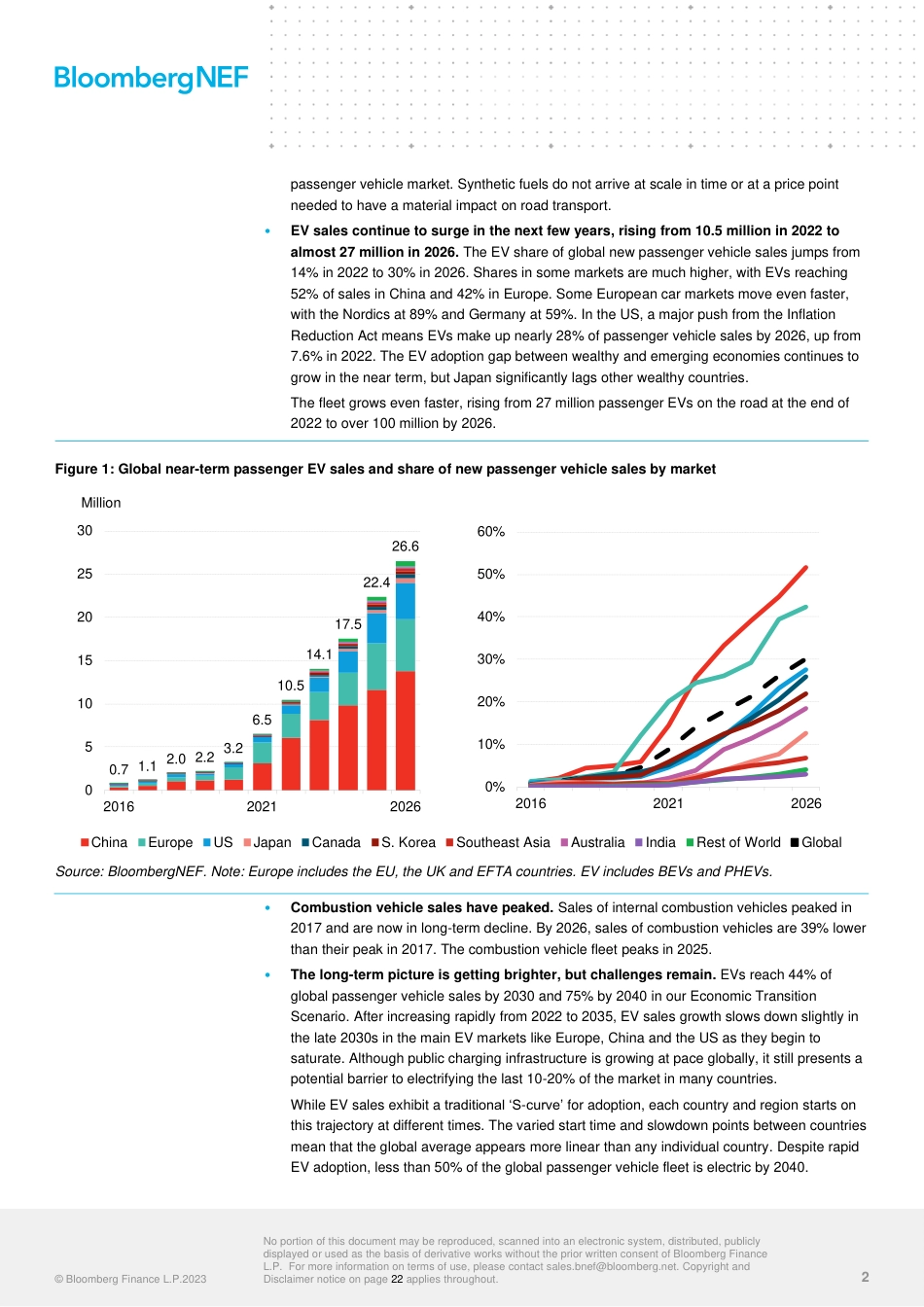

© Bloomberg Finance L.P.2023 No portion of this document may be reproduced, scanned into an electronic system, distributed, publicly displayed or used as the basis of derivative works without the prior written consent of Bloomberg Finance L.P. For more information on terms of use, please contact sales.bnef@bloomberg.net. Copyright and Disclaimer notice on page 22 applies throughout. 1 Executive Summary The transportation and automotive sectors are undergoing a period of profound transformation. Electrification is now spreading rapidly in almost all segments of road transport, from passenger cars to commercial vehicles, buses and two- and three-wheelers. Each country has its own unique mix of vehicles and while progress varies across them, the overall direction of travel is increasingly clear. Technology changes are at the core of this transition as battery prices have fallen dramatically over the last decade. Battery prices rose for the first time in 2022 but innovation in the area is not slowing down, with advances in areas like solid-state batteries, next-generation cathode and anode chemistries, and sodium-ion technology all reaching commercialization in the next few years. Yet technology changes alone are not enough to keep the road transport sector on track for net-zero emissions by mid-century. Policymakers have an important role to play in driving the automotive market toward zero-emissions options, improving fuel efficiency, getting the power system ready for electric vehicles, and in reducing overall car dependency. Eliminating emissions from road transport will require all hands on deck, including automakers, battery manufacturers, charging companies, grid operators, miners, large fleet operators and con...