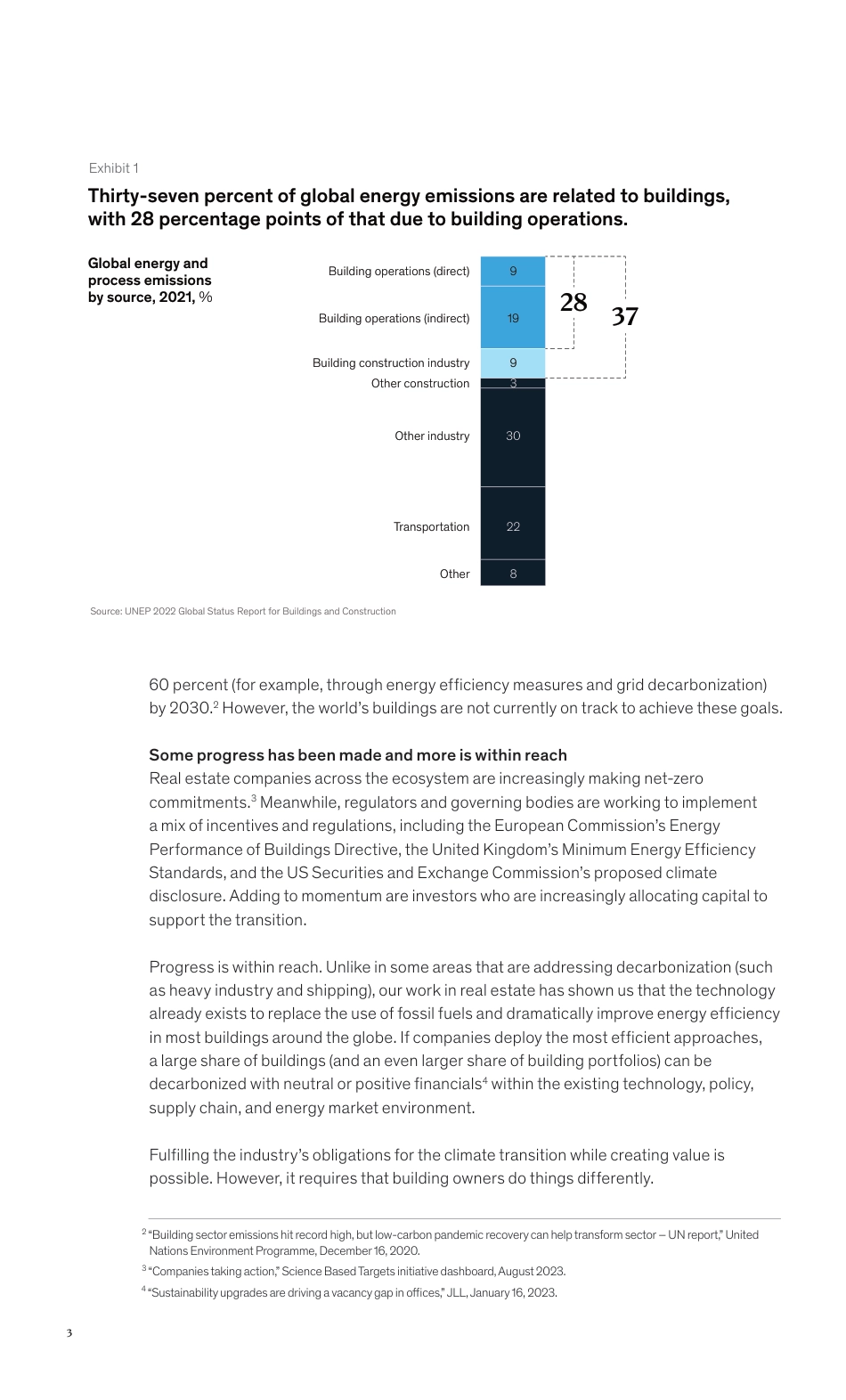

An AI-informed approach makes it faster, easier, and cheaper to decarbonize real estate. Here’s how.This article is a collaborative effort by Brodie Boland, Daniel Cramer, Alastair Green, Darya Guettler, Focko Imhorst, and Marita Winslade, representing views from McKinsey’ Real Estate Practice.A new way to decarbonize buildings can lower emissions—profitablyReal estate companies are increasingly accepting the imperative to decarbonize buildings, but they frequently find the task difficult, laborious, and expensive.Owners with portfolios of many unique buildings often have no centralized inventory that indicates the conditions inside or the types of equipment they contain. What’s more, physical energy audits and building-by-building net-zero plans are lengthy, costly, and enjoy no benefits of scale. Due to these limitations, the traditional approach to decarbonization has created a widespread impression that decarbonizing buildings is significantly unprofitable.But thanks to improvements in the quantity and quality of data and analytic methods, there is a better approach. It is now possible to use a combination of data from satellites, geospatial analytics, regulations, labor and equipment costs, building characteristics, energy, and other sources to rapidly create a high-fidelity picture of the current state of an individual building without ever stepping foot inside.By applying machine learning, AI, and physics-based modeling, portfolio owners can quickly identify building decarbonization opportunities. This includes the current type and estimated capacity of heating and cooling systems, the site-specific potential for solar or geothermal power, and where insulation and efficiency levels are substandard. Advanced evolutionary...