3 / 44

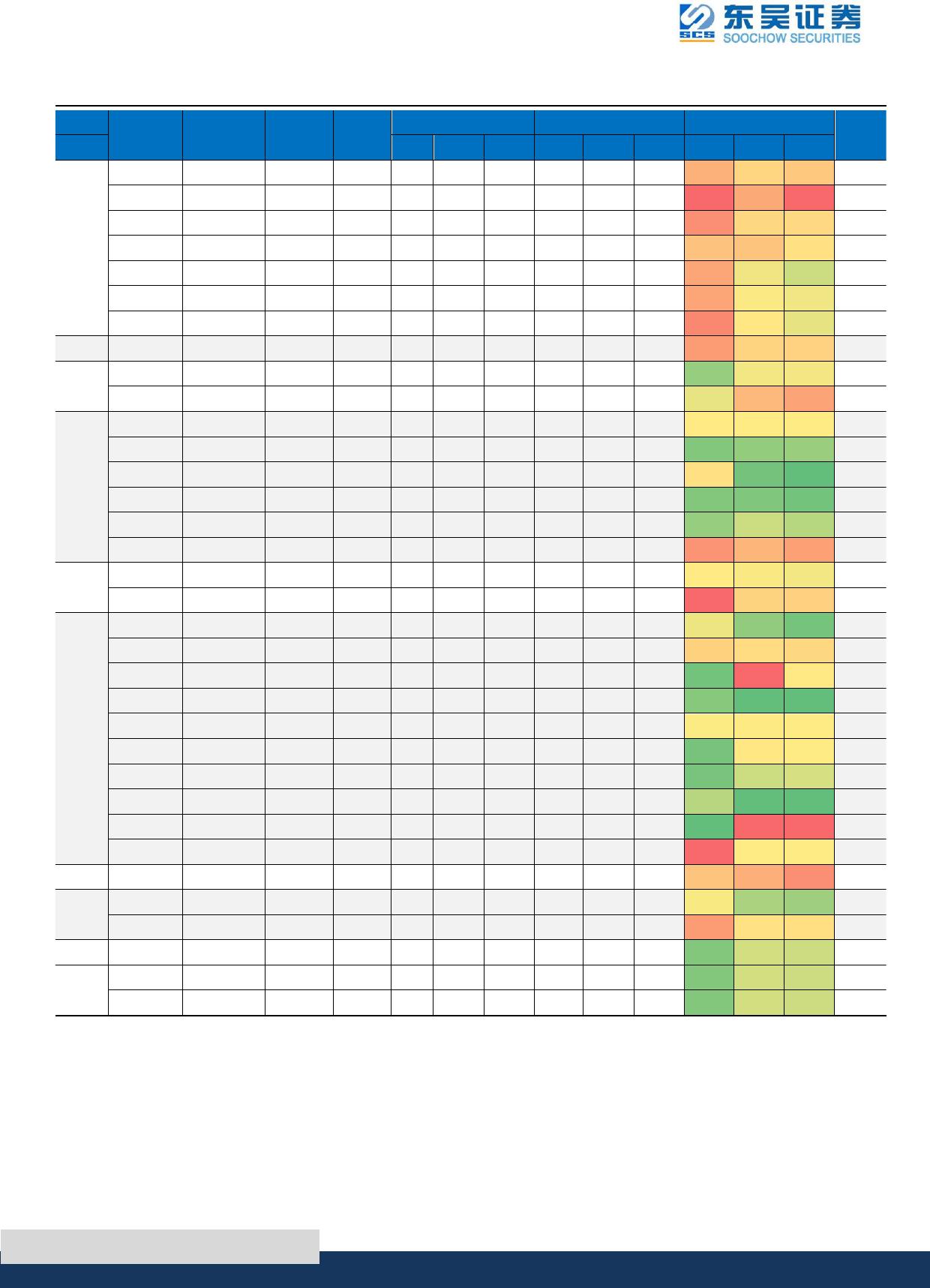

新能源汽车板块 2023 年H1 收入同增 20.8%,归母净利润同减 14.7%,板块业绩增速放缓。我们共选

取了 96 家上市公司,划分为上游材料、锂电池中游(含隔膜、六氟磷酸锂及电解液、电池、正极、负极、

添加剂、铜箔、铝箔、结构件 9个细分板块)、汽车核心零部件、整车、锂电设备 5个子板块,进行了统计

分析。1)收入和净利润:2023 年上半年营业收入达 15323.69 亿元,同比增加 20.8%;实现归母净利润 955.96

亿元,同比减少 14.7%。2023 年Q2 新能源汽车板块营收同比增加 27.7%,受去库存+盈利下滑影响,归母

净利润同环比分别下滑 22.6%、1.5%。2023 年二季度实现营收 8151.59 亿元,同比增加 27.7%,环比增加

13.7%;实现归母净利润 474.32 亿元,同比下降 22.6%,环比下降 1.5%。分板块来看,23H1 上游环节利润

分配同比显著下滑,Q2 电池环节利润占比环比大幅提升。2023 年上半年上游材料利润占整个新能源汽车板

块比重为 26.5%,锂电池中游占比 38.1%,其中电池环节占比 26.5%,环比+5.9pct,核心零部件占比 6.7%,

整车占比 28.7%;23Q2 上游材料利润占比为 23.8%,锂电池中游占比 40.9%,其中电池环节占比 40.9%,环

比+5.6pct。核心零部件占比 7.9%,整车占比 27.4%。2023 上半年扣非归母净利润同比增速排序依次为电池

(110.11%)>汽车核心零部件(27.38%)>锂电设备(11.90%)>结构件(-1.79%)>锂电池中游(-10.41%)>整车(-

12.33%)>三元前驱体(-15.62%)>隔膜(-15.77%)>负极(-27.59%)>碳酸锂(-46.91%)>三元正极(-54.38%)>铝箔

(-57.00%)>六氟磷酸锂及电解液(-72.42%)>铜箔(-96.53%)> 正极(-100.88%)>添加剂 (-143.50%)>铁锂正极(-

180.99%);2023Q2 扣非归母净利润环比增速排序为整车(440.43%)>汽车核心零部件(38.76%)>锂电设备

(15.55%)>隔膜(-13.16%)>三元前驱体(-20.40%)>负极(-29.66%)>电池(-34.78%)>六氟磷酸锂及电解液(-

41.76%)>结构件(-42.12%)>锂电池中游(-46.62%)>碳酸锂(-49.86%)>三元正极(-54.38%)>铜箔(-65.10%)>铝箔

(-66.57%)>正极(-112.31%)>铁锂正极(-178.51%)>添加剂(-1767.85%)。2)盈利趋势看:板块整体盈利水平向

下,中游材料盈利分化明显,电池盈利较为稳健:2023 年H1 板块整体毛利率为 17.23%,同比减少 1.42pct;

归母净利率 6.24%,同比减少 2.59pct。2023年Q2,板块毛利率为 16.87%,同比减少 3.02pct,环比减少 0.78pct;

归母净利率 5.82%,同比减少 3.78pct,环比下降 0.90pct。3)Q2 费用率环比小幅下降,同比小幅上升:新能

源汽车板块 2023 年H1 整体费用率 10.14%,同比上升 0.66pct;2023 年Q2 费用率 9.66%,同比上升 0.42pct,

环比下降 1.03pct:2023 年H1 板块整体费用率 10.14%,同比上升 0.66pct;2023 年二季度费用率 9.66%,同

比上升 0.42pct,环比下降 1.03pct。4)应收款、预收款及存货:板块整体去库存,存货有所下降:2023 年上

半年末板块整体应收账款为 4227.19 亿元,较年初增长 2.4%;预收款项 1294.05 亿元,较年初基本持平;存

货达到 4921.33 亿元,较年初下降 5.58%。2023 年Q2 应收账款 4227.19 亿元,较年初增长 2.40%;预收款项

1,294.05 亿元(包括合同负债),与年初持平;存货 4921.33 亿元,较年初减少 5.58%。5)2023 年H1 板块现

金流同比增加 76.93%,23 年Q2 经营现金流环比上升 681.51%:2023 年上半年板块经营活动净现金流为

1788.17 亿元,同比增加 76.93%。2023 年第二季度为 1585.31 亿元,同比增加 58.78%,环比上升 681.51%。

碳酸锂价格 4月触底反弹至 30 万元/吨震荡,现回落至 20 万元/吨,预计 H2 锂价在 15-20 万元之间波动。

目前锂盐厂预计库存仍有 5万吨+,电池及正极厂基本按需采购。随着下半年份江西、非洲等新产能释放,

我们预计碳酸锂价格回落至 15-20 万元/吨,盈利回归合理水平。1)收入和归母净利润:23 H1 碳酸锂板块

营收 882.61 亿元,同比增长 3.41%,归母净利润 252.86 亿元,同比减少 42.06%,其中,23Q2 板块营收达

到444.25 亿元,同比减少 11.45%,环比上升 1.34%;归母净利润 112.91 亿元,同比下滑 56.80%,环比下

滑19.32%。2)毛利率和净利率:2023H1 毛利率 50.43%,同比下降 15.77pct,环比下降 9.30pct;归母净

利率 28.65%,同比下降 22.48pct,环比下降 16.07pct。2023Q2 毛利率 46.10%,同比下降 20.12pct,环比

下降 8.72pct;归母净利率 25.42%,同比下降 26.68pct,环比下降 6.51pct。3)费用率:上游材料 2023 年

H1 期间费用率 5.03%,同比下降 0.45pct;23 年Q2 期间费用率 4.92%,同比上升 0.04pct。4)应收、预收

款及存货:2023 年H1 板块应收账款为 208.14 亿元,较年初减少-6.42%,较 Q1 末减少 2.52%。2023 年H1

预收账款 39.97 亿元,较年初减少 15.21%,较 Q1 末减少 3.96%。2023 年H1 存货为 314.36 亿元,较年初增

加6.71%,较 Q1 末减少 0.30%。5)现金流:2023H1 经营活动净现金流为 255.51 亿元,同比降低 7.64%。

锂电池中游板块盈利分化:电池盈利稳中有升,中游材料盈利快速下降。23 年H1 电池板块盈利高增,全年

VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP