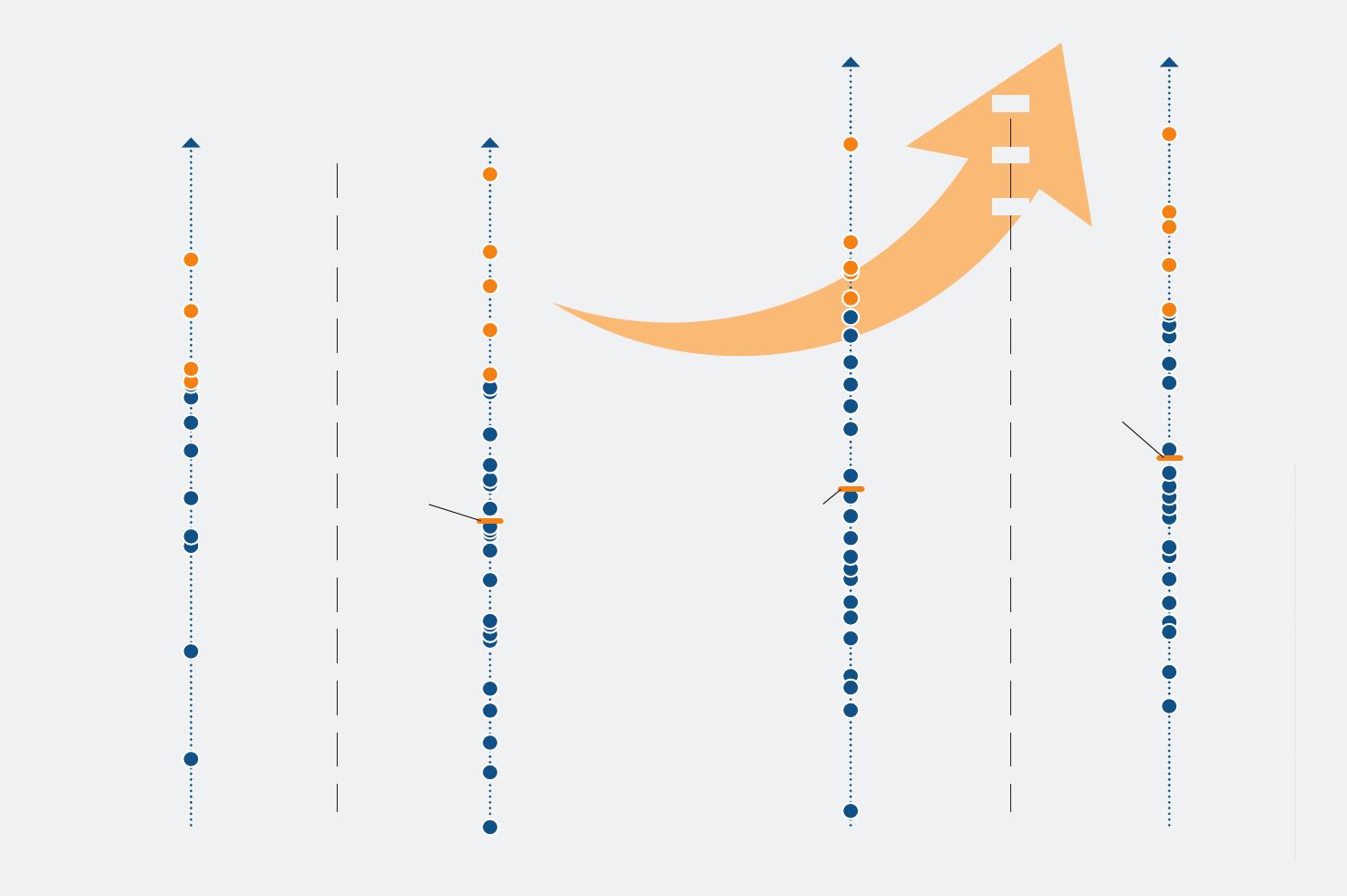

1EVChargingIndexEdition4EVChargingIndexEdition42023RechargedTheelectricvehicleandEVchargingmarketsregainstability2EVChargingIndexEdition43EVChargingIndexEdition4Afteraturbulentfirsthalfof2022,theelectricvehicle(EV)andEVchargingmarketreturnedtostronggrowthaccordingtothelatesteditionofRolandBerger'sEVChargingIndex.Severalkeymarketindicators,suchasEVsalesandcharginginfrastructuredevelopments,hitrecordhighs,despiteturbulentenergypricesinsomemarkets.ThefourtheditionoftheIndex,covering30marketsinfiveregions–Europe,China,Americas,MiddleEastandAsia(other)–and31indicators,isbasedonindustryinterviews,primaryresearchandasurveyof16,000participantsfromallregionsconductedinthefirsthalfof2023.Inthisreport,wepresenttheoverallfindingsandfocusonfourtopicalareas.First,withglobalEVsalespenetrationreachingarecordhighin2022,welookathowthefactorsaffectinginterestinEVsdifferacrosstheregions.Second,weassessthedriversbehindtherapidexpansionofpublicEVchargingnetworks,fromnewtechnologiestoconvenience.Third,asthepercentageofEVownerswhoreportusingpublicchargingreaches90%,weanalyzechangingcustomerbehaviorsandfindthatrangeanxietyisstillamajorproblem.Lastly,weexaminetheemergingregionalizationofOEMs'strategieswithregardtoEVcharginginfrastructure,especiallythedifferentapproachesappliedintheUnitedStatesandChina.CoverphotoAndrewMerry/GettyImages45EVChargingIndexEdition4EVChargingIndexEdition4AllofthetopfiveperformersinthefourtheditionoftheIndexincreasedormaintainedtheirscorecomparedtothepreviousedition,withallatrecord-breakinghighs.Chinatoppedtherankingswithatotalof82(outof100),followedbyGermany(74),theUnitedStates(73)andtheNetherlands(69).Norway(65)knockedtheUnitedKingdomoutofthetopfivebylessthanonepoint.Thegapsbetweenthetopfivenarrowedconsiderably,withGermanyandtheUnitedStates,inparticular,makinggroundonChina.Scoresandrankings:ThepackclosesonleaderChina,withimprovementsacrosstheboardSource:EVVolume;RolandBergerEVChargingIndex1515202025253535454555556565757530304040505060607070808085QatarUAETurkeyThailandBelgiumBrazilIndiaFranceNorwayCanadaSaudiArabiaIndonesiaIsraelEdition2(April2022)HungarySwitzerlandPortugalSwedenUKNetherlandsGLOBALGLOBALGLOBALGermanyUSAChinaSouthKoreaItalySingaporeJapanSpainQatarQatarVietnamVietnamUAEUAETurkeyTurkeyThailandThailandRomaniaRomaniaBelgiumBelgiumBrazilBrazilIndiaIndiaFranceFranceNorwayNorwayCanadaCanadaSaudiArabiaSaudiArabiaIndonesiaIndonesiaMalaysiaMalaysiaIsraelIsraelEdition3(November2022)Edition4(May2023)HungaryHungarySwitzerlandSwitzerlandPortugalPortugalSwedenSwedenUKUKGermanyGermanyUSAUSAChinaChinaSouthKoreaSouthKoreaItalyItalySingaporeSingaporeJapanJapanSpainSpainUAETurkeyCanadaItalySpainSouthKoreaSwedenBelgiumFranceGermanyNorwayNetherlandsChinaUKUSAEdition1(November2021)NetherlandsNetherlandsClosingthegap:WhileChinaagaintopstherankings,thechasingpackofGermany,theUS,theNetherlandsandNorwayarecatchingup6EVChargingIndexEdition47EVChargingIndexEdition4Infact,theimprovedperformanceofcountriesacrosstheMiddleEastandSoutheastAsiahelpedtodriveuptheaveragecountryscorefrom45to51points.ThisindicatesahealthyandgrowingglobalEVchargingmarket.Therewaspositivenewsattheotherendofthetable,too.Severalcountriesshowedabigimprovementintheirscore,withMalaysia(41)andIndonesia(41)bothjumpingby12points,andevenbottom-of-the-tableSaudiArabiajumpingfrom16to27points.Source:RolandBergerEVChargingIndexGlobalgrowth:Improvedscoresinalmostall30countriesreflectacross-the-boardimprovementinEVchargingBrazil45>6050-59.940-49.920-39.9NotincludedinthescopeEVCHARGINGINDEXSCORINGRESULTS[totalof100pointsfrom31rankingindicators]Portugal46Switzerland58Italy51Turkey39Israel36UAE35India51Japan47Qatar42SaudiArabia27Hungary34Spain58France64Belgium49Netherlands69Norway65Sweden60UK65USA73Germany74Canada49China82Indonesia42Malaysia41SouthKorea63Thailand41Singapore48Romania39Vietnam308EVChargingIndexEdition49EVChargingIndexEdition41�Tobetterreflecttheseandotherdevelopments,weadjustedsomeindicatorsofthecustomersurveyinthefourtheditionoftheIndex.Wereplacedseveral"EVpurchasing"indicatorswith"EVchargingexperience"indicators,including"experienceonchargingspeed"and"convenienceofpubliccharging".Theaimistobetterreflectcustomersatisfactionwiththedevelopmentofcharginginfrastructure.SeveralrecenteventsintheEVmarkethavehelpeddrivethisoverallincreaseinscores.1Akeyfactoristhatapricewarhasbrokenout.Whilethechoiceofhigher-price-segmentEVmodelshasalwaysbeenstronginglobalmarkets,thepickingsinthelower-pricesegmenthavebeenslim.OEMshavebeenslowtofillthisgapbutarenowacting.Tesla,forinstance,iscuttingpricesonitsexistingmodelsandisexploringalow-costoption,whileBYDissettoofferitsbasicSeagullmodelfromUSD12,000inChina.Volkswagenisalsoconsideringalow-costmodelfortheEuropeanmarket.Developmentsinthechargingmarketitselfarealsohavinganimpact.Forexample,inlate2022TeslabeganexploringopeningupitsmuchenviedandfastexpandingsuperchargernetworktoallEVsinmorecountries.California,oneoftheworld'sbiggestEVmarkets,announceditwasinvestingUSD2.9billiontomorethandoubletheUSstate'snumberofpublicchargerstoaround170,000.Newpartnershipsalsocontinuedtospringup.InOctober,HertzannouncedadealwithenergygiantBPtobuildanEVchargingnetworkintheUnitedStatestoservicetherentalfirm'sgrowingEVfleet.Inaddition,GMannouncedapushintoholisticchargingservicesthroughitsnewsubsidiary,GMEnergy.WearebeginningtoseetheimpactfromofaseriesofnewlawsandinvestmentinelectrificationbytheUSfederalgovernment,asbillionsinfundingisstartingtobedisbursed.ItsInflationReductionAct(IRA),NationalElectricVehicleInfrastructure(NEVI)programandCHIPSandScienceActwilltogetherhaveamajorimpactonEVsales,charginginfrastructureandsemiconductorcapacityintheU.S.GlobalEVsalespenetrationrates(theshareofEVssoldasapercentageoftotalvehiclessold)reachedrecordhighsinthesecondhalfof2022,hitting15%atthegloballevel.Themarketthereforeappearsrelativelyresilienttoexternalfactors,whileconsumersensitivitytoinputenergycostsandriskshasrecededsincethelasteditionoftheIndex.EuropeanEVsalesreboundThefourtheditionoftheEVChargingIndexshowsthatEVsalesinmajorEuropeancountriesreboundedinlate2022afteradownswinginthefirsthalfof2022.TheunderlyingreasonbehindthisdipwastheenergycrisisandEVdrivers'highlevelofpricesensitivity–ourcustomersurveysin2021and2022showedthat42%and59%ofparticipants,respectively,regardedcostsasakeyconcernforEVpurchasing.Backontrack:EVsalespenetrationratesleapedinH22022aselectricitypricesreturnedtopre-UkrainewarlevelsEVSALESPENETRATIONRATES[H22021toH22022,%]Source:EVVolumes;IHS;RolandBergerEVmarket:ThesectorremainsresilientEuropeChina27%2021H2to2022H22021overall2022overall20%4%3%4%15%24%25%4%3%4%14%28%29%6%6%4%16%AmericasMiddleEastAsia(other)Globaloverall2021H22022H12022H223%26%16%27%3%5%2%4%3%4%13%15%10EVChargingIndexEdition411EVChargingIndexEdition4UkrainewarstillhasglobalimpactInthethirdeditionoftheIndex(H12022),weaskedoursurveyrespondentsabouttheimpactofthewarinUkraineontheirinterestinEVs.Globally,58%expressedconcernsoverfluctuatingenergypricesandtheresultingdiminishingEVtotalcostofownershipadvantages.Inthefourthedition,EVownersseemtohaveadaptedtotheeffectsoftheconflict.Now,only46%overallhaveconcernsaboutthewar'simpact,althoughthedegreeofadaptationvaries.RespondentsinChinaandtheMiddleEastnowregisterthelowestlevelsofconcern(16%and38%)andsawthebiggestdropssincethepreviousedition.Butwhiletheyalsobothrecordedsharpfalls,aroundhalfofrespondentsinEuropeandtheAmericasstillharborconcernsabouttheimpactofthewaronEVpurchases.InEurope,thisismostlikelyduetotheproximityoftheconflictandcontinueduncertaintyoverenergyprices.Europeanelectricitypricessoaredtoanunprecedentedlevelinearly2022,significantlypushingupthecostofEVdrivingandunderminingcustomers'confidenceinEVownership.However,oncesupplyanddemandconditionsallowedsomenormalizationofcosts,theEuropeanEVsalesandpenetrationrateinH22022surgedto28%from24%inH12022,higherthaninH22021.Source:DIEMPlatform;RolandBergerSource:2023EVChargingIndexEd.4customersurvey;RolandBergerJAN2022MAR2022MAY2022AUG2022HIGHESTPRICEChangein%ofaffectedparticipantsEVOWNERSFEELINGNOTORLESSAFFECTEDEVOWNERSSTILLFEELINGMILDLYMOREAFFECTEDAsenergypricesfluctuateduetotheevent,ithadsomeimpactNoimpactatallQ4AVERAGEREDUCTIONNOV2022493JAN2023GlobaloverallEuropeChinaAmericasMiddleEastAsia(other)MONTHLYAVERAGEELECTRICITYWHOLESALEPRICES[EurosperMWh,2022.01to2023.01]Thecostofwar:WhileconcernsabouttheimpactofthewarinUkraineonEVadoptionhavefallen,almosthalfofourglobalrespondentsremainwary469364447190FranceGermanyNetherlandsUKSwedenPricebacktoJan'22level,beforetheUkrainewarHastheinvasionofUkraineaffectedyourinterestinEVadoption???4258-12%-3%-39%-13%-26%-19%54464951524845558416396152483664623830704951US67%51%Netherlands51%50%UK50%44%Spain59%40%Germany48%53%France47%52%Sweden45%55%Italy44%55%Edition3resultEdition4resultGermanySwedenNetherlandsUKFrance469197-58%190141-26%447198-56%364122-67%493214-57%12EVChargingIndexEdition413EVChargingIndexEdition4TherecentboominEVsaleshasgivenahugeboosttotheglobalEVchargingmarket.Inparticular,publicchargingnetworkshavebeenrapidlyexpanding,whiletheongoingrolloutoffast-chargingtechnologyhastransformedthestructureofchargingnetworks.Accordingtooursurveyresults,thecombinationofthetwomadechargingEVsatpublicchargingstationsmuchmoreconvenientinH22022thanbefore.Inthissectionwetakeacloserlookatfastchargingandperceptionsofpublicchargingnetworks.FastchargingandtheDCchampionsFastchargersacceleratethechargingprocessbyconvertingACpower(fromthegrid)toDCpower(requiredbythebattery)atthechargingstationanddeliveringtheDCpowerdirectlytotheEV'sbattery.DCchargersarenowgrowingfasterthanACchargersinpubliccharging.Theyareespeciallyprevalentalonghighways,wheredriverswanttochargeuprapidlybeforecontinuingtheirjourney.Publiccharging:TherisingshareoffastchargersisboostingsatisfactionlevelsOursurveyresultsshowagrowingglobaltrendinpublicDCchargersaswellasDCchargerdensitymorewidely.Chinaisleadingthewayintherollout:ItsshareofDCchargersinpublicnetworksexceeded42%inH22022,forexample.Meanwhile,theMiddleEastisarisingDCstar:ItsDCchargersharegrewby7%in2022tomorethan21%,whileitsDCchargingdensityroseby125%to1.3DCchargersper100kilometersofroad.Bothfiguresaresettogrowrapidly.CustomerperceptionsaboutpublicandfastchargingUnsurprisingly,EVownersarerespondingpositivelytotheexpansionofpublicchargingnetworksandDCfastcharging.Inoursurvey,respondentsfromallfiveregionsshowedhigherlevelsofsatisfactionwiththeconvenienceofEVcharging.Atotalof83%saidthatpublicchargingnetworkswereeasiertoaccessinH22022,comparedwith67%inH12022.EVownersinChina,theAmericasandtheMiddleEastrecordedthehighestlevelsofsatisfaction.Poweringahead:AllregionssawgrowthinfastDCchargingshareanddensityin2022,withChinaleadingthewayEaseofaccess:Theshareofglobalsurveyrespondentswhothinkpubliccharginghasbecomeeasiertoaccessgrewby16%betweenH1andH22022Source:EVVolumes;deskresearch;RolandBergerSource:2023EVChargingIndexEd.4customersurvey;RolandBergerDCSHAREOFPUBLICCHARGINGINFRASTRUCTURE[%,2022H1toH2]DCCHARGERDENSITY–#OFDCCHARGERSPER100KMROADWAYS[#,2022H1toH2]EuropeChinaAmericasMiddleEastAsia(other)Globaloverall20.4%21.5%19.3%19.5%40.5%42.3%18.5%22.3%14.5%21.4%22.1%22.0%2.32.72.62.911.714.40.30.30.61.32.22.3+1.8%+22.9%+0.2%+13.4%+3.8%+25.5%+6.9%+125.0%-0.1%+5.2%ThemostsufficientThemostsignificantimprove-ment2022H12022H2Doyouthinkpubliccharginghasbecomeeasieroverthepast6months?[resultsof2022H1vs.2022H2]??PERCENTAGEWHOFEELITISMORECONVENIENT(muchmoreconvenient+abitmoreconvenient)MuchmoreconvenientOverallsatisfactionrates:xx%=2022H1xx%=2022H2AbitmoreconvenientNodifferenceMoredifficultGlobaloverallEuropeChinaAmericasMiddleEastAsia(other)67%61%74%70%76%76%83%78%93%88%89%87%35%27%51%41%48%39%23%20%21%26%30%30%15%20%7%11%10%12%24%28%23%22%16%17%2%2%2%1%1%9%10%3%8%8%6%48%51%42%46%42%48%44%42%53%45%45%47%0%14EVChargingIndexEdition415EVChargingIndexEdition4AkeypurposeofourChargingIndexistogaugeandunderstandtheshiftingbehaviorsandpreferencesofEVowners.Inthisedition,wefocusoncustomerpreferencesinpubliccharging.GrowingrelianceonpublicchargingnetworksGlobally,only10%ofEVownersnevervisitapubliccharginglocation.Morethan30%ofEVownersusepublicchargingservicesthreeormoretimesaweek.ChineseEVownersareparticularlydependentonpublicchargingnetworks.Thus,thepenetrationrateinChinais96%,with17%ofChineseEVownersvisitingpubliccharginglocationsmorethanfivetimesaweek–significantlyhigherthantheglobalaverage.Customerbehavior:EVownersarebecomingincreasinglydependentonpublicchargingWhenitcomestopublicchargingspeeds,EVownersinChinaandtheMiddleEastarethemostsatisfied,witharoundtwo-thirdsofrespondentsinbothregionsagreeingthatspeedsaresufficient.Acrossallregions,themajorityofrespondentsaresatisfied.Fastenough:MorethanhalfofEVownersthinkpublicchargingspeedsaresufficient,withChineserespondentsparticularlysatisfiedFrequentvisitors:ThevastmajorityofglobalEVownersusepubliccharginginfrastructureatleastonceaweekBasedonyourexperience,areyousatisfiedwiththechargingspeedofcurrentpublicchargingfacilities?Onaverage,howoftendoyouchargeyourEVviaapublicchargingnetwork?????Source:2023EVChargingIndexEd.4customersurvey;RolandBergerSource:2023EVChargingIndexEd.4customersurvey;RolandBergerEuropeEuropeChinaChinaAmericasAmericasMiddleEastMiddleEastAsia(other)Asia(other)GlobaloverallGlobaloverallIdon'thaveanopinionNeverorquiterarely1-2timesperweek3-4timesperweekOver5timesperweekYes,it'sgenerallyfastenoughNo,there'smajorroomforimprovementonchargingspeed5%40%55%5%36%59%5%30%65%3%37%60%7%45%48%1%30%69%10%49%32%9%13%49%30%8%4%47%32%17%9%48%34%10%8%43%39%10%6%50%35%10%Chineseownersdependmostonpubliccharging16EVChargingIndexEdition417EVChargingIndexEdition4RangeanxietystillasignificantproblemDuetocustomerdependencyonpublicchargingandgenerallypoorchargersufficiency,rangeanxietystubbornlyremainsaproblemforEVowners.Forexample,oursurveyshowedthatmorethanhalfofcustomersexpectEVstomanageatleast500kilometersonafullcharge.Overall,56%ofrespondentssaidtheirrangeanxietywashighorveryhigh.AsianEVdriverstendtobethemostanxiousaboutrange,Europeanstheleast.RoomforimprovementinpublicchargingsufficiencyMeasuringthefrequencyofvisitstopublicchargingnetworksdoesnotgiveusafullpictureofpublicchargingsufficiency.Thisisbetterdoneusingthevehicle-to-public-chargerratio.OursurveyshowspoorsufficiencyinregularpublicchargersbutbettersufficiencyinpublicDCchargers.InChina,theratiosofbothtypesofchargersincreasedinH22022,indicatingthattheexpansionofpubliccharginginfrastructureinChinaisfailingtokeepupwiththecountry'ssoaringEVsalesandcarparc.EuropeandtheAmericasmanagedtoimprovetheirratios,albeittoalevelstillsignificantlybehindChina.Upsanddowns:Whilevehicle-to-public-chargerandvehicle-to-DC-chargerratiosareimprovinginEuropeandtheAmericas,theyarefallingintheotherregionsFarfromresolved:RangeanxietyisaparticularprobleminAsiancountries,withEuropeanEVdriversmorerelaxedaboutfindingtheirnextchargingstationSource:EVVolumes;RolandBergerSource:2023EVChargingIndexEd.4customersurvey;RolandBergerBettersufficiencyFormula=EVcarparc/charger#1�Examplesofrangeanxiety:"veryhigh"–ownersdemandEVrangeabove700km,"high"–500-700km,"mild"–300-500km;otherexamplesincl.EVowners'satisfactionaboutpublicchargersufficiency,chargingspeedLowersufficiencyGlobaloverall2022H12022H12022H22022H2VEHICLE-TO-PUBLIC-CHARGERRATIOVEHICLE-TO-DC-CHARGERRATIODEGREESOFRANGEANXIETYAMONGGLOBALEVOWNERS14.6118.315.9105.7EuropeChinaChina18.4149.817.6120.2China6.014.87.116.7Americas16.5112.014.666.6MiddleEast9.4130.269.517.6192.0Asia(other)8.912.771.7Thelowertheratio,thebetterthesufficiency79%Asia(other)SouthKorea70%Asia(other)Singapore70%AmericasUSA68%MiddleEastQatar68%EuropeGermany59%EuropeFrance56%EuropeItaly55%EuropeUK35%EuropeNetherlands34%1%20%46%33%2%29%49%21%3%28%46%24%4%28%46%22%8%24%37%31%5%36%41%18%5%38%41%15%7%38%38%17%18%46%27%8%18%49%27%7%%ofveryhigh&highLowMildHighVeryhigh118EVChargingIndexEdition419EVChargingIndexEdition4KeydifferentiationbetweenmarketchallengersandmarketdefendersGlobalsalesofEVsarerisingfastandthepenetrationrateisforecasttosurpass50%by2030.Especiallyinthepremiumsector,thedrivingforcebehindthisrapidexpansionisasmallgroupofEVmanufacturers(NTOs–newtransformativeornewtechnologyOEMs)thathaveathree-yearCAGRofaround71%.Meanwhile,conventionalpremiumbrandshaveunexpectedlyfallenbehindintermsofcapturingmarketshare.OneofthemainwaysthatNTOsdifferentiatethemselvesisbyprovidingbrandedchargingnetworks,givingcustomersaseamlesschargingexperience.Forexample,Teslanowoperatesaround45,000superchargersworldwide,whileNIOhas13,000,plus1,300batteryswaplocationsinChinaalone.Oursurveyresultsshowthat42%ofpeoplewhoownNTObrandsaresatisfiedwiththeircurrentchargingexperience,comparedtojust34%ofthosewhoownconventionalpremium-brandEVs.Inaddition,morethanBrandedcharging:IncreasedregionalizationofOEMs'EVcharginginfrastructurestrategyWherepeopleliketochargeIntermsofwheretocharge,destinationpublicchargingisthepreferredoption.Accordingtooursurvey,workplacechargingisthemostpopularoverallchoiceoflocation(26%),followedbyshoppingcenters(20%).Hotelsandresorts(11%)arealsogaininginpopularity.Highwaycharging(15%)istheleadingnon-destinationlocation.Location,location,location:Chargingatso-calleddestinations(workplace,shoppingcenters,etc.)accountsformostpublicchargingusageGrowingapart:Themajorconventionalpremium-brandOEMsarefallingbehindleadingnewtechnologyOEMsinglobalEVsalesSource:RBonlinesurvey2022Source:IHS;RolandBergerHowoftendoyouusethefollowingpubliccharginglocations(besideshomecharging)???GlobaloverallEuropeChinaAmericasMiddleEastAsia(other)26%19%11%15%14%14%1%24%20%11%15%16%14%1%32%16%12%16%12%13%0%26%19%12%16%13%13%1%27%17%12%17%13%13%1%26%16%12%15%14%15%1%Workplace(e.g.,parkinglotsnearoffice)5newtechnologyOEMs(Tesla,LiAuto,NIO,XPENG,Rivian)CAGR2020-22:71%13leadingconventionalOEMs(BMW,Mercedes-Benz,Audi,Volvo,LandRover,Cadillac,Infinity,...)CAGR2020-22:39%ChargingpointsalonghighwaysParkinglotsatshopping/retailcentersMunicipalstreet-sidechargingareaParkinglotsofhotels/resortsOtherCommunityparkinglots20200.60.620211.20.920221.81.2[2020-22,munits]20EVChargingIndexEdition421EVChargingIndexEdition4Readytorecharge70%ofpremium-brandEVownerssaythattheexistenceofanown-brandnetworkwouldsignificantlyinfluencetheirdecisiontobuyfromthatbrand.TheUnitedStates:IncreasedstandardizationOEMsaroundtheglobearepushingtheEVtransitionanddevelopingtheirownbrandedchargingnetworks.However,wecanobservedifferentstrategiesindifferentregions,drivenbydistinctcustomerdemandsandvaryingcompetitivedynamics,plusthefactthatdifferentregionsareatdifferentphasesofthetransitiontoelectricvehicles.IntheUnitedStates,forexample,EVsaleshavegrownfast,ataround55%in2022,yetthepenetrationrateofEVs,atapproximately6.8%,stilllagsbehindthatofEuropeandChina.USOEMsnowseestandardizationofthechargingtechnologyasthekeydrivertospeeduptheEVtransitionandareaddressingcomplaintsfromtheirclientsaboutthepoor-qualitypublicchargingnetwork.ThecompetitionbetweentheNorthAmericanChargingStandard(NACS)usedbyTeslaandtheCombinedChargingSystem(CCS),historicallybackedbyotherconventionalOEMs,hasreachedatippingpoint,withFordandGM,andlaterOEMssuchasVolvo,PolestarandRivian,andCPOplayersincludingBlinkandElectrifyAmerica,announcingagreementsunderwhichtheirvehicleswillbeabletoaccessTesla'ssuperchargernetwork.SAEInternationalhasalsoannounceditwillexpeditetheprocessfortheNACSplugtobecomeastandardbytheendof2023.ThisstandardizationwilllikelyfurtherdriveupEVpenetrationintheUnitedStates.China:DifferentiationintheEVmarketThevaluepropositionofbrandedchargingisquiteadifferentstoryinChina,whereEVpenetrationisrelativelyhigh,ataround28%andgrowing.ForChineseOEMs,brandedchargingcanactasakeydifferentiatingpointintheirEVstrategy,enablingthemtopromoteauniqueEVbrandimage,offerexceptionalcustomerexperienceandshowcasecutting-edgetechnology,suchassuperfastcharging.LeadingNTOsinChinaofferalevelofserviceintheirbrandedchargingnetworkthathasneverbeenseenbefore,includingvariouschargingoptions(fromfastchargingtoswapping),differentlocations(fromshoppingcentersandofficebuildingstohighways)andpremiumservices(fromvaletchargingtodiscountsinnearbystores).Anothercommonsalestacticistoofferusersafreechargingquotaforacertainperiodoftimeinthebrandedchargingnetwork.TocatchupwithChina,manyglobalOEMs,includingAudiandPorsche,arestartingtobuildtheirownbranded-chargingnetwork,allowingthemtomeettheircustomers'demandswithregardstoconvenience,diversityandapremiumchargingexperience.Therecanbenodoubtthatit'sbeenabusyfewmonthsintheglobalEVchargingmarket.Butwhilestrivingtobouncebackfromthefalloutofgeopoliticaltensionsandenergypriceturbulence,themarkethasshowntheresiliencetofulfillthelong-termvisionoftheEVtransition.TheperceivedroleofEVcharginghasbeengraduallytransformingfromsimplymeetingdemandtomorediversevalues–forbothEVOEMsandcustomers.Insomemarkets,premiumOEMsarebettingonbrandedchargingnetworkstoboostsalesandreinforcecustomerloyalty.Ontheotherhand,customersareexpectingcharginganxietytoberelievedthroughsufficiencyofchargingpointswithfastcharginganddiversecoverageoflocations.WithallofthesepositivesignshighlightedinthefourtheditionoftheEVChargingIndex,itseemsthemarketisreadytorecharge.Wewillcontinuetotrackitandseeifthegrowingtrendsofscale,diversityandqualityaresustained.22EVChargingIndexEdition423EVChargingIndexEdition4YourcontactsPhotosRolandBergerGmbHROLANDBERGERistheonlymanagementconsultancyofEuropeanheritagewithastronginternationalfootprint.Asanindependentfirm,solelyownedbyourPartners,weoperate51officesinallmajormarkets.Our3000employeesofferauniquecombinationofananalyticalapproachandanempathicattitude.Drivenbyourvaluesofentrepreneurship,excellenceandempathy,weatRolandBergerareconvincedthattheworldneedsanewsustainableparadigmthattakestheentirevaluecycleintoaccount.Workingincross-competenceteamsacrossallrelevantindustriesandbusinessfunctions,weprovidethebestexpertisetomeettheprofoundchallengesoftodayandtomorrow.RonZhengSeniorPartnerShanghaiOfficeron.zheng@rolandberger.com+8618121011388BobZaborsSeniorPartnerChicagoOfficebob.zabors@rolandberger.com+13129534741JackZhuangPrincipalShanghaiOfficejack.zhuang@rolandberger.com+8615601602410ErinSowerbyPrincipalDetroitOfficeerin.sowerby@rolandberger.com+16195649041TimLongstaffPartnerLondonOfficetim.longstaff@rolandberger.com+447880202910PhotosRolandBergerGmbHPublisherRolandBergerGmbHSederanger180538MunichGermany+49899230-023_2077_FLYThispublicationhasbeenpreparedforgeneralguidanceonly.Thereadershouldnotactaccordingtoanyinformationprovidedinthispublicationwithoutreceivingspecificprofessionaladvice.RolandBergerGmbHshallnotbeliableforanydamagesresultingfromanyuseoftheinformationcontainedinthepublication.©2023ROLANDBERGERGMBH.ALLRIGHTSRESERVED.

VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP