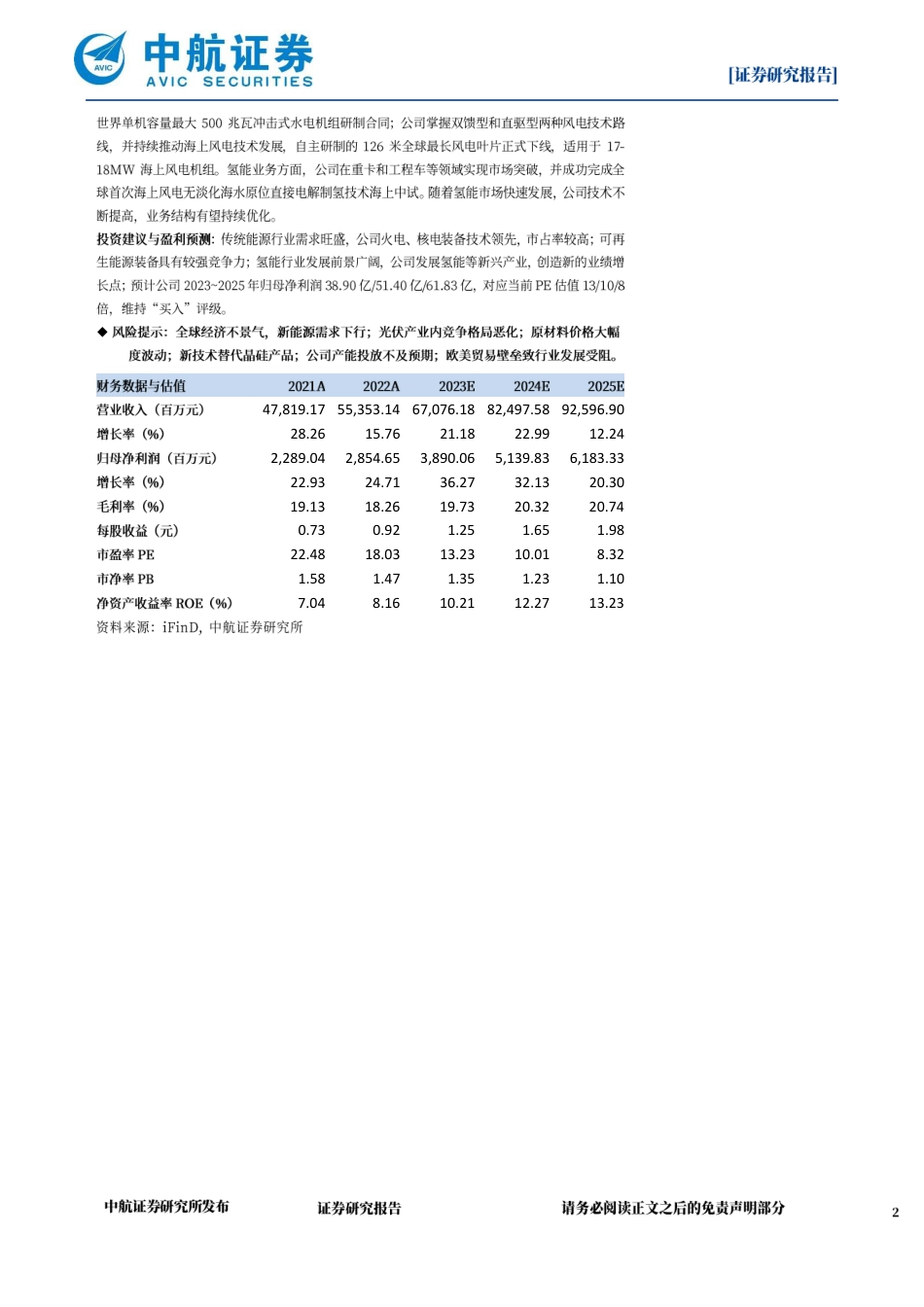

1曾帅分析师SAC执业证书:S0640522050001联系电话:邮箱:zengshuai@avicsec.com◆◆◆◆◆◆47,819.1755,353.1467,076.1882,497.5892,596.9028.2615.7621.1822.9912.242,289.042,854.653,890.065,139.836,183.3322.9324.7136.2732.1320.3019.1318.2619.7320.3220.740.730.921.251.651.9822.4818.0313.2310.018.321.581.471.351.231.107.048.1610.2112.2713.23资产负债表利润表会计年度202120222023E2024E2025E会计年度202120222023E2024E2025E货币资金18,72215,03920,92323,71334,750营业收入47,81955,35367,07682,49892,597应收票据及应收账款10,98111,35214,73319,18320,171营业成本38,67045,24553,84065,73573,395预付账款3,6365,4854,0868,6966,595营业税金及附加240326402495602存货19,06218,45521,02733,75230,673销售费用1,4581,4832,0122,4342,732其他9,4736,39316,75925,21320,586管理费用2,7903,1173,7234,5375,000流动资产合计61,87556,72477,529110,555112,775研发费用2,1102,2752,8513,4243,796长期股权投资2,2902,3982,3982,3982,398财务费用40(98)(119)(149)(133)固定资产4,9664,8765,1925,4585,674资产/信用减值损失(748)(203)(455)(469)(376)在建工程286376376376376公允价值变动收益174(62)232(10)(71)无形资产1,6521,7671,6411,5151,389投资净收益427484402437441其他24,05638,43838,63938,32038,842其他2(535)000非流动资产合计33,25047,85548,24748,06748,679营业利润2,6583,3214,5465,9817,199资产总计103,105115,265125,776158,622161,454营业外收入5157555455短期借款42103505050营业外支出4352765762应付票据及账款20,21427,37726,76241,52936,759利润总额2,6673,3254,5255,9787,192其他7,3157,75346,98061,30663,751所得税238315430568683流动负债合计27,57135,23273,792102,885100,560净利润2,4293,0104,0955,4106,509长期借款1,5659511,5001,5001,500少数股东损益140156205271325其他8,1808,2658,5658,3368,389归属于母公司净利润2,2892,8553,8905,1406,183非流动负债合计9,7459,21610,0659,8369,889每股收益(元)0.730.921.251.651.98负债合计67,72176,64083,857112,721110,449少数股东权益2,8863,6433,8134,0114,266股本3,1193,1193,1193,1193,119资本公积11,44311,64511,64511,64511,645留存收益18,06320,20123,42927,19232,021其他(128)17(88)(66)(46)股东权益合计35,38438,62541,91945,90151,005主要财务比率负债和股东权益总计103,105115,265125,776158,622161,454会计年度202120222023E2024E2025E成长能力营收增长率28.26%15.76%21.18%22.99%12.24%营业利润增长率23.05%24.93%36.89%31.57%20.36%现金流量表归母净利润增长率22.93%24.71%36.27%32.13%20.30%会计年度202120222023E2024E2025E盈利能力税后经营利润2,4293,0103,8905,1406,183毛利率19.13%18.26%19.73%20.32%20.74%折旧与摊销762763810860910净利率4.79%5.16%5.80%6.23%6.68%财务费用100(74)(119)(149)(133)ROE7.04%8.16%10.21%12.27%13.23%投资损失(426)(481)(400)(435)(439)营运资金变动(13,896)(4,679)611(675)6,018其它现金流6,6109,870437261255每股指标(元)经营活动现金流(4,421)8,4105,2295,00212,795每股收益0.730.921.251.651.98资本支出2819007001,229948每股经营现金流-1.422.701.681.604.10长期投资514109000每股净资产10.4211.2212.2213.4314.99其他(3,848)(14,195)478(2,211)(1,513)估值倍数投资活动现金流(3,053)(13,186)1,177(982)(565)市盈率22.4818.0313.2310.018.32债权融资51269279199212市净率1.581.471.351.231.10股权融资(835)(698)(801)(1,429)(1,405)EV/EBIT4.122.26-0.59-0.77-1.93其他(55)512000EV/EBITDA4.662.54-0.68-0.87-2.15筹资活动现金流(378)(117)(522)(1,230)(1,193)汇率变动影响13222现金净增加额(7,851)(4,890)5,8862,79211,039数据来源:iFinD,中航证券研究所

VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP