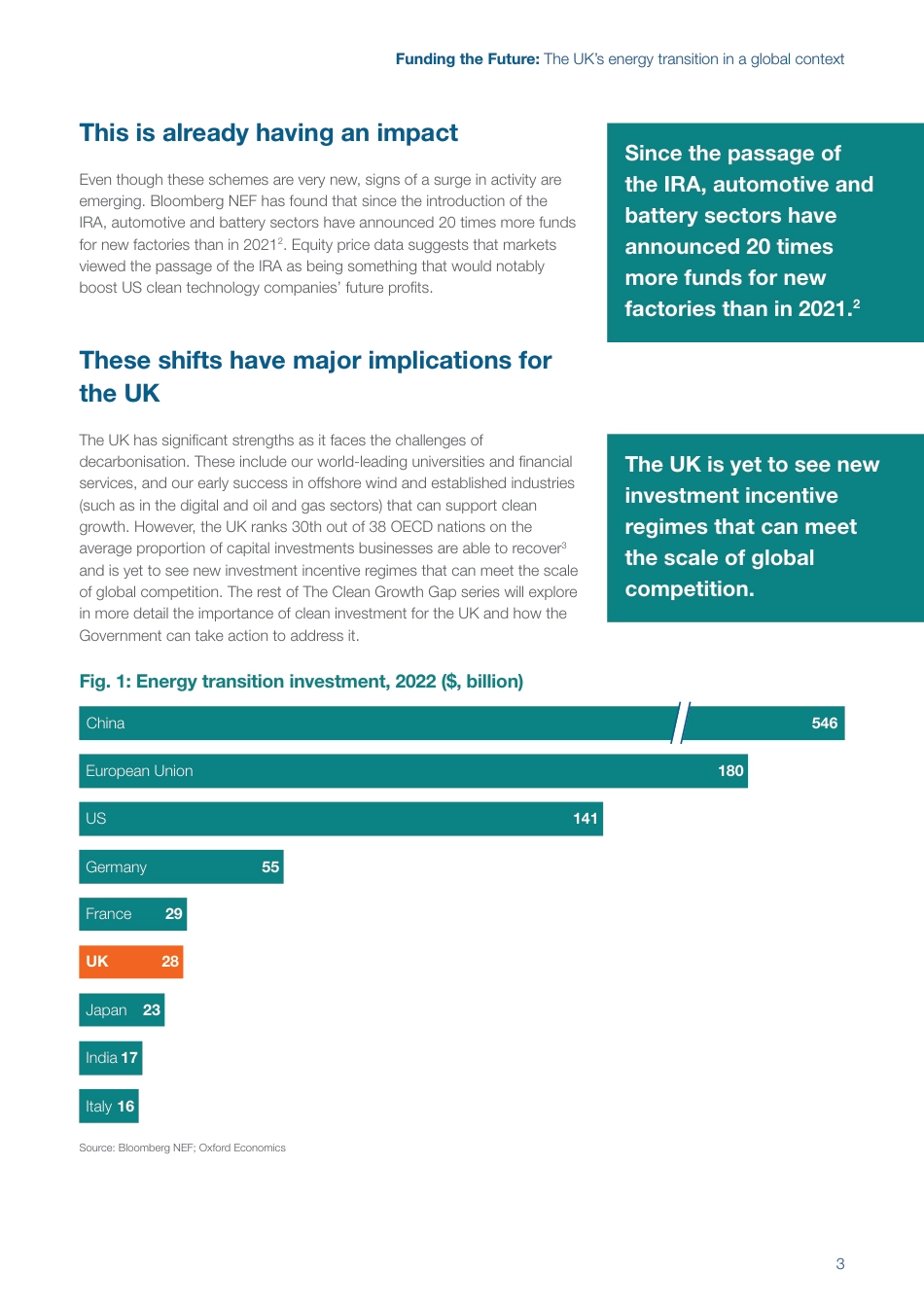

The UK’s energy transition in a global contextPart of The Clean Growth Gap – a series of reports and economic analysis from Energy UK, supported by Oxford EconomicsFunding the FutureFunding the Future: The UK’s energy transition in a global context2Executive Summary: The UK’s Energy Transition in a Global ContextNet Zero presents knotty challenges of global collaboration and competition. This is especially true in our world of globally connected finances, where investment flows across borders to where it can be put to best use. These flows are shaped by the decisions of governments around the world, and if we are to understand how to attract investment to the UK, we must first appreciate how the UK compares to other countries.“Funding the Future” - the second in Energy UK’s “The Clean Growth Gap” series - sets out what governments around the world have done to attract investment in their clean economies and what this means for the UK as it considers its next steps in the energy transition.Investment is key to the energy transitionInvestment is the way the world will fund the transition to a Net Zero economy and in turn shape all our futures. The UK’s energy security, future prosperity and the potential to achieve our climate goals are all reliant on the ability to attract investment. Around the world, this investment mostly comes from the private sector (60% in 2022 according to The International Energy Agency (IEA)1), but government action and strong policy support is vital to unlocking it.The world is investingChina dominates global activity, boasting nearly half of the world’s clean technology investments in 2022. Its $546 billion spend in low carbon technologies was over three...