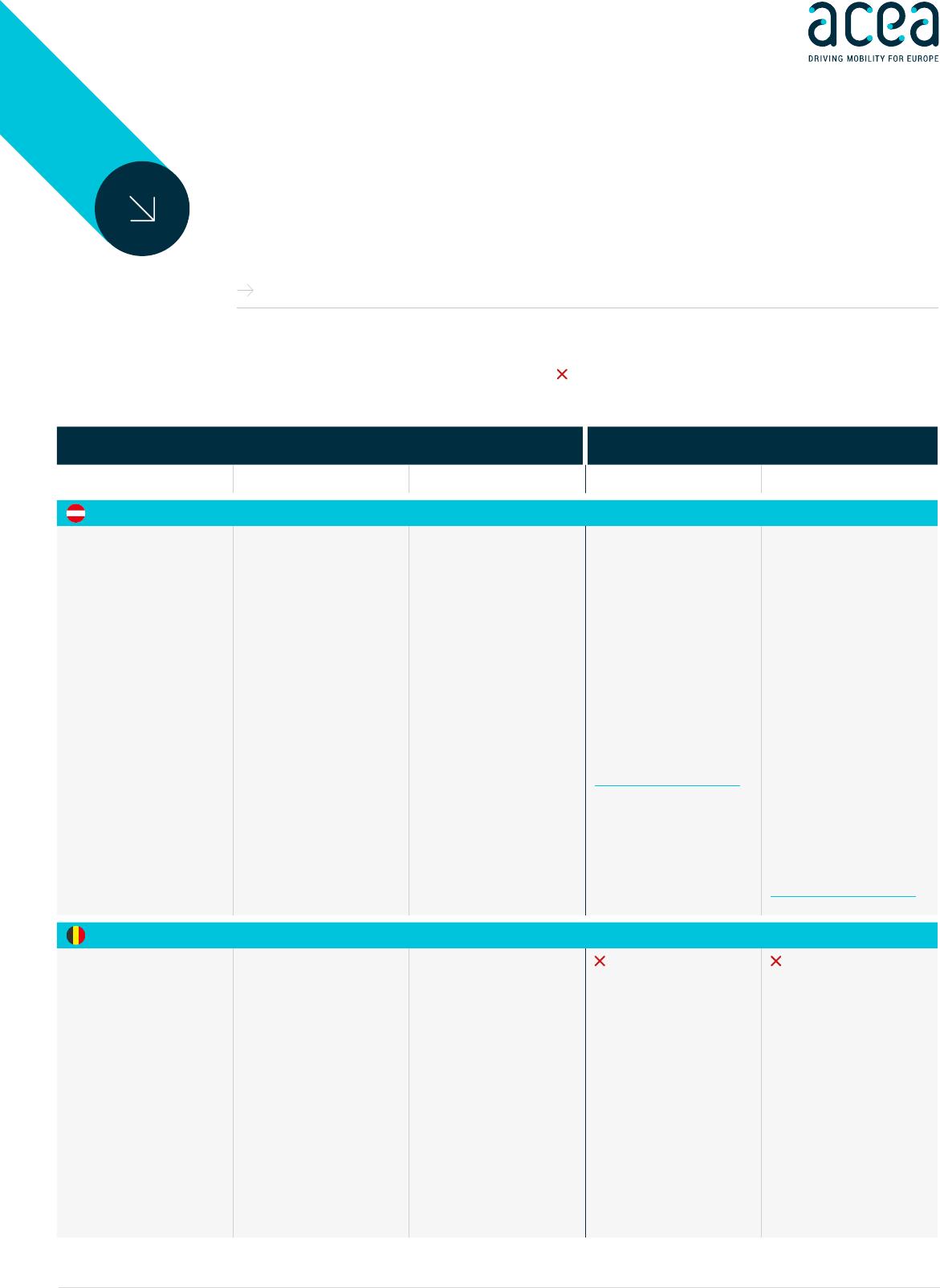

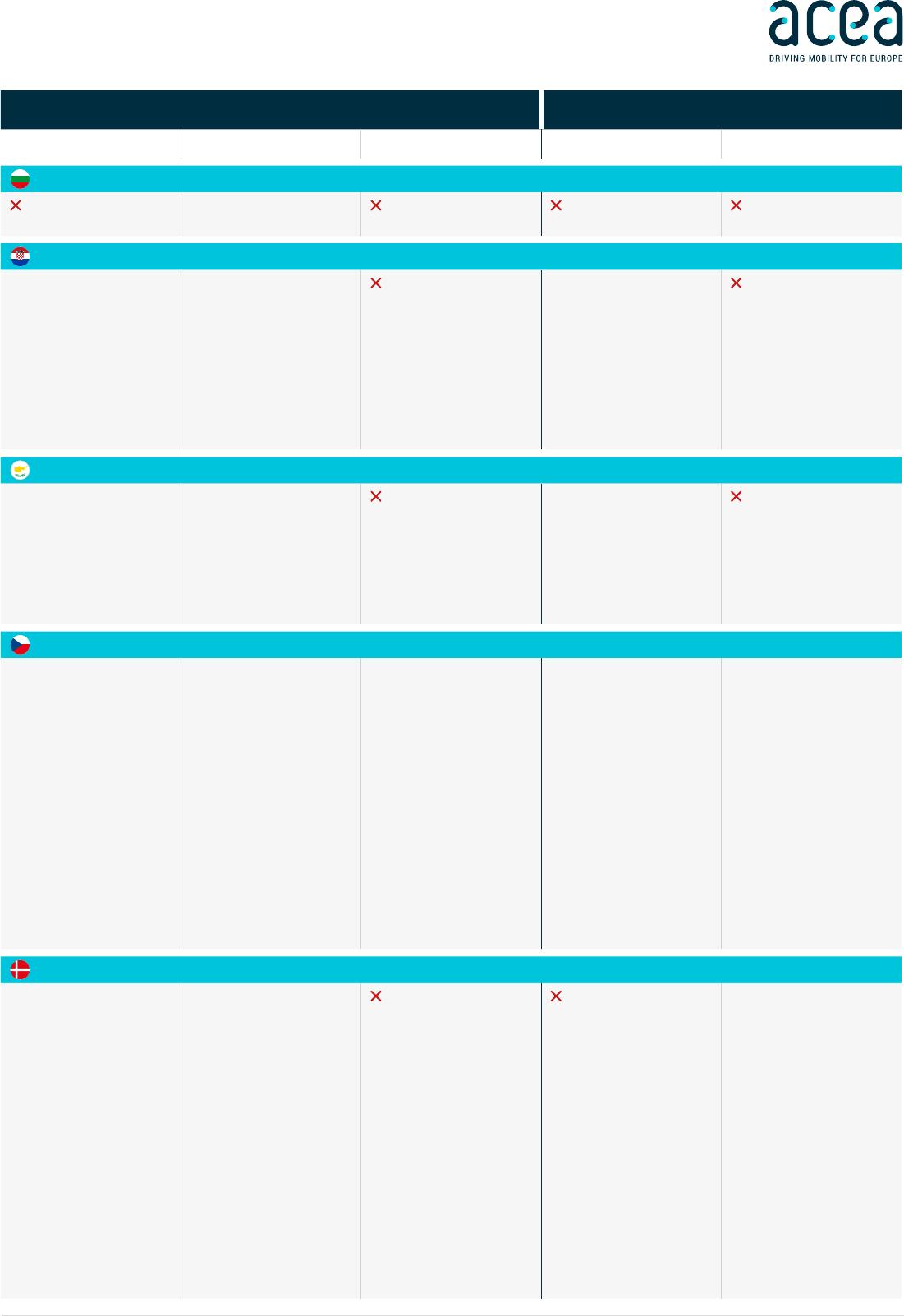

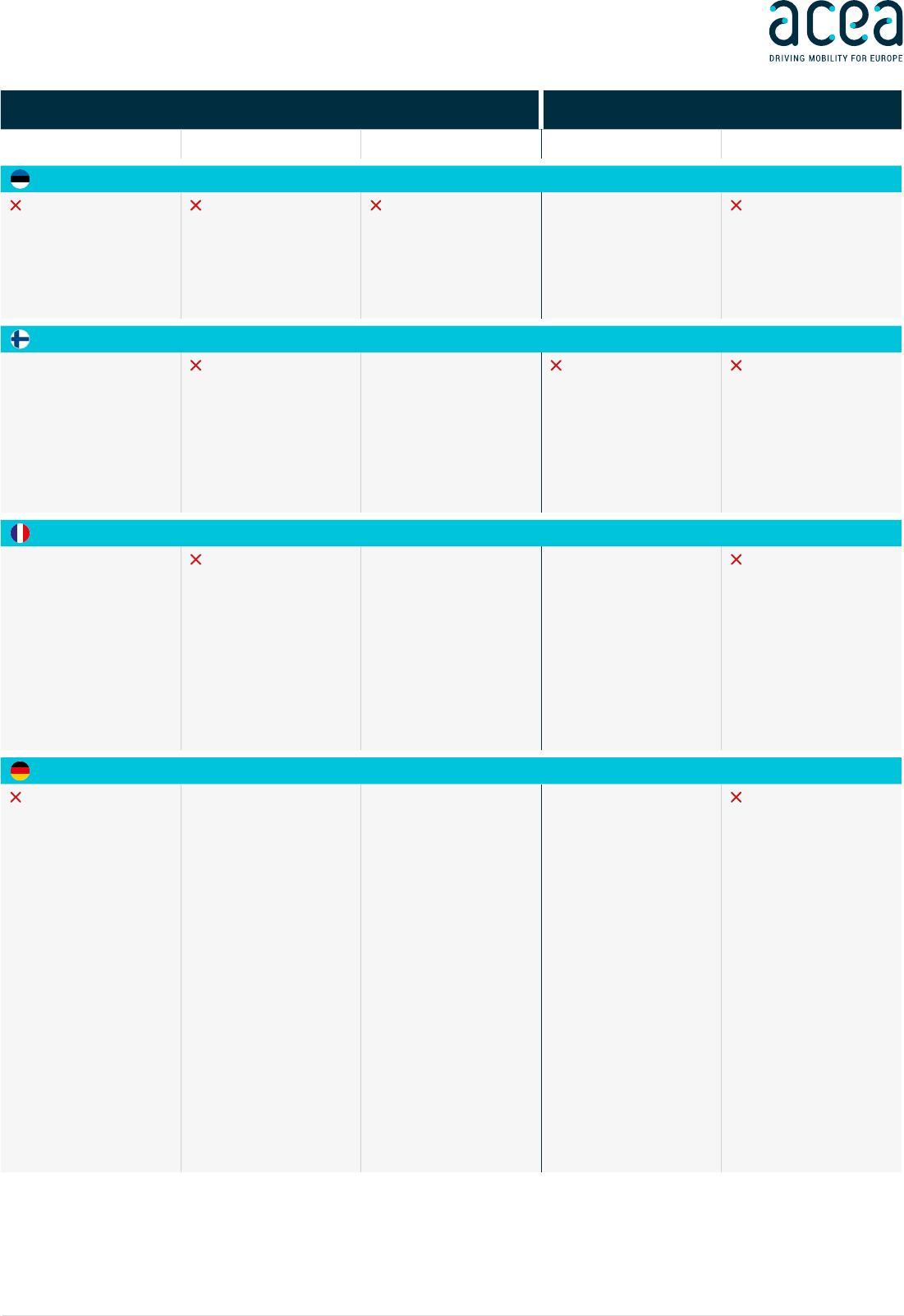

TAXBENEFITSINCENTIVESAcquisitionOwnershipCompanycarsPurchaseInfrastructureAUSTRIAVATdeductionandexemptionfromtaxforzero-emissioncarsusedforbusinesspurposes(egBEVsandFCEVs).Vehiclegrosspurchasevalue(including20%VATandpollutiontax):•≤€40,000:fullVATdeduction•€40,000-80,000:VATdeductionforthefirst€40,000•>€80,000:noVATdeductionExemptionfromownershiptaxforallzero-emissioncars.Exemptionfrompollutiontaxforallzero-emissioncars.Exemptionfromownershiptaxforallzero-emissioncars.Ataxinvestmentincentiveforthepurchaseofazero-emissioncaramountingto10%andaspecialdepreciationapplies.Exemptionfrompollutiontaxforallzero-emissioncars.Foremployees,theprivateuseofazero-emissioncompanycar,andtheelectricitytochargeit,areexemptedfromtaxationasbenefitinkind.Bonusuntiltheendof2023forthepurchase(privateuse)ofnewcarswithafullyelectricrangeof≥60kmandgrosslistpriceof≤€60,000:•€3,000forBEVsandFCEVs•€1,250forPHEVsandEREVsAdditionalincentivesaregrantedbyprovincesandcommunities.Formoredetails:www.umweltfoerderung.atBonusuntiltheendof2023forthepurchase(privateuse)ofthefollowingloadinginfrastructure:•€600foranintelligentloadingcable•€600forawallbox(inasingle/doublehouse)•€900forawallbox(inahousingcomplexassingleequipment)•€1,800forawallbox(inahousingcomplexasintegratedequipmentwithloadmanagement)Additionalincentivesaregrantedbyprovincesandcommunities.Formoredetails:www.umweltfoerderung.atBELGIUM•BrusselsandWallonia:minimumtaxrate(€61.50)forBEVsandFCEVs(M1).•Flanders:BEVsandFCEVs(M1)areexempt.•BrusselsandWallonia:minimumratesforBEVsandFCEVs(€85.27/yearforM1).•Flanders:BEVsandFCEVsareexempt.•6%VAT(insteadof21%)forelectricityconsumption•TaxbenefitsforBEVsandFCEVsinBrussels,Flanders,andWalloniaapplytocompanycarsaswell.•Maximumdeductibility(100%)ofexpensesforM1with≤50gCO2/km(NEDC)andbatterycapacity≥0.5kWhper100kgofvehicleweight.•MinimalannualbenefitinkindforBEVs,FCEVs,andPHEVs(M1):4%ofthelistvalue.TAXBENEFITSANDPURCHASEINCENTIVESElectricpassengercars27EUmemberstates(2023)GLOSSARYBEVBatteryelectricvehicleFCEVFuelcellelectricvehicle(hydrogen)PHEVPlug-inhybridelectricvehicleEREVExtended-rangeelectricvehicleHEVHybridelectricvehicleNobenefitorincentiveavailableM1Passengercarwww.acea.auto1TAXBENEFITS&PURCHASEINCENTIVES:ELECTRICPASSENGERCARSTAXBENEFITSINCENTIVESAcquisitionOwnershipCompanycarsPurchaseInfrastructureBULGARIAExemptionforelectricvehicles.CROATIANoexcisedutiesforelectricvehicles.Exemptionfromspecialenvironmentaltaxforelectricvehicles.Incentivescheme(onceperyear,limitedfunds):•€9,291forBEVs•€5,309forPHEVsThereisa12-monthdeadlinetopurchasethevehicleandsubmitagrantrequest.Thevehiclemustbekepttwoyears.CYPRUSExemptionforvehiclesemitting≤120gCO2/km.Minimumrateforvehiclesemitting≤120gCO2/km.•Upto€12,000toscrapandreplacewithavehicleemitting<50gCO2/kmandcosting≤€80,000.•Upto€19,000tobuyaBEV(≤€80,000)+€1,000toscrapanoldcar.CZECHREPUBLICBEVsandFCEVsemitting≤50gCO2/kmexemptfromregistrationcharges(withaspecialnumberplate).•BEVsandHEVsexemptfromroadtax.•Vehiclesemitting≤50gCO2/kmexemptfromroadtoll.•Reductionofthedepreciationperiodforchargingstationsforelectricvehiclesfrom10tofiveyears(wallboxesandstandalonechargingstations).•AccelerateddepreciationforBEVsandPHEVsbelow50gCO2/km.•Roadtaxexemptionforalternativelypoweredvehicles(ieBEVs,HEVs,FCEVs,CNG,LPG,andE85).•Taxreductionfrom0.5-1%forBEVsandPHEVsusedforprivatepurposes.Purchaseincentiveforlow-andzero-emissionvehiclesbystateandlocalgovernmentbodies.SupportfromtheMinistryofTransportforthedevelopmentofcharginginfrastructure.DENMARKZero-emissionvehicles:•Pay40%oftheregistrationtax•AdditionalDKK165,000registrationtaxdeduction•DKK900deductionoftaxablevalueperkWhbatterycapacity(max45kWh)Low-emissionvehicles(emitting<50gCO2/km):•55%oftheregistrationtax•AdditionalDKK47,500registrationtaxdeduction•DKK900deductionoftaxablevalueperkWhbatterycapacity(max45kWh)•TaxesonownershiparebasedonCO2emissions.•Zero-emissioncarsandcarswithCO2emissionsofmax58g/kmpaytheminimumsemi-annualtaxrateofDKK370.Thevalueofachargingstand/chargingoutletprovidedtogetherwithacompanycar(attheemployee’sresidence)isnottaxed.www.acea.auto2TAXBENEFITS&PURCHASEINCENTIVES:ELECTRICPASSENGERCARSTAXBENEFITSINCENTIVESAcquisitionOwnershipCompanycarsPurchaseInfrastructureESTONIANewM1BEVsandFCEVs(purchaseandleasing):•€5,000/vehicleforindividuals•€4,000/vehicleforlegalpersonsFINLANDZero-emissionpassengercarsareexemptfromregistrationtaxasof1October2021.•Taxdeductionof€170permonthfromtaxablevalue(incometax)forBEVs(2021-2025).•Chargingofelectricvehiclesataworkplaceisexemptfromincometax(2021-2025).FRANCE•Regionsprovideanexemption(eithertotalor50%)foralternativelypoweredvehicles(ieelectric,HEVs,CNG,LPG,andE85).•BEVs,FCEVs,andPHEVs(witharangeof>50km)areexemptfromthemass-basedmalus.ExemptionfromCO2-basedtaxcomponent(‘TVS’)forvehiclesemitting<60gCO2/km(apartfromdieselvehicles).BonusforanewBEVorFCEV:•€5,000forhouseholdsifvehicle≤€47,000•€3,000forlegalpersonsifvehicle≤€47,000Scrappageschemeforasecond-handornewBEVorFCEVof≤€47,000:upto€6,000,basedonincome.GERMANY•10-yearexemptionforBEVsandFCEVsregistereduntil31December2025.Exemptiongranteduntil31December2030.•Exemptionfromtheannualcirculationtaxforvehiclesemitting≤95gCO2/km.•ReductionofthetaxableamountforBEVsandPHEVs(from0.5-1%ofthegrosscataloguepricepermonth).PHEVsmustmeetfurtherrequirements,whichbecomemorestringentovertime.•AdditionalreductionoftaxableamountforBEVswithagrosslistpriceupto€60,000(0.25-1%ofthegrosscataloguepricepermonth).Asof1January2023,fundingisonlyavailablefornewandusedBEVsandFCEVs.One-thirdofthefundingisprovidedbytheindustryandtwo-thirdsbythegovernment.•Bonusfornewcarswithanetlistprice≤€40,000:€6,750•Bonusfornewcarswithanetlistprice>€40,000and≤€65,000:€4,500•From1September2023,onlyprivateindividualswillbeabletoapplyforfunding.•From1January2024,reductioninfundingandstricterrequirements.www.acea.auto3TAXBENEFITS&PURCHASEINCENTIVES:ELECTRICPASSENGERCARSTAXBENEFITSINCENTIVESAcquisitionOwnershipCompanycarsPurchaseInfrastructureGREECE•75%reductioninregistrationtax(RT)forPHEVsupto50gCO2/km.•50%reductioninRTforHEVsandPHEVsemitting≥50gCO2/km.•HEVswithanenginecapacity≤1,549ccandregisteredbefore31October2010areexemptfromcirculationtax.•60%ofthecirculationtaxforHEVswithenginecapacity≥1,550ccregisteredbefore31October2010.•Exemptionforcarsemitting≤90gCO2/km(NEDC)or122g(WLTP).•BEVsareexemptfromthepersonalincomepresumptionsystem.•Exemptionofthebenefit-in-kindtaxforBEVsandPHEVsemitting≤50gCO2/km(NEDCorWLTP)withanetretailprice(NRP)≤€40,000.•Deductibleof€40,000intheNRPforBEVsandPHEVsupto50gCO2/kmwithhigherNRPvalue.•30%cashbackonNRPforBEVs,withamaxcashbackof€8,000.Extra€1,000ifacarof≥10yearsisscrapped,orthebuyeris≤29yearsold.•40%cashbackonNRPforBEVtaxis,withamaxcashbackof€17,500.Extra€5,000forscrappingtheoldtaxi,whichismandatory.HUNGARYTaxexemptionforBEVsandPHEVs.TaxexemptionforBEVsandPHEVs.TaxexemptionforBEVsandPHEVs.From15June2020,purchaseincentivesforelectriccars:•€7,350foragrosspriceofupto€32,000•€1,500ifthepriceisbetween€32,000-44,000IRELAND•€5,000reliefforBEVscostingupto€40,000.Therelieftapersoffafter€40,000andendsat€50,000.•BEVsareexemptfromanitrogenoxides(NOx)tax.•Minimumrate(€120peryear)forBEVs.•Reducedrate(€140peryear)forPHEVs≤50gCO2/km.0%ofbenefitinkindappliestothefirst€50,000forBEVs.Purchaseincentivesforindividualsin2021:•Upto€5,000forBEVs•Upto€5,000forPHEVswith≤50gCO2/kmandfull-electricrangeof≥50kmITALY•BEVs:five-yearexemptionfromthedateoffirstregistration.Afterthisperiod,75%reductionofthetaxrateappliedtoequivalentpetrolvehicles.•HEVs:Applicationofaminimumflatrate(€2.58/kW).Someregionsapplydiscountsonthetaxownership.•€3,000(€5,000withscrappage)foraBEV/PHEVemitting≤20gCO2/kmandwithasellingpriceof≤€35,000+VAT.•€2,000(€4,000withscrappage)foraBEV/PHEVemitting21-60gCO2/kmandwithasellingpriceof≤€45,000+VAT.Fordomesticusers,acontributionof80%ofthepurchaseandinstallationpriceofstandardpowerinfrastructuresforrechargingelectricvehicles,withinthemaximumlimitof€1,500perapplicant.LATVIAExemptionfromtheregistrationcostsforBEVvehicles(firstregistration).ExemptionforM1vehiclesemitting≤50gCO2/km.Minimumrate(€10)forBEVs.www.acea.auto4TAXBENEFITS&PURCHASEINCENTIVES:ELECTRICPASSENGERCARSTAXBENEFITSINCENTIVESAcquisitionOwnershipCompanycarsPurchaseInfrastructureLITHUANIAExemptionforelectricvehicles(firstregistrationonly).Purchaseincentives(bonus)forvehicles≤sixmonths:•M1electricvehicle:€4,000•Additional€1,000forscrappinganolddieselorpetrolM1,ownedforatleast12months,withavalidMOTMaximumsubsidyis€400,000percompany.Purchaseincentives(bonus)forindividualsin2021:•€2,500forausedM1electricvehiclewithfirstregistrationafter2April2016,ormodelyear2016andlater•€5,000foranewM1electricvehiclenotolderthansixmonthsfromthefirstregistration•Additional€1,000forscrappingolddieselorpetrolM1,ownedforatleast12months,andwithavalidMOTforthedates:2February2021or13March2020LUXEMBOURGOnly50%ofadministrativetax.Minimumrateof€30peryearforzero-emissionvehicles.Monthlybenefitinkindfrom0.5-1.8%dependingonCO2emissions.•BEVs:≤18kWh:€8,000>18kWh:€3,000•PHEVs:≤50gCO2/km:€2,500MALTAMinimumrateforvehiclesemitting≤100gCO2/km.Minimumrateforvehiclesemitting≤100gCO2/km.BEVs:•€11,000forindividuals•Upto€20,000forcompanies(additionalincentiveifestablishedinandoperatingfromcertainlocalitiesAdditionalgranttoscrapavehicleof≥10years.Formoredetails:www.transport.gov.mt/land/sustainable-transport/financial-incentives-2023/new-electric-vehicles-6188www.acea.auto5TAXBENEFITS&PURCHASEINCENTIVES:ELECTRICPASSENGERCARSTAXBENEFITSINCENTIVESAcquisitionOwnershipCompanycarsPurchaseInfrastructureNETHERLANDSExemptionforzero-emissioncars.Exemptionforzero-emissioncars.50%tariffforPHEVs.Minimumrate(16%)forzero-emissioncars.Capat€30,000forBEVs.Nocapforhydrogencars.•Subsidyscheme(SEPP)forindividualstobuy/leaseasmallorcompactBEVcar,neworused.•Arbitrarydepreciationofenvironmentalinvestmentsscheme(Vamil)forFCEVcarsortaxisandBEVcarsequippedwithsolarpanels.Formoredetails:www.rvo.nl/subsidie-en-financieringswijzer.POLAND•ExemptionforBEVs.•ExemptionforPHEVsupto2,000ccuntilend2029.Depreciation:•uptoPLN225,000forBEVsandFCEVs•uptoPLN150,000forvehiclesemitting0-50gCO2/km•uptoPLN100,000forvehiclesemitting>50gCO2/kmPurchaseincentivesforindividualsandlegalpersons(purchase,leasing):fromPLN18,750toPLN27,000forBEVsandFCEVsofamaxpriceofPLN225,000Upto50%oftheeligiblecostsforhydrogenstations.PORTUGALCartax:•BEVs:completeexemption•PHEVs:75%reductionifrangeinall-electricmode≥50kmand<50gCO2/km•HEVs:40%reductionifrangeinall-electricmode>50kmandCO2emissions≤50g/kmExemptionforbatteryelectricvehicles(BEVs).Autonomouscorporateincometax:•ExemptionforBEVs•ReductionforPHEVsifrangeinall-electricmode≥50kmandCO2emissions<50g/kmVATdeductionforM1:•100%forBEVs≤€62,500+VAT•100%forPHEVs≤€50,000+VATPrivateusers:€3,000tobuyanewBEV(M1vehicle),withpurchasingpriceofupto€62,500,limitedtoonevehicleperperson.ROMANIAExemptionforelectricvehicles.Renewalscheme(RABLA)forcars:•Upto€3,300foraHEV(≤160gCO2/km)•Upto€6,400foraPHEV(≤78gCO2/km)•Upto€11,500foraBEVSLOVAKIA•BEVregistrationissubjecttoamaximumchargeof€33.•BEVsorPHEVscombinedwithotherfueltypesorenergysources,aredepreciatedfortwoyears.•ExemptionforBEVs.•50%forFCEVsandHEVs.www.acea.auto6TAXBENEFITS&PURCHASEINCENTIVES:ELECTRICPASSENGERCARSTAXBENEFITSINCENTIVESAcquisitionOwnershipCompanycarsPurchaseInfrastructureSLOVENIAMinimumadditionaltaxrate(0.5%)forBEVs.Incentivescheme:upto€4,500forBEVs.SPAIN•Exemptionfrom‘specialtax’forvehiclesemitting≤120gCO2/km.•CanaryIslands:VATexemptionforalternativelypoweredvehicles(egBEVs,FCEVs,PHEVs,EREVs,andHEVs)emitting≤110gCO2/km.75%reductionforBEVsinmaincities(egBarcelona,Madrid,Valencia,Zaragoza,etc).Theuseofacompanycarforprivatepurposesisregardedasapaymentinkindandincludedinthecalculationofpersonalincometax:•30%reductionforBEVsandPHEVs≤€40,000•20%reductionforHEVs≤€35,000Incentivescheme(MOVESIII)in2021-2023:•Cars(M1):€4,500-7,000forBEVsandFCEVs,and€2,500-5,000forPHEVs,forprivateindividuals,dependingonwhetheravehicleisbeingscrapped•DifferentincentivesforSMEsandlargecompanies(+MOVESFLOTAS)Formoredetails:•www.idae.es/ayudas-y-financiacion/para-movilidad-y-vehiculos/programa-moves-iii•www.idae.es/ayudas-y-financiacion/para-movilidad-y-vehiculos/programa-moves-flotasIncentivescheme(MOVESIII)in2021-2023:•Self-employed,individuals,neighbouringcommunities,andadministration:70%oftheeligiblecost•Companiesandpublicchargingpoints(power≤50kW):35%oftheeligiblecostforalarge,45%foramedium,and55%forasmallcompany•Companiesandpublicchargingpoints(power>50kW):30%oftheeligiblecostsTheseamountsareincreasedifthelocationisinmunicipalitieswithlessthan5,000inhabitants.SWEDENLowannualroadtax(SEK360)forzero-emissionvehiclesandPHEVs.Theprivateuseofacompanycaristaxedonbenefits.Forsomecars,thereisapermanenttaxreductionofthebenefitvalue.Thereductionisafixedamountbasedontheenvironmentaltechnology:•BEVsandFCEVs:SEK350,000•PHEVs:SEK140,000Thetaxablebenefitvalueisbasedonthenewcarpriceandreducedbytherelevantamount.Thediscountmaynotexceed50%ofthecarprice.•50%taxdeduction(maxSEK15,000)forhouseholdsinstallingachargingboxathomeforanelectriccar.•LaddabilengrantfortheinstallationofACchargingforresidentsinapartmentbuildings.Formoredetails:www.naturvardsverket.se/amnesomraden/klimatomstallningen/klimatklivet/elbilsladdning-och-laddinfrastruktur/www.acea.auto7TAXBENEFITSINCENTIVESAcquisitionOwnershipCompanycarsPurchaseInfrastructureICELANDMinimumtaxrate:5%ofthecustomvalue.BEVsandHEVs:•Customclearance:VATwaiver(€8,800/ISK1,320,000).•NoVATontheretailprice≤€36,600(ISK5,500,000);fullVATabovethat.Specialdiscountforbatteryelectriccarrentals:thetotalamountismax€6,600,000(ISK1,000,000,000)in2023.Max300carsperrentalcompany.VATwaiveronchargingstationsandtheinstallationofchargingstations.SWITZERLANDElectriccarsareexemptfromtheautomobiletax.Variouscantonsreduceorexemptthetraffictaxoveracertainperiod,dependingonthefuelconsumption(CO2/km).Variouscantonsreduceorexemptthetraffictaxoveracertainperiod,dependingonthefuelconsumption(CO2/km).Variouscantonsandmunicipalitiescontributetotheinstallationcostsforelectromobility.UNITEDKINGDOMPreferentialtaxratesforelectricandultralowemissioncars(<75gCO2/km).Formoredetails:www.gov.uk/tax-company-benefits/tax-on-company-cars35%discount(max£2,500)foraconvertedM1toawheelchairaccessiblevehicle.Itshould:•havezeroCO2emissions;•beabletotravel≥112kmwithoutanyemissions;and•cost<£35,000(conversioncostnotincluded).•TheElectricVehicleHomechargeScheme(EVHS):forhomeownerswholiveinapartmentsandpeopleinrentalaccommodation.•TheWorkplaceChargingScheme(WCS):electriccarchargerinstallationschemeforbusinesses.Itcoversupto75%ofthecostandmax£350/socket(max40sockets).www.acea.auto8EFTAmemberstatesandtheUnitedKingdom(2023)TAXBENEFITSINCENTIVESAcquisitionOwnershipPurchaseInfrastructureAUSTRIAVATdeductionandexemptionfromtaxforcommercialvehicles,includingbusinessuseBEVs,FCEVs,PHEVs,HEVs,andEREVs.Taxexemptionforallzero-emissioncommercialvehicles(egBEVsandFCEVs).Bonusuntiltheendof2023forpurchasing(businessuse)commercialvehicles(importers’bonus+federalbonus):•€2,000+€18,000fore-buses(M2)•€0+€52,000fore-buses(M3,≤39personsincludingdriver)•€0+€78,000fore-buses(M3,40-120personsincludingdriver)•€0+€130,000fore-buses(M3,>120personsincludingdriver)•€2,000+€4,000fore-vehicles(N1,2-2.5t)•€2,000+€8,000fore-vehicles(N1,>2.5t)•€2,000+€22,000fore-vehicles(N2)•€7,000+€65,000fore-vehicles(N3)Additionalincentivescanbegrantedbyprovincesandcommunities.Formoredetails:www.umweltfoerderung.atBonusuntiltheendof2023forpurchasing(commercialuse)thefollowingloadinginfrastructure:•Publicaccess:-€2,500forAC-normalchargingpoint(≤22kW)-€15,000forDC-quickchargingpoint(<100kW)-€30,000forDC-quickchargingpoint(≥100kW)•Privateaccessonly:-€900forAC-normalchargingpoint(≤22kW)-€4,000forDC-quickchargingpoint(<50kW)-€10,000forDC-quickchargingpoint(50-100kW)-€20,000forDC-quickchargingpoint(≥100kW)Additionalincentivescanbegrantedbyprovincesandcommunities.Formoredetails:www.umweltfoerderung.atTAXBENEFITSANDPURCHASEINCENTIVESElectriccommercialvehicles27EUmemberstates(2023)www.acea.auto1GLOSSARYBEVBatteryelectricvehicleM2Vehicleforcarriageofpassengers,mass≤5tPHEVPlug-inhybridelectricvehicleM3Vehicleforcarriageofpassengers,mass>5tHEVHybridelectricvehicleN1Vehicleforcarriageofgoods,mass≤3.5tEREVExtended-rangeelectricvehicleN2Vehicleforcarriageofgoods,mass>3.5tand≤12tFCEVFuelcellelectricvehicle(hydrogen)N3Vehicleforcarriageofgoods,mass>12tNobenefitorincentiveavailableTAXBENEFITS&PURCHASEINCENTIVES:ELECTRICCOMMERCIALVEHICLESwww.acea.auto2TAXBENEFITSINCENTIVESAcquisitionOwnershipPurchaseInfrastructureBELGIUM•BrusselsandWallonia:minimumratesforBEVsandFCEVs(€38.64/yearforN1).•Flanders:BEVsandFCEVs(N1)areexempt.6%VAT(insteadof21%)forelectricityconsumption.•Federallevel:35%deductionofinvestmentinnewBEVsandFCEVs(N1-N3)andinrelatedchargingandfuellinginfrastructure.•Brussels:formicroorsmallcompanies,upto€15,000toreplacemaxthreeN1vehicles/year.Formoredetails:www.economie-emploi.brussels/prime-lez•Flanders(forSMEs):-40%ofadditionalcostupto€400,000/vehicleformaxtwoBEVs(N2and/orN3).-27.5%ofadditionalcostupto€600,000/vehicleformaxtwoBEVs(M2and/orM3).-22.5%ofadditionalcostupto€350,000/vehicleformaxtwoFCEVs(N2and/orN3).Formoredetails:EcologypremiumplusAgentschapInnoverenenOndernemen(vlaio.be)BULGARIAExemptionforelectricvehicles.CROATIANoexcisedutiesforelectricvehicles.Exemptionfromspecialenvironmentaltaxforelectricvehicles.Incentivescheme(onceperyear,limitedfunds):•N1:-upto€5,309forPHEVs-upto€9,291forBEVsorFCEVs•N2,N3,M2andM3:-max€53,089bycompanyforBEVs,PHEVs,orFCEVs-upto40%offundspervehicle-themaxamountdependsonthecategoryThereisa12-monthdeadlinetopurchasethevehicleandsubmitagrantrequest.Thevehiclemustbekeptfortwoyears.CYPRUSExemptionforvehiclesemitting≤120gCO2/km.Minimumrateforvehiclesemitting≤120gCO2/km.•Upto€12,000toscrapandreplacewithavehicleemitting<50gCO2/kmandcosting≤€80,000.•Upto€100,000fore-buses.•€20,000fore-trucks.TAXBENEFITS&PURCHASEINCENTIVES:ELECTRICCOMMERCIALVEHICLESwww.acea.auto3TAXBENEFITSINCENTIVESAcquisitionOwnershipPurchaseInfrastructureCZECHREPUBLICBEVsandFCEVsemitting≤50gCO2/kmexemptfromregistrationcharges(withaspecialnumberplate).•BEVsandHEVsexemptfromroadtax.•Vehiclesemitting≤50gCO2/kmexemptfromroadtolls.•Reductionofthedepreciationperiodforchargingstationsforelectricvehiclesfrom10tofiveyears(wallboxesandstandalonechargingstations).•AccelerateddepreciationforBEVsandPHEVsbelow50gCO2/km.Purchaseincentiveforlow-andzero-emissionvehiclesbystateandlocalgovernmentbodies.SupportfromtheMinistryofTransportforthedevelopmentofcharginginfrastructure.DENMARKZero-emissionvehicles(max4,000kgtotalweight):•Pay40%ofregistrationtax•AdditionalDKK77,500registrationtaxdeduction•DKK900deductionoftaxablevalueperkWhbatterycapacity(max45kWh)Low-emissionvehiclesemitting<50gCO2/km(max4,000kgtotalweight):•55%ofthefullregistrationtax•AdditionalDKK47,500registrationtaxdeduction•DKK900deductionoftaxablevalueTaxesonownershiparebasedonCO2emissions.Zero-emissionvehiclesandvehicleswithCO2emissionsofmax58g/kmpaytheminimumsemi-annualtaxrateofDKK370.ESTONIANewN1BEVsandFCEVs(purchaseandleasing):•€5,000/vehicleforindividuals•€4,000/vehicleforlegalpersonsFINLANDZero-emissionvansareexemptfromregistrationtaxasof1October2021.•Purchaseincentiveof€2,000-6,000forelectricvansfrom2022-2025.•Purchaseincentiveof€6,000-50,000forelectrictrucksfrom2022-2025.TAXBENEFITS&PURCHASEINCENTIVES:ELECTRICCOMMERCIALVEHICLESwww.acea.auto4TAXBENEFITSINCENTIVESAcquisitionOwnershipPurchaseInfrastructureFRANCE•Regionsprovideanexemption(eithertotalor50%)foralternativelypoweredvehicles(ieBEVs,HEVs,CNG,LPG,andE85).•BEVs,FCEVs,andPHEVs(witharangeof>50km)areexemptfromthemass-basedmalus.BonusforanewN1BEVorFCEV:•€6,000forhouseholds,ifvehicle≤€45,000•€4,000forlegalpersonsifvehicle≤€45,000Scrappageschemeforasecond-handornewzero-emissionvehicle(BEVorFCEV),basedonweight:•N1classI:€5,000•N1classII:€7,000•N1classIIIorN2(withweightexemption):€9,000GERMANY•10-yearexemptionforBEVsandFCEVsregistereduntil31December2025.Exemptiongranteduntil31December2030.•Exemptionfromtheannualcirculationtaxforvehiclesemitting≤95gCO2/km.GREECE0%registrationtaxforbatteryelectricorplug-inhybridvans,lorries,andtrucks.30%onthenetretailprice(NRP)cashbackforBEVvans(upto€8,000),plus€1,000forscrapping.HUNGARYIRELAND€5,000reliefforBEVsupto€40,000.Therelieftapersoffafter€40,000andendsat€50,000.•Minimumrate(€120peryear)forBEVs.•Reducedrate(€140peryear)forPHEVs≤50gCO2/km.Purchaseincentivesforindividualsin2021:•Upto€5,000forBEVs•Upto€5,000forPHEVswith≤50gCO2/kmandfull-electricrangeof≥50km•Upto€3,800forbatteryelectricvansITALY•BEVs:Five-yearexemptionfromthedateofthefirstregistration.Afterthisperiod,75%reductionofthetaxrateappliedtoequivalentpetrolvehicles.•HEVs:Applicationofaminimumflatrate(€2.58/kW).Someregionsapplydiscountsontaxownership.N1:•€4,000foraBEV/PHEV≤1.5t•€6,000foraBEV/PHEV>1.5tN2:•€12,000foraBEV/PHEV≤7t•€14,000foraBEV/PHEV>7tTAXBENEFITS&PURCHASEINCENTIVES:ELECTRICCOMMERCIALVEHICLESwww.acea.auto5TAXBENEFITSINCENTIVESAcquisitionOwnershipPurchaseInfrastructureLATVIAExemptionfromfirstregistrationcostsforBEVs.ExemptionforN1vehiclesemitting≤50gCO2/km.LITHUANIAExemptionforelectricvehicles(firstregistrationonly).LUXEMBOURGOnly50%ofadministrativetax.Minimumrateof€30peryearforzero-emissionvehicles.MALTAMinimumrateforvehiclesemitting≤100gCO2/km.Minimumrateforvehiclesemitting≤100gCO2/km.BEVsforindividuals:•N1:€11,000perBEV•M2andN2:40%ofsellingprice,cappedat€70,000BEVsforcompanies:•N1:upto€20,000•M2andN2:upto€70,000•M3andN3:upto€400,000•AdditionalincentiveifestablishedinandoperatingfromcertainlocalitiesAdditionalgranttoscrapavehicleof≥10years.Formoredetails:www.transport.gov.mt/land/sustainable-transport/financial-incentives-2023/new-electric-vehicles-6188NETHERLANDS•Subsidyscheme(SEBA)forentrepreneurstobuy/leaseanewcommercialvehicle(N1orN2weighingupto4,250kg).•Environmentalinvestmentdeduction(MIA)forBEVandFCEVlightcommercialvehicles.•Formoredetails:www.rvo.nl/subsidie-en-financieringswijzerPOLAND•ExemptionforBEVs.•ExemptionforPHEVsupto2,000ccuntilend2029.Depreciation:•uptoPLN225,000forBEVsandFCEVs•uptoPLN150,000forvehiclesemitting0-50gCO2/km•uptoPLN100,000forvehiclesemitting>50gCO2/kmPurchaseincentivesforindividuals:•PLN18,750-27,000forBEVsandFCEVsofamaxpriceofPLN225,000Incentivesforlegalpersons(purchase,leasing):•uptoPLN70,000forN1BEVsandFCEVsUpto50%oftheeligiblecostsforhydrogenstations.TAXBENEFITS&PURCHASEINCENTIVES:ELECTRICCOMMERCIALVEHICLESwww.acea.auto6TAXBENEFITSINCENTIVESAcquisitionOwnershipPurchaseInfrastructurePORTUGALExemptionforBEVs.Companies(limitedtoN1vehicles):€6,000tobuyanewBEV.ROMANIAExemptionforelectricvehicles.SLOVAKIA•BEVregistrationissubjecttoamaxchargeof€33.•BEVs,orPHEVscombinedwithotherfueltypesorenergysources,aredepreciatedfortwoyears.•ExemptionforBEVs.•50%forFCEVsandHEVs.SLOVENIAMinimumadditionaltaxrate(0.5%)forBEVs.SPAIN•Exemptionfrom‘specialtax’forvehiclesemitting≤120gCO2/km.•CanaryIslands:VATexemptionforalternativelypoweredvehicles(egBEVs,FCEVs,PHEVs,EREVs,andHEVs)emitting≤110gCO2/km.•Reductionof75%forBEVsinmaincities(egBarcelona,Madrid,Valencia,Zaragoza,etc).Incentivescheme(MOVESIII)in2021-2023:•Vans(N1):€7,000-9,000forprivateindividuals,dependingonscrapping•Additional€1,000frommanufacturers•DifferentincentivesforSMEsandlargecompanies(+MOVESFLOTAS)Formoredetails:•www.idae.es/ayudas-y-financiacion/para-movilidad-y-vehiculos/programa-moves-iii•www.idae.es/ayudas-y-financiacion/para-movilidad-y-vehiculos/programa-moves-flotasIncentivescheme(MOVESMITMA)forN2,N3,M2,andM3vehicles:•ScrappageofavehicleregisteredbeforeJanuary2019(€2,500-25,000dependingonEuroclassandtypeofvehicle)•Acquisitionofnewalternativelyfuelledvehicles(BEVs,PHEVs,HEVs,andalsogasforbuses)•Incentivesfrom€15,000-190,000,dependingonthevehicletypeandthecompanysizeFormoredetails:www.mitma.gob.es/el-ministerio/sala-de-prensa/noticias/mar-16112021-1646Incentivescheme(MOVESIII)in2021-2023:•Self-employed,individuals,neighbouringcommunities,andadministration:70%oftheeligiblecost•Companiesandpublicchargingpoints(power≤50kW):35%oftheeligiblecostforalarge,45%foramedium,and55%forasmallenterprise•Companiesandpublicchargingpoints(power>50kW):30%oftheeligiblecostsTheseamountsareincreasedifthelocationisinmunicipalitieswithlessthan5,000inhabitants.TAXBENEFITS&PURCHASEINCENTIVES:ELECTRICCOMMERCIALVEHICLESwww.acea.auto7TAXBENEFITSINCENTIVESAcquisitionOwnershipPurchaseInfrastructureSWEDENN1:Lowannualroadtax(SEK360)forzero-emissionvehiclesandPHEVs.Environmentaltrucks:•Forcompanies,municipalities,andregions•Max20%ofthevehicle’spurchasepriceElectricbuspremium:•ForBEVs,PHEVs,FCEVs,andtrolleybuseswithacapacityof>14passengers•Forapublictransportauthority,municipality,orlimitedcompany(authorisedtoprocurepublictransport),thepremiumis20%ofthepurchaseprice(max100%ofthepurchasepricedifferencewiththeclosestdieselbus)•Foratransportcompany,thepremiumis40%ofthedifferencewiththeclosestdieselbus•Plug-inhybridbusesreceivehalfthepremiumamount•Grantsforvarioustypesofcharginginfrastructure(residents,businesses,andorganisations)fromtheSwedishEnvironmentalProtectionAgency.•SupportfromKlimatklivetforDCchargingforbusinessvehicles.Formoredetails:www.naturvardsverket.se/amnesomraden/klimatomstallningen/klimatklivet/elbilsladdning-och-laddinfrastruktur/Environmentaltrucksareheavytrucks(>3.5t)poweredsolelybybioethanol,gasorelectricalenergyfromafuelcell,abattery,oranexternalsource.Truckspoweredbyacombinationoftheabovefuelsarealsoeligibleforsupport(egaplug-inhybridpoweredbyelectricityandbioethanolorgas).www.acea.auto8TAXBENEFITSINCENTIVESAcquisitionOwnershipPurchaseInfrastructureICELANDMinimumtaxrate:5%ofthecustomvalue.BEVsandHEVs:•Customclearance:VATwaiver(€8,800/ISK1,320,000).•NoVATontheretailprice≤€36,600(ISK5,500,000);fullVATabovethat.Specialdiscountforbatteryelectrictrucks:thetotalamountismax€2,600,000(ISK400,000,000)in2023.VATwaiveronchargingstationsandtheinstallationofchargingstations.SWITZERLANDVehicleswithmorethan3.5ttotalweightdrivenbyanelectricmotorareexemptfromthedistance-relatedheavyvehiclefee(HVF).Variouscantonsandmunicipalitiescontributetotheinstallationcostsforelectromobility.UNITEDKINGDOMSmallvans:•35%discount(max£2,500)•<2,500kggrossvehicleweight•<50g/kmCO2emissionsandbeabletotravel≥96kmwithoutanyemissionsLargevans:•Max£5,000•2,500-4,250kggrossvehicleweight•<50g/kmCO2emissionsandbeabletotravel≥96kmwithoutanyemissionsTrucks:•20%discount(max£16,000)•4,250-12,000kggrossweight•CO2emissionsof≥50%lessthantheequivalentconventionalEuroVIvehiclethatcancarrythesamecapacityandbeabletotravel≥96kmwithoutanyemissionsFormoredetails:www.gov.uk/plug-in-vehicle-grants/trucksEFTAmemberstatesandtheUnitedKingdom(2023)

VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP VIP

VIP