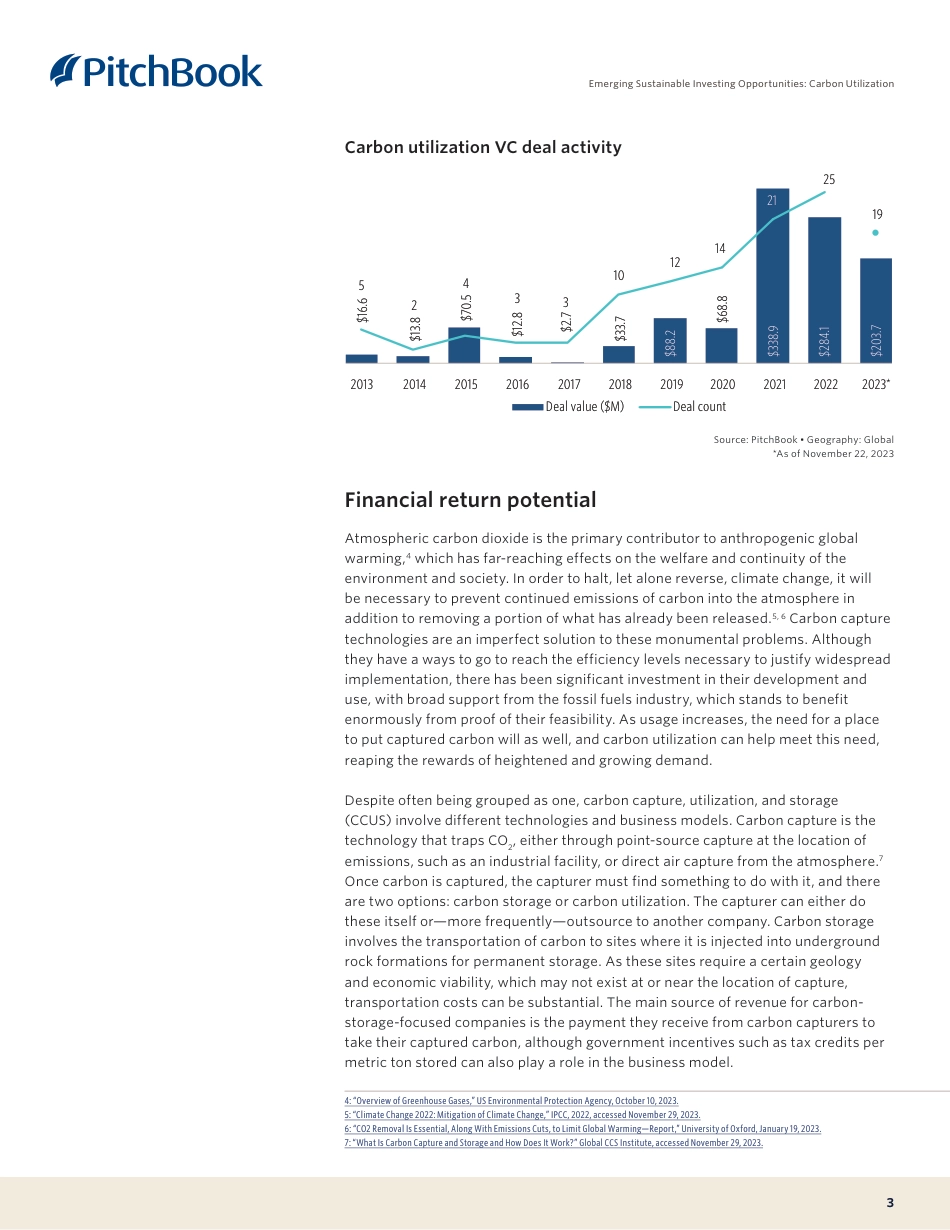

1Institutional Research GroupAnalysisPitchBook Data, Inc.John Gabbert Founder, CEONizar Tarhuni Vice President, Institutional Research and EditorialDaniel Cook, CFA Head of Quantitative ResearchPitchBook is a Morningstar company providing the most comprehensive, most accurate, and hard-to-find data for professionals doing business in the private markets.Emerging Sustainable Investing Opportunities: Carbon UtilizationHow carbon utilization can create a double bottom line of financial returns and positive social and environmental ImpactKey takeaways• As usage of carbon capture technologies continues to rise, the question of what to do with captured carbon has grown more urgent, and carbon utilization is part of the answer.• The financial return potential of this opportunity is dictated in large part by carbon capture’s proliferation, government funding and regulatory support, challenges faced by its main alternative, and corporate sustainability commitments.• Carbon utilization has the potential to create positive environmental Impacts by enabling a more sustainable lifecycle for captured carbon, providing lower-carbon substitutes for traditional products, and reducing reliance on an alternative that presents environmental risks in addition to social ones, creating a minor social Impact potential as well.Anikka Villegas Analyst, Fund Strategies & Sustainable Investinganikka.villegas@pitchbook.comInsights developed in collaboration with John MacDonagh, Senior Analyst, Emerging Technology at PitchBook Data.Key takeaways1Introduction2Financial return potential3Environmental and social Impact potential7ContentsPublished on December 11, 2023PublishingDesigned by Caroline SuttieDataAlyssa Williams Senior Data Analystpbinstitutionalresearch @pitchbook.com2Emer...