesthatmaynotbeexcludedunderapplicablelaw.Copyright:©PexaparkAG.ThispublicationisthecopyrightofPexaparkAG.Noportionofthisdocumentmaybephotocopied,reproduced,scannedintoanelectronicsystemortransmitted,forwardedordistributedinanywaywithoutpriorconsentofPexapark.pexapark.comhello@pexapark.com